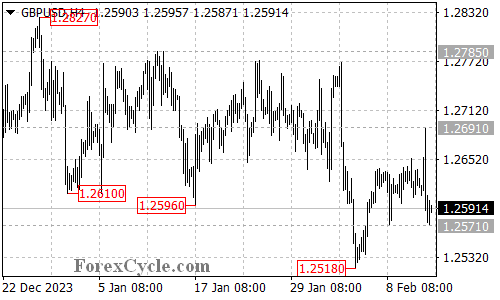

GBPUSD Tests Support: Will It Hold Or Break?

GBPUSD has reached a make-or-break point, testing the key support level at 1.2571. The technical analysis reveals two potential scenarios depending on whether this support holds or not.

Scenario 1: Support Holds, Uptrend Resumes

- Key Hurdle: If the price bounces back from 1.2571, it would indicate that the bulls are defending this support level.

- Resistance Test: The immediate hurdle in this scenario would be at 1.2691.

- Upside Potential: Surpassing 1.2691 could trigger another rise, potentially leading to a retest of the previous resistance at 1.2785. A break above this level would strengthen the bullish case and suggest a resumption of the uptrend.

Scenario 2: Support Breaks, Downtrend Continues

- Breakdown Warning: If the price breaks below 1.2571, it would signal a breach of support and potentially indicate a continuation of the downtrend.

- Next Target: The next potential support level in this scenario lies at 1.2518.

- Further Decline: If the selling pressure persists and breaks below 1.2518, the pair could aim for the 1.2400 area.

Overall Sentiment

The current price action around 1.2571 is crucial for GBPUSD’s near-term direction. A bounce would suggest a potential uptrend continuation, while a break below would indicate a possible extension of the downtrend.

More By This Author:

AUDUSD Breaks Support: Further Downturn Or Bounce In Sight?GBPUSD Rebounds: Will It Consolidate Or Resume Downtrend?

USDCAD Retreats: Uptrend Over Or Temporary Dip?

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!