Futures Flat Ahead Of ECB And Barrage Of Bank Earnings With $2.1 Trillion In Options Expiring

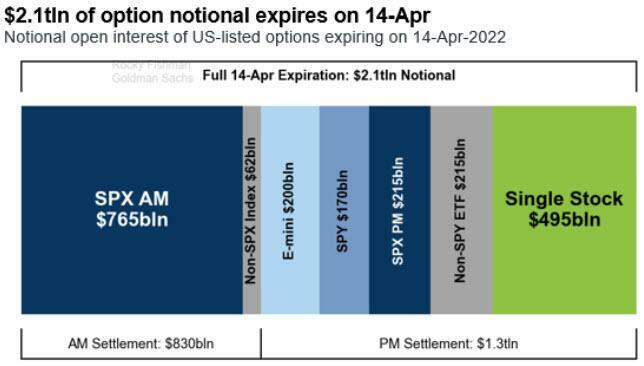

US index were flat on Thursday, reversing earlier gains sparked by hopes of imminent easing in China, as investors turned their attention to the ECB which is set to maintain its speedier withdrawal of stimulus, data on retail sales and unemployment claims, and a barrage of earnings from Goldman Sachs, Morgan Stanley, Citigroup and Wells Fargo, and all of this happening as $2.1 trillion in options are set to expire (since tomorrow is a holiday).

(Click on image to enlarge)

At 7;00am ET, S&P futures were unchanged at 4440, Nasdaq futures were down 0.1% and Europe’s Stoxx 600 rose 0.2%. Asian stocks rose after China again indicated looser monetary policy is on the way. Treasuries extended gains as investors dialed back aggressive bets on Federal Reserve interest-rate hikes. The yen bounced from a two-decade low against the dollar. The greenback slipped after snapping its longest winning streak since 2020. Oil fell. Twitter shares soared after Elon Musk offered to buy the whole company for $54.20.

(Click on image to enlarge)

Delta Air Lines gained 0.9% in premarket trading, extending this week’s rally after it had its price projection raised at JPMorgan and Barclays. However the biggest mover in the premarket was Twitter which soared as much as 18%, and was last trading at $51 following a hostile offer by Elon Musk; Tesla shares fell.

While elevated and sticky inflation “remains a key risk for investors,” there are signs that price growth will ease in the rest of the year, according to Mark Haefele, chief investment officer at UBS Global Wealth Management. “In our base case, this should allow central banks to slow the pace of monetary tightening and tone down hawkish rhetoric,” he said. “That in turn should lower the threat of an economic hard landing.”

China is expected to cut a key policy interest rate for the second time this year on Friday and reduce the reserve requirement ratio soon. South Korea raised its key interest rate and Singapore further tightened policy, spurring advances in their currencies.

“We have actually turned cautiously optimistic on the Chinese equity market in April already,” Stefanie Holtze-Jen, Asia-Pacific chief investment officer at Deutsche Bank AG in Singapore, said on Bloomberg Television. “We perceived the communication from the government as the line in the sand.”

“We’re still being cautious” about equities, Michael Vogelzang, chief investment officer at CAPTRUST, said on Bloomberg Television. “We think there’s still a lot more that can go wrong than probably can go right.”

The latest developments over the war in Ukraine included a European Union warning for member states that President Vladimir Putin’s demand that “unfriendly countries” effectively pay for Russian gas in rubles would violate sanctions. The U.S. will expand the scope of weapons it’s providing to Ukraine in a new $800 million package of military assistance.

In Europe, gains for travel and consumer companies outweighed declines in the telecommunications and energy industries, leading the Stoxx Europe 600 Index up 0.1% and Stoxx 50 up 0.3%. CAC 40 outperforms, adding 0.4%, FTSE 100 lags, dropping 0.2%. Atlantia jumped 4.9% in Milan after the Benetton family and Blackstone offered to buy out the Italian highway operator for 23 euros per share. Ericsson dropped 5.6% in Stockholm after its earnings missed estimates. Here are some of Europe's most notable movers:

- Wizz Air shares jump as much as 8.9% after it said it sees its 4Q operating result ahead of guidance provided at 3Q. Concorde says the low-cost carrier’s expectation to fly 30%-40% more compared with 2019 capacity in the next two quarters is “encouraging.”

