Futures Slide On Inflation Fears As Ukraine Ceasefire Hopes Crumble

Photo by Zbynek Burival on Unsplash

After yesterday's furious short covering/technical driven surge in risk assets, futures and global markets are sliding this morning after Ukraine and Russia failed to make progress in halting the war and bridging the vast differences between them at the first high-level talks between their foreign ministers since the Russian invasion began. Emini S&P futures dropped 0.83% or 36 points to 4,240 as of 730am after rising as high as 4,298 yesterday, with the Nasdaq dropping 1.3% and Dow futures sliding 0.9%. The dollar was higher, as were 10Y Treasury yields which rose to 1.9532%, while Oil rebounded after the biggest one-day plunge in over three months as the fallout from Russia’s invasion of Ukraine continues to rattle what one analyst called a “panic-stricken” market. DXY regains 98.00, while the EUR slides pre-ECB and following yesterday's advances while the RUB remains bid. Looking ahead, highlights include US CPI, ECB Policy Announcement & Press Conference with President Lagarde, EU Leaders Summit, RBA's Lowe, US Supply.

(Click on image to enlarge)

The big highlight this morning was news of the latest failed ceasefire attempt: Ukraine's Foreign Minister Dmytro Kuleba said that Russia indicated it will continue attacks until its goals are met, Ukrainian Foreign Minister Dmytro Kuleba said after the meeting lasting about 90 minutes with his Russian counterpart Sergei Lavrov in Turkey on Thursday. “The broad narrative he conveyed to me is that they will continue their aggression until Ukraine meets their demands, and the least of these demands is surrender,” Kuleba said.

In other words, there was no progress on a ceasefire as "Russia stuck to its script" although Kuleba said he is ready to meet again in this format. Meanwhile, the Russian Foreign Minister says a possible meeting between the Ukrainian and Russian presidents was discussed, but need more preparations. Gere are all the other notable reecnt developments in the Ukraine/Russia negotiations:

- Ukrainian Foreign Minister Kuleba says no progress on ceasefire; Russia stuck to its script; holding the meeting with his Russian counterpart was not easy; ready to meet again in this format; ready to continue engagement to stop the war. Mariupol was the most difficult situation, Lavrov did not commit to a humanitarian corridor in Mariupol. Have two tasks now: organising humanitarian corridor from Mariupol and reaching 24-hour truce.

- Russian Foreign Minister Lavrov says a possible meeting between the Ukrainian and Russian presidents was discussed; but need more preparations, Reminded Ukraine that Russia had presented its proposals and Moscow wants a reply. Prepared to discuss security guarantees for Ukraine. Possible meeting between the Ukrainian and Russian presidents was discussed; but need more preparations. No one here today was discussing a ceasefire; on oil/gas sanctions, says never used oil and gas like weapons.

- Reminder, prior to the Foreign Ministers meeting the Russian Kremlin said the Turkey meeting could open the way for talks between Russian President Putin and Ukrainian President Zelensky, awaiting the outcome of today's Foreign Minister talks.

- EU is to back Ukraine's European bid although fast membership is unlikely, according to Sputnik citing reports.

- White House said Russia's claims of alleged US biological weapons labs and chemical weapons development in Ukraine are false and that the US should be on the lookout for Russia to possibly use chemical or biological weapons in Ukraine in light of its false claims.

- US Secretary of State Blinken discussed with Ukrainian Foreign Minister Kuleba additional security and humanitarian assistance for Ukraine and discussed Russian attacks on population centres

- US Defense Secretary Austin spoke with Ukrainian counterpart about continued provision of defensive assistance for Ukraine.

- Spain is ready to send a new batch of weapons to Ukraine, according to reports in Sputnik citing the Defence Minister

As a result of today's ceasefire disappointment, equities have moved sharply lower as yesterday's exuberance fizzled, dragging the Euro Stoxx 50 down -2.4%. US futures have been moving in-line with European bourses as geopolitics currently dominates ahead of the ECB and US CPI.

