FX Weekly: Still Sailing In A Sea Of Calm, But What If A Bolt From The Blue Strikes

Last week's global equity rally faltered amid concerns over delayed Federal Reserve rate cuts. Coinciding with this, the dollar hit its best stretch in nearly two months, though the move was modest. The yield on the US two-year Treasury note rose from 4.73% on May 15 to 4.95% by the week's end, suggesting that the US dollar is unlikely to trend downwards until US data shows a sustained decline over a period of 4 to 8 weeks and short end yields move convincingly below 4.75 % (Implying Fed 2 cut’s + in 2024).

The overarching message from Fed officials has been clear: rate cuts are a distant prospect. This has led traders to dial back their expectations for imminent rate cuts, making it challenging to maintain a short dollar view that relies on the eventual realization of Fed rate cuts.

Financial markets have so far appeared primarily immune to ongoing uncertainties. However, a sudden, unsavory development could prompt a sharp change in conditions and significantly higher FX volatility. Until such a bolt from the blue occurs, FX markets are sailing in relatively calm seas, which supports the carry trade environment.

Given these conditions, it's tough to make a strong argument for going long on the Japanese yen (JPY), especially since the JPY remains the primary funding currency for carry trades. The market's current state favors strategies that capitalize on low volatility and stable interest rate differentials, further reinforcing the carry trade's appeal.

The Bank of Japan (BoJ) has likely intervened a few weeks again to buy time, hoping for US data to weaken enough to make the Federal Reserve reconsider its "higher for longer" stance. However, US data hasn't softened significantly, and the Fed remains resolute. This has led to a resurgence in the carry trade, with "Mrs. Watanabe," the archetypal Japanese retail investor, making a significant comeback over the past year. In a low-volatility FX market, dislodging her has proven challenging.

This week, I don't see a strong argument for directional changes in the major currencies. As a result, FX volatility is likely to remain low, favoring the carry trade environment. This scenario should continue to support the USD/JPY, with markets potentially pushing towards 158.0, testing the BoJ's tolerance for FX intervention.

Weekly cross-border flow data from the Ministry of Finance (MoF) released on Friday showed a sharp upturn in demand for foreign bonds by Japanese investors last week. This marked the most significant buying since December last year, when a falling USD/JPY drew in demand, further supporting the carry trade thesis.

