GBP/USD Forecast: Continues To Recover

- The British pound has been fairly strong during the trading session on Friday as the jobs number in the United States came out as adding just 12,000 jobs last month.

- That being said, you can only read so much into it mainly due to the fact that a lot of the numbers were skewed by hurricane issues in places like Georgia and North Carolina, the data probably won't fully factor in everything for several weeks.

- So, I think Wall Street and the trading public in general are probably going to ignore that for a little while.

Now there are questions as to whether or not the Federal Reserve will be willing to cut interest rates by 25 basis points at the next meeting. And perhaps more importantly, at least in the short term, we have the presidential election on Tuesday.

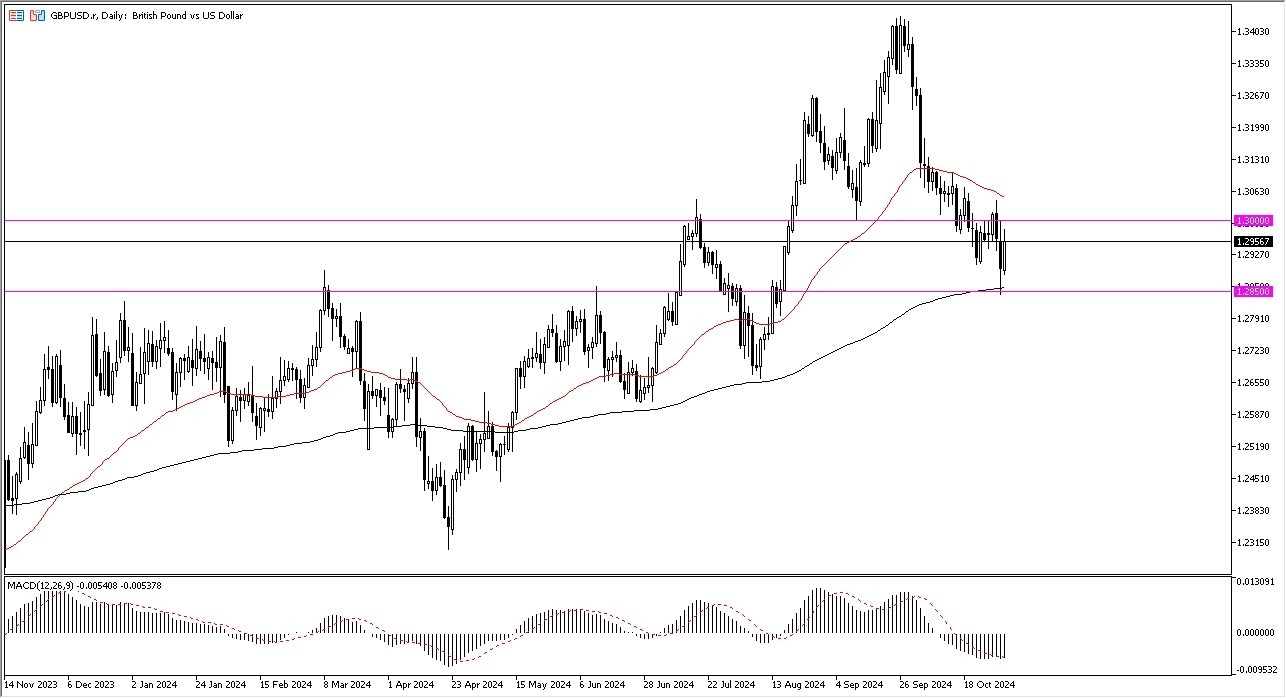

It'll be interesting to see how this plays out, but at this point, it looks like we are at least trying to recover. Speaking of the recovery from the technical analysis standpoint, it's worth noting that Thursday had seen this pair slam into the 1.2850 level, which also features the 200-day EMA. This is an indicator that a lot of traders will pay close attention to.

(Click on image to enlarge)

Recent Action

Based on the action of the last 36 hours or so, it looks like the Friday candlestick is just going to be a continuation of that recovery, as perhaps the British pound got a little oversold. A break above the 1.30 level would be very positive, but it's really not until we break above the 50-day EMA that you can start to think along the lines of a stronger recovery. If we were to turn around and break down below the 1.2850 level, the US dollar will probably take off with quite a bit of gusto and strength. I also anticipate that would probably be a market wide phenomenon for the greenback, not just against the British pound.

More By This Author:

GBP/CHF Forecast: GBP Plummets Against Franc

EUR/USD Monthly Forecast: November 2024

Gold Forecast: Gold Continues To Show Strength

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more