Both the S&P and Nasdaq rallied on Wednesday as investors took advantage of lower valuations following a four-day rout in the wake of Russia’s invasion of Ukraine. Among notable premarket moves, Amazon.com Inc. jumped after the e-commerce giant announced a stock split and a $10 billion stock buyback, which analysts said were positive signs of management confidence. CrowdStrike Holdings rose 12% after it posted another strong quarter, analysts said, with all metrics beating expectations. Here are some other notable premarket movers:

- Cryptocurrency-exposed stocks fall on Thursday, following Bitcoin lower after Wednesday’s jump. Among U.S. crypto stocks falling in premarkettrading are Riot Blockchain (RIOT, -5.4%), Marathon Digital (MARA, -6%).

- Shares of companies related to infrastructure may be in focus Thursday after the House passed a long-delayed $1.5 trillion spending bill that would fund the U.S. government through the rest of the fiscal year. Stocks to watch include Vulcan Materials (VMC), Martin Marietta Materials (MLM).

- Asana (ASAN) plunges 25% in U.S. pre-market trading after the software company said it plans to increase spending next year, leading to a 1Q earnings forecast that missed estimates and concern from analysts about margins. The results prompted a downgrade to underweight from neutral at JPMorgan.

- CrowdStrike (CRWD) jumped 12% in premarket trading after it posted another strong quarter, analysts said, with all metrics beating expectations.

- Marqeta (MQ) shares jumped 13% in postmarket trading after reporting revenue for the fourth quarter that beat the highest analyst estimate.

- Fossil (FOSL) dropped 15% in extended trading on Wednesday, after the maker of fashion accessories reported its fourth-quarter results and gave a forecast for full-year sales growth.

In Europe, the Stoxx 600 slumped as much as 1.5% - its fifth drop in six days - after posting its biggest gain in two years on Wednesday. All sectors were in the red barring health care, miners and energy. Autos, banks and consumer products are the worst-performing sectors. FTSE MIB lags, dropping 2.9%. The European Central Bank is set to announce its policy decision later in the day. Here are some of the biggest European movers today:

- K+S shares gain as much as 8.3% in Frankfurt after the company reported a dividend per share for 2021 that was a “surprise” beat of analysts’ estimates, Baader says in a note to investors.

- SMCP shares jump as much as 11% after the French owner of the fashion brands Sandro and Maje reported FY results that showed good progress in terms of profitability, according to Jefferies,

- Thales rose alongside European defense peers after the company was raised to a new Street-high of EU142 from EU108 at Citi; Saab meanwhile gain as much as 9% after Sweden said it wants to boost defense spending to reach 2% of GDP.

- Boohoo shares soar as much as 15% as clothing retailer’s reiteration of guidance reassures analysts, with Liberum saying the stock looks oversold.

- Leroy Seafood and other Norwegian salmon-producing peers rise after DNB named its top picks by DNB in a review of the sector, reiterating its bullish outlook for it.

- Russia- exposed European stocks slide afresh after Wednesday’s rebound as the war in Ukraine continued to bring volatility, with Nokian Renkaat (-8.1%) among the worst performers.

- Hugo Boss falls as much as 7.2% after the German apparel maker reported full-year results. Citi expects mid-single-digit Ebit consensus downgrades due to Russia’s invasion of Ukraine.

- JCDecaux shares fall as much as 4.1%. The French outdoor ad company reported 2021 results that beat estimates, yet it surprised some analysts by saying it won’t pay a dividend this year.

