Futures Rebound On "Massive" EU Bond Stimulus Plan; Nickel Halted After Record Surge, Gold Over $2000

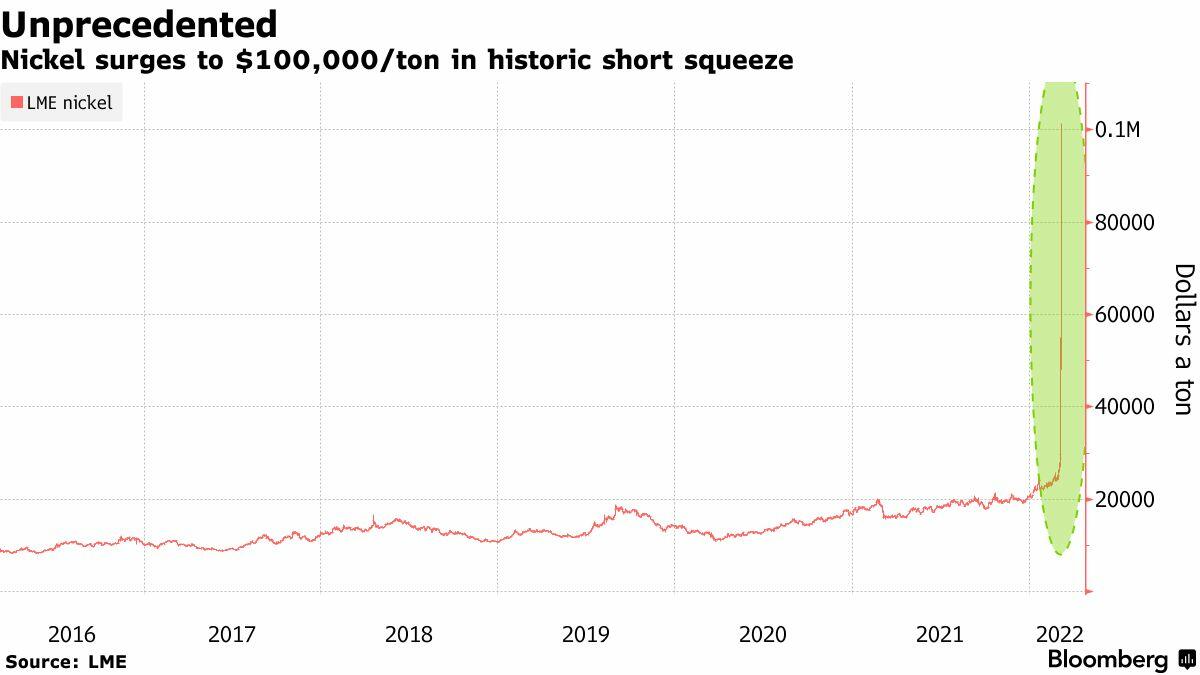

Futures rebounded from yesterday huge loss, and after touching a session low of 4,138, S&P futures bounced shortly after the European when Bloomberg reported that the European Union was set to reveal a quasi "Marshall Plan" this week to issue issue "potentially massive” joint bonds to fund energy and defense and help counter the fiscal fallout from Russia’s invasion of Ukraine (how Europe will do that at a time when QE is ending and buyers for global debt are shrinking fast amid surging rates remains unclear). S&P 500 futures gained 0.7% following the benchmark index’s biggest loss since October 2020, while Dow futures rose 0.6%. Contracts on the Nasdaq 100 were up 0.6% at 7:15 a.m. Bonds and the dollar dropped, and the euro strengthened. The commodity melt up continued: nickel was halted on the LME after soaring 250%, oil traded just shy of $130 and gold was above $2000.

(Click on image to enlarge)

The EU's bond-sale proposal may be presented as soon as next week, according to Bloomberg. The extraordinary move comes just a year after the EU launched a 1.8 trillion-euro ($2 trillion) emergency package backed by joint debt to finance member states’ efforts to deal with the pandemic. Now, the bloc faces massive financing needs as it begins to reform its military and energy infrastructure following Russia’s invasion of Ukraine.

