GBP/USD Extends Bullish Rebound Ahead Of Expected BoE Rate Cut

Photo by Colin Watts on Unsplash

GBP/USD caught a much-needed lift on Wednesday, rising back above 1.3350 as bullish momentum claws back chart paper following last week’s one-sided plunge into 15-week lows near 1.3140. The Bank of England (BoE) is on the board for Thursday, poised to deliver a 25 bps interest rate cut.

Cable has extended into a bullish leg back up, climbing for three of the last four trading sessions, and bouncing nearly 1.75% bottom-to-top after chalking in a technical rebound from the 200-day Exponential Moving Average (EMA) near 1.3175. With a technical floor priced in from the 1.3200 handle, the way is clear for GBP/USD bulls to continue muscling the pair back into the last swing high near the 1.3600 region.

(Click on image to enlarge)

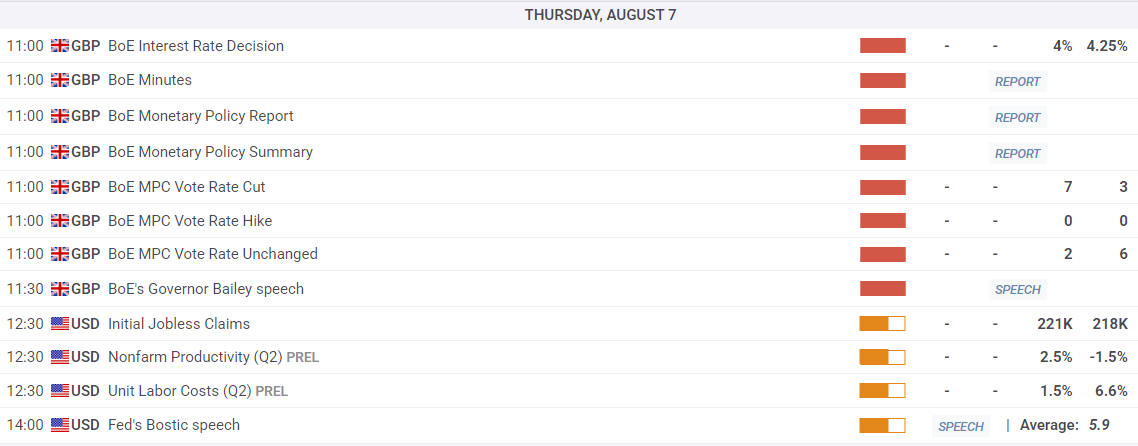

The BoE is poised to trim interest rates on Thursday, with median market forecasts expecting the Monetary Policy Committee (MPC) to vote 7-to-3 in favor of a quarter-point trim, bringing the BoE’s main reference rate down to 4.0% from 4.25%. If the BoE matches market expectations and cuts interest rates this week, this will be the seventh rate cut from the UK’s central bank since the BoE started trimming rates in July of 2024.

GBP/USD daily chart

(Click on image to enlarge)

More By This Author:

Dow Jones Industrial Average Jumps On Wednesday, But Gains Remain LimitedGBP/USD Flatlines, Pound Sterling Churns The Waters As BoE Rate Call Looms

Crude Oil Markets Jitter As U.S.-Russia Sanctions Debacle Heats Up