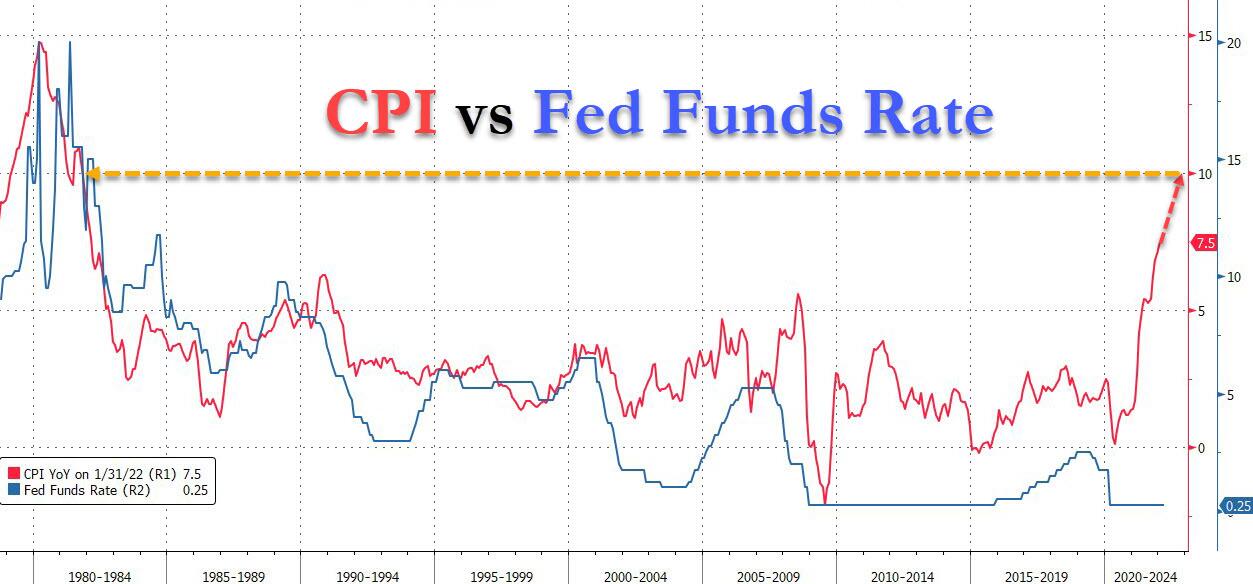

Data on the U.S. consumer price index due later in the day are forecast to show an acceleration to a 7.8% increase in February from a year earlier, which would be the most since 1982, when the Fed Funds rate was about 10%.

(Click on image to enlarge)

Still, the figures will capture data from before the Ukraine war and economists now expect inflation to peak at 8%-9%, given the jump in prices of staples like oil and food. Traders have also reduced bets on the pace of monetary tightening by the Federal Reserve due to economic uncertainty. Chair Jerome Powell has signaled a quarter-point rate hike at the central bank’s meeting next month -- its first increase since 2018.

“The wider question will be around how many more hikes will follow,” Michael Hewson, chief market analyst at CMC Markets UK, said in an email. “It seems highly unlikely that we’ll need to see anywhere near the number of rate hikes expected right now, given the strength of the dollar.”

Earlier in the session, Asian stocks headed for their best daily performance since June 2020 following an overnight retreat in oil prices that helped ease investor worries over global inflation. The MSCI Asia Pacific Index climbed as much as 2.6%, bolstered by gains in the information-technology and financial sectors. TSMC, Sony Group and Toyota were among the largest contributors to Thursday’s rally. The stock benchmark is headed for a second-straight gain following a slump that had pushed the measure into a technical bear market. Oil fluctuated after posting the biggest drop since November in the previous session. Futures rose near $111 a barrel on Thursday after plunging 12% in New York. An earlier spike in crude prices triggered by a ban on Russia oil by the U.S. had seen the Asian equities benchmark sink on Tuesday to the lowest since October 2020, as many economies in the region rely on imported oil. “There’s a bit of relief among investors given how sharply share prices had fallen because of oil prices,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank. “But it’ll be difficult for investors to push prices higher and higher, unless we see a resolution” to the war between Russia and Ukraine, she said. Gains were broad-based in the region with benchmarks in Japan, Taiwan and South Korea leading. The Topix index snapped a four-day selloff, rising 4%, the most in 21 months

In FX, the Bloomberg Dollar Spot Index advanced, yet moved in a narrow range compared to the wild swings in the previous days. The dollar strengthened against most of its Group-of-10 peers; the Australian and New Zealand dollars were the best performers and Scandinavian pairs were the worst. The euro hovered around $1.1050 while Bunds lead European bonds higher, following three days of losses that drove 10-year yields almost 30 basis points higher. The ECB policy announcement as well as possible news on European Union joint bonds are in focus as leaders meet at a summit in Versailles.

In rates, Treasuries are flat across the curve, fading earlier gains even as S&P 500 futures are under pressure after Wednesday’s 2.6% advance, after Ukraine ceasefire talks failed to end Russian assault on Ukraine. Yields are higher by less than 1bp across the curve with curve spreads little changed; 10-year flat at ~1.95%, underperforms bunds and gilts by 1bp-2bp. The Auction cycle concludes with $20b 30-year reopening at 1pm; Wednesday’s 10-year tailed by 0.3bp; the WI 30-year yield around 2.318% is ~2bp richer than February’s new-issue sale, which tailed by 1.1bp. Focal points for U.S. session include February CPI, expected to show highest y/y rates since 1980s, and 30-year bond reopening, week’s third and last coupon auction.

