GBP/USD Weekly Forecast: Dollar To Gain Amid Upbeat Data

The GBP/USD weekly forecast is bearish. The dollar will likely keep strengthening as economic indicators point to a healthy economy despite high rates.

Ups And Downs Of GBP/USD

Britain is on track to avoid a protracted recession after a poll revealed a surprisingly strong rebound in business activity this month, increasing the prospect of another Bank of England interest rate hike in March.

According to data from the Commerce Department, consumer spending, which accounts for two-thirds of US economic activity, rose by 1.8% in January, above analyst estimates and marking the most robust growth in almost two years.

The personal consumption expenditures (PCE) price index, the Fed’s preferred measure of inflation, also rose by 0.6% last month, the most in the previous six months. These reports came after the FOMC minutes, which were hawkish, and the data on unexpectedly declining unemployment claims. They all indicate that the economy is strong despite higher rates.

The dollar index increased by 0.65% to a seven-week high, rising against other major currencies.

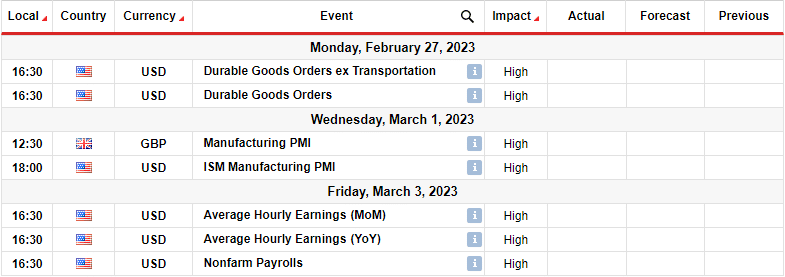

Next Week’s Key Events For GBP/USD

(Click on image to enlarge)

Investors expect economic releases from the UK and the US next week, but all focus will be on the US nonfarm payrolls. The labor market’s resilience has surprised many, and it might continue. A higher-than-expected reading could push GBP/USD lower.

GBP/USD Weekly Technical Forecast: Bearish RSI Divergence Plays Out

The daily chart shows GBP/USD trading below the 22-SMA and the RSI below 50, indicating the current move is bearish. The previous bullish trend paused at the 1.2403 resistance, where bears took over and pushed the price below the 22-SMA. Bulls made another attempt at the 1.2403 resistance but failed to go above and instead made a bearish divergence.

This has allowed bears to take over a second time. The price already respects the SMA as resistance, the start of a bearish trend. Bears must start making lower highs and lows to further confirm the trend.

At the moment, the price has stopped at 1.1926, a key support level. It could consolidate here briefly before breaking below and reaching the 1.1604 support.

More By This Author:

EUR/USD Weekly Forecast: US Inflation Rises By Most In 6 MonthsUSD/CAD Weekly Forecast: US Inflation Remains Stubbornly High

EUR/USD Price Analysis: Euro Climbs As Focus Shifts To US CPI