A new round of stimulus would come as welcome relief for a market whipsawed in recent weeks as Russia’s invasion of Ukraine sent crude-oil and gas prices soaring, raising concerns about inflation and economic growth. Still, details remain sketchy and the plan has not yet been nailed down, keeping investors on edge amid the ongoing war in Ukraine and soaring commodity prices.

“Today’s reaction is perhaps short-term; we need something more solid,” said Jane Foley, head of FX strategy at Rabobank, on Bloomberg television. “The reality is that Europe’s energy security has a massive question mark and there’s a fog, therefore, over the economic outlook for the euro zone.”

U.S. stocks have been roiled this year as the war in Ukraine and resulting sanctions on Russia sent oil soaring at a time when investors were already worried about slowing economic growth. The Federal Reserve’s meeting next week is now in focus, with Chair Jerome Powell indicating interest rates could be hiked by 25 basis points to rein in inflation.

“A wait-and-see stance now prevails as investors cautiously monitor the situation,” said Pierre Veyret, technical analyst at ActivTrades. “All eyes are likely to be on the Fed over the coming days as investors watch how central banks move forward with monetary tightening in such an uncertain environment.”

"We believe it is currently hard for investors to attach high confidence in any individual market outcome materializing and we hold a neutral stance on equities,” Mark Haefele, chief investment officer at UBS Global Wealth Management, wrote in a note. "We like commodities, energy equities and the U.S. dollar as portfolio hedges in the short term.”

Tightening monetary policy to contain inflation presents further challenges. The gap between two-year and 10-year Treasury yields is around the narrowest since March 2020, a sign of expectations of slowing economic expansion. Meanwhile, the average price of gasoline in the U.S. rose to a record.

“It’s all about slowing growth and rising inflation,” Alifia Doriwala, Rock Creek co-chief investment officer, said on Bloomberg Television. “With the sanctions on Russia intensifying, it’s hitting all sectors. Then you are going to have some central bank action amidst uncertain economic growth.”

Mandiant declined in premarket trading, with Piper Sandler saying it is fairly valued after closing 16% higher on Monday following a report in The Information that Google is in talks to acquire the cybersecurity company, which had previously been reported to garner interest from Microsoft. Here are some other notable premarket movers:

- Meta Platforms (FB) edged lower in premarket trading; it faces multiple short-term risks and may not return to double-digit growth before 2H22, Arete Research analyst Rocco Strauss writes in a note, slashing price target to a joint Street-low. Piper Sandler also lowers its target on Facebook’s parent.

- Arena Pharmaceuticals Inc. (ARNA) shares rose more than 3.5% in premarket trading just days before the expiry on March 9 of the current waiting period for its proposed acquisition by Pfizer Inc. under HSR.

- ThredUp (TDUP) shares dropped 11% in extended trading after the online consignment company gave a first- quarter revenue outlook that trailed the average of analysts’ estimates. The company also reported a wider-than-expected fourth-quarter loss.

- Rover Group (ROVR) fell 13% postmarket after the pet-sitting platform provided sales forecasts that disappointed. The company anticipates “pandemic dynamics will persist well into 2022.”

- Shares of 908 Devices (MASS) jumped 7% in postmarket trading after fourth-quarter revenue topped analyst projections. The quarterly loss per share was narrower than expected.

- Clarus (CLAR) shares gained 11% in postmarket trading, after the company’s fourth-quarter revenue and 2022 sales view both beat analysts’ estimates.

In the latest geopolitical developments, Ukraine and Russia said they would make their fourth attempt Tuesday to establish a humanitarian corridor for civilians fleeing areas of heavy fighting. Still, with the VIX trading in the mid-30s, a level traditionally seen as presaging market bottoms (or crashes if the VIX extends gains) investors were bracing for more turbulence. Some more overnight developments courtesy of Newsquawk:

- Russian forces have held fire within Ukraine, as of 07:00GMT, via Reuters citing Ifx/Defence Ministry; subsequently, Ukrainian Presidential Official says the evacuation of civilians from Sumy and Irpin is underway.

