GBP/USD Outlook: Williams Challenges Fed Rate Cut Expectations

The GBP/USD outlook takes a subtly bearish turn on Monday. The pair is retracing its steps from recent peaks due to comments by Federal Reserve Bank of New York President John Williams. On Friday, Williams challenged the market consensus for rate cuts, emphasizing that the Fed wasn’t currently deliberating on them and deeming speculation premature.

However, there is still bullish support for the currency. Notably, data on Friday revealed that Britain’s services sector experienced increased growth this month. The PMI showed that the business activity gauge climbed to 52.7 from 50.9 in the services sector, marking its highest reading since June. This is only the second time since July that the index exceeded the 50.0 growth threshold.

Therefore, the economy, for the time being at least, can steer clear of a recession. Moreover, this came a day after the Bank of England affirmed its stance on keeping interest rates high.

On Thursday, the Bank of England kept borrowing costs unchanged, emphasizing the need to keep rates elevated to mitigate risks from persistently high inflation. However, financial markets are pricing in rate cuts for the coming year.

Economists pointed out that the data supported the Bank of England’s decision not to discuss reducing borrowing costs.

GBP/USD key events today

The currency might end up moving sideways today as no key events are coming from the UK or the US today.

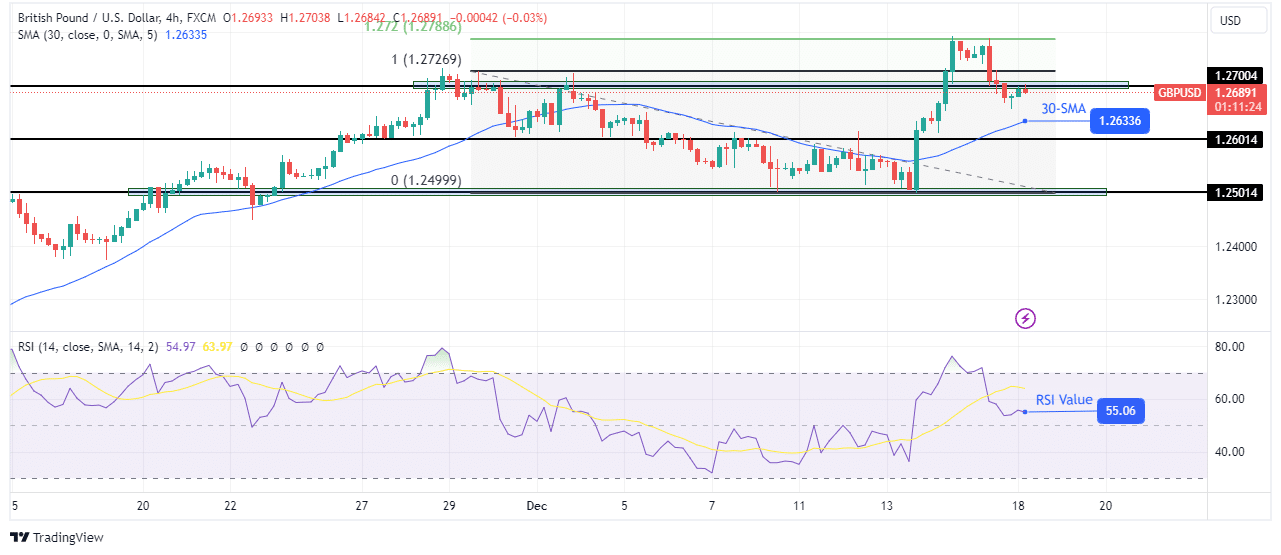

GBP/USD technical outlook: Price takes a step back from recent highs

GBP/USD 4-hour chart

The price is pulling back on the charts after making new highs above the 1.2700 key level. Initially, the bullish trend paused around the 1.2700 key level, allowing bears to reverse the trend.

Although the price traded below the 30-SMA, the move was shallow, meaning bears were not much stronger than bulls. Moreover, the RSI never got oversold. The weak downtrend stopped at the 1.2501 key support level, where bulls took charge with a bullish engulfing candle that broke above the 30-SMA.

The Bulls have made a strong move that has extended to the 1.272 key fib level. Moreover, this level has acted as strong resistance, leading to a pullback. However, the uptrend will likely soon resume, given the strong bullish bias.

More By This Author:

USD/JPY Weekly Forecast: Fed-BoJ Divergence Leads SellersGBP/USD Weekly Forecast: Hawkish BoE Gathering Traction

GBP/USD Price Analysis: Bulls Dominate After Hawkish BoE

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more