Futures Swing As Treasury Yields Near 2%, China Plunge-Protectors Activated

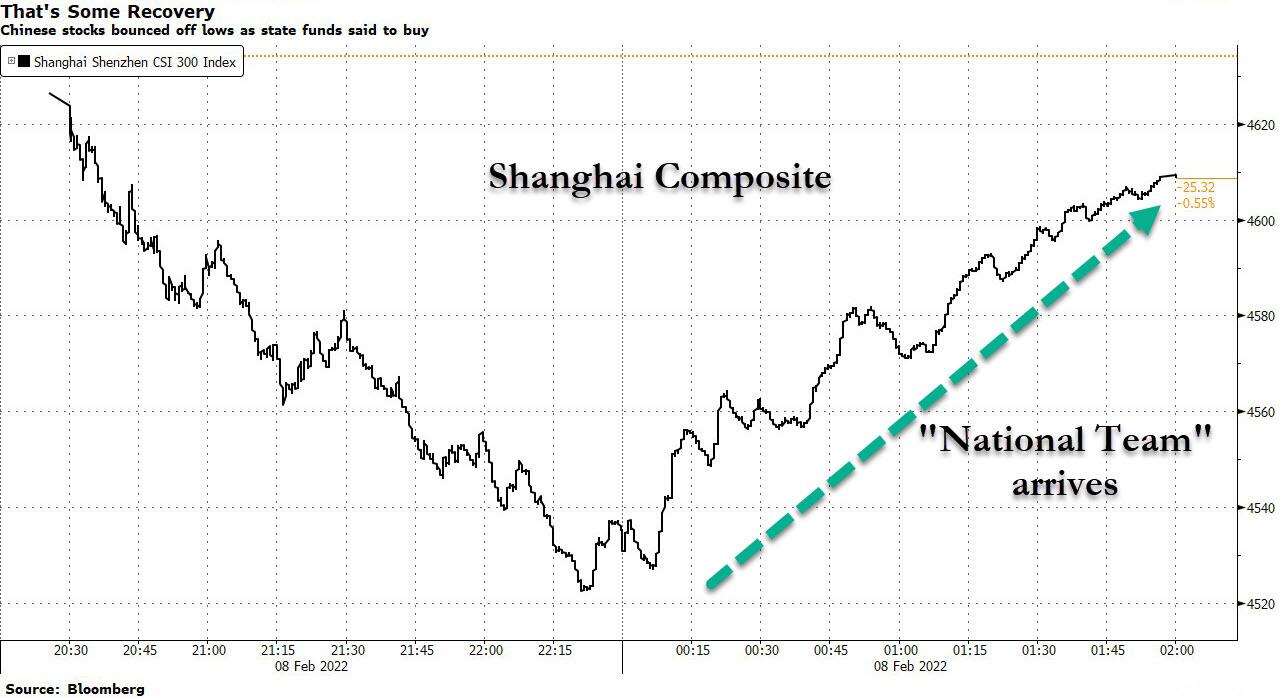

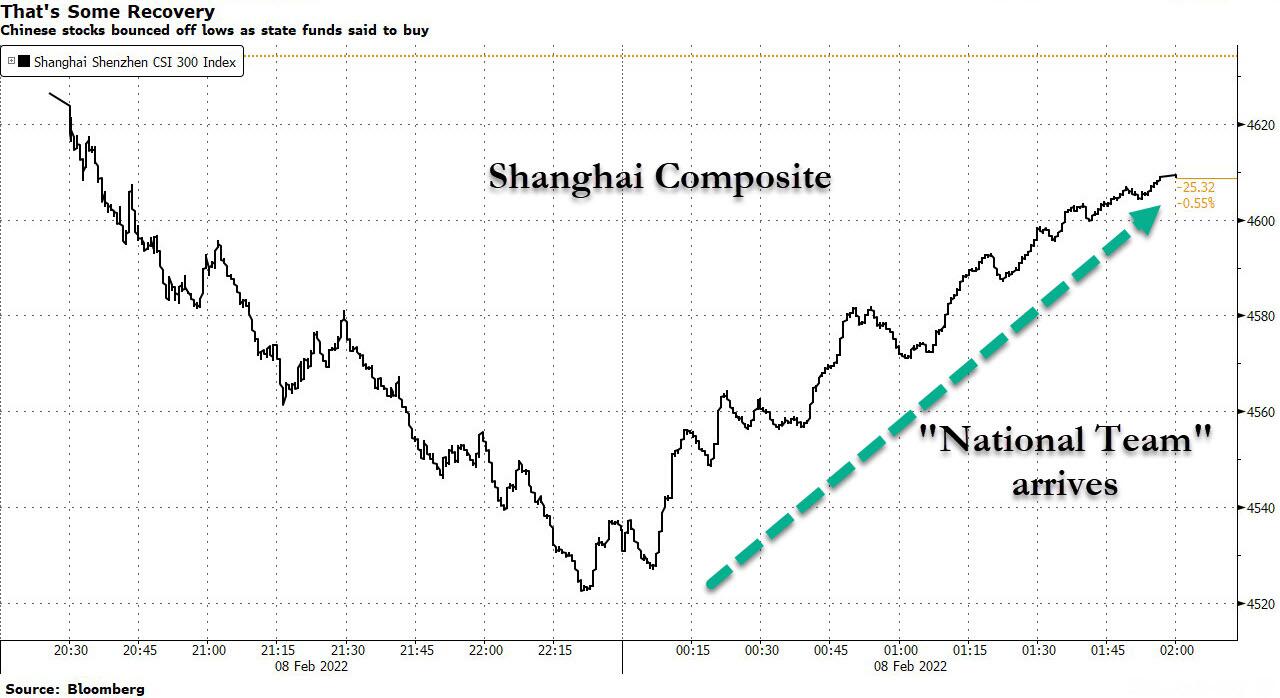

US equity futures have again swung sharply in illiquid overnight trade, and after yesterday's wild dump in the last hour of trading, emini futures initially made some gains only to lose it all as US traders came to their desks as investors monitored the latest jump in Treasuries yields and as expectations for aggressive rate hikes mount. The yield on the U.S. 10-year Treasury traded as high as 1.9559% - a level last seen in December 2019 - closing in on 2% while Nasdaq 100, S&P 500 and Dow Jones futures all traded modestly in the red. Oil slid on potential de-escalation in Russia-Ukraine tensions and the resumption of Iran nuclear talks, while stocks in Europe made gains. Chinese stocks also tumbled, suffering their biggest intraday drop since August 2021, before the Beijing PPT in the face of Chinese state-backed funds intervened in the stock market on Tuesday, helping the benchmark index stage a strong recovery. Bitcoin declined for the first time in six days, falling below $44,000.

(Click on image to enlarge)

“We consequently see the announced combination of tapering, hiking and balance-sheet reduction in the same year as too risky for financial markets,” said Unigestion’s head of macro and dynamic allocation, Guilhem Savry. “The risks for U.S. growth are greater than highlighted by the Fed, and we see little room for a strong upside in risky assets.”

In premarket trading, shares in U.S.-listed Chinese stocks, including Alibaba Group Holding rose after Bloomberg reported that state-backed funds were said to have intervened in the Chinese stock market on Tuesday amid a worsening rout. China's CSI 300 Index ended down just 0.6% at the close, paring an earlier slump of 2.4%, as state-related funds entered the market to buy local shares in the afternoon session, Bloomberg reported citing two sources.

(Click on image to enlarge)

Pfizer declined in premarket trading after its 2022 revenue forecast missed estimates (unclear if the company will now push to vaccinate embryos, pets and dead people next). Velodyne Lidar soared after Amazon.com Inc. acquired warrants that could result in a potential stake in the auto-sensor maker Here are some other notable premarket movers:

- Peloton (PTON US) drops 14% in premarket after the Wall Street Journal reports that Chief Executive Officer John Foley will step down and become executive chair. The maker of exercise bikes will also shed about 2,800 jobs, WSJ said.

- Nvidia (NVDA US) is abandoning its purchase of Arm from SoftBank, according to people familiar with the situation. Falls 1.3% in premarket.

