GBP/USD Price Analysis: Directionless Under 1.3350, Eying Brexit, BoE

The GBP/USD price analysis suggests a neutral stance as the pair remains in a narrow range. Apparently, the pair lacks any directional bias.

The GBP/USD pair fluctuated between moderate gains and small losses on Monday, hovering just beneath the mid-1.3300 level during pre-European trading.

Photo by Colin Watts on Unsplash

Price action on the first day of the week was subdued as the pair struggled to benefit from Friday’s good bounce from the 1.3280-75 area, which was the lowest since December 2020. Since investors have waited to see if the new variant of the Omicron Coronavirus will disrupt economic recovery, global risk sentiment has stabilized slightly. As a result, a surge in US Treasury bond yields was triggered by the flow of risk, which stimulated the demand for the US dollar and weighed on the GBP/USD pair.

Meanwhile, the pound sterling remains under pressure due to the ongoing uncertainty surrounding Brexit. Margaritis Schinas, the vice president of the European Commission, said on Saturday that the UK had to deal with its own migrant problems post-Brexit. In addition, traders are discouraged from putting rates on the GBP/USD pair upward amid intensifying disputes over fishing rights between France and the UK. Even so, the Bank of England’s expectations of an impending rate hike provided some support.

The UK will not release any major economic data on Monday, while Pending Home Sales will be released by the US business magazine. Thus, the GBP/USD pair is at the mercy of US dollar price fluctuations and new developments in the Brexit saga. Furthermore, broader market sentiment on risk and US bond yields could affect the dollar and boost large companies.

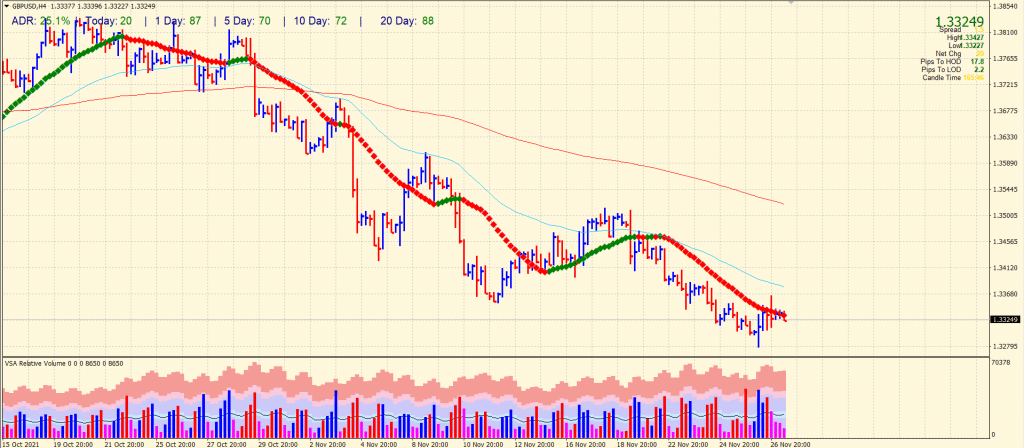

GBP/USD Price Technical Analysis: Buyers Shy Of 1.3350

(Click on image to enlarge)

The GBP/USD price remains in a narrow range around the 20-period SMA on the 4-hour chart. Any bullish attempt will find a resistance cluster in the 1.3350-65 area, where a bounce back may occur. However, if the price clears the hurdle, we may see a surge towards the 1.3400 handle. On the flip side, 1.3300 will act as strong support ahead of 1.3275.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more