GBP/USD Price Analysis: Bulls Dominate After Hawkish BoE

The Bank of England (BOE) stands firm in its hawkish stance, even as the prospect of US rate cuts gains traction, making for a bullish GBP/USD price analysis. On Thursday, the BOE affirmed its commitment to keeping British interest rates elevated for an extended period. In contrast, the Fed has signaled rate cuts in 2024.

Governor Andrew Bailey declared a 6-3 vote to hold rates at a 15-year high of 5.25%. Additionally, Bailey said there was still a big distance to cover in addressing inflation concerns. Therefore, he went against the expectations of investors who had increasingly bet on rate cuts. Unlike the Federal Reserve’s indication of potential rate cuts in the United States, the BOE did not discuss cutting rates. On the contrary, it expressed concerns that Britain’s inflation might be more persistent.

Meanwhile, data this week revealed a slowdown in wage growth and a 0.3% decline in gross domestic product in October. It raises concerns about a potential recession ahead of the expected 2024 national election. Still, the BOE remained steadfast. As a result, investors revised their expectations for the first rate cut from March to May.

ING economist James Smith noted the BOE’s reluctance to support rate cut expectations. This is a divergence from the more proactive stance of the Federal Reserve.

GBP/USD key events today

- UK Flash Manufacturing PMI

- UK Flash Services PMI

- US Empire State Manufacturing Index

- US Flash Manufacturing PMI

- US Flash Services PMI

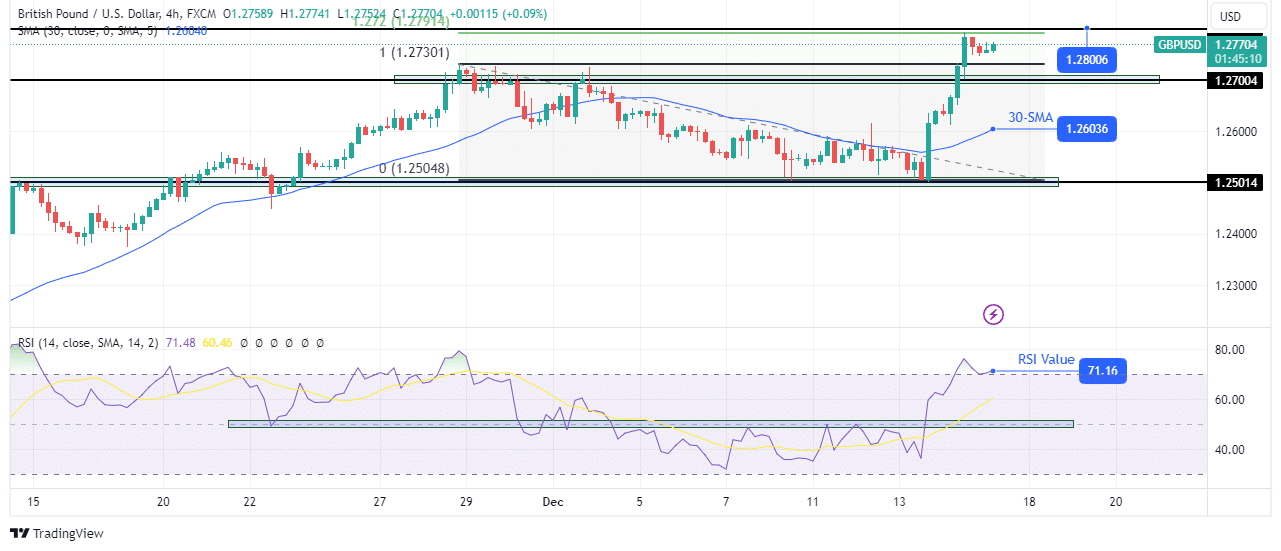

GBP/USD technical price analysis: Potential pullback as bullish momentum peaks

GBP/USD 4-hour chart

On the technical side, GBP/USD has broken above the 1.2700 key resistance level in a strong bullish surge. As a result, the price left the 30-SMA far below, showing massive bullish strength. Similarly, the RSI has risen to the overbought region. However, this might also lead to a pullback as the bullish move is overextended. On the fib tool, the price has extended to 1.27 in one move without pauses.

Moreover, there is resistance slightly above at the 1.2800 key level. Therefore, a short pause would allow the price to retest the 1.2700 level. Furthermore, it would allow the SMA to catch up with the price.

More By This Author:

EUR/USD Outlook: Euro Gains As ECB Maintains Hawkish StanceGold Price Rallies Above $2,000 After Dovish FOMC

USD/JPY Price Stalls Below 146.0, Focus Shifts On FOMC

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more