- General Motors (GM US) shares slide 3.1% in premarket trading after Morgan Stanley analyst Adam Jonas cuts stock to equal-weight from overweight, citing lower than expected 2022 outlook.

- Selectquote (SLQT US) slumps as much as 48% in premarket trading after the insurance agency’s revenue forecast missed the average analyst estimate.

- Velodyne Lidar (VLDR US) jumps 42% in premarket trading after Amazon.com acquired warrants that could result in a potential stake in the auto-sensor maker.

- Second Sight Medical (EYES US) climbed 15% in premarket trading after announcing Monday evening it agreed to buy Nano Precision Medical for ~134m shares.

- U.S.-listed Chinese stocks, including Alibaba, rise in premarket trading, following a report that Chinese state-backed funds were said to have intervened in the Chinese stock market on Tuesday amid a worsening rout. Alibaba (BABA US) +0.8%, DiDi (DIDI US) +1.1%.

- Chegg (CHGG US) gains 8% in premarket trading after the online education company’s first- quarter and full-year revenue forecast beat the average analyst estimate.

- Graham (GHM US) tumbled 27% in extended trading after the industrials company cut its revenue outlook for fiscal 2022. It also suspended its dividend.

- Editas Medicine (EDIT US) falls 13% in premarket after saying the employment of Chief Medical Officer Lisa Michaels with the genome-editing company “was terminated.” She worked in the post for about 15 months.

- Bowlero (BOWL US) gained 5.4% in postmarket trading after the operator of bowling centers said its board has approved a $200 million share and warrant buyback program through Feb. 3, 2024.

Investors are awaiting data Thursday expected to show stubbornly high U.S. inflation. That could inject further volatility into financial markets bracing for a Federal Reserve cycle of rate hikes and eventual balance-sheet reduction. But the rise in yields could also support some equities, like banks and value stocks, according to Goldman Sachs Group Inc., amid generally solid earnings.

“Markets will get used to the tightening regime at some point,” Chris Iggo, chief investment officer, core investments at AXA Investment Managers, wrote in a note. “The growth and earnings forecast revisions in the next few months will be key.”

Investors are assessing the likely broader impact of Fed policy, “particularly within credit markets,” Kristen Bitterly, head of North America investments at Citi Global Wealth, said on Bloomberg Television. “That is what most investors are looking at right now in terms of what can actually inject volatility into the broader market.”

In Europe, the Stoxx Europe 600 index erased an earlier advance, with a drop in the technology sector weighing on the benchmark. Basic-resources stocks jumped more than 2% as iron ore roared past $150 a ton and aluminum headed toward a four-month high. BP Plc gained after reporting strong earnings and announcing a share buyback. Miners, insurance and banks were the strongest performing sectors; tech lags. Here are some of the biggest European movers today:

- Orpea rise as much as 11% alongside peer Korian, rallying after investors dumped shares in retirement-home operators due to allegations of mistreatment of elderly people at Orpea.

- BP advances as much as 2.3% after boosting its share buyback as its profit soared. Analysts noted strong cashflow and guidance.

- Continental rises after Handelsblatt reported it plans to make its Autonomous Mobility unit independent and may consider an IPO in the future, citing unidentified people familiar with the matter.

- AMS-Osram stock rises as much as 7.4%. Results beat estimates, helped by strong demand and high capacity utilization in auto sector, according to ZKB analyst Andreas Mueller.

- Befesa rises after Kepler upgrades the stock to buy, saying the latest market wobbles have created an attractive entry point for Befesa’s high-quality stock.

- Ocado shares plunge as much as 13%, the biggest decliner in the Stoxx 600 Index, after the British online grocer reported FY21 results that missed market expectations.

- Yara shares tumble as much as 7% after 4Q earnings missed estimates. Analysts claimed the miss was due to a time lag and isn’t reflective of the largest nitrogen producer’s fundamentals.

