GBP/USD Price Analysis: Dollar Gains Before Critical US NFP Data

In Friday’s GBP/USD price analysis, a bearish tone prevails as the pound succumbs to a stronger dollar ahead of a pivotal US employment report. Investors keenly anticipate the release of the US non-farm payrolls, eagerly seeking insights that could illuminate the Fed’s next policy decisions.

A Reuters poll estimates that the US unemployment rate remained 3.9% in November. On the other hand, the non-farm payrolls might rise to 180,000 from 150,000 in October.

Meanwhile, investor confidence in early rate cuts by major central banks is growing.

However, futures markets indicate investors believe the BoE’s first rate cut may not occur until June. At the same time, there are expectations for March cuts by the European Central Bank and the Federal Reserve. This belief has contributed to limited profit-taking on the pound’s November rally.

The upcoming BoE meeting next week will likely result in no change for UK rates. However, market attention will be on the post-meeting statement.

Elsewhere, recent data in the US revealed a moderate increase in Americans filing new claims for unemployment benefits. Consequently, it indicates a gradual loss of momentum in the labor market due to higher borrowing costs.

GBP/USD key events today

- US average hourly earnings

- US non-farm employment change

- US unemployment rate

- US consumer sentiment

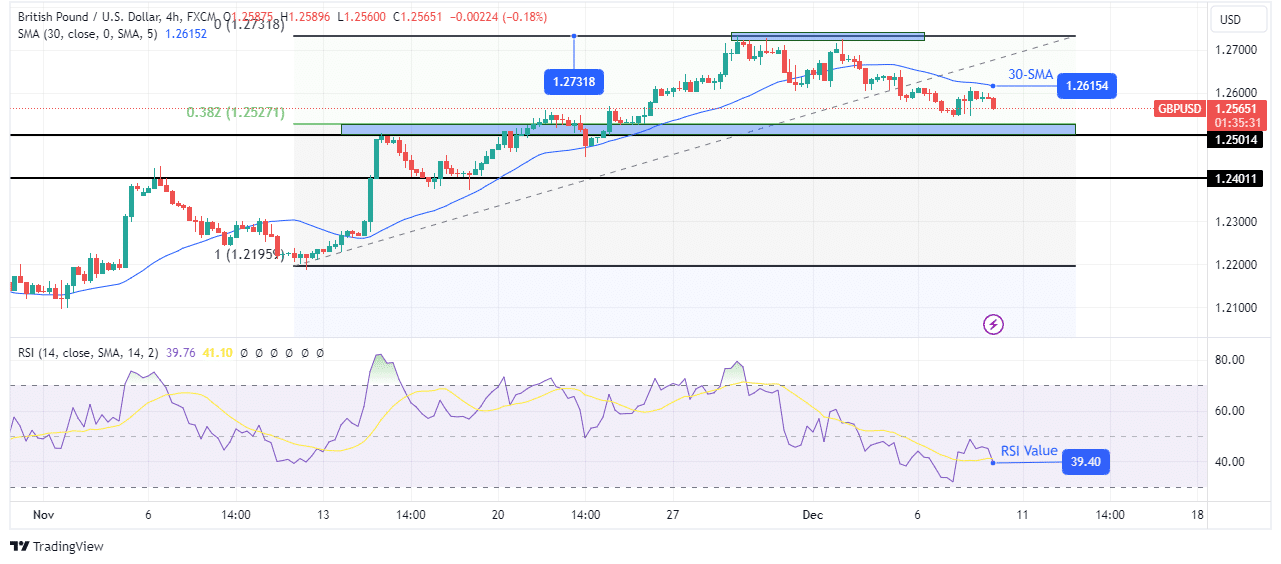

GBP/USD technical price analysis: Price nears a resilient support zone

GBP/USD 4-hour chart

Pound bears are finding their footing below the 30-SMA as the new bearish trend slowly takes shape. GBP/USD has been in a strong uptrend that paused at the 1.2731 key level. At this point, bears took over when they pushed the price below the 30-SMA.

Now, the price is making lower lows and highs, indicating that bears are in the lead. However, they will still face strong support levels that could stop the downtrend.

The price is approaching a strong support zone comprising the 0.382 fib retracement and 1.2501 key support levels. A break below this zone would allow the price to retest the 1.2401 key level. However, bulls might resume the previous uptrend if the zone holds firm.

More By This Author:

USD/JPY Price Aiming to Pounce 145.0 After Downbeat US ADPUSD/CAD Forecast: Loonie Loses Ground After BoC’s Pause

AUD/USD Price Analysis: Aussie Gains Despite Economic Hurdles

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more