- Holcim shares rise as much as 4.3%, most since March 29, following a Bloomberg report that the group is considering the sale of assets in India.

- Atlantia shares rise as much as 5.8% after Italy’s Benetton family and Blackstone have made a EU19b bid to buy out the infrastructure group, it follows Bloomberg News last week’s report that the firm was circled by potential suitors.

- Hermes shares advance as much as 4.6% after publishing 1Q sales that one analyst described as “spectacular.” Peers are also up with Richemont rose as much as +3%

- Ericsson shares fall as much as 9.2% after reporting adjusted operating profit that undershot average analyst estimates by 25%. While the first-quarter revenue came ahead of expectations, a “clear miss” on profits together with multiple new headwinds to margins may keep investors on the sidelines, according to Barclays.

- VW shares decline as much as 2.3% after the car-maker reported preliminary figures that Jefferies says are “overall negative.”

- UPM shares decline as much as 5.1% on Friday after the Finnish company said it has not been able to come to new collective labor agreements with the Paperworkers’ Union.

- Ashmore shares sink as much as 9.2%, the most since April 2020, after the emerging markets-focused asset manager reported 3Q net outflows of $3.7b, which analysts say were worse than consensus expectations.

European bonds fell and the euro advanced as attention turns to the ECB, which is set to maintain its speedier withdrawal of stimulus.

Earlier in the session, Asian stocks headed for a two-day gain amid growing expectations that China’s central bank will ease policy to support growth in the region’s biggest economy. The MSCI Asia Pacific Index climbed as much as 0.8% as all sectors rose, with shares in mainland China leading the regionon hopes that the People’s Bank of China will cut its key policy rate soon. A 50-basis point, broad-based reduction in the reserve requirement ratio could also be confirmed as early as Friday, injecting 1.2 trillion yuan ($188 billion) of liquidity into the economy, Citigroup said. While an RRR cut “will help in terms of stabilizing expectations, it could be just an expedient measure as the economy urgently calls for more easing,” wrote Huatai Securities analysts including Yi Huan in a note. Asia’s cyclical and defensive shares climbed with SoftBank Group hauling up the gauge, as Mizuho Securities said the technology giant may sell some of its assets to improve its finances.

Japan’s main gauges were also among the top performers in Asia, rising for a second day, driven by advances in technology shares. Electronics makers were the biggest boost to the Topix, which gained 1%. Fast Retailing and Tokyo Electron were the largest contributors to a 1.2% rise in the Nikkei 225. The Kospi index ended the day little changed after the Bank of Korea raised its seven-day repurchase rate by a quarter percentage point.

China’s growth outlook has been a key pressure point for Asian shares as the country maintains its Covid Zero strategy. The MSCI Asia Pacific Index is down about 10% in 2022, extending last year’s underperformance versus the S&P 500. “China’s dynamic zero-Covid policy could ravage the Chinese economy if lockdowns continue,” Alicia Garcia Herrero, chief economist for Asia Pacific at Natixis, wrote in a note. “Beyond the reduced demand for imports from China, an even more immediate effect is inflation given the world’s dependence on China’s production of intermediate goods.”

In rates, yields are lower by as much as 2bp in 3- to 5-year sector, steepening 5s30s spread by about that much with long-end yields little changed; 10-year, lower by ~1bp at around 2.69%, outperforms bunds and gilts in the sector by 5bp-6bp. Treasuries were slightly richer across front-end and belly of the curve, steepening most curve spreads and outperforming European core rates ahead of ECB policy decision at 7:45am ET and President Christine Lagarde’s press conference. Focal points of U.S. session include retail sales data and three Fed speakers. Sifma has recommended a 2pm close ahead of Friday’s U.S. market holiday. German curve bear-steepens with yields up 2.5-3bps across the back end. Peripheral spreads widen to Germany with 10y BTP/Bund widening 2.9bps to 242.3bps. Cash USTs bull-steepen with the curve seeing ~2bps of riching from the 5y point out. U.K. curve bear-steepens with 30y yields rising over 3bps.