Asian equities fluctuated, as a broad selloff in Chinese stocks countered gains in financials along with rising bond yields. The MSCI Asia Pacific Index rose as much as 0.6% before erasing that gain and dipping 0.1%. Indexes dropped in China and Hong Kong while Australia and Singapore shares rose. Wuxi Biologics was the biggest drag on Hong Kong’s benchmark gauge, plunging by a record before trading was halted as the U.S. added the firm and other entities to its “unverified” list. The latest tensions between Beijing and Washington further cloud the outlook for China stocks after the CSI 300 Index entered a bear market just before the Lunar New Year holidays.

As noted above, China's national team stepped into prevent a market rout, helping the CSI 300 index to close down just 0.6% after tumbling 2.0% earlier. The move by state funds was intended to slow the pace of declines, a Bloomberg source said, noting that financial shares including brokerages were among those to have been purchased. Sub-gauges of cyclical sectors such as energy, utilities and financials posted gains in Tuesday’s session even as the benchmark ended lower. There was no information on the amount purchased or the frequency of such buying.

(Click on image to enlarge)

Historically, Beijing has supported markets when needed around significant events or dates. The funds stepped in to stem a market rout during the National People’s Congress in March last year. Stocks on the mainland have had a weak start to 2022 as the monetary policy divergence between Beijing and Washington -- touted as one key reason for global brokerages to recently turn bullish on Chinese shares -- has yet to lead to any meaningful gains. Even last month’s cut to a key interest rate failed to excite local traders, with the CSI 300 down 6.7% so far this year.

Asian equities overall have been relatively less scathed than U.S. peers by the prospect of tighter monetary policy from the Federal Reserve. The Asian stock benchmark is down less than 3% so far this year, helped by a recent rebound, compared with a decline of nearly 6% in the S&P 500 Index. Sentiment remains fragile, however, as investors brace for central bank policy decisions this week from India, Thailand and Indonesia, as well as U.S. inflation data. “The bearish sentiment that has engulfed markets this past month has all to do with changing fundamentals and their potential impact on corporate earnings, and hence on valuations,” said Olivier d’Assier, head of APAC applied research at Qontigo, adding that investors should re-evaluate firms given a hawkish monetary policy

In rates, Treasuries remained under pressure, with yields higher by 2bp-3bp across the curve, after 10-year rose as much as 4bp to YTD high 1.956%. Treasury 10-year yield is just below 1.95%, where convexity hedging is expected to pick up; curve spreads are within 1bp of Monday’s closing levels. Refunding auction cycle begins with 3-year note sale at 1pm ET; 10- and 30-year new issues follow over next two days. Today's auction includes $50b 3-year note, followed by the sale of a $37b 10-year note Wednesday and $23b 30-year bond Thursday. WI 3-year yields at ~1.588% is above auction stops since December 2019 and ~35bp cheaper than last month’s, which stopped 0.4bp through.

(Click on image to enlarge)

German Bunds bull-steepened, richening 4bps across the short end. Gilts bear-steepen with long end yields ~3bps higher. USTs bear-flatten, trading broadly in line with gilts at the short end. Most peripheral spreads fade an initial widening move, short-end Spain outperforms. 10y Bund/BTP spread remains slightly wider on the session.

In FX, Bloomberg dollar spot index rose as the greenback traded steady to higher versus most of its Group-of-10 peers, while NZD and GBP are the strongest performers in G-10 FX, NOK, CAD and EUR underperform. The euro temporarily dropped below $1.14 before steadying and European bonds reversed an early decline. The euro’s advance versus its Group-of-10 peers since the latest ECB policy decision is less pronounced versus the Swedish krona in the spot market and options bets are extensively in favor of the currency. The pound advanced versus the euro for the second day as traders weighed comments from ECB President Christine Lagarde on Monday, in which she stressed a “gradual” approach to adjusting monetary policy. Australian and New Zealand sovereign bond yields hit multi-year highs after their U.S. counterpart rose on bets for more aggressive Federal Reserve rate hikes; the RBA is seen raising rates to 1.25% this year by swaps traders. Japan’s benchmark 10-year government bond yield rose to a fresh six-year high, as markets tested the Bank of Japan’s tolerance for such moves; the yen fell

In commodities, crude futures slumped after French President Macron told reporters he got assurances from Russia’s Putin of no more escalation. WTI snapped 2% lower before finding support near $89, Brent drops below $91. Most base metals trade in the red; LME nickel falls 1.2%, underperforming peers. LME aluminum outperforms. Spot gold is little changed at $1,820/oz

Bitcoin declined for the first time in six days, falling below $44,000.

