GBP/USD Tanked Below 1.2600 After US NFP And ISM PMIs Data

Image Source: Pexels

- The mixed US Nonfarm Payrolls data initially failed to boost the US dollar, but the ISM Manufacturing PMI data lifted sentiment.

- UK business activity remains in contraction, but inflation nears 7%, complicating BoE’s next move.

- The Office for National Statistics revised UK economic size, indicating a 0.6% growth in Q4 2021 compared to Q4 2019.

The pound slumped late in the New York session versus the greenback on Friday as US Treasury bond yields rose and bolstered the US dollar. The GBP/USD currency pair hit a daily high of 1.2712 before reversing its course and diving toward the recent exchange rate at around 1.2590.

GBP/USD Dropped as US Business Activity Improved, While UK Factory Activity Remained at Recessionary Levels

Financial markets remained calm after a busy week in the US. The August Nonfarm Payrolls data was mixed, with 187,000 jobs added, beating the 177,000 estimate. However, the rise in the Unemployment rate to 3.8% year-over-year, above the forecasted 3.5%, surprisingly didn’t boost the US dollar.

Investors speculate that the Federal Reserve might delay tightening monetary conditions in September, leading to reduced bets on rate hikes by November.

Consequently, the GBP/USD currency pair initially surged towards its daily peak. However, a business activity report that surpassed expectations triggered a reversal, causing the pound to relinquish those gains. The ISM Manufacturing PMI increased from 46.4 to 47.6 in August, exceeding the projected 47. Most subcomponents of the report improved, indicating a more optimistic perspective on business activity in the US.

Another factor that underpinned the greenback was that US bond yields recovered some lost ground, which underpinned the US Dollar Index (DXY) back above the 104.000 figure.

Earlier data in the UK showed that British business activity remained in contractionary territory, dropping for six consecutive months below the 50 threshold, as revealed by the S&P Global/CIPS Manufacturing PMI, coming at 43.0 from 45.3 in July. That makes the case for a Bank of England (BoE) pause on its tightening cycle, but inflation remains close to 7%. Nevertheless, traders foresee a 25 bps rate increase in the upcoming meeting.

However, there is a silver lining. The Office for National Statistics revised its assessment of the UK economy, indicating that it was 0.6% larger in the fourth quarter of 2021 than in the final quarter of 2019. This contrasts with the prior estimate of a 1.2% reduction in size.

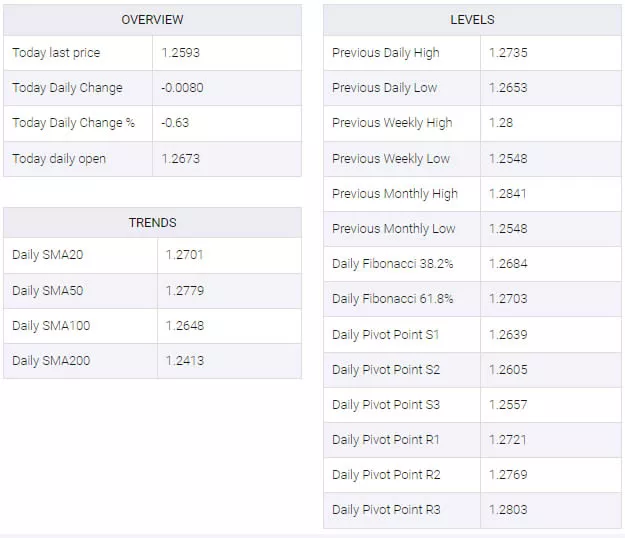

GBP/USD Price Analysis: Technical Outlook

The daily chart portrayed the pair as neutral-to-downward biased, but it could shift downward if the GBP/USD pair manages to swing below the June 29 low of 1.2590. Once cleared, the next support would be an up-slope trendline drawn from May lows at around 1.2550/75, followed by the Aug. 23 swing low of 1.2548. A decisive break of the pair could test the 200-day Moving Average (DMA) at 1.2414. Upside risks lie at the Aug. 30 daily high at 1.2746, shy of the 50-DMA at 1.2774.

GBP/USD Technical Levels

More By This Author:

EUR/JPY Consolidates Overnight Pullback From Multi-Year Peak

WTI Price Analysis: WTI rises near $83.00 amid supply crunch fears

USD/JPY Slips Below 146.00 On Mixed Us Data, BoJ Split Policy Views

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more