GBP/USD Weekly Forecast: Hawkish BoE Gathering Traction

The GBP/USD weekly forecast shows a bullish trajectory. The narrative unfolds with the Bank of England holding steadfast to its hawkish stance, which contrasts the Federal Reserve’s more dovish outlook.

Ups and downs of GBP/USD

GBP/USD had a bullish week amid a divergence in policy outlooks between the US Federal Reserve and the Bank of England. Major catalysts for last week’s move included US and UK policy meetings and US inflation reports.

Notably, inflation reports from the US showed further easing, supporting a Fed pivot. As a result, policymakers were dovish at the Fed meeting on Wednesday, signaling an end to rate hikes. Meanwhile, the BOE held its hawkish tone, stating that inflation was still concerning, leading to a rally in the pair.

Next week’s key events for GBP/USD

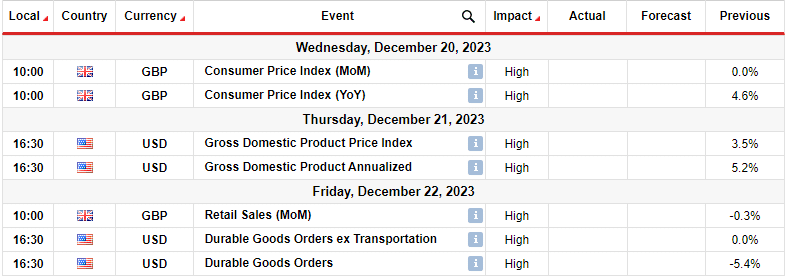

(Click on image to enlarge)

GBP/USD traders will focus next week on the UK inflation report. On Thursday, the Bank of England was hawkish. Moreover, Governor Andrew Bailey emphasized that the battle against inflation is ongoing.

Therefore, the inflation report will impact the outlook for rate cuts in the UK. Additionally, the UK will release retail sales data showing whether consumers are spending big or not. Consequently, this will also show the state of demand and inflation in the economy.

Meanwhile, economic data from the US will include the gross domestic product and core durable goods orders.

GBP/USD weekly technical forecast: Bulls aim for 1.3001 resistance level

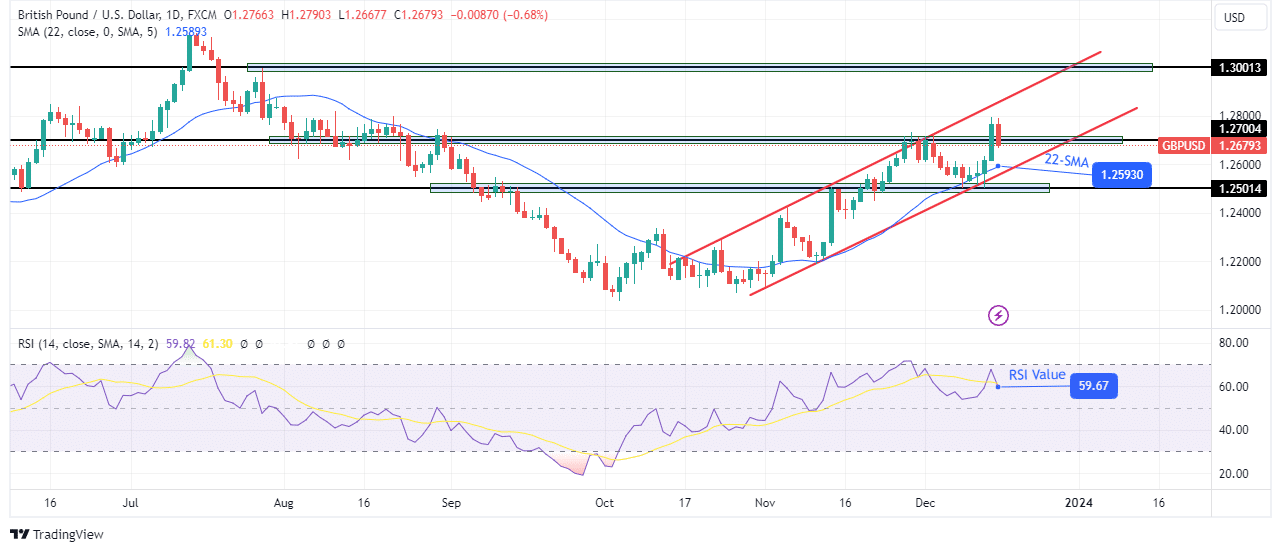

(Click on image to enlarge)

GBP/USD daily chart

On the daily chart, GBP/USD trades in a bullish channel, respecting the channel support and resistance. At the same time, the price is making higher highs and lows, further confirming a bullish trend. The most recent high came near the 1.2700 key level, while the most recent low was near the 1.2501 key level. However, the uptrend exceeded the recent high when bulls broke above 1.2700. Therefore, the bullish trend will likely continue.

Moreover, indicators on the chart show further upside potential. The 22-SMA has acted as support, pushing the price higher every time it pulls back. Meanwhile, the RSI trades above 50, indicating stronger momentum for bulls. Therefore, there is a high chance the price will continue higher next week as bulls target the 1.3001 resistance level.

More By This Author:

GBP/USD Price Analysis: Bulls Dominate After Hawkish BoEEUR/USD Outlook: Euro Gains As ECB Maintains Hawkish Stance

Gold Price Rallies Above $2,000 After Dovish FOMC

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more