Looking at today's calendar, it’s a fairly quiet day ahead - data releases include the US trade balance and Italian retail sales for December, and from central banks we’ll hear from the ECB’s Villeroy. Pfizer, KKR and Peloton are among the companies reporting results today.

Market Snapshot

- S&P 500 futures down 0.1% to 4,466.5

- STOXX Europe 600 up 0.8% to 469.03

- MXAP little changed at 187.59

- MXAPJ down 0.1% to 613.73

- Nikkei up 0.1% to 27,284.52

- Topix up 0.4% to 1,934.06

- Hang Seng Index down 1.0% to 24,329.49

- Shanghai Composite up 0.7% to 3,452.63

- Sensex up 0.4% to 57,866.39

- Australia S&P/ASX 200 up 1.1% to 7,186.69

- Kospi little changed at 2,746.47

- German 10Y yield little changed at 0.22%

- Euro down 0.3% to $1.1403

- Brent Futures down 0.6% to $92.13/bbl

- Gold spot down 0.1% to $1,818.69

- U.S. Dollar Index up 0.24% to 95.63

Top Overnight News from Bloomberg

- ECB Governing Council member Pablo Hernandez de Cos says he expects inflation to moderate, though there are currently upside risks to prices, especially in the short term

- While conventional logic suggests rising yields should buoy the greenback, traders are now betting the Fed’s policy tightening will crimp economic growth down the road. Demand for dollar call-options has plummeted to the lowest in nine months with the currency erasing its year-to-date gains. That’s the putting dollar bulls at Morgan Stanley, Bank of America Corp. and Citigroup Inc. on the defensive

- European natural gas prices rose after U.S. President Joe Biden said the controversial Nord Stream 2 pipeline won’t move forward if Russia invades Ukraine. Russian flows through a key route also declined

A more detailed look at global markets courtesy of Newsquawk

Asian stocks were mixed after the choppy mood in the US with global newsflow dominated by geopolitical headlines despite a lack of developments. ASX 200 (+1.1%) was led by miners and with the top-weighted financials sector lifted after earnings updates from Macquarie and Suncorp. Nikkei 225 (+0.1%) was supported by favourable currency flows and after US agreed to roll back Trump-era steel tariffs on a quota of Japanese steel products, but with upside limited after disappointing data including the miss on Household Spending and Labour Cash Earnings. Hang Seng (-1.0%) and Shanghai Comp. (+0.7%) initially pressured with Hong Kong announcing tighter COVID19 restrictions and amid US-China related frictions in which WuXi Biologics slumped more than 30% and its shares were halted after the inclusion of two units in the US ‘unverified’ list, while tech was also subdued with the ChiNext board now eyeing a bear market.

Top Asian News

- Asian Stocks Steady as China Slides, Financials Rise With Yields

- China Eases Loan Curbs on Public Rental Homes: Evergrande Update

- Abu Dhabi Ports’ Stock Surges After $1.1 Billion Share Sale

- Nissan Raises Profit Outlook on High Car Prices, Weaker Yen

European bourses are also mixed and in proximity to the unchanged mark following an indecisive open. Performance briefly picked up amid reports regarding China State funds, but this was shortlived and followed by a pullback. Sectors are mixed as Basic Resources & Banks outperform on base metals/yields while Tech lags on the latter and as the NQ probes negative territory. US futures are similarly mixed/unchanged, action directionally following European peers but has been more contained thus far.

Top European News

- European Gas Rises After Biden Issues Warning on Nord Stream 2

- Continental Weighs Options for Automated Driving Unit: HB

- Goldman Strategists See End of Europe’s Stock Woes in ECB Pivot

- Danske Picks Blessing as Chair as Bank Recoups From Scandal

In FX, the DXY was firmer around 95.50 pivot point as UST curve flips and flattens. Euro hands back more ECB inspired gains as President Lagarde warns against hasty hawkish conclusions. Loonie and NOK recoil in tandem with WTI and Brent. Yen yields to Buck bounce and technical headwinds after failing to breach resistance. Sterling boosted by EUR/GBP reversal, but Cable faces upside option expiry interest. Former RBA board member Edwards sees the RBA to start moving rates in August and thinks there could be four rate hikes this year, according to WSJ. Also, ANZ Bank sees every meeting by the RBA in June to be live.