- Note, Ukrainian forces are stopping civilians from leaving Mariupol and Volnovakha through humanitarian corridors, via AJA Breaking citing Donetsk Separatists

- Russian President Putin said they will only use professional soldiers in its Ukraine operation and will not use conscript soldiers in Ukraine.

- EU Commission VP Dombrovskis says that Russia President Putin is likely to increase his military ambitions and challenge NATO in Baltic Sea nations, unless Putin is stopped in Ukraine, via Politico;

- additionally, Dombrovskis was sceptical about diplomatic overtures towards Putin and maintained that nothing should be off the table re. sanctions.

- EU is reportedly considering a massive joint bond sale to finance defence and energy, according to Bloomberg citing sources; plan could be announced as early as this week. An announcement which sparked risk-on action, details here

- EU Commission has prepared a new set of sanctions against Russia and Belarus following the invasion of Ukraine, according to Reuters sources; to be discussed today, blacklisting further oligarchs, providing guidance over monitoring crypto-assets, ban export of maritime tech to Russia.

- EU will unveil a plan on Tuesday to reduce gas imports from Russia by two-thirds within a year, according to FT.

European equities snapped higher after a soggy start, with the Stoxx Europe 600 index rallying more than 1% before trimming the advance to 0.3% after three days of sharp declines, as the possibility of further central-bank stimulus lifted sentiment. Some of the most-battered sectors, including banks, utilities and carmakers, outperformed, while media and personal care stocks underperformed The Euro Stoxx 50, which yesterday entered a bear market, reversed an initial 1.2% drop to rally as much as 2.8%. FTSE MIB and IBEX outperform, rallying over 2%. Here are some of the biggest European movers today:

- M&G shares bounce as much as 15%, the most since November 2020, after the U.K. asset manager and insurer reported a broad-based FY beat, Citi (neutral) writes in a note.

- IWG shares jump as much as 15%, also the most since November 2020, after Davy said the office space provider’s full-year results were “slightly better” than the broker’s own estimates.

- Telecom Italia shares rise as much as 12% after an Italian newspaper report that its independent directors may be open to giving KKR access to its data room.

- European renewables stocks jump after a Bloomberg report that the EU is considering issuing joint bonds on a massive scale to finance energy and defense spending in the wake of the

- EDF shares, which have lost almost a quarter of their value this year, is one of the biggest gainers on the news, jumping as much as 10% after the report was published.

- Lindt shares climb as much as 2.3% after the chocolate maker raised mid-term targets in its FY report, with ZKB analyst noting OSG guidance was raised for both 2022 and the medium term.

- Banks lead a broader rebound in European stocks after the sector subindex closed at a one-year low on Monday, with Societe Generale +7.4% and ABN AMRO +6.9% leading gains in the sector.

- Greggs shares drop as much as 11% after the U.K. bakery chain said worse-than- expected cost pressures will likely prevent “material profit progression in the year ahead.”

- Hermes shares fall as much as 3.6% after Bernstein trims the price target of several luxury stocks due to risks for the sector from Russia’s invasion of Ukraine.

- Maersk shares fall after being downgraded to neutral from overweight at JPMorgan on a higher freight rate exposure than more defensive names in the shipping sector.

- Danone shares fall as much as 3.3% before paring losses after the world’s biggest yogurt maker announced new guidance that Bernstein called “modest but sensible.”

Earlier in the session, Asia’s stock benchmark extended declines in a bear market amid growing anxiety over how the sanctions on Russia will impact the global energy market and economy. The MSCI Asia Pacific Index fell as much as 1.8% on Tuesday, having lost 3.1% the previous day in its biggest drop in about a year. The slump has left the measure down by almost 23% from a February 2021 peak. Materials firms were among the biggest drags amid volatile price swings in base metals, while financial companies also weighed. “People aren’t able to assess at all, how big of a fallout there is going to be from the sanctions on Russia” as well as its invasion of Ukraine, said Tetsuo Seshimo, a portfolio manager at Saison Asset Management Co. in Tokyo. “This is something no one’s been prepared for and everyone’s rushing to respond to what’s happening.” The Asian benchmark is poised for a third day of declines amid investor angst over the fallout from the war in Ukraine and sustained regulatory pressure on China’s technology sector. Benchmarks in China, Taiwan and the Philippines were the day’s worst performers.

