GBP/USD Weekly Forecast: Diverging Fed-BoE Weighs On Pound

Photo by Colin Watts on Unsplash

The British pound managed to partially recover its losses against the US dollar after the pair plunged to the monthly low of 1.3400. The downside came after the dollar picked up strength amid escalating Middle East tension. Moreover, the diverging central bank signals also weighed on the GBP/USD.

The week began with the shockwaves coming from the Iran-Israel war that deteriorated the global risk sentiment. The fears of oil supply disruption via the Hormuz Strait triggered a broader risk aversion that pushed safe-haven flows to the US dollar. The dollar’s recovery was further supported by the hawkish Fed tone as the Fed held rates unchanged and reiterated data dependence for the next rate cuts.

President Trump maintained an aggressive stance against Iran, calling for unconditional surrender. He approved military action against Iran but kept it on hold for two weeks before taking a decisive action. This temporarily de-escalated the tension and provided some temporary support to the risk assets.

This sentiment shift allowed the pound to recover from the monthly lows. Meanwhile, the Bank of England’s dovish tone was already priced in. The central bank held rates on hold at 4.25%, with the BoE governor hinting at future cuts. However, the MPC vote split gave a hawkish signal as six members voted in favor of a hold while three members voted for a cut.

Nevertheless, the pound’s recovery was overshadowed by the weaker UK retail sales data that showed a 2.7% decline in May, raising concerns about the UK’s consumer demand.

Key Events for the GBP/USD Next Week

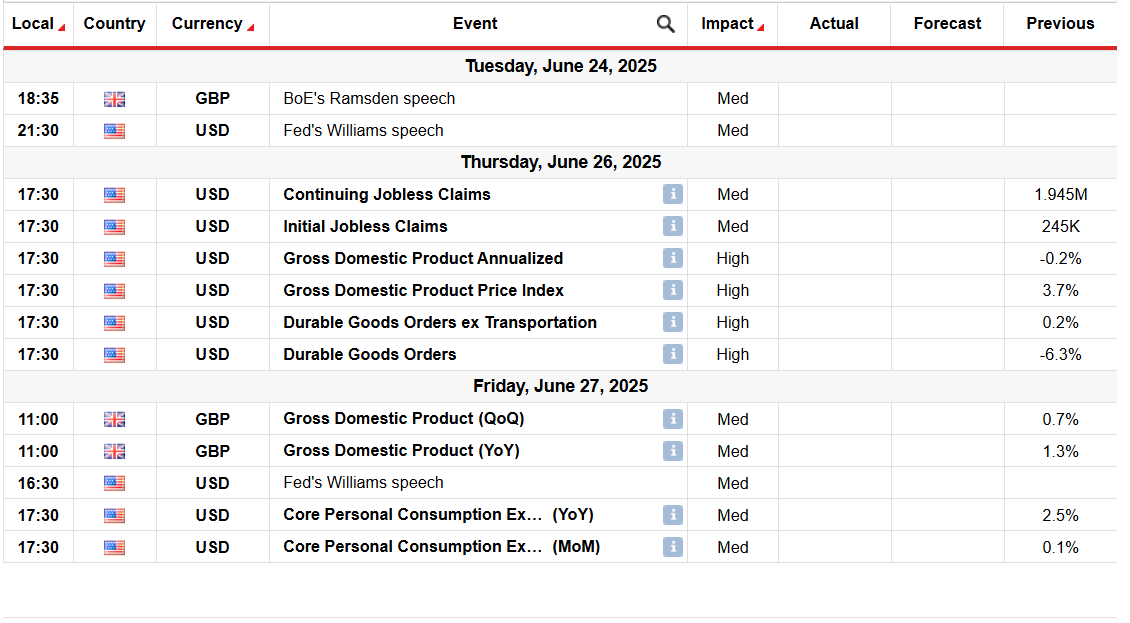

(Click on image to enlarge)

GBP/USD weekly key events

Looking forward, the traders will primarily focus on central bank commentary and PMI readings from both sides of the Atlantic. The US Core PCE Index, US GDP, and Durable Goods Orders data are also important to watch.

GBP/USD Weekly Technical Forecast: Buyers Exhausted Under 20-SMA

(Click on image to enlarge)

GBP/USD daily chart

The GBP/USD daily chart shows a slight bearish scenario as the price remains below the 20-day SMA level. Earlier in the week, the price briefly broke the key support zone at 1.3400 but managed to recover. However, the price tested the 20-day SMA and reversed the gains on Friday. It shows a sign of buyers’ exhaustion. Still, the major support of 1.3400 continues to support the pair.

Breaking the 1.3400 level may bring the 1.3340 level as a target ahead of 1.3265. The daily RSI is near 50, showing no clear bias at the moment. However, the probability of a downside breakout is higher.

More By This Author:

AUD/USD Outlook Rebounds Amid Upbeat Chinese Data

Gold Forecast Subdued Post-Fed, Downside Limited By Geopolitics

GBP/USD Forecast: Sellers Testing 1.34 After Hawkish Fed

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more