In commodities, WTI and Brent have been extending to the downside throughout the European morning, with focus firmly on geopolitics; sending the benchmarks to lows of USD 89.01/bbl & USD 90.18/bbl. Numerous updates regarding Russia after yesterday's talks with Macron who voiced progress; albeit, the Kremlin as expected highlighted a failure to achieve a deal. Iranian Vienna talks resume today and initial commentary has Iran sounding somewhat less optimistic. Spot gold/silver are softer but contained and in familiar levels around numerous DMAs.

US Event Calendar

- 6am: Jan. SMALL BUSINESS OPTIMISM, 97.1, est. 97.5, prior 98.9

- 8:30am: Dec. Trade Balance, est. -$83b, prior -$80.2b

DB's Jim Reid concludes the overnight wrap

Last week’s global bond selloff has carried over into this one, with longer-end yields hitting new highs as markets adjust to the recent newsflow, even if the front end rallied a bit yesterday after an initial morning sell-off. This ultimately left curves steeper. A late European session speech from ECB President Lagarde helped calm peripheral spreads after a mini rout in the morning.

We’ll get to exactly what she said shortly but let’s look at the move and vol in bond markets, especially in Europe. At the wides for the day, 10yr BTPs and Greek bonds were +10.5bps and +25.5bps wider respectively. 10yr BTPs yields peaked before lunchtime and only closed +1.5bps wider. 2yr BTPs saw a bigger range, hitting 0.47% at the highs (+14.5bps) before closing at 0.30%, -2.1bps lower for the day. In Greece, 10yr yields only came back -6.1bps from the highs and closed +22.0bps at 2.45%. Note that at the lows in mid-2021, Greek 10yr yields got close to 0.5%. One to watch as the ECB accelerates pull back.

In the core of Europe, 10yr bunds (+2.0bps), which closed at 0.22%, and OATs (+1.8bps) both hit their highest level since January 2019. In both cases it was rising real yields that led the upward moves, with inflation breakevens actually declining as investors remain relatively calm for the time being that central banks can keep a grip on longer-term inflation. After opening a few bps higher, 2yr notes in both regions ended the day lower, declining -3.9bps in Germany and -2.0bps in France.

Credit started to crack in the morning and started to show signs of stress. EU iTraxx Main was over +5bps at one point before closing +2.75bps wider. The last +5bps daily move was on September 20th, when the market was briefly concerned about the potential of an Evergrande default. Crossover was +25bp in the morning but closed +12bps wider. IG is under-performing HY which makes sense if you believe we’re in a rates/central bank tantrum and not yet at a stage where there’s a real economic threat. Europe is also under-performing US in recent days which again makes sense given Europe has been the latest rates market to have been shaken. The peripheral widening of recent days has not helped European credit either. We are getting closer to what we thought were fairly aggressive widening targets for H1 from our 2022 outlook published in November. Back then we felt that after the rates tantrum we would eventually recognise the economy would survive it and we would recover. We will have to review that call one way or another soon. For now, no reason to suggest the thesis will change.

So what did ECB President Lagarde say in her address to lawmakers in the European Parliament yesterday? Overall her remarks struck a similar tone to the ECB communications last week, noting that inflation risks have moved to the upside, and did not explicitly push back on the market repricing of tighter ECB policy. She did highlight that the ECB would take a gradual approach to tightening policy, drawing a distinction from other advanced economies that may need to tighten quicker, and that the ECB would remain flexible and data dependent. Crucial for the intraday turnaround in peripheral spreads, President Lagarde voiced resolute support for the periphery across multiple questions, noting the ECB will use any instrument to ensure policy is transmitted to all member states.

