Futures Slide, Yields Jump And Oil Surges As Inflation Fears Return Ahead Of Biden-Powell Meeting

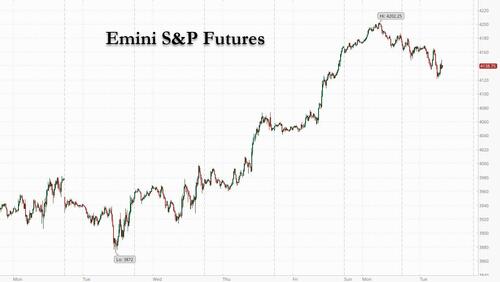

After posting solid gains on Monday when cash markets were closed in the US for Memorial Day, boosted by optimism that China's covid lockdowns are effectively over, and briefly topping 4,200 - after sliding into a bear market below 3,855 just over a week earlier - on Tuesday US equity futures fell as oil’s surge following a partial ban on crude imports from Russia added to concerns over the pace of monetary tightening, exacerbated by the latest data out of Europe which found that inflation had hit a record 8.1% in May.

As of 7:15am ET, S&P futures were down 0.4% while Nasdaq futures rose 0.1% erasing earlier losses. European bourses appeared likely to snap four days of gains, easing back from a one-month high while Treasury yields climbed sharply across the curve, joining Monday’s selloff in German bunds and European bonds. The dollar advanced and bitcoin continued its solid rebound, trading just south of $32,000. Traders will be on the lookout for any surprise announcement out of the White House after 1:15pm when Joe Biden holds an Oval Office meeting with Fed Chair Jerome Powell and Janet Yellen.

As noted last night, Brent oil rose to above $124 a barrel after the European Union agreed to pursue a partial embargo on Russian oil in response to the invasion of Ukraine, exacerbating inflation concerns; crude also got a boost from China easing coronavirus restrictions, helping demand.

With the price of oil soaring, energy stocks also jumped in premarket trading; Exxon gained as much as 1.5% while Chevron rose as much as 1.4%, Marathon Oil +2.9%, Coterra Energy +3.7%; smaller stocks like Camber Energy +8.8% and Imperial Petroleum rose 15%, leading advance. US-listed Chinese stocks jumped, on track to wipe out their monthly losses, as easing in lockdown measures in major cities and better-than-expected economic data gave investors reasons to cheer. Shares of e-commerce giant Alibaba Group Holding Ltd. were up 4.4% in premarket trading. Among other large-cap Chinese internet stocks, JD.com Inc. advanced 6.7% and Baidu Inc. gained 7%. Cryptocurrency stocks also rose in premarket trading as Bitcoin trades above $31,500, with investors and strategists saying the digital currency is showing signs of bottoming out. Bitcoin, the largest cryptocurrency, advanced 1.2% as of 4:30 a.m. in New York. Crypto stocks that were rising in premarket trading include: Riot Blockchain +9%, Marathon Digital +8.1%, Bit Digital +6.1%, MicroStrategy +9.4%, Ebang +3.4%, Coinbase +5.3%, Silvergate Capital +5.2%.

“It’s very hard to have conviction at the moment,” Mike Bell, global market strategist at JPMorgan Asset Management, said in an interview with Bloomberg Television. “We think it makes sense to be neutral on stocks and pretty neutral on bonds actually.” The possibility that Russia could retaliate to the EU move on oil by disrupting gas flows “would make me be careful about being overweight risk assets at the moment,” he said.

U.S. stocks are set for a slightly positive return in May despite a dramatic month in markets, which saw seven trading days in which the S&P 500 Index posted a move bigger than 2%. Global stocks are also on track to end the month with modest gains amid skepticism about whether the market is near a trough and as volatility stays elevated. Fears that central bank rate hikes will induce a recession, stubbornly high inflation and uncertainty around how China will boost its flailing economy are keeping investors watchful. On the other hand, attractive valuations, coupled with hopes that inflation may be peaking has made investors buy up stocks.

In Europe, Stoxx 600 Index was set to snap four days of gains, retreating from a one-month high, with technology stocks among the heaviest decliners. The UK's FTSE 100 outperforms, adding 0.4%, CAC 40 lags, dropping 0.6%. Travel, real estate and construction are the worst-performing sectors. Among individual stock moves in Europe, Deutsche Bank AG slipped after the lender and its asset management unit had their Frankfurt offices raided by police. Credit Suisse Group AG dropped after a Reuters report that the bank is weighing options to strengthen its capital. Unilever Plc jumped as activist investor Nelson Peltz joined its board. Royal DSM NV soared after agreeing to form a fragrances giant by combining with Firmenich.

Asian stocks rose Tuesday, helped by a rally in Chinese shares after Shanghai further eased virus curbs and the nation’s factory activity showed signs of improvement. The MSCI Asia Pacific Index climbed as much as 0.5% Tuesday, on track for the first monthly advance this year, even as investors sold US Treasuries on renewed inflation concerns. Chinese stocks capped their longest winning streak since June.

“Asia has seen the worst earnings revision of any region in the world,” David Wong, senior investment strategist for equities at AllianceBernstein, told Bloomberg Television. “When the news is really bleak, that is when one wants to establish a position in Chinese equities,” he said. “It is very clear that the policy support is on its way.” Tech and communication services shares were among the biggest sectoral gainers on Tuesday. Asia stocks are on track to eke out a gain of less than a percentage point in May as the easing of China’s lockdowns improves the growth outlook for the region. Still, the impact of aggressive monetary-policy tightening on US growth and higher energy and food costs globally are weighing on sentiment in the equity market as traders struggle to assess the earnings fallout.