The Bloomberg Dollar Spot Index headed for a second day of losses, falling 0.1%. and the dollar fell against most of its Group-of 10 peers. CHF and AUD are the weakest performers in G-10 FX, SEK and NZD outperform. The euro rose above $1.09 while yields on Bunds and Italian bonds advanced as money markets increased ECB rate hike bets ahead of the monetary policy decision. Sweden’s krona strengthened against all of its G-10 peers and the nation’s sovereign bonds slumped, led by the front-end of the curve. Markets rushed to price in faster Riksbank tightening after its target measure, CPIF, rose to 6.1% on an annual basis in March. Economists surveyed by Bloomberg expected underlying prices to rise by 5.6%. The Australian dollar declined versus its New Zealand counterpart as the economy added fewer jobs than expected last month. Yen snapped a nine-day losing streak as U.S. yields continued to fall and players prepared for the long Easter weekend. Japanese government bonds followed Treasuries higher. BOJ Deputy Governor Masazumi Wakatabe said that it’s desirable for foreign exchange rates to reflect economic fundamentals and move in a stable manner.

In commodities, crude futures decline. WTI trades within Wednesday’s range, falling 0.7% to trade around $103. Brent falls 0.7% to $108. Most base metals trade in the red; LME zinc falls 1.1%, underperforming peers. LME aluminum outperforms, adding 1.1%. Gold weakens to around $1,972.

The commodity-fueled jump in costs exacerbated by Russia’s war in Ukraine continues to ripple across the global economy and color market sentiment. JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said inflation and the conflict were creating “significant” challenges. The firm was among the first of the big U.S. banks to report earnings.

Looking to the day ahead, the main highlight will be the ECB’s latest policy decision. We’ll also hear from the Fed’s Williams, Mester and Harker. Data releases include US retail sales for March, the weekly initial jobless claims, and the University of Michigan’s preliminary consumer sentiment index for April. Lastly, earnings releases are again financials heavy, with Wells Fargo, Citigroup, Morgan Stanley, Goldman Sachs and UnitedHealth Group showcasing.

Market Snapshot

- S&P 500 futures down 0.1% to 4,437.75

- STOXX Europe 600 little changed at 457.19

- MXAP up 0.6% to 175.12

- MXAPJ up 0.4% to 580.08

- Nikkei up 1.2% to 27,172.00

- Topix up 1.0% to 1,908.05

- Hang Seng Index up 0.7% to 21,518.08

- Shanghai Composite up 1.2% to 3,225.64

- Sensex down 0.4% to 58,338.93

- Australia S&P/ASX 200 up 0.6% to 7,523.43

- Kospi little changed at 2,716.71

- German 10Y yield little changed at 0.78%

- Euro up 0.2% to $1.0906

- Brent Futures down 0.7% to $108.07/bbl

- Gold spot down 0.1% to $1,975.23

- U.S. Dollar Index down 0.17% to 99.71

Top Overnight News from Bloomberg

- Jumbo-sized interest rate hikes from Canada to New Zealand are boosting market confidence that central banks are on track to tame inflation, putting bonds back in investors’ focus

- Russian authorities are considering a step-by-step approach to rolling back the harsh capital controls imposed to stabilize markets after the invasion of Ukraine. Discussions this week focused on options that included extending the deadline for exporters to carry out mandatory conversions of their overseas earnings into rubles and lowering below 80% the share of foreign proceeds that companies are obliged to sell in the market, according to people informed on the matter

- Russia threatened to deploy nuclear weapons in and around the Baltic Sea region if Finland and Sweden join the North Atlantic Treaty Organization as tensions fueled by Vladimir Putin’s invasion of Ukraine spread

- Singapore’s central bank further tightened monetary settings and raised its inflation forecast, sending the currency higher as it seeks to fight cost pressures that threaten the recovery from the pandemic

- Chinese President Xi Jinping says his government will stick to its zero-tolerance approach to Covid even as public anger simmers in Shanghai and economic costs mount

- Copper and aluminum rose on signs China will loosen monetary policy to revive its virus-wracked economy, while zinc dipped but remained near the highest close since 2006 amid a global supply crunch

A More detailed breakdown of global news from Newsquawk

Asia-Pac stocks were mostly positive after the gains on Wall St where risk appetite was supported by lower yields, although some bourses lagged on policy tightening. ASX 200 traded higher but with gains capped by cautiousness in the top-weighted financials sector after Bank of Queensland's shares failed to benefit post-earnings. Nikkei 225 outperformed and reclaimed the 27,000 level with Japan's ruling coalition parties unveiling their draft relief proposals. Fast Retailing (9983 JT) 6-month (JPY): Net Profit 146.84bln, +38.7%; Operating Profit 189.3bln, +12.7%; Pretax Profit 212.6bln, +24%; Sees FY net income at 190bln (prev. guidance 175bln). KOSPI and Straits Times Index lagged after the BoK unexpectedly hiked rates by 25bps points and the MAS tightened FX-based policy, respectively. Hang Seng and Shanghai Comp were kept afloat with speculation rife that the PBoC will lower rates tomorrow via an MLF rate cut, while Citi also sees the possibility for a RRR cut on Friday to free up around CNY 1.2tln cash.