Even if we’re a long way from crisis territory, the coming months will be fascinating in terms of just how far central banks are able to go when it comes to tackling inflation, and investors are getting more confident that we’re set to see plenty of hikes from global central banks over the coming months. Indeed, even if the Fed hikes in line with what futures are pricing (5 hikes in 2022) and doesn’t move to go faster, 125bps worth of hikes in a calendar year would still be the most we’ve seen since 2005, so a completely different playbook to the last cycle. And speaking of the US, there was a smaller rise in longer-dated sovereign bonds there yesterday, with 10yr Treasury yields up +0.7bps to 1.92%, just shy of their closing peak in December 2019. In Asia we are above that level though at 1.943% as I type.

Equities had a relatively quieter day, although the impact of widening spreads was evident as Italy’s FTSE MIB (-1.03%) and Spain’s IBEX 35 (-0.36%) lagged behind what was generally a decent performance across the rest of the continent, including a +0.68% advance for the STOXX 600 following five consecutive weekly declines. The US indices also put in a weak performance with the S&P 500 down -0.37%. The index was trading in a narrow range for most of the day before hitting both its intraday peak and trough within the last 45 minutes of trading, declining -1.11%. That time frame overlapped with President Biden and Chancellor Scholz’s joint press conference, (more below), but it doesn’t seem like there was any smoking gun that should have triggered that big of a selloff. Instead, it appears the S&P was keeping with the recent trend of heightened late day price action. Communication services (-2.24%) led the declines, with the mega-cap names within the sector performing the worst. Indeed, the FANG+ Index underperformed the S&P, declining -1.94%.

Overnight, Chinese stocks are slipping, with the Shanghai Composite (-0.90%) and CSI (-2.14%) both trading in the red. Additionally, the Hang Seng (-1.54%) is trading down, as Chinese tech stocks fall. Meanwhile, the Nikkei (+0.28%), Kospi (+0.45%) are both slightly higher. Looking forward, equity futures in the US are fairly flat as I type.

In terms of data, household spending in Japan fell -0.2% y/y, declining for the fifth straight month in December as consumer demand remained sluggish. It followed a -1.3% drop in the prior month. Separately, real cash earnings fell -2.2% y/y in December, posting its biggest decline since a -2.3% fall in May 2020 and against -0.8% analyst expectations. At the same line, nominal wages slipped -0.2% y/y in December marking their first fall in 10 months, after an upwardly revised +0.8% in November.

The attempts to find a diplomatic solution to the recent tensions along the Ukrainian-Russian border were elevated to the heads of state level yesterday. President Putin welcomed President Macron in Moscow for discussions, while Chancellor Scholz made his first White House visit as Chancellor to host a joint press conference with President Biden, where the situation in eastern Europe featured. There were the usual remarks that it was in the collective interest of all parties to find a diplomatic solution, and that all sides remained open to discussions, yet there was little the way in tangible progress. Chancellor Scholz did note that Germany would absolutely be united with the US on Russia sanctions, including offering support to President Biden’s assertion that the Nord Stream 2 pipeline project would be stopped were Russia to invade (European natural gas futures didn’t appear affected, declining -3.70% on the day). Meanwhile, President Putin noted he was preparing a response to the US and NATO on security guarantees.

In US Congressional news, the House Appropriations Committee Chair put forth a short-term bill that would keep the government funded through early March in attempt to prevent the government shutting down when the current continuing resolution expires at the end of next week. This would be the third such stopgap designed to give lawmakers time to negotiate program funding levels for this fiscal year.

In a bit of advertising for my team's work, Galina and Luke have just published a presentation on the targets and penalties in sustainability-linked bonds. These bonds tie interest payments to hitting ESG goals and have been one of the fastest growing segments of the market. See the report here for more.

There wasn’t much data of note yesterday, though German industrial production unexpectedly fell -0.3% in December (vs. +0.5% expected), driven by a -7.3% decline in construction. That said, November’s reading was revised up to show a +0.3% expansion (vs. -0.2% contraction previously).

It’s a fairly quiet day ahead on the calendar now. Data releases include the US trade balance and Italian retail sales for December, and from central banks we’ll hear from the ECB’s Villeroy. Otherwise, Pfizer will be releasing earnings today.

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more