GBP/USD Rises Towards 1.3300 As UK Economy Grows Above Forecasts

Photo by Colin Watts on Unsplash

The Pound Sterling extended its gains against the US Dollar, driven by a positive reading of economic growth in the UK and softer-than-expected data in the US, which fueled speculation of a slower economic outlook. At the time of writing, the GBP/USD trades at 1.3293, up 0.31%.

GBP/USD climbs as UK economy posts stronger-than-expected growth while US inflation and retail data disappoint

US economic data released earlier suggested that the disinflationary process continues as the economy cools. The US Producer Price Index (PPI) in April declined 0.5% MoM, below the estimated 0.2% expansion. Excluding volatile items, PPI fell 0.4% MoM beneath forecasts of a 0.3% increase.

Other data showed that Retail Sales disappointed investors, edging up by 0.1% month-over-month (MoM), above forecasts for a 0.0% increase. Initial Jobless Claims for the week ending May 10 rose by 229,000, as expected, unchanged from the previous week.

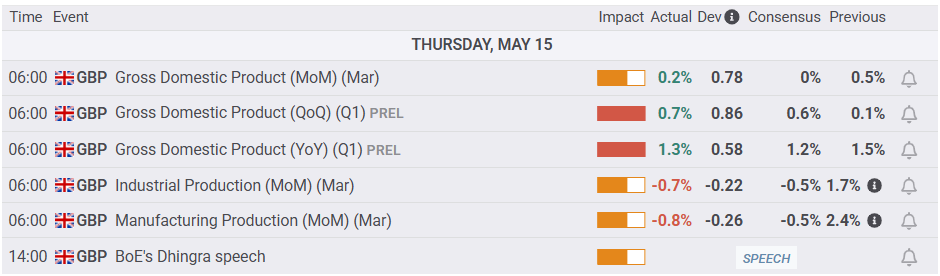

Across the pond, Gross Domestic Product (GDP) figures suggested the economy is stronger than expected, exerting pressure on the Bank of England (BoE) to keep interest rates on hold. In the 3 months to March, GDP rose by 0.7%, up from 0.1% in the previous reading, bearing the 0.6% growth foreseen by economists and the BoE.

(Click on image to enlarge)

Source: FXStreet

Despite posting solid figures, US President Donald Trump’s trade policies and high UK employment taxes could weigh on the economic outlook. The British Finance Minister, Rachel Reeves, commented that economic headwinds are approaching and emphasized the significance of the government’s trade agreements with the US and India.

Ahead this week, the UK economic docket is absent. Across the Atlantic, housing data and the University of Michigan Consumer Sentiment preliminary survey for May would be eyed by traders.

GBP/USD Price Forecast: Technical outlook

From a technical standpoint, the GBP/USD remains upwardly biased; however, in the short term, a pullback may be on the cards. If the pair extended its losses below 1.33 and clears 1.3250, the first support would be the 1.3200 figure. Once breached, the next floor level would be the May 13 daily low of 1.3165.

Conversely, if GBP/USD climbs past 1.3359, the May 14 high, the next resistance would be the May 6 high at 1.3402.

(Click on image to enlarge)

More By This Author:

Silver Price Forecast: XAG/USD Drops Over 2% On High US Yields, Hovers Near $32.00Mexican Peso Hits 7-Month High Amid Weak U.S. Dollar, Eyes On Banxico

Gold Price Tumbles Below $3,200 On Trade Optimism And Rising U.S. Yields

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more