In commodities, crude futures advance. WTI trades within Wednesday’s range, adding 4.8% to trade below $114. Brent rises 5.6% around $117. Spot gold rises to about $2,000/oz. Base metals are mixed; LME tin falls 2.6% while LME aluminum gains 5.4%.

To the day ahead now, and the main highlights will include the aforementioned ECB meeting and President Lagarde’s press conference, the US CPI release for February, as well as the EU leaders’ summit in Versailles. On top of that, there’s the weekly initial jobless claims from the US, and an earnings release from Oracle.

Market Snapshot

- S&P 500 futures down 0.4% to 4,256.50

- STOXX Europe 600 down 0.9% to 430.75

- MXAP up 2.5% to 175.19

- MXAPJ up 1.9% to 572.19

- Nikkei up 3.9% to 25,690.40

- Topix up 4.0% to 1,830.03

- Hang Seng Index up 1.3% to 20,890.26

- Shanghai Composite up 1.2% to 3,296.09

- Sensex up 1.4% to 55,414.06

- Australia S&P/ASX 200 up 1.1% to 7,130.83

- Kospi up 2.2% to 2,680.32

- German 10Y yield little changed at 0.17%

- Euro down 0.2% to $1.1054

- Brent Futures up 4.5% to $116.12/bbl

- Gold spot down 0.5% to $1,982.73

- U.S. Dollar Index up 0.14% to 98.11

Top Overnight News from Bloomberg

- The ECB is set to decide how it can shield the continent’s economy from the consequences of the war in Ukraine while navigating an unprecedented inflation shock that shows no signs of abating

- Ukraine and Russia made little apparent progress in halting the war and bridging the vast differences between them at the first high-level talks between their foreign ministers since the Russian invasion began

- The euro looks set to cap the most volatile week in two years with more wild swings around the European Central Bank meeting. Overnight volatility is at the highest on the day of an ECB meeting since the pandemic concerns of March 2020. Euro bears are aiming for a return below $1.10 after the common currency sank Monday to $1.0806, its lowest since May 2020, while bulls hope to build on Wednesday’s biggest rally since June 2016

- If the swap market is to be believed, Russia is going to default on foreign debt, and insurance is going to pay out. Trading on credit-default swaps, used to insure against non-payment, has skyrocketed this week despite the myriad of questions over whether Russia’s plan to repay some foreign bondholders in rubles could ultimately be judged as a default

- Pacific Investment Management Co. has amassed a huge wager that Russia will not default on its debt, the Financial Times reported

- China will widen the yuan trading band for the ruble from March 11. CNY/RUB will be allowed to trade 10% around the fixing rate for the currency pair to meet the demand for market development, according to a statement from the China Foreign Exchange Trade System

- The House passed a long-delayed $1.5 trillion spending bill that would fund the U.S. government through the rest of the fiscal year and provide $13.6 billion to respond to Russia’s invasion of Ukraine

- Hungary’s central bank continued to raise the key interest rate as policy makers double-down in their efforts to shore up the forint, one of the world’s hardest-hit currencies since Russia’s invasion of Ukraine. The central bank hiked the one-week deposit rate by 50 basis points to 5.85% on Thursday. The median estimate in a Bloomberg survey was for an increase to 6%

- European factories and households used to benefit from a summer lull in power prices. Not this year. In one of the clearest signs of how the electricity market has been turned upside down as the war in Ukraine makes energy supplies more uncertain, German power futures for July are almost six times more expensive than the December average over the past ten years

A more detailed look at global markets courtesy of Newsquawk

Asia Pacific stocks traded with firm gains following a rally in global peers alongside an aggressive pullback in oil prices and with some optimism ahead of Russia-Ukraine talks after Ukrainian President Zelensky voiced a willingness for compromises. ASX 200 was lifted by strength across most industries aside from the commodity sectors following the cooling in underlying prices. Nikkei 225 surged with the gains magnified by a weaker currency and with Japan to raise the daily cap of foreign arrivals to 10k from 3k. Hang Seng and conformed to the heightened risk environment in which the former attemptedShanghai Comp. to reclaim the 21k level but with further upside restricted by weakness in some developers and blue-chip energy stocks.