Japanese stocks fell as traders assessed inflation risks amid the war in Ukraine and sanctions on Russia. The Topix slid 1.9% to 1,759.86 at the 3 p.m. close in Tokyo, while the Nikkei 225 declined 1.7% to 24,790.95. Toyota Motor Corp. contributed the most to the Topix’s decline, decreasing 1.8%. Out of 2,176 shares in the index, 345 rose and 1,786 fell, while 45 were unchanged. “With the strengthening sanctions on Russia’s economy, there is a worry over supply fears and soaring costs for products that will be a huge damage to the economy and to corporate earnings,” said Hideyuki Ishiguro, senior strategist at Nomura Asset Management.

In FX, the Bloomberg Dollar Spot Index was steady after three days of gains and the greenback traded mixed against its Group-of-10 peers; NOK, SEK and EUR are the best G-10 performers; AUD and CHF lag. Scandinavian currencies and the euro led gains as they pared some of the losses induced by the war in Ukraine while currencies that had benefited, such as the Australian dollar and the Swiss Franc, slipped. The euro briefly rose above the $1.09 handle on news that the EU is considering a joint bond sale to finance energy and defense spending. The Australian dollar led losses as recently established long positions were liquidated. Australian business sentiment improved in February as an outbreak of the omicron variant dissipated, easing supply- chain disruptions and reviving demand, a National Australia Bank survey showed. Poland’s zloty and Hungary’s forint led gains among emerging-market currencies versus the euro, after both tumbled to record lows this week; the ruble erased gains after earlier rising as much as 25% versus the dollar in offshore trading amid disagreements between EU governments on a move to ban Russia’s oil imports.

The ruble was indicated as much as 25% higher versus the dollar in offshore trading before paring the gain. That may reflect disagreements between European Union governments on whether to follow the U.S. in seeking a ban on imports of oil from Russia. Russian local markets remain closed through Wednesday.

In rates, the 10-year Treasury yield jumped seven basis points and yields on core European bonds also rose. Treasury yields rose by 4-7bps, led by the belly; German bund yields were 8-9bps higher while Italian yields fell by up to 4bps. The spread between 10-year Italian and German yields -- a key gauge of risk in the euro region -- tightened. Another spread that tightened is the 5s10s curve, because 5Y yields today rose 10bps to 1.804%, meaning that the difference between the 5Y and 10Y is now below 6bps, taking out the March 2020 lows and back to 2007 pre-crash levels.

(Click on image to enlarge)

In Europe, bund futures dropped back onto a 165-handle. 10y BTP futures stage a short-lived 100 tick rally. Bund, Treasury and gilt curves bear flatten, belly of the German curve underperforms by 2-3bps. Peripheral spreads tighten significantly with 10y Bund/BTP narrowing ~13bps near 148bps.

JPMorgan Chase & Co. said it will remove Russian bonds from all of its widely-tracked indexes, further isolating the nation’s assets from global investors.

In commodities, WTI pushed past $122 a barrel on fears of disarray in commodity flows stemming from the war in Ukraine and sanctions on Russia. Brent rose ~3% back on a $127-handle. European gas futures jumped as much as 32% after Russia threatened to cut natural gas supplies to Europe via the existing Nord Stream pipeline. Most base metals trade in the green; LME nickel stages a historic spike, trading above $100,000 a ton before paring gains and being subsequently halted on LME.

