GBP/USD Forecast: British Pound Bounces On Friday

That being said, I also recognize that this is a market that will continue to be noisy, especially as the Monetary Policy Committee had two of its members vote for an interest rate cut this past week, so that does put a little bit of negativity into the British pound, but on Friday we have the market reacting to the University of Michigan Consumer Sentiment numbers coming out much lower than anticipated, and this course has people already starting to try to price in the idea of the Federal Reserve cutting rates. This of course is nonsense, but it was the catalyst on Friday.

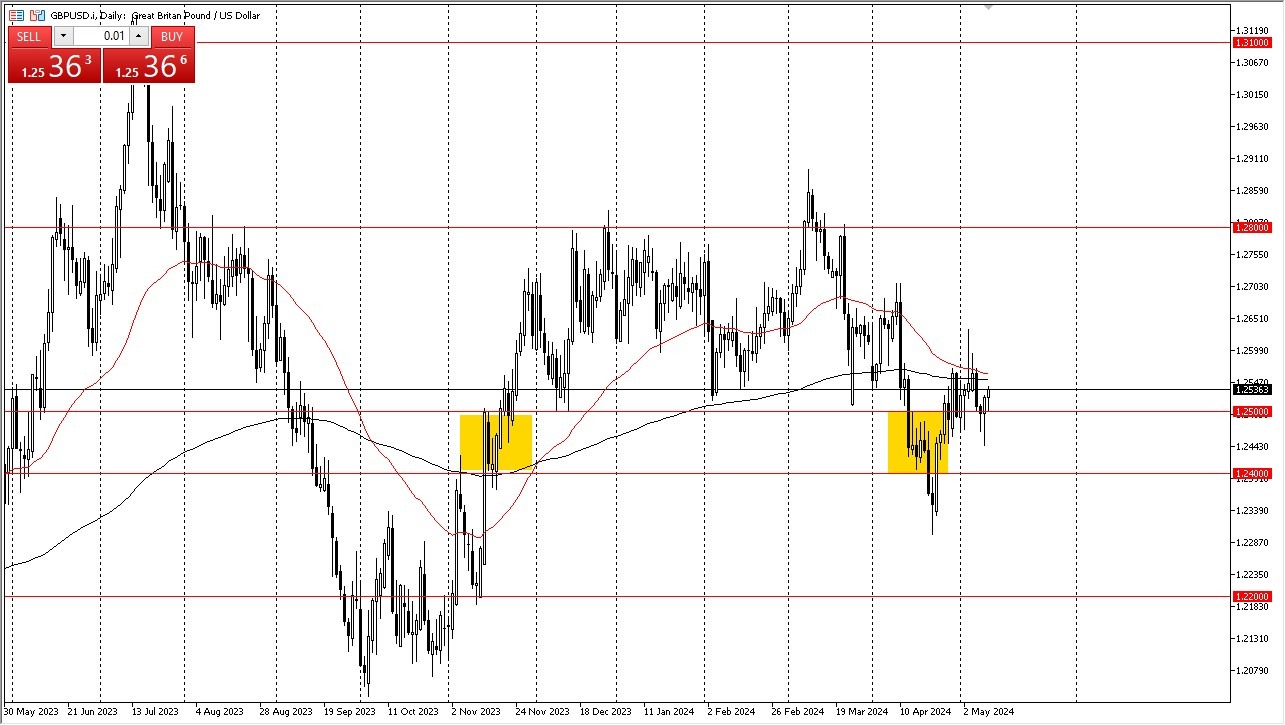

Choppy Conditions Ahead

I suspect that we are going to continue to see a lot of choppy action in this pair, as well as the rest of the Forex world, as people simply have no idea where to price risk at the moment. Ultimately, the Federal Reserve is going to stay tighter for longer, despite the fact that we did see a crack in consumer confidence. Quite frankly, it’s going to take a lot more than that to get the Federal Reserve to start moving again.

In the short term, we have the 200-Day EMA and the 50-Day EMA just above, and then of course we have resistance near the 1.26 level. Any signs of exhaustion in that area would probably get jumped upon, as a potential shorting opportunity. If we can break above there, then the market could very well find its way back to the 1.27 level above. That being said, it’s going to be noisy regardless and you have to keep an eye on the fact that any geopolitical tension almost always favors the US dollar anyway.

More By This Author:

Pairs In Focus This Week - Sunday, May 12DAX Forecast: Powers Higher To Reach New Highs

GBP/JPY Forecast: British Pound Continues To Rally Against Yen Despite Bank Of England

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals and ...

more