GBP/USD Forecast: 1.3275 Resistance Rejected Amid 5.1% UK Inflation

The GBP/USD forecast sees the pair trading in the red at 1.3251 level at the time of writing. It’s located far below 1.3282 today’s high. It has slipped lower after the UK inflation data was released. Still, the current drop could be only a temporary one.

Photo by Colin Watts on Unsplash

The pair could come back to test and retest the immediate support levels before jumping higher. The price will be driven by fundamentals these days, so you have to be careful as anything could happen.

The UK Consumer Price Index reported a 5.1% growth in November versus 4.8% expected and compared to 4.2% in October, while the Core CPI rose by 4.0% versus 3.7% expected and compared to 3.4% in the previous reporting period. The PPI Input, PPI Output, and the RPI increased more than expected.

The pressure remains high as the Dollar Index tries to extend its upwards movement ahead of the FOMC. The Federal Reserve is to release its Federal Funds Rate tonight. The FOMC Economic Projections, FOMC Statement, and the FOMC Press Conference could bring sharp movements.

Also, don’t forget that the US Retail Sales is expected to report a 0.8% growth, while the Core Retail Sales could rise by 0.9% in November.

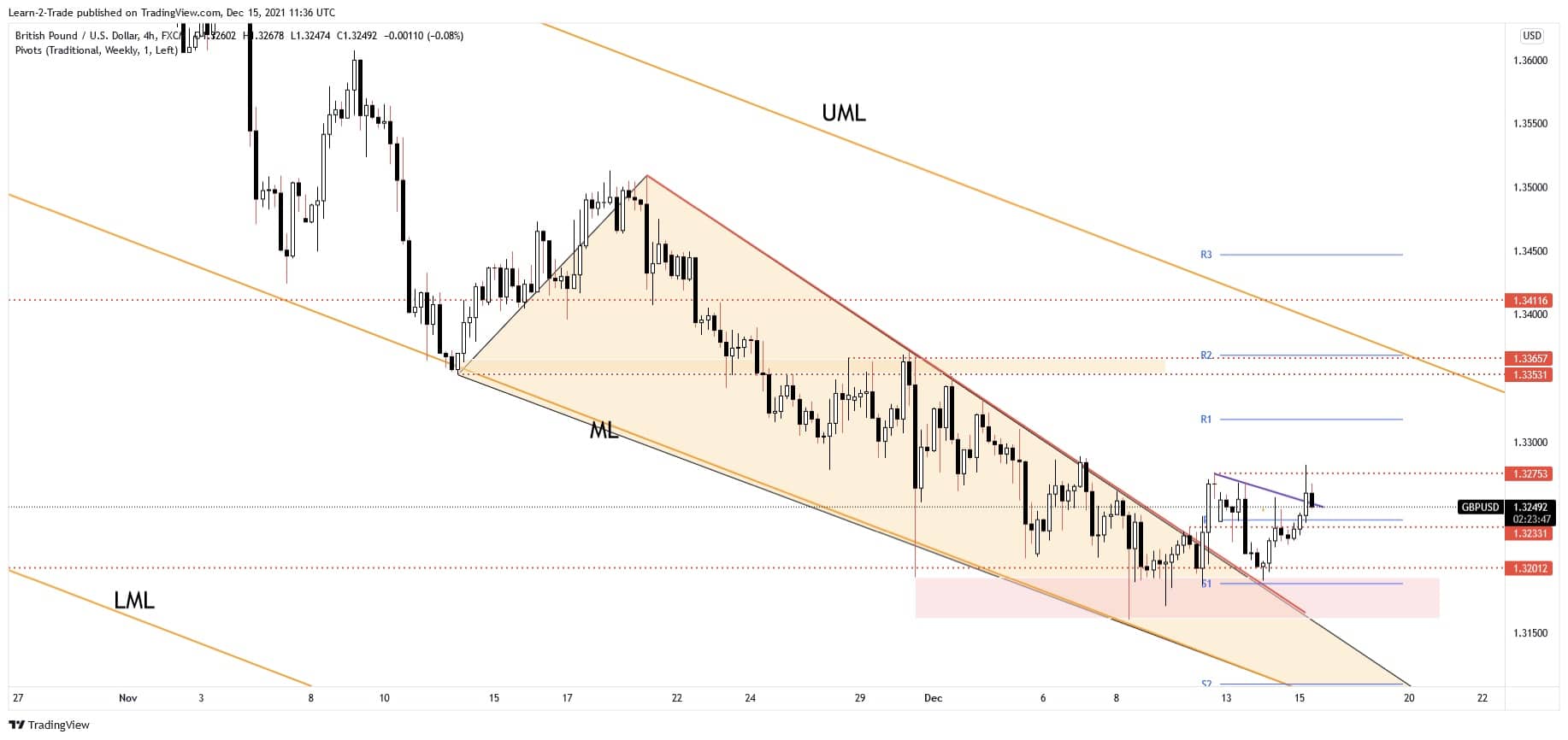

GBP/USD Forecast: Price Technical Analysis – Range Formation

(Click on image to enlarge)

The GBP/USD pair registered only a false breakout with great separation through 1.3275 level signaling strong supply around that former high.

It has slipped lower to retest the broken minor downtrend line. In the short term, it’s trapped between 1.3275 and 1.3201 levels. An upside breakout from this range formation could activate an upside continuation.

Technically, after escaping from the Falling Wedge pattern and after retesting 1.32 psychological level, the currency pair was somehow expected to develop an upwards movement.

The upside pressure remains intact despite a minor retreat. Actually, a minor drop was somehow expected after the most recent rally.

Moving sideways above the weekly pivot point of 1.3239, a minor consolidation, could announce a new bullish momentum.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more