GBP/USD Price Vulnerable Under 1.37 Amid Firm USD, Brexit Concern

Trying to regain a foothold after Friday’s hard hit, the GBP/USD price is under pressure below 1.3700. However, as the US dollar continues to strengthen and Brexit risks loom, the bears remain in control.

As the PCE price index climbs to 4.4% y/y in September compared with 4.2% growth earlier on Friday, the US dollar index continues to climb near two-week highs amid growing expectations of an earlier-than-expected Fed interest rate hike.

Photo by Colin Watts on Unsplash

Treasury bonds have also experienced an increase in yield. The 10-year base rates have risen by 1.50% so far. The markets responded fully to the Fed’s announcement of reducing its bond purchases this week.

In addition, escalating disputes between the UK and France over fishing rights will affect the British currency. In a recent interview with the Financial Times (FT), French President Emmanuel Macron said the Brexit dispute was a “test” of Britain’s “credibility.”

“It will be a drama, it will be a disaster,” Jean-Marc Puisso, head of the French ports of Calais and Boulogne, warned despite this.

Vice president of International Relations and Forecasting at the European Commission, Maros Sefcovic, said: “He fears the (British) government won’t consider proposals from Brussels.”

The pair will likely remain tense as they prepare for the big week, keeping an eye on the Fed and Bank of England announcements as well as Friday’s NFP report. Meanwhile, dealers will benchmark their business against the final UK Manufacturing PMI and the US ISM Manufacturing PMI.

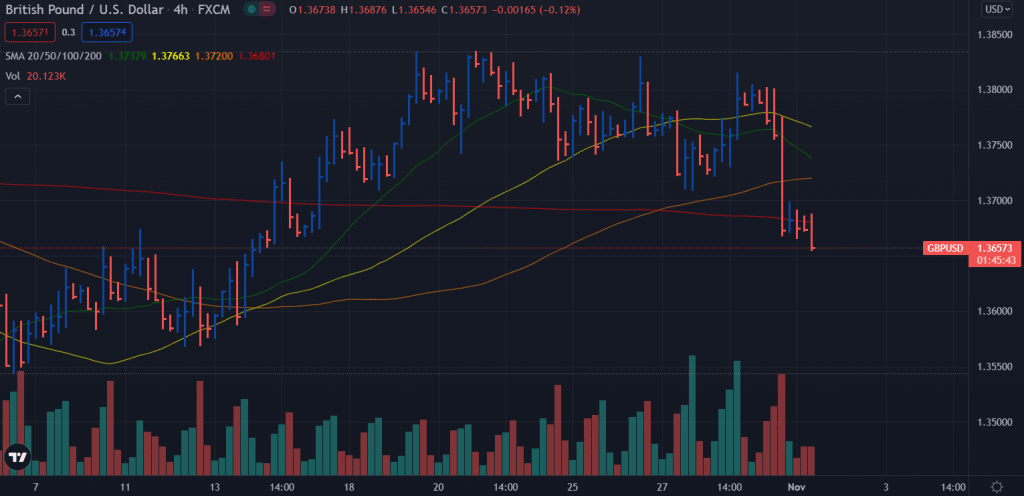

GBP/USD Price Technical Analysis: Bears To Test 1.3600

(Click on image to enlarge)

The GBP/USD price remains under strong bearish pressure below the 200-period SMA. The price is also well below other key moving averages and the key level of 1.3700. However, the price is now at another important horizontal support level of 1.3660. If the support is broken, we may see a plunge towards the 1.3600 area ahead of 1.3570. On the upside, 200-period SMA (1.3675) and 1.3700 will be the key hurdles to overcome. The volume data shows a bearish bias while the price is still at a low average daily range level at the moment.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more