Japanese stocks dropped after data showed the nation’s factory output dropped in April for the first time in three months as China’s Covid-related lockdowns further disrupted supply chains. Benchmark gauges were also lower as 22 Japanese companies were set to be deleted from MSCI global standard indexes at Tuesday’s close. The Topix Index fell 0.5% to 1,912.67 on Tuesday, while the Nikkei declined 0.3% to 27,279.80. Nippon Telegraph & Telephone Corp. contributed the most to the Topix’s drop, as the telecom-services provider slumped 2%. Among the 2,171 companies in the index, shares in 1,369 fell, 720 rose and 82 were unchanged. “Until after the FOMC in June, stocks will continue to sway,” said Shingo Ide, chief equity strategist at NLI Research Institute, said referring to the US Federal Reserve.

India’s benchmark equities index clocked its biggest monthly decline since February, as a surge in crude oil prices raised prospects of tighter central bank action to keep a lid on inflation. The S&P BSE Sensex slipped 0.6% to 55,566.41 in Mumbai, taking its monthly decline to 2.6%. The NSE Nifty 50 Index dropped 0.5% on Tuesday. Mortgage lender Housing Development Finance Corp. fell 2.6% and was the biggest drag on the Sensex, which had 16 of the 30 member stocks trading lower. Of the 19 sectoral indexes compiled by BSE Ltd., 10 declined, led by a measure of power companies. The price of Brent crude, a major import for India, climbed for a ninth consecutive session to trade around $124 a barrel. “The primary focus in the coming weeks will be on central banks’ policy measures to stabilize inflation,” Mitul Shah, head of research at Reliance Securities Ltd. wrote in a note. “Changes in oil prices and amendments to import and export duties might play a role in assessing the market’s trajectory.”

Similarly, in Australia the S&P/ASX 200 index fell 1% to close at 7,211.20, with all sectors ending the session lower. The benchmark dropped 3% in May, notching its largest monthly decline since January. Suncorp was among the worst performers Tuesday after it was downgraded at Morgan Stanley. De Grey Mining rose after an update on its Mallina Gold Project. In New Zealand, the S&P/NZX 50 index rose 1.5% to 11,308.34.

With rate hikes in full swing in the US and the UK, the ECB is preparing to lift borrowing costs for the first time in more than a decade to combat the 19-member currency bloc’s unprecedented price spike. In the US, Federal Reserve Governor Christopher Waller said he wants to keep raising interest rates in half-percentage point steps until inflation is easing back toward the central bank’s goal.

In rates, Treasuries are off worst levels of the day although yields remain cheaper by 5bp-7bp across the curve as opening gap higher holds. 10-year TSY yields around 2.815%, cheaper by 7.7bp on the day, while intermediate-led losses widen 2s7s30s fly by ~4.5bp; bund yields around 2bp cheaper vs Monday close, following hot euro- zone inflation prints. European bonds also pressure Treasuries lower after euro-zone inflation accelerated to a fresh all-time high and ECB hike premium was added across front-end. Italian bond yields rose by up to 6bps after data showed that euro-zone consumer prices jumped 8.1% from a year earlier in May, exceeding the 7.8% median estimate in a Bloomberg survey. Comments from Fed’s Waller on Monday -- backing half-point hike at several meetings -- saw Treasury yields reset higher from the reopen, following US Memorial Day holiday. Front-end weakness reflects Fed hike premium returning in US swaps, with around 188bp of hikes now priced in for December FOMC vs 182bp at Friday’s close.

In FX, the Bloomberg Dollar Spot Index rose 0.2% as the greenback outperformed all Group-of-10 peers apart from the Norwegian krone, though the gauge is still set for its first monthly fall in three. The euro erased Monday’s gain after data showed that euro-zone consumer prices jumped 8.1% from a year earlier in May, exceeding the 7.8% median estimate in a Bloomberg survey. Norway’s krone rallied after the central bank said it will reduce its daily foreign currency purchases on behalf of the government to the equivalent of 1.5 billion kroner ($160 million) next month. Norway has been benefiting from stronger revenue from oil and gas production as the war in Ukraine contributed to higher petroleum prices. Sterling slipped against the broadly stronger dollar. UK business confidence rose for the first time in three months in May, with more companies planning to increase prices. Cable may see its first month of gains since December. The yen fell as Treasury yields surged. Japanese government bonds also took a hit from selling in US bonds while a two-year note auction went smoothly. Australian and New Zealand bonds extended an opening fall as cash Treasuries dropped on return from a long weekend. Dollar strength weighed on the Aussie and kiwi.

In commodities, Brent rises 2% to trade around $124 after European Union leaders agreed to pursue a partial ban on Russian oil. Spot gold falls roughly $4 to trade at $1,852/oz. Base metals are mixed; LME nickel falls 1.7% while LME zinc gains 0.9%.

Looking at the day ahead, the data highlights will include the flash CPI reading for May from the Euro Area, as well as the country readings from France and Italy. On top of that, we’ll get German unemployment for May, UK mortgage approvals for April, and Canada’s Q1 GDP. Over in the US, there’s then the FHFA house price index for March, the Conference Board’s consumer confidence indicator for May, the MNI Chicago PMI for May and the Dallas Fed’s manufacturing activity for May. Otherwise, central bank speakers include the ECB’s Villeroy, Visco and Makhlouf.c

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more