GBP/USD Price Pauses Gains By 1.1200, All Eyes On US PCE

The GBP/USD price rallied in the short term as the US dollar saw a mild downside correction. The pair is trading at 1.1172 at the time of writing, below 1.1234, today’s high.

The USD lost significant ground versus the other major currencies after mixed economic data during the week. Today, the UK data came in mixed as well. The Current Account came in at -33.8B above -43.2B expected, Final GDP rose by 0.2% even though the analysts had expected a 0.1% drop. Nationwide HPI registered showed a 0.0% growth compared to 0.2% expected. In contrast, Revised Business Investment came in line with expectations. It reported a 3.7% growth.

In addition, the M4 Money Supply dropped by 0.2% versus a 0.5% growth expected. Mortgage Approvals indicator came in at 74K above 63K expected, while Net Lending to Individuals was reported higher at 7.2B exceeding the 6.4B estimates.

Later, the US data could bring more action to the GBP/USD pair. The Core PCE Price Index is expected to report a 0.5% growth while Revised UoM Consumer Sentiment could remain steady at 59.5 points. Furthermore, the Chicago PMI, Personal Income, and Personal Spending indicators will also be released.

Dollar Index price technical analysis: Corrective phase

After failing to stay above the bullish channel’s upside line, the Dollar Index developed a corrective phase. Now, it has slipped lower within a down-channel. As long as it stays under the descending trendline, the DXY could extend its downside movement. The current sell-off forced the USD to depreciate versus its rivals.

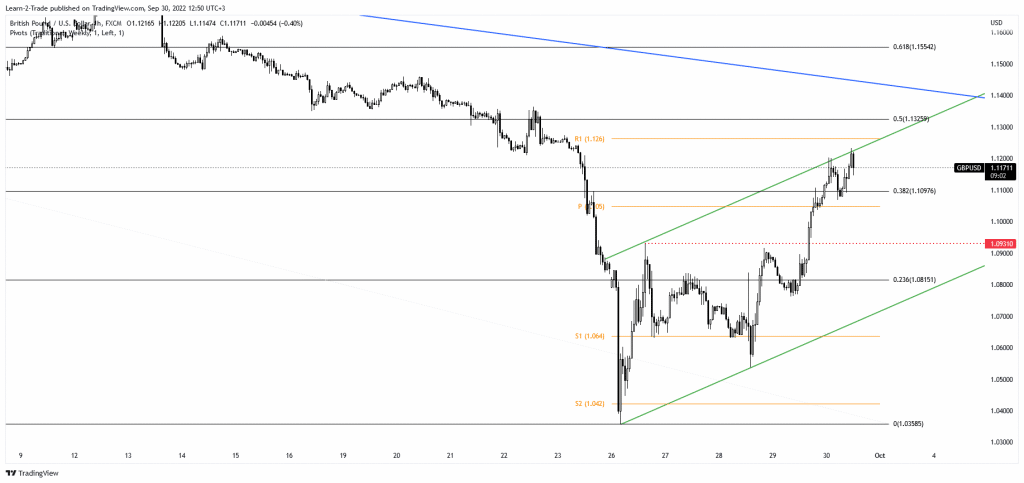

GBP/USD price technical analysis: Bullish channel

(Click on image to enlarge)

As you can see on the hourly chart, the GBP/USD pair extended its growth after taking out the 1.0931 resistance. The pair has reached the 1.1200 psychological level and the channel’s upside line, representing upside obstacles.

After its amazing rally, we cannot exclude a temporary drop. The price could come back to test the near-term downside obstacles before trying to resume its swing higher. The 1.1400 and the downtrend line represent upside targets. Don’t forget that the channel could represent a bearish pattern after making a valid breakdown through the ascending trendline.

More By This Author:

USD/CAD Outlook: OPEC+ Ready To Intervene To Pause Price DeclineAUD/USD Forecast: Flight to Safe-haven USD, Dumping Aussie

EUR/USD Outlook: Europe’s Inflation Expectations on the Rise

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more