GBP/USD Price Recovers From US NFP-Led Losses

The GBP/USD price turned to the upside, trading at 1.2579 at the time of writing. Surprisingly or not, the pair came back higher after reaching Friday’s low of 1.2502, even though the US reported better-than-expected data.

The United States Non-Farm Payrolls came in at 199K versus 184K expected, Average Hourly Earnings rose by 0.4%, beating the 0.3% growth estimated, Unemployment Rate dropped unexpectedly from 3.9% to 3.7%, while Prelim UoM Consumer Sentiment was reported higher at 69.4 points versus 62.0 forecasts.

Unfortunately for the USD, the US dollar printed temporary retreats after reaching the 104.21 key upside obstacle. Taking out this obstacle activates further growth and helps the greenback to dominate the currency market. Tomorrow, the fundamental factors should have a major impact. The US is to release the inflation figures. The Consumer Price Index could announce a 0.0% growth in November after a 0.0% growth in October. CPI y/y could report a 3.1% growth, while Core CPI is expected to register a 0.3% growth, compared to the 0.2% growth in the previous reporting period.

On the other hand, the UK is to release the Claimant Count Change, Average Hourly Earnings, and Unemployment Rate data.

GBP/USD Price Technical Analysis: Bullish Momentum

(Click on image to enlarge)

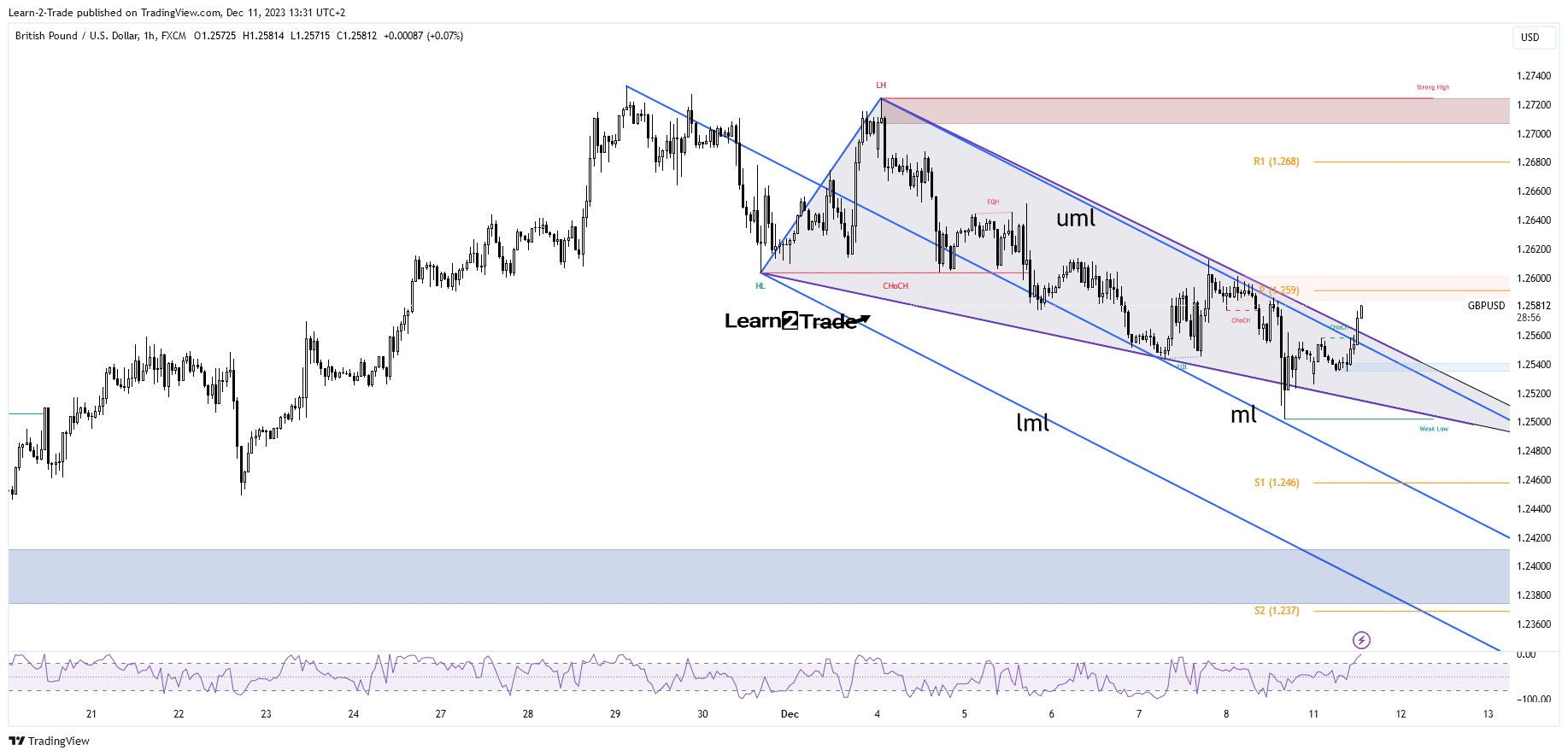

GBP/USD 1-hour chart

From the technical point of view, the GBP/USD pair developed a Falling Wedge chart pattern after failing to take out the median line (ml) of the descending pitchfork. Its failure to retest this dynamic support announced exhausted sellers.

As you can see, the price jumped above the downtrend line (pattern’s resistance) and through the upper median line (uml), signaling a new leg higher. Now, it is almost at the weekly pivot point of 1.2590. This stands as a static resistance. Taking out this level and stabilizing above the 1.26 psychological level activates further growth.

More By This Author:

EUR/USD Outlook: Euro Hovers Near Three-Week LowUSD/JPY Forecast: Dollar Recovers Ahead Of Inflation, Fed

AUD/USD Weekly Forecast: Employment Boost Sparks Dollar

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more