Top Asian News

- U.K. Sanctions Abramovich, Deripaska on Russia’s War in Ukraine

- China to Double Yuan’s Trading Band for Russian Ruble to 10%

- China Will Double Yuan Trading Band Against Ruble to 10%

- Behind-the-Curve Fed Confronts an Inflation Shock: Macro View

European equities continue to move lower as yesterday's exuberance wanes and further pressure emerges from the

readout of the Ukrainian-Russian Foreign Ministers meeting, -2.4%Euro Stoxx 50

US futures are pressured, -0.7%, though to a lesser extent than but have been moving in-line with EuropeanES

bourses as geopolitics currently dominates ahead of the ECB and US CPI.

Sectors are pressured and defensives are faring marginally better, while Basic Resources and Oil/Gas gain amid

commodity action.

Top European News

- European Gas Fluctuates With Russia-Ukraine Talks in Focus

- Sweden Aims to Boost Defense Spending to NATO Target

- China to Double Yuan’s Trading Band for Russian Ruble to 10%

- Spirax-Sarco Rises as Jefferies Notes ‘Robust’ Outlook

In Fixed income, bonds claw back some heavy losses, but fade from recovery highs ahead of ECB, US CPI and the 30 year auction.

BTPs lag awaiting anything supportive from the ECB or President Lagarde at the post-meeting presser. Treasury curve essentially flat following weak 3 and 10 year note sales irrespective of big back-up in yields In FX, the Euro showing signs of fatigue following extensive recovery gains on the eve of ECB as risk sentiment sours again; EUR/USD fades from just shy of 1.1100 through key Fib at 1.1060 towards hefty option expiries at round number below. DXY regains composure and 98.000+ status, while Gold rebounds through USD 2000/oz in wake of no progress on a ceasefire between Russia and Ukraine. Rouble remains on a firmer footing however as a Putin/Zelensky meeting is still possible and dialogue to continue; USD/RUB around 119.00. Forint failed to get full 1 week depo hike anticipated from NBH and Norwegian Krona capped after strong CPI data and Brent’s big midweek reversal. NBH increase the one-week deposit rate to 5.85% vs prev. 5.35% (exp. 6.00%).

In commodities, WTI and are firmer but remain well within recent ranges as the benchmarks derive further upside from theBrent Foreign Ministers remarks; thus far, WTI Apr and Brent May have highs of USD 114.21/bbl and USD 117.28/bbl UAE Energy Minister said UAE is committed to the OPEC+ agreement and its existing monthly production adjustment mechanism, while it believes in the value that OPEC+ brings to the oil market. UK PM Johnson is facing calls to urge Saudi to produce more oil, while it was also reported that Foreign Secretary Truss supports a push within the Cabinet to convince UK PM Johnson to approve the return of in the UK, according to The Telegraph fracking Standard Chartered expects a sharp fall in Russian oil output after volumes are displaced from the European market and sees as it will be unable to sell all the oilRussia having to shut-in oil production; displaced from the European market. Spot gold derived notable upside from Kuleba/Lavrov, eclipsing the USD 2000/oz mark and moving to a high of USD 2007/oz from circa. USD 1980/oz prior to the presser commencing. LME said it will permit nickel position transfers although trading remains halted. Chinese nickel giant Tsingshan secured bank lifelines following the historic short squeeze.

US Event Calendar

- 8:30am: Feb. CPI MoM, est. 0.8%, prior 0.6%; Feb. CPI YoY, est. 7.9%, prior 7.5%

- CPI Ex Food and Energy YoY, est. 6.4%, prior 6.0%

- CPI Ex Food and Energy MoM, est. 0.5%, prior 0.6%

- 8:30am: Feb. Real Avg Weekly Earnings YoY, prior -3.1%, revised -3.0%; Real Avg Hourly Earning YoY, prior -1.7%, revised -1.8%

- 8:30am: March Initial Jobless Claims, est. 217,000, prior 215,000; Continuing Claims, est. 1.45m, prior 1.48m

