GBP/USD Forecast: Dollar Recovers After Fed’s Remarks

The dollar strengthened on Wednesday, casting a shadow of bearishness on the GBP/USD forecast as traders contemplated the likelihood of an impending US interest rate hike. Meanwhile, investors were anticipating remarks from Federal Reserve Chair Jerome Powell later.

On Tuesday, Fed Governor Christopher Waller highlighted the remarkable third-quarter US economic growth as a factor to monitor in the central bank’s deliberations on future policy decisions. Notably, the value hit an annualized rate of 4.9%,

Furthermore, his comments prompted a fellow Fed official to explicitly call for another rate hike. Fed Governor Michelle Bowman interpreted the recent GDP data as evidence that the US economy not only remained robust but may have even accelerated. Consequently, it might necessitate a higher Fed policy rate.

Meanwhile, British consumer spending last month saw its slowest growth in over a year, as indicated in a Tuesday survey.

Barclays reported a 2.6% increase in spending on their debit and credit cards from September 24 to October 21 compared to the previous year. It represents the smallest annual rise since September 2022. Moreover, it is a decline from the 4.2% growth seen in the previous month. Additionally, when adjusted for a 6.7% consumer price inflation in September, the actual volume of goods and services purchased by British consumers decreased.

GBP/USD key events today

The UK will not release major economic reports today. Therefore, investors will focus on key events from the US, including,

- Fed Chair Powell’s speech.

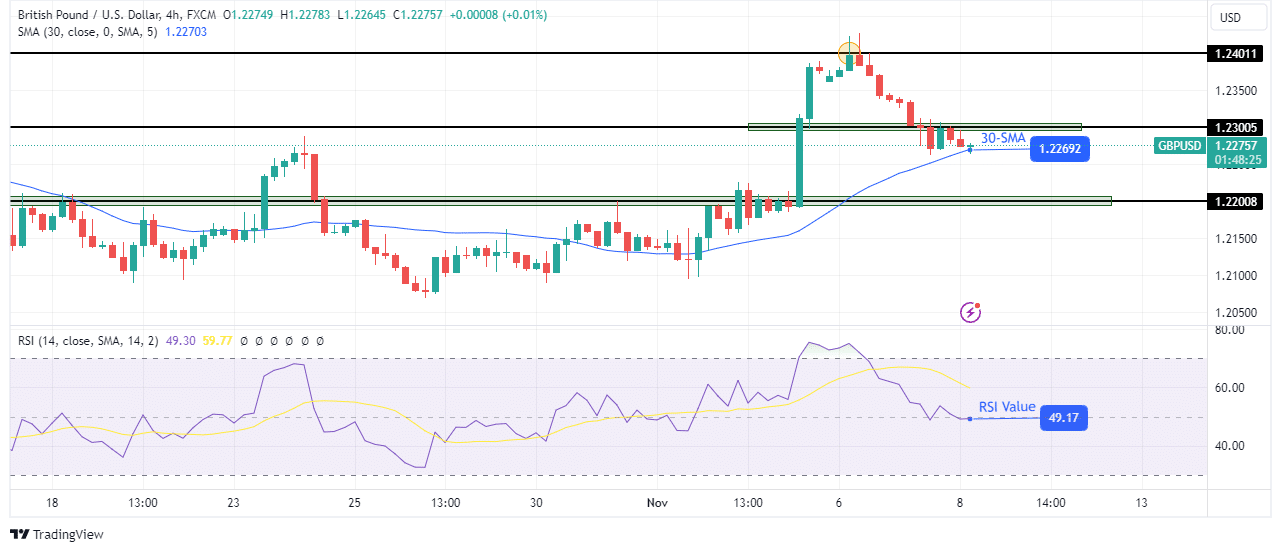

GBP/USD technical forecast: RSI highlights waning bullish momentum.

GBP/USD 4-hour chart

The pound’s decline from the 1.2401 key level has paused at the 30-SMA support. Similarly, the RSI shows that bulls have lost momentum as it rests on the pivotal 50 mark. 50 is a pivotal level because it separates strength in bulls and bears.

Therefore, if the RSI stays above 50 and the price above the 30-SMA, there is support for further upside in the pair. However, if it goes below 50 and the price breaks below the SMA, bears will take over. Still, the bullish bias remains, so the price will likely soon break above 1.2300 to retest the 1.2401 resistance level.

More By This Author:

USD/JPY Outlook: Yen Braces For Gains After Lackluster JobsGold Price At Resistance Under $2,000 Ahead Of The US NFP

EUR/USD Outlook: Optimism Swells As US Rates Approach Peak

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more