GBP/USD Outlook: British Wage Growth Hits The Brakes In Nov

On Tuesday, the GBP/USD outlook took a bearish turn as the pound faced a decline, fuelled by data revealing a drop in British wage growth throughout November. This development has intensified anticipation for substantial interest rate cuts by the Bank of England this year.

Official data on Tuesday revealed a drop in the growth of British wages, excluding bonuses, to 6.6% in the September-to-November period compared to the same period a year earlier. Meanwhile, economists had anticipated a 6.6% rise in the regular earnings measure.

Notably, the Bank of England has been concerned about rapid pay increases. Consequently, the bank has worked to bring inflation down to its 2% target despite a recent slowdown in the headline rate of price growth. However, now there is less pressure due to the slowdown in pay increases.

Markets await insights from Britain’s inflation figures to gauge the BoE’s timeline for starting monetary policy easing. At the same time, money markets are currently factoring in approximately 130 basis points of BoE interest rate cuts by year-end, with a probable initial cut in May.

The central bank is concerned about persistent inflation and the potential risk of more fiscal easing in the UK March budget. Moreover, recent data revealed that Britain’s economy exceeded expectations in November but remains susceptible to a mild recession. This poses a challenge for Prime Minister Rishi Sunak ahead of the anticipated 2024 election.

GBP/USD key events today

- US Empire State Manufacturing Index

- BOE Gov Bailey Speaks

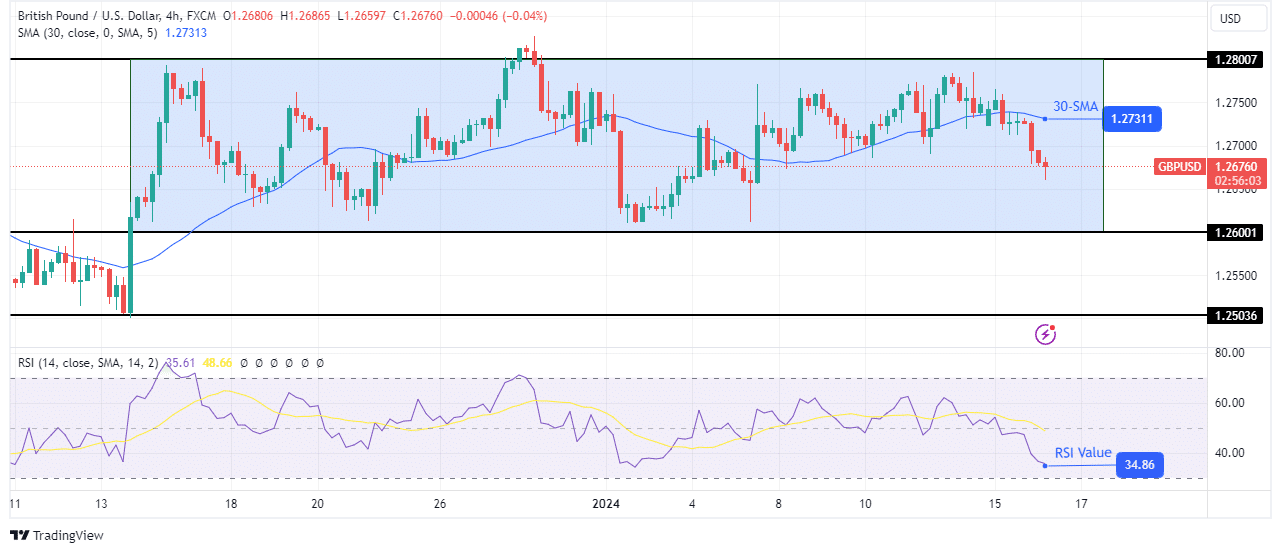

GBP/USD technical outlook: Eyes on 1.2600 as Bears gain momentum

(Click on image to enlarge)

GBP/USD 4-hour chart

On the technical side, the GBP/USD price is bearish as the price is falling well below the 30-SMA. At the same time, the RSI is quickly falling toward the oversold region, a sign that bears are gaining momentum. Therefore, the price might soon retest the 1.2600 support level.

However, on a larger scale, the price is still stuck in a sideways move between the 1.2800 resistance and 1.2600 support levels. As such, a bearish trend can only emerge if the price breaks below the 1.2600 support level. Bears would then retest the 1.2503 support level.

More By This Author:

USD/CAD Outlook: Pair Holds Steady On A Public HolidayUSD/JPY Price Accumulating Buying at 145.0, Eyes On US PPI

USD/CAD Price Picks Momentum Near 1.3375, Eying US CPI

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more