Top Asian News

- Chinese Stocks Advance as Key Rate Cut Seen as Soon as Friday

- TSMC Raises Sales Outlook Despite Fears Around Global Demand

- Sri Lanka Seeking Up to $4 Billion as IMF Talks Set to Start

- Uniqlo Owner Gets Serious About Conquering North American Market

European bourses are firmer, Euro Stoxx 50 +0.4%, but off best levels as sentiment was hit on commentary from Russia's Medvedev and as we await key bank earnings. Sectors in Europe are contained and are not exhibiting any pronounced theme thus far. US futures remain within narrow parameters at this point in time awaiting updates from Goldman Sachs and Morgan Stanley before Retail Sales rounds off the week's key data; NQ +0.1%. Tesla (TSLA) CEO Musk, on April 13th, offered to purchase all of the outstanding Twitter (TWTR) shares for USD 54.20/shr (vs prior close of USD 45.85); said it was his final offer. TWTR +13% in the pre-market. TSMC (2330 TW) Q1 (TWD): Revenue 491bln (prev. 362bln), Net Profit 202.7bln (exp. 184.7bln), Gross Margin 55.6%. Expects chip demand to continue in the long term, believes capacity will remain tight this year and expects another strong year. Working to address supply chain challenges with tool suppliers.

Top European News

- ArcelorMittal Buys $1 Billion Voestalpine Plant in Texas

- VW Sees Profit Surge on $3.8 Billion Hedging Boost

- Valneva’s Covid Vaccine Gets U.K. Clearance After Rocky Ride

- Macron’s Lead Grows in French Election Polling Average

FX:

- DXY almost full point down from midweek y-t-d peak as US Treasury yields continue to recede ahead of packed pre-Easter agenda index hovering above 95.500 vs 100.520 high.

- Kiwi rebounds after RBNZ letdown with tailwinds from AUD/NZD cross in wake of weaker than forecast Aussie jobs data, NZD/USD back on 0.6800 handle, AUD/USD straddling 0.7450.

- Euro takes advantage of Greenback retreat awaiting words of wisdom from ECB President Lagarde following policy announcement that is not expected to reveal changes; EUR/USD above 1.0900 vs close shave with 2022 low (1.0806) yesterday.

- Swedish Crown aloft as more consensus and Riksbank target topping inflation prints prompt earlier rate hike calls, EUR/SEK pivots 10.3000.

- Korean Won and Singapore Dollar boosted by shock BoK hike and MAS tightening, but Chinese Yuan backs off amidst growing speculation about PBoC easing possibly as soon as tomorrow.

Fixed income:

- Eurozone bonds extend retreat from recovery peaks and underperformance ahead of the ECB.

- Bunds nearer 155.00 after rebound to just shy of 156.00, Gilts sub-119.00 vs 119.65 Liffe high and 10 year T-note closer to 120-19+ overnight bottom than 121-05+ top.

- US Treasuries down in sympathy with Gilts and curve a tad steeper after so-so long bond auction.

- Debt also defensive pre-long Easter weekend and busy line up of US data, including IJC and retail sales.

Commodities:

- WTI and Brent are pressured and in relatively proximity to the session's troughs of USD 102.50/bbl and USD 107.01/bbl.

- Newsflow remains focused on Ukraine-Russia, particularly Medvedev's commentary, and the COVID situation in China as other cities are on edge re. Shanghai.

- Libyan National Unity Government adopted a plan to develop the oil sector to raise output to 1.4mln bpd, according to Reuters.

- Chinese refiners are seen cutting April's crude throughput by 900k BPD, around 6% of the 2021 average, via Reuters citing sources/analysts; expected to export 2mln/T of refined fuel in April, counter to earlier China plan to halt exports.