- 12pm: 4Q US Household Change in Net Wor, prior $2.36t

- 2pm: Feb. Monthly Budget Statement, est. -$212b, prior -$310.9b

DB's Jim Reid concludes the overnight wrap

When it comes to dislocations and extreme moves, it’s been another volatile 24 hours for markets. But for the first time in a while there’s been a much more optimistic tone across multiple asset classes, with the biggest daily decline in commodities since 2008, a major rebound in global equities, as well as a continued move higher in sovereign bond yields. That comes ahead of another pivotal day ahead for investors, with many important events taking place. First, the Russian and Ukrainian foreign ministers will be meeting in Turkey, marking the first cabinet-level meeting between the two sides since the invasion began. Second, we’ll get some idea of how the ECB are viewing matters with their policy decision at 12:45 London time, followed by President Lagarde’s press conference 45 minutes later. Third, we’ve got the US CPI release at the same time as Lagarde begins her press conference, which will be the final print before the Fed are expected to commence their hiking cycle next week. And finally, EU leaders are meeting in Versailles later on, amidst growing speculation about whether they might move further on fiscal policy.

Ahead of all that however, stock markets in Asia have followed their global counterparts higher this morning following a blockbuster session for their US and European peers during which oil prices fell back sharply from their recent surge. The moves have been massive, with Brent Crude oil sliding by -13.16% in yesterday’s session to close at $111.14/bbl, the biggest daily move lower since April 2020, although this morning it’s seen a partial recovery to $115.15/bbl. That’s helped equities post strong gains, with the Nikkei (+4.02%) leading the way, followed by the CSI (+2.30%), Shanghai Composite (+1.91%) and the Hang Seng (+0.76%). South Korea’s Kospi (+1.82%) has also returned to trade this morning from yesterday’s presidential election, in which conservative opposition candidate Yoon Suk-yeol narrowly prevailed. Looking forward, US equity futures are only pointing towards a slight loss of momentum, with contracts on the S&P 500 down -0.19%.

A key factor that’s bolstered sentiment and led to that sharp move lower in commodities have been indicators from Ukraine that there could be a basis for talks to continue with Russia, alongside signals about a potential boost to OPEC+ output. Indeed, Bloomberg’s Commodity Spot Index (-5.20%) saw its largest daily decline since 2008 yesterday. A particular driver of those moves was that Ukrainian President Zelensky himself said in an interview with Germany’s Bild newspaper that he was prepared for certain compromises, with oil prices extending their decline on the back of those comments. That also followed separate remarks from his deputy chief of staff earlier in the day, who said Ukraine was open to discussing Russia’s demands on neutrality if they were given security guarantees. It’s worth stressing that the two sides are still a long way apart from each other, with the deputy chief of staff also saying that they wouldn’t cede a “single inch” of territory, but the gap between the two has narrowed relative to where it had been.

That decline in oil prices was then offered further support by the potential for greater supply, thanks to comments from officials in various OPEC countries. The FT reported that the UAE’s ambassador to Washington said that they would encourage OPEC “to consider higher production levels”, whilst Iraq’s oil minister said that the country could increase output if the OPEC+ group required. Outside of OPEC, two roadblocks toward a renewed Iran deal were also cleared, even if a final deal still remains out of reach, while the US Secretary of Energy urged domestic producers to increase oil output and said that US energy strategy was on an emergency “war footing”.

As well as those developments on Ukraine and oil, the growing risk-on tone in markets yesterday (particularly in Europe) occurred against the backdrop of additional signals that the EU summit tonight could see bold action on the fiscal front, with reports over recent days indicating that further joint borrowing was possible in response to the Ukraine crisis. Then around the time of the European close, news came through from a French Presidency official that leaders would be holding talks about a possible EU resilience and investment plan. That said, they also mentioned that discussions were at an initial stage, and comments from officials in some of the northern European countries over recent days had indicated more resistance to that, so it’ll be interesting to see how this ends up developing today.

Speculation about such measures coincided with a massive surge in European equities, with the STOXX 600 (+4.68%), Germany’s DAX (+7.92%) and Italy’s FTSE MIB (+6.94%) all posting their largest daily advances since March 2020. And that also went hand-in-hand with a major turnaround on the rates side, with sovereign bond yields moving higher across the continent, including those on 10yr bunds (+10.4bps), OATs (+10.1bps) and BTPs (+8.3bps). Over the 3 sessions since the start of the week, yields on 10yr bunds are up by a massive +28.5bps, putting them roughly around their pre-invasion levels. That has coincided with a re-appraisal of ECB pricing this year, with 34bps of hikes now priced in for 2022 as a whole, up from a closing low of 6bps earlier last week.