GBP: Will UK Election Risk Dull Its Recent Outperformance

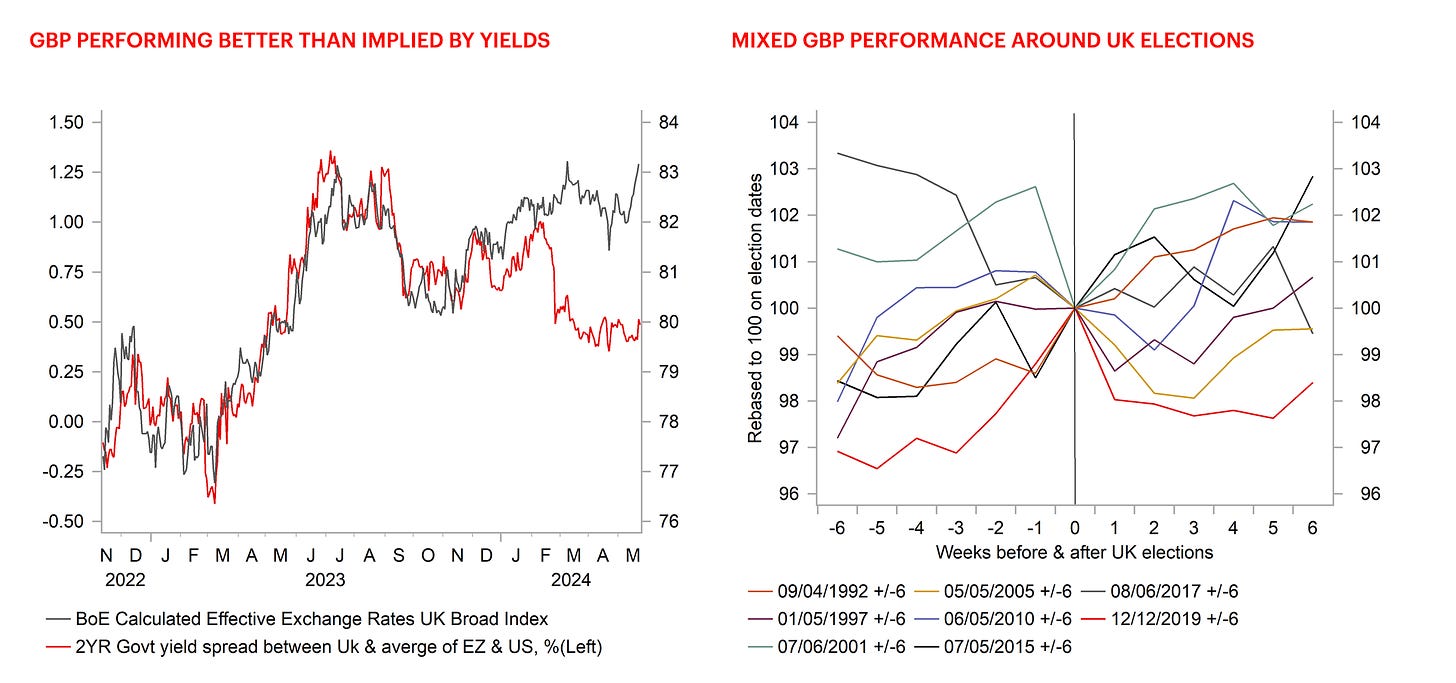

The British pound (GBP) has strengthened over the past week, pushing the GBP/USD pair (cable) back above the 1.2700 level. This year, the GBP and the USD have been among the top-performing G10 currencies. The following critical technical level to watch is 1.28. This upward momentum has been driven by higher yields in the UK, favourable conditions for carry trades, and positive economic data.

The latest UK Consumer Price Index (CPI) report for April revealed that while headline inflation fell sharply to 2.3%, driven by a 13% reduction in energy prices due to Ofgem's energy price cap adjustment, core and services inflation slowed much less than expected. This indicates persistent inflationary pressures, complicating the Bank of England’s (BoE) policy decisions.

Market participants had anticipated a potential rate cut from the BoE in June, but the recent data has pushed back these expectations. The UK rate market is now pricing in only 9 basis points of cuts by the August Monetary Policy Committee (MPC) meeting and 17 basis points by the September meeting.

In addition, Prime Minister Rishi Sunak announced an early general election on 4uly 4. This announcement comes amid disappointing local election results and the government's lagging poll position. Despite the increase in political uncertainty, the impact on the GBP is expected to be limited.

Given its substantial poll lead, the market is primarily prepared for a Labour Party victory. Labour's economic policies, focusing on stability and maintaining the net debt rule, are not expected to alter the GBP’s outlook significantly. The potential for improved EU-UK relations under a Labour government is noted, but significant changes to the Trade and Cooperation Agreement are unlikely until its following review in 2026.

Historical data on the trade-weighted GBP around previous UK elections shows mixed performance. The best performances were seen ahead of the 1997 and 2019 elections, while the worst was before the 2017 election. The current political landscape is somewhat reminiscent of the 1997 election, which saw Labour win a landslide victory. However, the economic fundamentals in 1997 were more supportive of a stronger GBP, including robust GDP growth and higher BoE policy rates.

