GBP/USD Outlook: Pound Maintains 5-Month Low Following Data

The GBP/USD outlook suggests downward momentum as the Pound clings near 5-month lows following US and UK data. While the US boasts surprisingly strong sales figures, the UK registered a mild dip in wage growth.

The dollar strengthened after another set of positive economic data from the US. Retail and core retail sales jumped in March, indicating robust consumer spending. This report followed the hot inflation figures and the blockbuster jobs report. Consequently, it gave policymakers another reason to doubt whether inflation is on a downtrend. Moreover, it led to a further decline in Fed rate cut expectations. The likelihood of a cut in July has fallen to 41%. Meanwhile, the likelihood of a cut in September has risen to 46%.

Demand in the US economy has remained robust despite the high interest rates. Meanwhile, most other major economies are slowing down with inflation falling. Therefore, there is a growing divergence in monetary policy outlooks.

Elsewhere, the pound weakened after data revealed a slight easing in the UK labor market. Core wage growth in the UK slowed in the three months to February, giving the Bank of England another reason to consider rate cuts. Wages without bonuses grew 6.0%, down from 6.1%.

Still, the shifting rate cut outlook in the US has affected the BoE’s rate cut outlook. Investors are scaling back expectations for UK rate cuts because the Fed might only cut interest rates later in the year. If the BoE starts cutting much earlier, it could lead to a policy divergence that would weigh on the pound.

GBP/USD key events today

- BOE Gov Bailey Speaks

- Fed Chair Powell Speaks

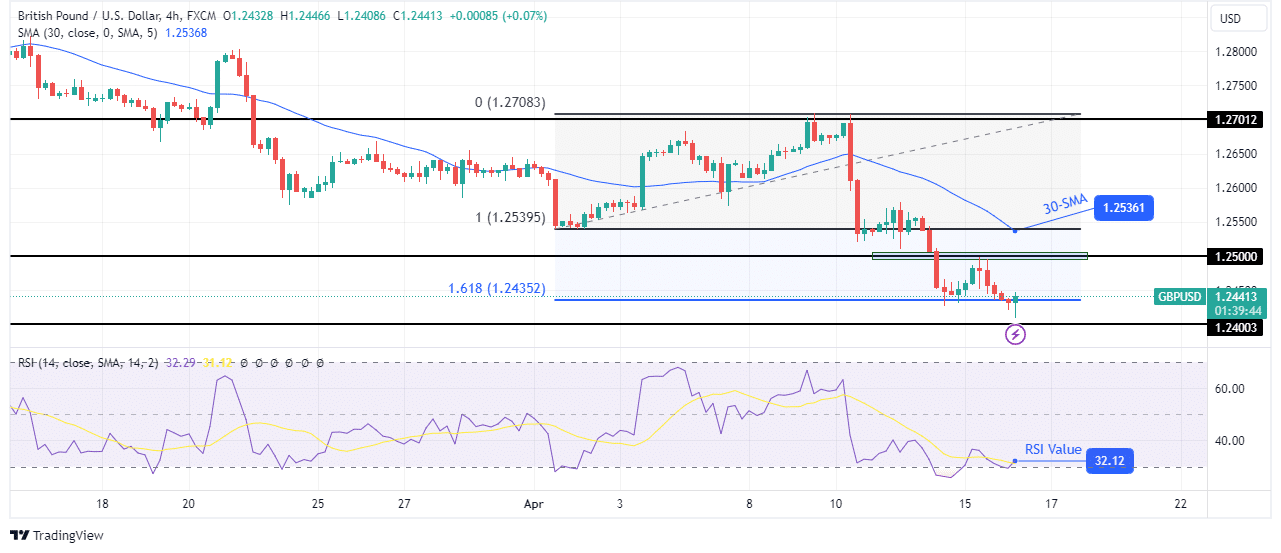

GBP/USD technical outlook: Weak below 1.2500 support

(Click on image to enlarge)

GBP/USD 4-hour chart

On the technical side, the GBP/USD price has broken below the 1.2500 key support level and has reached the 1.618 Fib extension level. Moreover, the bearish bias is strong as the price sits well below the 30-SMA with the RSI just above the oversold region.

However, the bearish move looks exhausted as the price makes smaller candles. At the same time, the RSI has made a higher low, indicating weaker momentum. Therefore, the price might be pulled back to retest the 1.2500 key level or the 30-SMA before continuing to be lower.

More By This Author:

GBP/USD Weekly Forecast: Fed’s Delayed Cut Weighs On PoundEUR/USD Price Analysis: Euro Tumbles Amid ECB’s Cut In June

USD/CAD Outlook: Bullish As BoC-Fed Divergence Widens

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more