(Click on image to enlarge)

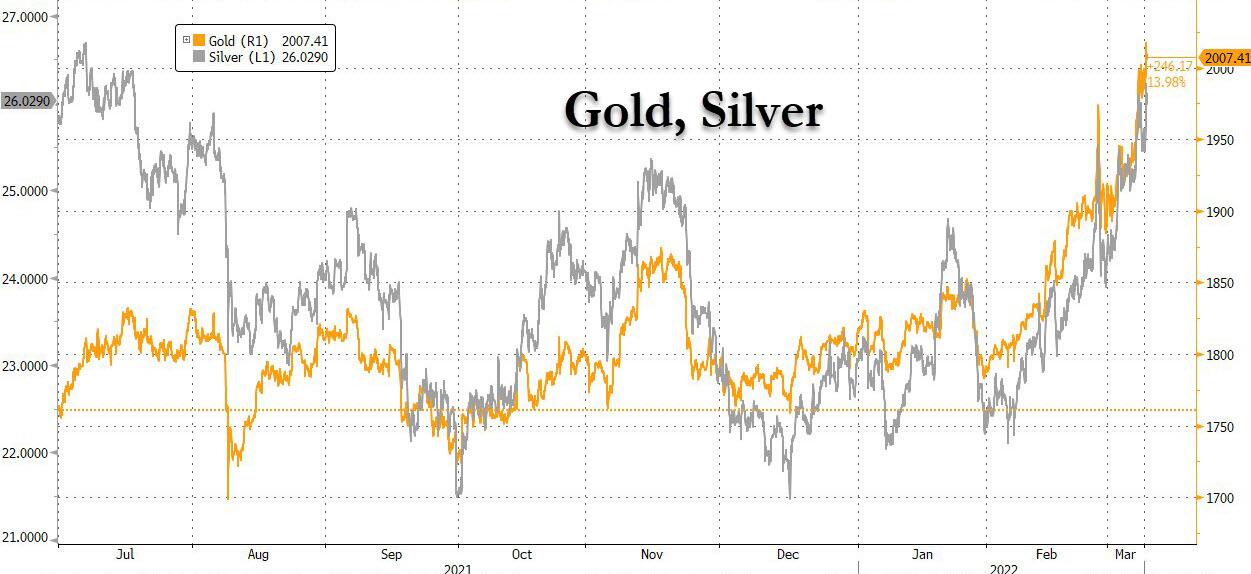

Spot gold rallies to highs of $2,021 so far before fading.

(Click on image to enlarge)

Looking at the day ahead, and it’s a pretty quiet day in terms of the events calendar. Data releases include German industrial production and Italian retail sales for January. Central bank speakers include RBA Governor Lowe.

Market Snapshot

- S&P 500 futures up 0.4% to 4,213.50

- STOXX Europe 600 up 0.9% to 421.04

- German 10Y yield little changed at 0.06%

- Euro up 0.3% to $1.0885

- MXAP down 1.6% to 170.26

- MXAPJ down 1.4% to 558.11

- Nikkei down 1.7% to 24,790.95

- Topix down 1.9% to 1,759.86

- Hang Seng Index down 1.4% to 20,765.87

- Shanghai Composite down 2.4% to 3,293.53

- Sensex up 1.1% to 53,449.23

- Australia S&P/ASX 200 down 0.8% to 6,980.33

- Kospi down 1.1% to 2,622.40

- Brent Futures up 2.6% to $126.36/bbl

- Gold spot up 0.5% to $2,008.65

- U.S. Dollar Index down 0.18% to 99.12

Top Overnight News from Bloomberg

- Russia’s threat to cut off gas to Europe in retaliation for sanctions sent prices surging more than 30%, as the European Union scrambles to find alternatives

- Average pump prices in the U.S. are now $4.173 per gallon, the highest level since records going back to 2000, according to auto club AAA. Government data going back to 1990 show prices have never been higher than they are now. In California, the most expensive U.S. state for drivers, prices have surged to $5.444 a gallon

- Britain is heading for a recession in the second half of the year if energy prices remain at current levels, according to the National Institute of Economic and Social Research

- U.K. households are facing the biggest fall in living standards for half a century as Russia’s invasion of Ukraine deepens the cost of living crisis, according to the Resolution Foundation

- Surging oil prices pushed Japan’s current account into the biggest deficit in eight years, highlighting the economy’s vulnerability as it braces for additional fallout from Russia’s invasion of Ukraine

- Japanese funds bought the largest amount of euro-denominated bonds in more than a year as yields soared amid low currency-hedging costs. Investors acquired a net 1.15 trillion yen ($10 billion) of the securities in January, according to the latest balance- of-payments report released on Tuesday. They sold a net 15.4 billion yen of Russian bonds, the most since March 2014, according to the data