These moves will put the ECB’s decision today in focus, with investors interested in how the Ukraine conflict and its implications are affecting their thinking on monetary policy. At the February meeting before markets were worried about Ukraine, we got a big hawkish surprise, since President Lagarde failed to repeat her previous remarks that a 2022 hike was unlikely, and said there was “unanimous concern” about inflation surprises. Inflation has continued to surprise on the upside since then, hitting a record since the single currency’s formation at +5.8% in February, but clearly the downside risks to growth have also increased, so an unenviable dilemma for policymakers. In terms of what to expect this time round, our European economists write in their preview (link here) that the Ukraine conflict raises the risk that liftoff in rates is delayed. But they still expect a strong message from this meeting will be the ECB’s unwavering commitment to delivering on the 2% inflation target, with a resolve to hike when necessary to preserve price stability. So the ECB can stall normalization, but only if the data (and in particular inflation expectations and other indicators of second round effects) allow it to stall. Keep an eye out for their latest staff forecasts as well, and in particular what they’re saying about the all-important 2024 inflation forecast, since one of the ECB’s conditions for liftoff is that they see inflation stabilizing at 2% over the medium term.

Staying on that central bank theme, the US CPI release today will be important as we approach the Fed’s decision next week, and represents the last big piece of data they’ll get alongside last week’s stronger-than-expected jobs report. Our US economists are expecting that the year-on-year number for February will rise to +7.8%, which if realized would be the strongest print in 40 years. They’re also forecasting core at +6.3%, and they published a strategy update on the release as well yesterday (link here). In terms of the implications for next week, Fed funds futures have mostly discounted the possibility of a 50bps move that we saw turbocharged by the last CPI reading (just ahead of US warnings about a Russian invasion), and were pricing in 26.4bps worth of hikes next week by yesterday’s close. That’s in line with the view put forward by Fed Chair Powell in his testimony last week, who said that he was “inclined to propose and support a 25bp rate hike” at this meeting, as well as our US economists, who are also expecting a 25bp hike in March, followed by further hikes of 25bps at subsequent meetings for the rest of the year. Our US econ team also put out a note yesterday (link here) expecting the Fed to unveil plans for the structure of QT at next week’s meeting, as well.

Treasury yields moved higher ahead of the CPI print, with those on 10yr yields up +10.8bps to 1.95% on the improvement in risk sentiment which accelerated after the Treasury auctioned 10yr securities, and this morning they’ve only seen a slight pullback of -1.4bps. Yesterday’s gain was thanks to a sizable +15.7bp rise in real rates, the largest daily increase since February 2021, and the S&P 500 also benefitted from the improved risk tone, albeit underperforming European equities by “only” advancing +2.57% on the day. The gains were broad based, with 422 shares ending the day in the green. The NASDAQ did better than the S&P, picking up +3.59%. There were signs of some market stresses easing as well, with Bloomberg’s index of US financial conditions easing for the first time this week, and the VIX index of volatility (-2.68pts) fell for a 2nd consecutive session.

There wasn’t much in the way of data yesterday, though we did get the US jobs openings for January, which came in higher than expected at 11.263m (vs. 10.95m expected), whilst the December reading was revised up to a record 11.448m. The slight decline in job openings in January meant that the ratio of vacancies per unemployed worker fell slightly from a record 1.8 in December to 1.7 in January, but that’s still the second highest on record and points to an incredibly tight labor market. The quits rate also fell back from a record 3.0% to 2.8%, but that still leaves it some way above its pre-pandemic peak. Overnight, we’ve also had producer price inflation from Japan, which came in at +9.3% on a year-on-year basis, above the +8.6% expected and hitting its highest level in four decades.

To the day ahead now, and the main highlights will include the aforementioned ECB meeting and President Lagarde’s press conference, the US CPI release for February, as well as the EU leaders’ summit in Versailles. On top of that, there’s the weekly initial jobless claims from the US, and an earnings release from Oracle.

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more