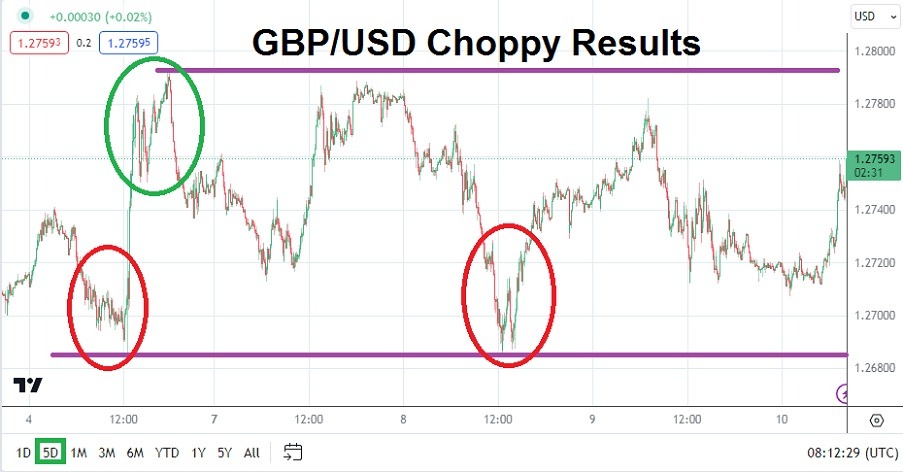

GBP/USD: Recent Choppy Results Likely To Continue Near-Term

The GBP/USD should be expected to become fast today and tomorrow as financial houses react to the economic data via U.S CPI today, U.S PPI tomorrow, and U.K GDP data also on Friday.

Day traders who thought it was safer to trade one of the most sought-after currency pairs via the GBP/USD have found the trading landscape resembling a field of landmines waiting to cause harm in many instances. The GBP/USD is trading near 1.27600 as of this writing and readers are urged to look at live market prices when comparing this article to the developments which are being produced in real time.

Last Thursday the GBP/USD did trade below the 1.27000 value, and this was followed by new lows on Friday and then on Tuesday of this week when the currency pair challenged the 1.26850 realm. On the 3rd of August the GBP/USD traded near a low of nearly 1.26200 which flirted with values seen in late June and the 14th of the same month. While many financial institutions and perhaps traders believe the GBP/USD is oversold within its current price range, dangers abound and global market jitters have certainly helped demonstrate the nervous results in Forex.

GBP/USD: What has Gone Down has also Gone Up

While the lower depths of the GBP/USD have been discussed, traders who have been participating in the Forex pair will no doubt point to the reversals upwards that have also been exhibited. The ability to create a choppy almost whipsaw like trading landscape have made the GBP/USD dangerous the past week. Resistance levels slightly above the 1.27800 have been tested a few times in the past handful of day. And then after testing these highs, lows have followed in many instances.

Trading in the GBP/USD may remain extremely volatile today and tomorrow. Day traders should take a deep look within themselves today, and ask if they have the experience level needed to speculate on the GBP/USD in the near term. Today the U.S. will release important Consumer Price Index readings which will provide insights about inflation. Tomorrow the U.K. will publish key Gross Domestic Product numbers which will give traders information regarding growth. The results from U.S. inflation news today and tomorrow will add to nervous tension, and so will the U.K. growth data tomorrow. The GBP/USD will rattle on the outcomes.

GBP/USD Support and Resistance Levels may Widen Today and Tomorrow

- The GBP/USD should be expected to become fast today and tomorrow as financial houses react to the economic data via U.S CPI today, U.S PPI tomorrow, and U.K GDP data also on Friday.

- Having produced a choppy range the entire past week, speculators should brace for more volatility as equilibrium is sought in the midst of an unclear economic outlook for many financial institutions.

- Traders leaning toward bullish perspectives in the GBP/USD cannot be blamed, but the one-month trend has not been positive, and betting for a sustained turnaround upwards could be dangerous in the short term.

GBP/USD Short-Term Outlook:

- Current Resistance: 1.27750

- Current Support: 1.27540

- High Target: 1.27980

- Low Target: 1.27090

(Click on image to enlarge)

More By This Author:

BTC/USD: Bounce Higher After Challenging Important SupportEUR/USD Technical Analysis: Anticipation Of The Most Important Event

Forex Today: China Going into Deflation?

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more