A more detailed look at global markets courtesy of Newsquawk

In Asia-Pacific, stocks declined amid headwinds from global peers as geopolitical and supply concerns remain centre stage. ASX 200 was led lower by weakness in commodity-related sectors including energy after oil prices receded from highs. Nikkei 225 fell below the 25k level for the first time since November 2020. Hang Seng and Shanghai Comp. were subdued but with losses in Hong Kong cushioned by some reprieve for big tech, while the mainland was pressured on developer woes after Yuzhou Property defaulted on an interest payment.

Top Asian News

- China Stocks Slide as Inflation Risks Complicate Easing Path

- Hong Kong’s Mass Covid Testing Could Be Postponed to April: SCMP

- Asia Stocks Drop as Traders Weigh Impact of Russia Sanctions

- Indonesia’s Coal Miners Are Bracing for New Export Curbs

European bourses are mixed, Euro Stoxx 50 +0.9%, after an initial boost to sentiment on source reports around large-scale EU bond issuance; albeit, this upside has waned. Similar action has been exhibited in US futures, ES +0.4%, though performance there is positive across the board once more after a brief foray back into negative territory. Within European, sectors are equally mixed with Basic Resources subdued as base-metals waned after LME action while Banking names remain at the top of the pile given yield action. UK Chancellor Sunak and City Minster Glen met with some London-listed Cos, demanding that they signal a more robust approach towards their own holdings in Russia, via Sky News; however, some fund managers were concerned it would turn them into forced sellers.

Top European News

- IWG Soars as Davy Highlights ‘Excellent’ Momentum Into 1Q

- Fear Grips Global Diesel Markets on Russian Supply Crunch

- Schaeffler Suspends Earnings Guidance on War in Ukraine

- How Europe Became So Dependent on Putin for Its Gas: QuickTake

In Fixed Income, debt extending declines as risk sentiment recovers and Russia abides by no fire rules governing evacuation routes from Ukraine. Bunds also undermined by reports suggesting that the EU is ready to embark on huge joint issuance to pay for energy and defence measures. Gilts only briefly appeased by solid 2051 DMO re-opening sale and USTs remain heavy ahead of a 3 year note auction.

In commodities, WTI and Brent remain underpinned and have not attempted to move with any conviction out of the sessions ranges in European hours, that sees a peak of USD 123.38/bbl USD 127.99/bbl, respectively. UK PM Johnson is planning to tap new areas of the North Sea for oil and gas reserves, according to The Times. Venezuelan President Maduro said talks with the US were polite and productive, while negotiations will continue. Libya's NOC lifted the force majeure and resumed output at the Sharara oil field. IEA's Birol says that oil prices can still go above today's prices; could release a substantial amount of oil stocks if required. LME Nickel saw gains in excess of 100% taking it above USD 100k/t, prompting the LME to suspend trade; spot gold/silver are firmer on the session though off highs and seemingly capped by USD 2020/oz and USD 2031/oz for gold. CME suspended approved status for warranting and delivery of six brands of gold and silver until further notice. LME has suspended trading in Nickel; suspension is, at a minimum, for the remainder of today. LME Nickel contract on all venues suspended as of 08:15GMT, inter-office trades should not be booked for Nickel after this point. Goldman Sachs raised its 3-month gold target to USD 2,300/oz from USD 1,950/oz, while it raised its 6-month target to USD 2,500/oz from USD 2,050/oz and raised its 12-month target to USD 2,500/oz from USD 2,150/oz. CCB International Global Markets received an extension on missed nickel margin calls.

US Event Calendar

- 6am: Feb. SMALL BUSINESS OPTIMISM, 95.7, est. 97.2, prior 97.1

- 8:30am: Jan. Trade Balance, est. -$87.3b, prior -$80.7b

- 10am: Jan. Wholesale Trade Sales MoM, est. 1.0%, prior 0.2%

- 10am: Jan. Wholesale Inventories MoM, est. 0.8%, prior 0.8%

DB's Jim Reid concludes the overnight wrap

Talking of dislocations, it was yet another wild 24 hours for markets, with further crazy swings in commodities driving a major risk-off move in markets with the S&P 500 (-2.95%) relentlessly falling all day to the lowest since last June with the DAX at 16 month lows and in bear market territory 9 weeks after hitting all time highs.

