GBP/USD Holds Above 1.3500 As USD Loses Strength After CPI

Photo by Colin Watts on Unsplash

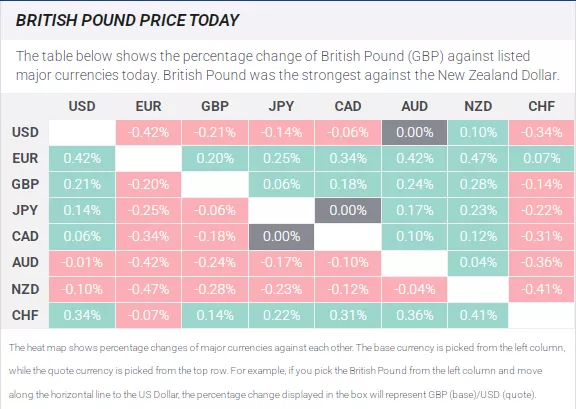

Following Tuesday's sharp decline, GBP/USD stages a rebound and trades above 1.3500 in the American session on Wednesday. At the time of press, the pair was up 0.23% on the day at 1.3528.

On Tuesday, GBP/USD came under bearish pressure after the disappointing labor market data revived expectations for the Bank of England to lower the policy rate twice more this year. The renewed US Dollar (USD) weakness, however, helped the pair shake off the bearish pressure midweek.

The data published by the US Bureau of Labor Statistics showed that the Consumer Price Index (CPI) rose 0.1% on a monthly basis in May. This reading followed the 0.2% increase recorded in April and came in below the market expectation of 0.2%. Similarly, the core CPI, which excludes volatile food and energy prices, increased 0.1% in this period, compared to analysts' estimate of 0.3%.

The USD Index turned south following the May inflation data and was last seen losing 0.3% on the day at 98.75. In the meantime, the probability of the Federal Reserve leaving the policy rate unchanged in September declined toward 30% after the CPI data, from nearly 40% on Tuesday, as per the CME FedWatch Tool.

Later in the American session, investors will pay close attention to the outcome of the 10-year US Treasury note auction.

More By This Author:

AUD/USD Drifts Closer To 0.6500 With The Focus Turning To The U.S. CPI ReleaseUSD/CHF Hesitates Above 0.8200 With Markets Awaiting Trade News

Crude Oil Gains Ground As Energy Markets Hope For Us-China Trade Solutions

Disclaimer: All the data in this article is for information and educational purposes only. Although the information contained in this article have been compiled or arrived at from ...

more