Chart Courtesy of MUFG

The Unsavory Bolt From The Blue

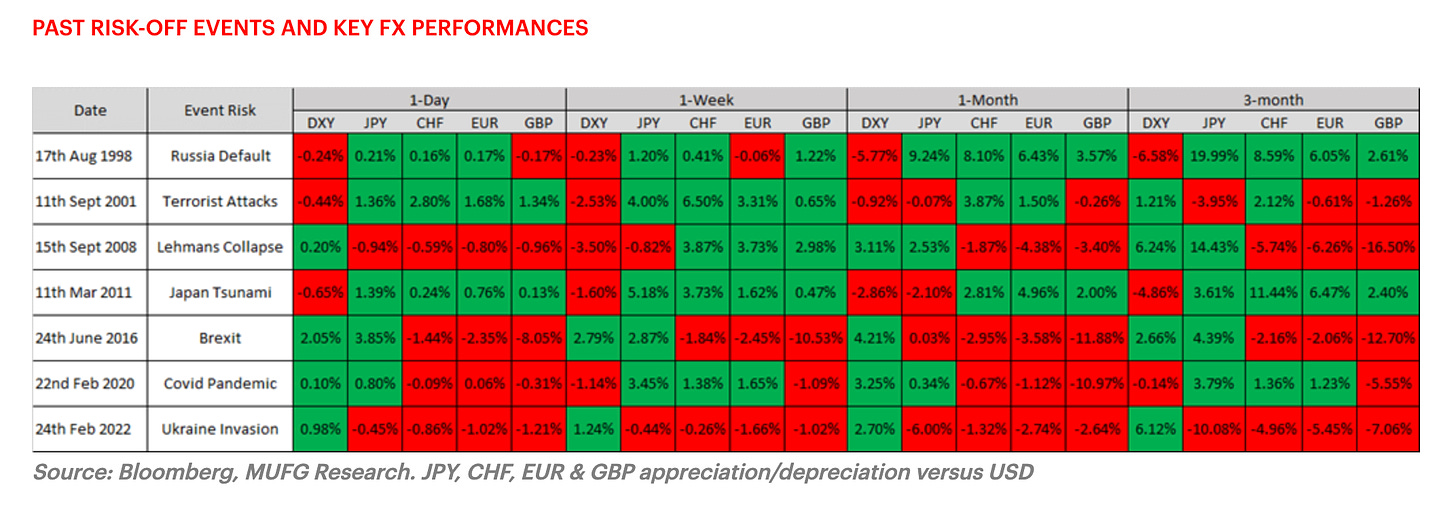

We seem to be in a permanent state of uncertainty, with geopolitical risks, inflation, and political instability all contributing to a thundery outlook. Despite these uncertainties, FX volatility remains remarkably low, reflecting the still reasonably coordinated monetary cycles in the forward market. This coordination limits conviction in trading based on expected divergences. But what if, with this low volatility, we get hit with an unsavory bolt from the blue?

Imagine a considerable risk event, a collapse in risk appetite, and a rush to protect the return of capital rather than the return on capital. A safe-haven asset is defined simply as “an investment that is expected to retain its value, or even increase in value during times of market turbulence.” In FX, reserve currency status, liquidity, size of capital markets, current account position, real yield, and political stability tend to be the most reliable characteristics of a safe-haven currency. ( MUFG)

The US dollar ticks most of those boxes, so is it a simple case of buying the dollar and forgetting about all other currencies? In most cases, yes. Many roads still lead to US dollar strength in risk-off scenarios. The dollar's status as the world's primary reserve currency, its unparalleled liquidity, the depth and stability of US capital markets, and the relatively high real yields compared to other developed economies make it the go-to asset in times of turmoil. While other currencies like the Swiss franc and Japanese yen also serve as safe havens, the US dollar's broad acceptance and availability give it a unique position.

Looking ahead at potential risk events and given investor concerns over inflation, a supply-side shock is a higher risk than before. Several scenarios could have significant implications for global markets and currencies:

-

Invasion of Taiwan by China: Such an event could severely disrupt the global supply of the most advanced semiconductors, as Taiwan and South Korea dominate global production. This disruption could lead to substantial inflationary pressures worldwide. Retaliatory sanctions on China and the economic fallout in the region would likely drive USD/Asia sharply higher as investors seek the relative safety of the US dollar.

-

Escalation of Conflict in the Middle East: An escalation involving attacks on energy production facilities would likely resemble the FX performance dynamics observed during Russia's invasion of Ukraine. A severe energy price shock would disproportionately impact the euro, yen, and pound, leading to a stronger US dollar as energy importers face increased costs and economic uncertainty.

-

US Treasury Market Shock: A specific shock to the US Treasury market, perhaps due to a sudden clog in the bond market plumbing, could undermine confidence in the US dollar. This scenario might see a capital shift to the very front end of the curve, potentially driving short-end yields negatively. Additionally, capital could flow to other major bond markets, such as Japan and the eurozone. While this could temporarily benefit the yen and euro, the Federal Reserve would likely swiftly intervene to stabilize the market, and Congress might also take rapid action to restore confidence.

Each of these scenarios underscores the potential for significant market volatility and shifts in currency performance:

-

Taiwan Invasion: Severe disruptions to semiconductor supply chains and retaliatory economic measures could lead to a significant appreciation of the USD against Asian currencies.

-

Middle East Conflict: Energy price shocks would likely weaken energy-importing currencies like the euro, yen, and pound while strengthening the US dollar.

-

US Treasury Market Shock: Initial loss of confidence in the US dollar could benefit the yen and euro, but swift policy responses would likely mitigate the crisis.

While the US dollar typically benefits from risk-off scenarios due to its safe-haven status, inevitable shocks, particularly those affecting the Treasury market, could temporarily alter this dynamic. However, the overall resilience of the US financial system and the likelihood of decisive policy responses would probably limit the duration and extent of any adverse effects on the dollar.

More By This Author:

Market And Investor Sentiment: Charting The Path Forward

Setting The Stage For Another Test Of The Bank Of Japan's Intervention Resolve ?

Stretched Risk Indicators Leave Investors Prone To Even Mildly Bad News