The day was filled with downbeat Ukraine news as political officials close to the latest round of peace negotiations poured water on any hopes that the conflict would be resolved in the near-term through negotiations. Specifically, Russian negotiators reportedly said the talks didn’t meet expectations, Ukrainians saying there were no significant results, while French President Macron, who is liaising between interested parties, said there wouldn’t be a diplomatic solution within the coming weeks. This dragged risk assets lower through the session. It all led to the continued risk selloff and inflationary pressures working their way into a number of assets.

For commodities, we were already coming out of their strongest week in aggregate since at least the 1950s, as I wrote about in yesterday’s chart of the day (link here). They’ve built on these gains so far this week and yesterday saw the Bloomberg’s Commodity Spot Index (+3.02%) advance for the 10th time in the last 11 sessions. Oil prices were at the forefront of this, with Brent Crude (+4.32%) rising to $123.21/bbl, which is the first time it’s closed above $120/bbl since 2012. That advance masked some sizeable intraday swings as well, since it had been trading around $135 and $128/bbl around the time of the Monday and Asian European open, before falling back throughout the day as remarks from Chancellor Scholz seemed to push back on aggressive energy sanctions against Russia, by describing their oil and gas imports as of “essential importance”. It does feel that the pressure is building on extending sanctions to Russian energy exports across European countries. Public opinion will matter here and there was Handelsblatt survey suggesting Germans would back stopping Russian energy imports. Of course Russia could act first on this front, especially if it felt a ban was coming. Indeed, Deputy Prime Minister Alexander Novak reportedly threatened to halt Nord Stream 1 gas supplies on state television yesterday.

Meanwhile, there were some reports that the European Commission would be revising its energy strategy to try and reduce EU dependence on Russian gas by 80% in 2022, which would make some of the Russian import bans more tenable. On the other side of the Atlantic, Congressional leaders in both parties apparently reached a deal to ban Russian energy imports into the US, independent of Europe, though apparently President Biden hadn’t made any decisions on a Russian oil import ban.

European natural gas futures hit another record high of €227/MWh yesterday thanks to another +18.0% increase, and at one point shortly after the European open they hit an intraday peak of €345/MWh (+78.6% at this point early in the session). This is now up more than 20-fold from where it was trading just a year earlier. Food prices also bore the brunt, as wheat futures increased +7.03% to a new all-time high. In addition Nickel rose an extraordinary +66% on the day as a short squeeze materlialised on supply concerns.

Overall it’s fair to say that if commodities stay at these elevated levels, it will make life even more difficult for central banks, who will have to try and thread the needle between preventing inflation becoming entrenched without aggravating the slowdown with higher interest rates.

We’ll have to wait and see how this unfolds, but in the meantime there’s been a massive rise in investors’ expectations of future inflation. In Germany, the 10yr breakeven has soared a further +17.8bps to 2.57%, a record in Bloomberg data going back to 2009. In Italy the equivalent measure is up +16.3bps to 2.38%, the highest since 2008. And it’s not obvious that investors are viewing this as a purely transitory surge, with the Euro Area 5y5y forward inflation swap that looks at inflation in the 5 year period starting 5 years from now, rising +9.9bps to 2.20%, a level not seen since early 2014. In the US, 10yr breakevens increased +14.8bps to 2.85%, the highest level on record and the largest daily increase since March 2020.

Ultimately, that big increase in inflation expectations outweighed the decline in real rates and led to a bad day for sovereign bonds on both sides of the Atlantic. Yields on 10yr bunds (+5.4bps), OATs (+3.9bps) and BTPs (+5.9bps) all moved higher by the close. Those on 10yr Treasuries were up +4.3bps to 1.77%, and we also saw the 2s10s yield curve flatten below 20bps for the first time this cycle intraday, touching 18.9bps before closing -3.0bps lower on the day at 21.9bps. All this before the rate hiking cycle has even started. For rates however, the two big events on the calendar this week are both taking place on Thursday, with the ECB’s decision as well as the US CPI reading for February, and previous occasions have had a sizeable influence on how markets are pricing in the monetary policy outlook.

