GBP/USD Forecast: Sellers Emerge Ahead Of US Core PCE Data

Wednesday’s GBP/USD forecast unveils a bearish outlook, spurred by the dollar’s surge in anticipation of key inflation data. Investors positioned themselves ahead of the core PCE price index, which the Fed closely monitors. On Tuesday, the dollar had pulled back slightly after the US released poor economic data.

Notably, consumer confidence in the US fell amid fears about the economy’s outlook. Consumers were concerned about the looming presidential election that could impact the economy. Additionally, another report revealed a decline in orders for core durable goods. Business investment in equipment softened in January.

However, investors brushed this weakness aside on Wednesday as they awaited inflation data. Recent figures on US inflation have come in higher than expected, showing persistence. Therefore, there is a high chance this trend will continue. If it does, the core PCE figure might be higher than the expected 0.4%. Consequently, investors would scale back expectations for June’s first Fed rate cut. As a result, the dollar would climb, leading to a decline in GBP/USD.

Meanwhile, according to figures from the US Commodity Futures Trading Commission, speculators have reduced their bullish positions in the pound as they await new catalysts in the market. At the same time, volatility has dropped significantly in the pound in recent weeks. However, the currency has mostly held steady.

GBP/USD key events today

- Preliminary US GDP

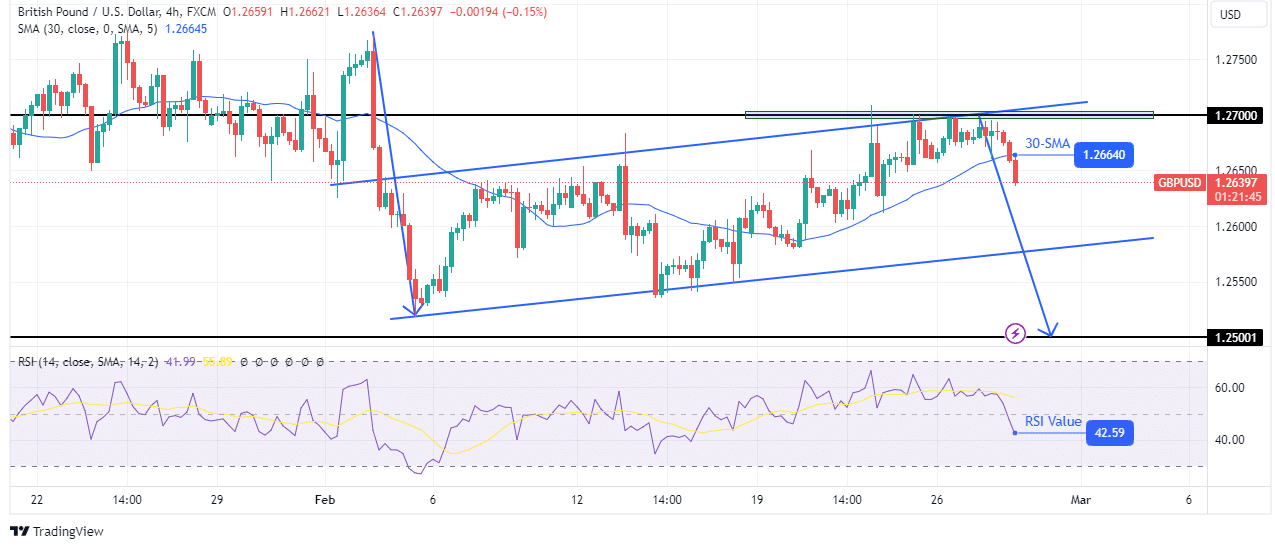

GBP/USD technical forecast: Price takes a dip after hitting its channel ceiling

(Click on image to enlarge)

GBP/USD 4-hour chart

On the charts, GBP/USD bounces lower after hitting a resistance zone comprising its channel resistance and the 1.2700 critical level. The price is currently trading in a bullish channel. However, after touching the channel resistance, bears have taken over with a break below the 30-SMA.

Notably, it made a solid bearish impulse leg before the price started trading in the channel. Therefore, there is a chance that the same will happen when it breaks out of its shallow channel. Currently, price action shows strong bearish momentum. Moreover, the RSI supports bearish momentum below 50. Consequently, the decline might continue past channel support to retest the 1.2500 key support level.

More By This Author:

AUD/USD Price Analysis: Aussie Slides On Softer InflationUSD/JPY Outlook: Yen Recovers As Greenback Retreats

GBP/USD Forecast: Friday’s Positive Sales Boosting Pound

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more