GBP/USD Steady At 1.3518 As PMIs Signal Slowdown, Powell Speech Eyed

Photo by Colin Watts on Unsplash

The Pound Sterling (GBP) remains steady during the North American session on Tuesday after business activity on both sides of the Atlantic slows down in September, according to Flash Purchasing Managers Indices (PMI) reports in the UK and the US. GBP/USD trades at 1.3518, virtually unchanged.

Sterling holds firm despite weak UK and US PMIs; central bank divergence underpins GBP but fiscal risks cap gains

The US Dollar (USD) seems to have found its feet as the US Dollar Index (DXY), which measures the buck’s value against a basket of six peers, is up 0.08% at 97.38. US Manufacturing PMI dipped to 52 from 53 in August. At the same time, the Services index fell from 54.5 to 53.9 in September.

Digging deep into the report, the survey of prices paid rose from 60.8 last month to 62.6 as companies cited tariffs as the principal cause of further cost increases.

In the meantime, traders’ eyes are set on Federal Reserve (Fed) Chair Jerome Powell's speech about the economic outlook, at around 16:30 GMT.

In the UK, S&P Global revealed that the Composite Purchasing Managers Index (PMI) covering the services and manufacturing sectors slowed to 51 in September from 53.5 in August, well below the economists' estimates of 52.7.

Despite this, GBP/USD managed to remain steady as the Sterling remains up 8% this year against the US Dollar.

Central bank divergence, favors GBP/USD upside

Nevertheless, divergence between the Federal Reserve and the Bank of England (BoE) would reduce the rate differential between the two countries. This favors further GBP/USD upside, but economists’ concern about the UK fiscal position might prevent Cable from reaching higher prices in the near term.

In the meantime, comments by Fed officials remain mixed, but not so in the BoE. Huw Pill said that inflation has proved to be more stubborn than expected and that it is declining at a sluggish pace.

Meanwhile, Chicago’s Fed Austan Goolsbee says the US remains in a “low hiring, low layoffs” phase, and added that the bank needs to get inflation to 2%. Recently, the Vice Chair for Supervision Michelle Bowman said that the Fed needs to cut three times total for 2025, including last week’s decision.

GBP/USD Price Forecast: Remains subdued at around 1.3480-1.3530

The pair consolidates at around the 20-day SMA at 1.3523, with traders unable to push prices above last Friday’s high of 1.3559. If done, this clears the path to challenge 1.3600 and higher prices. Conversely, the lack of follow-through to the upside suggests that buyers are reluctant to open fresh long positions.

Conversely, if GBP/USD drops below 1.3500, sellers could push prices towards the 100-day SMA at 1.3481, ahead of the 50-day SMA at 1.3467.

(Click on image to enlarge)

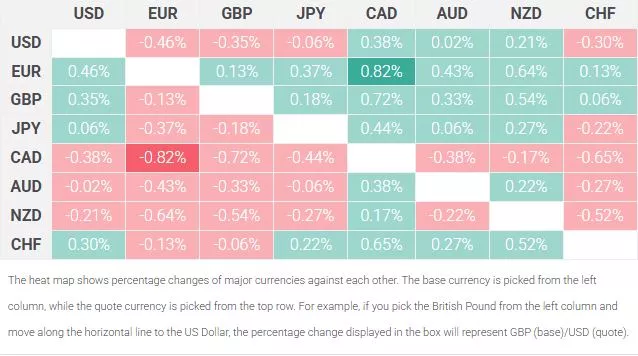

Pound Sterling Price This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Canadian Dollar.

More By This Author:

EUR/USD Rallies To 1.1800 As Dollar Slumps Ahead Of Powell

GBP/USD Rebounds As Dollar Softens, But UK Risks Limit Upside

EUR/USD Slipped As Dollar Rebounded, French Protests Weighed On Sentiment