Against that backdrop it was another bad and volatile day for equities. It started very poorly around the European open when the STOXX 600 hit an intraday low of -3.83% in the first hour of trading. By the close it had turned around to “only” close -1.10% lower, but that still marked the index’s lowest level since exactly a year ago today and now means the index has lost over -15% since its all-time closing high in early January. The Dax (-1.98%) has now lost -21.12% since the peak on January 5 and is at 16-month lows.

US indices saw even larger losses yesterday, with a notable move lower after Europe closed following the aforementioned headlines tempering expectations for a near-term diplomatic solution. The S&P 500 (-2.95%) had its worst daily return since October 2020 and moved back into correction territory thanks to heavy losses among the more cyclical sectors, while the VIX index of volatility (+4.47pts) hit its highest level in over a year, at 36.45pts. In turn, those losses saw the NASDAQ decline by an even larger -3.62%, more than -20% from its all-time high reached in November, and for the first time the FANG+ index (-4.41%) of megacap tech stocks closed more than -25% beneath its all-time high back in November.

Safe havens were one of the few beneficiaries from yesterday’s moves, with the US dollar index (+0.65%) strengthening to a 21-month high. Conversely the Euro (-0.68%) weakened for a 6th consecutive session to close at $1.085. Another haven beneficiary were gold prices, which closed at an 18-month high of their own at $1998.11/oz.

If you’re looking for any hope after a day of gloomy news, reports of the latest Russian demands seemed to be less excessive than over recent days, noting they would stop military action should Ukraine forego claims to enter any blocs and if Ukraine recognised Crimea, Donetsk, and Lugansk as Russian territory or independent. While not palatable for Ukrainian negotiators, the demands are at least traveling in the right direction.

Asian equity markets are trading lower again this morning though with mainland Chinese markets leading losses. The Shanghai Composite (-1.99%), CSI 300 (-1.69%), Nikkei (1.21%), Kospi (-0.80%) and the Hang Seng (-0.45%) are all trading in negative territory as the Russian-Ukraine conflict shows no sign of cooling. Moving ahead, stock index futures in the DMs point towards a negative start as contracts on the S&P 500 (-0.18%), Nasdaq (-0.34%), Dow Jones (-0.27%) and DAX (-0.57%) are weak. Brent crude is +2.0% up at $125.7/bbl with WTI futures gaining +1.4% to trade at $121.03/bbl. Meanwhile, the yield on the 10-yr US Treasury note moved +2.2bps higher at 1.795%.

Early this morning, data showed that Labour cash earnings in Japan rebounded + 0.9% y/y in January (vs Bloomberg consensus: +0.1%) and against December’s revised -0.4% drop, while inflation-adjusted real earnings surprisingly gained +0.4% y/y in January (vs consensus -1.0%), posting the first rise in five months. It followed a revised decline of -2.3% in the preceding month. Separately, Japan’s bank lending (+0.4% y/y) rose at the slowest pace in a decade in February and following a downwardly revised +0.5% increase in January. In central bank news, the BOJ Governor Haruhiko Kuroda this morning stated that the Japanese economy is yet to recover fully from the pandemic impact and also mentioned that the central bank would ramp its purchase of JGBs or conduct fixed-rate operations if the 10-yr JGB yield moves beyond the desired range.

Elsewhere German retail sales grew by +2.0% in January (vs. +1.9% expected) yesterday, and factory orders were up by +1.8% (vs. +1.0% expected). Foreign orders drove the rise with a +9.4% gain, contrary to domestic orders which fell -8.3%.

To the day ahead now, and it’s a pretty quiet day in terms of the events calendar. Data releases include German industrial production and Italian retail sales for January. Central bank speakers include RBA Governor Lowe.

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more