GBP/USD Weekly Forecast: Fed’s Delayed Cut Weighs On Pound

The GBP/USD weekly forecast is pointing southward, with the Fed expected to hang tight before making any moves to slash interest rates.

Ups and downs of GBP/USD

The GBP/USD pair had a bearish week as the dollar rallied amid a drop in rate cut expectations. The major event this week was the US inflation report. When it came out, investors were surprised by another month of higher-than-expected price growth. Moreover, it came after a blockbuster jobs report showing a robust labor market.

Consequently, there was a sharp adjustment in Fed rate cut expectations. Markets now predict only two rate cuts this year, starting in September. Inflation in the US has proven to be more stubborn than other major economies. This put the dollar in a better position than the pound.

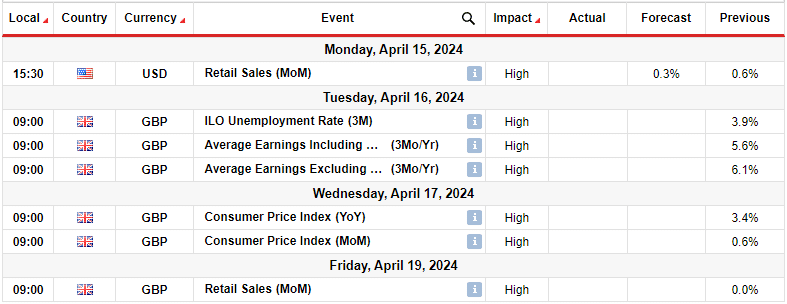

Next week’s key events for GBP/USD

Next week, investors will focus on retail sales data from the US and the UK. Furthermore, the UK will release data on employment and inflation. All focus will be on the UK CPI report, which will show the state of price growth in the economy. The recent US inflation report has put the GBP/USD pair in a weak position as the timing for the first Fed cut has moved to September.

Therefore, traders will wait to see whether the Bank of England will be in a position to cut interest rates before the Fed. A decline in UK inflation would further weaken the GBP/USD pair.

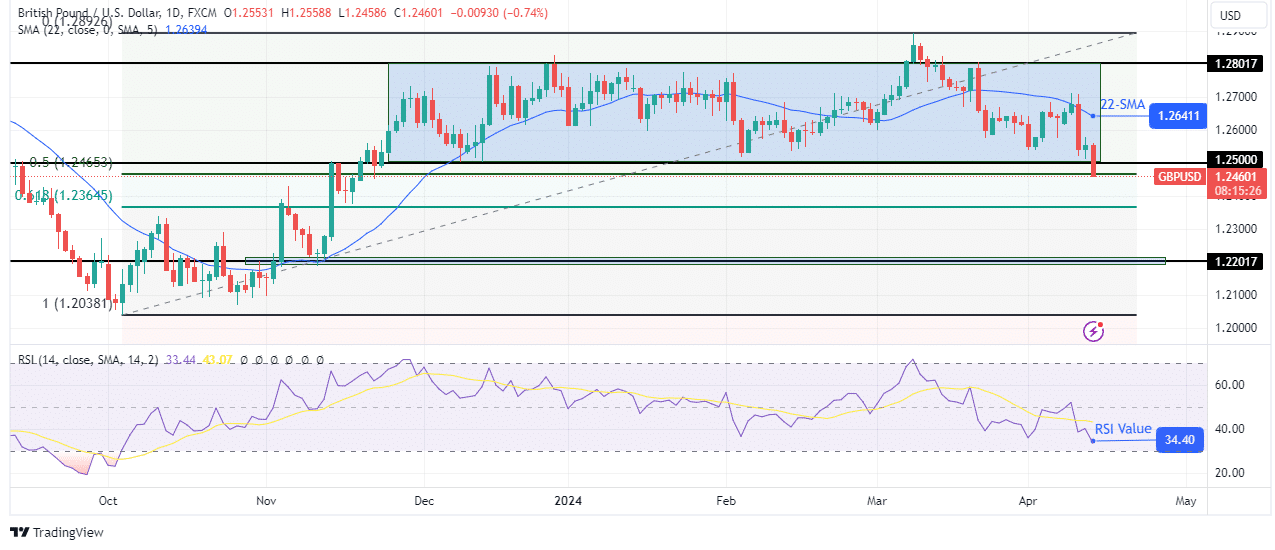

GBP/USD weekly technical forecast: Price signals impending rectangle breakout

(Click on image to enlarge)

GBP/USD daily chart

On the technical side, the GBP/USD price is on the verge of breaking out of its rectangle pattern. Moreover, the bias is bearish as the price falls well below the 22-SMA, and the RSI is approaching the oversold region.

The previous bullish trend paused when the price reached the 1.2801 key resistance level. It then consolidated with the 1.2801 level as resistance and the 1.2500 level as support. There has been a surge in momentum that has pushed the price to the 0.5 Fib retracement level.

If the price closes below the rectangle support, it will likely fall to the 0.618 Fib retracement level. Moreover, the path will be clear for the price to reach the 1.2201 support level.

More By This Author:

EUR/USD Price Analysis: Euro Tumbles Amid ECB’s Cut In JuneUSD/CAD Outlook: Bullish As BoC-Fed Divergence Widens

USD/CAD Forecast: CAD Retreats, USD Advances On Jobs Data

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more