GBP/USD Forecast: Resilience In UK Economy Boosts Pound

Wednesday brought a bullish outlook to the GBP/USD forecast due to signs of resilience in the British economy. Moreover, there were expectations that the Bank of England would delay rate cuts compared to other central banks.

British services firms experienced increased growth this month, indicating a modest recovery in the sluggish economy. However, factories are now feeling the impact of tensions in the Red Sea.

The PMI data will likely reassure the Bank of England before the upcoming interest rate meeting, suggesting a reduction in overall inflation pressure. Nevertheless, it may support the argument for a cautious approach in gradually lowering borrowing costs.

The preliminary S&P Global/CIPS UK Composite PMI rose to 52.5 in January, marking the highest level in seven months. Moreover, it was an improvement from December’s reading of 52.1.

Meanwhile, on Tuesday, data revealed a smaller-than-anticipated budget deficit for December in Britain. Therefore, there is space for tax cuts in the upcoming March budget. Analysts at Monex Europe mentioned that sentiment toward the UK economy is “generally improving.”

In the medium term, the key question for the British currency is whether the Bank of England will trail behind the Fed and the ECB in cutting rates and by what margin.

Meanwhile, market indicators suggest approximately a 50% probability that the BoE will start rate cuts in May. However, this timeline might be too early for the bank, which has expressed concerns about persistent inflation.

GBP/USD key events today

- US Flash Manufacturing PMI

- US Flash Services PMI

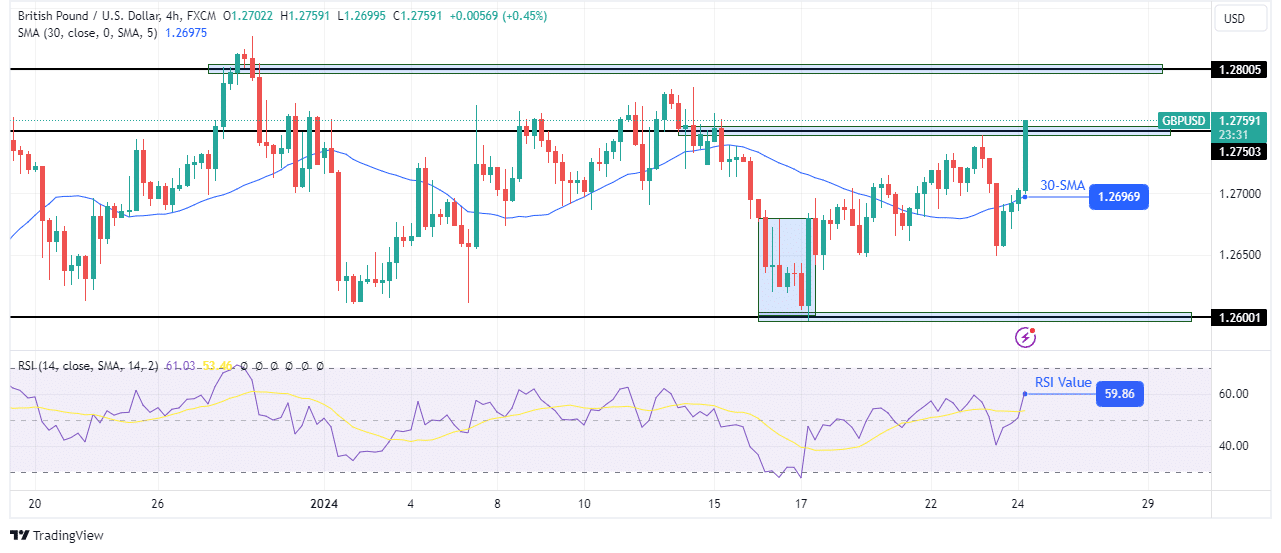

GBP/USD technical forecast: Renewed bullish momentum targets 1.2800

GBP/USD 4-hour chart

The pound is continuing higher and is on the verge of breaking above the 1.2750 resistance level. The bullish bias is strong and has been since the price made a bullish engulfing candle at the 1.2600 support level.

Initially, the bullish move paused at the 1.2750 resistance level, allowing bears to attempt a takeover at the 30-SMA. However, they failed as bulls returned with renewed momentum. If the price closes above 1.2750, bulls will soon retest the 1.2800. Additionally, a break above 1.2800 would finally allow the pair to trend after a long time in consolidation.

More By This Author:

EUR/USD Price Analysis: Euro Rises On Eve Of ECB Rate DecisionUSD/CAD Outlook: Investors Brace For The BoC Meeting

USD/CAD Price Analysis: Soaring Oil Pours Water On The Rally

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more