GBP/USD Price Analysis: Dollar Pauses Ahead Of FOMC

The GBP/USD price analysis hints bullishness as the pound secured gains on Tuesday. The backdrop for this positive move was the dollar, which took a breather in anticipation of the upcoming FOMC meeting. The dollar appears likely to end the month flat.

However, analysts highlight that the potential for another interest rate increase from the Federal Reserve is supporting the dollar. Moreover, they note the enduring strength of the US economy.

On Monday, the pound remained relatively stable against the dollar. Traders were anticipating the Bank of England’s (BoE) upcoming meeting on Thursday, where it will likely keep rates unchanged.

Notably, the British pound has struggled in currency markets recently due to diminishing risk appetite. This is due to stock market turbulence and conflict in the Middle East. Moreover, currency analysts have pointed out that deteriorating UK economic indicators have reinforced expectations that the BoE will maintain current rates.

Elsewhere, BoE data released on Monday revealed that British lenders approved the fewest home loans since January in September. It signals a sluggish property market.

Meanwhile, MUFG currency analysts noted that the BoE was probably at the peak of its rate-tightening cycle. Therefore, the focus will shift to “communication regarding the potential shift toward a more dovish stance in the upcoming meetings.”

The analysts suggested that a significant shift was not imminent. Still, they acknowledged that most data released since the last meeting in September indicated weak economic activity.

GBP/USD key events today

With no significant reports coming from the UK, traders will focus on US releases, including:

- CB consumer confidence for October.

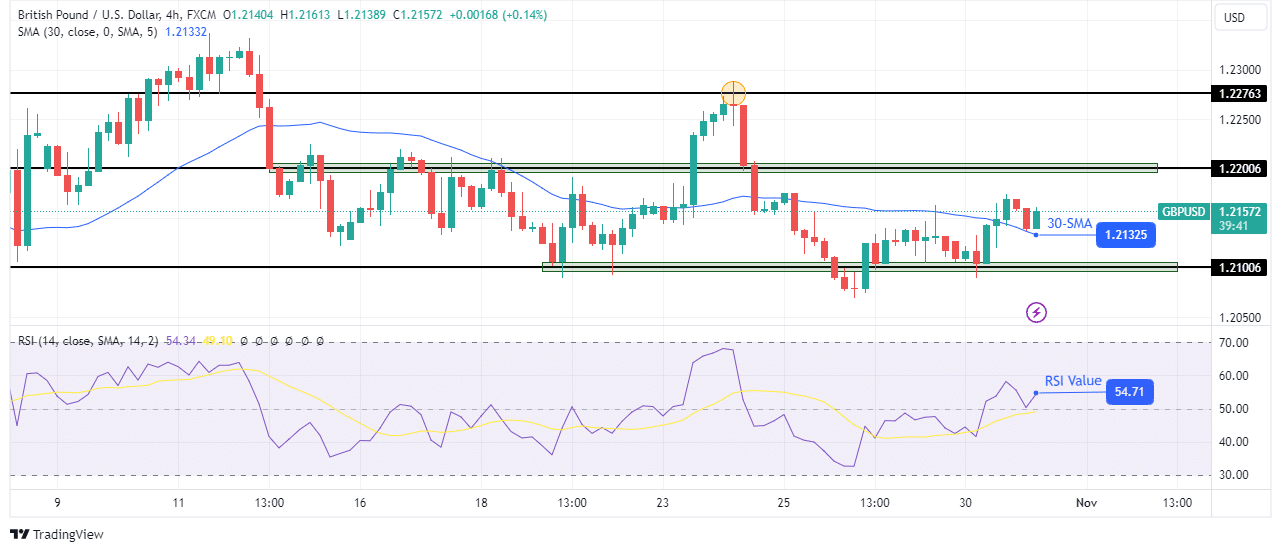

GBP/USD technical price analysis: Price rebounds from 30-SMA support.

GBP/USD 4-hour chart

The GBP/USD pair is bouncing higher after retesting the 30-SMA support. At the same time, the RSI is pushing off the pivotal 50 level moving toward the overbought level. This move follows a failed attempt to break below the 1.2100 support level.

Bulls took control by engulfing the candle from the 1.2100 support and breaking above the 30-SMA resistance. Moreover, they are now targeting the next resistance at 1.2200. A break above 1.2200 would strengthen the bullish bias. Furthermore, it would clear the path to retest the 1.2276 resistance.

More By This Author:

GBP/USD Weekly Forecast: BOE’s Tightening Nears Finish LineUSD/JPY Outlook: Dollar Anchors Yen Near 150 Ahead Of BoJ

EUR/USD Weekly Forecast: ECB’s Hike Campaign Grinds To A Halt

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more