- Spot gold/silver are pressured and have lost the brief upside derived from earlier geopolitical developments, yellow metal at lows of USD 1967/oz.

US Event Calendar

- 08:30: April Initial Jobless Claims, est. 170,000, prior 166,000

- Continuing Claims, est. 1.5m, prior 1.52m

- 08:30: March Import Price Index YoY, est. 11.9%, prior 10.9%; MoM, est. 2.3%, prior 1.4%

- March Export Price Index YoY, est. 16.2%, prior 16.6%; MoM, est. 2.2%, prior 3.0%

- 08:30: March Retail Sales Advance MoM, est. 0.6%, prior 0.3%

- March Retail Sales Ex Auto MoM, est. 1.0%, prior 0.2%

- March Retail Sales Control Group, est. 0.1%, prior -1.2%

- 10:00: Feb. Business Inventories, est. 1.3%, prior 1.1%

- 10:00: April U. of Mich. Sentiment, est. 59.0, prior 59.4;

- Current Conditions, est. 67.0, prior 67.2

- Expectations, est. 53.6, prior 54.3

- 1 Yr Inflation, est. 5.5%, prior 5.4%; 5-10 Yr Inflation, prior 3.0%

DB concludes the overnight wrap

The EMR will be joining much of the market on holiday and will be back on Tuesday. A happy, restful long weekend to our loyal readers, and cheers to whatever it is you may be celebrating.

Ahead of the holiday, the yield curve rose on the third day straight, with 2s10s having risen +42.5bps since its nadir at the start of the month. Global sovereign yields modestly fell, while US equities outperformed their European counterparts. The ECB meets today, where our economists are not expecting a change in tune.

Starting with Ukraine, the US announced another round of aid, which will include heavy weaponry. Meanwhile, Finland has started the process to obtain NATO membership, and Swedish media report Sweden is considering the same. This, following President Biden labelling Russia’s excursions into Ukraine a genocide, the lack of negotiation progress, and the collective bracing for a renewed assault in the east, has cast a gloomy pall over the conflict. The International Energy Agency elsewhere warned that the disruption to Russian oil supply has yet to bind, with upwards of 3m bbls/day coming offline starting in May. The combined effect was to send Brent crude oil futures higher, which gained +4.14% yesterday to $108.78bbl, their highest level in two weeks following a +10.5% gain over the last two days.

Sovereign yields had a subdued day by the standards of recent volatility, with yields falling across most jurisdictions and tenors. 10yr Treasuries were down -2.3bps, outpaced by the -5.7bp decline in 2yr yields that led to a further steepening of the curve. Most of the declines came in the New York morning, when reports of large block futures trades were relentlessly hitting the tapes.

In Europe, 10yr bund, OAT, and BTP yields were -2.4bps, -3.5bps, and -3.4bps lower ahead of today’s ECB meeting, respectively. Both ECB meetings so far this year have surprised on the hawkish side of expectations, which comes as inflation has continued to accelerate to the fastest since the single currency’s formation, at +7.5% in March. Today, however, our economists preview (link here) that they’re not expecting much change to the ECB’s message. Instead, they believe with the new staff forecasts in June, the ECB will announce that APP purchases will end in July, ahead of liftoff in September.

Equities were mixed in Europe, with the DAX falling -0.34%, while the STOXX 600 and CAC managed marginal gains of +0.03% and +0.07%, respectively. Farther from the conflict, the S&P 500 outperformed, climbing +1.12%, with mega-cap shares leading the way on falling discount rates, as the FANG+ climbed +2.06%. The S&P outperformance came amidst mixed results from some bellwether US financials, with JPM missing analyst earnings expectations while Blackrock sales came below expectations. In their release, JPM noted that they were increasing reserves to account for increased recession probabilities and to account for exposures to the war, two themes likely to suffuse earnings releases this season.

In other central bank news, the Bank of Canada rose rates by +50bps to 1.00%, as was expected, and announced that their bond purchases would stop on April 25, a decision that contained some intrigue. The 50bp hike was the largest since 2000; Canada is no outlier in fighting multi-decade high inflation. The BoC said interest rates would need to rise further, as there was growing risk of higher inflation expectations becoming entrenched, a primal fear for any central banker. How much further? President Macklem suggested rates may need to surpass neutral if inflation doesn’t moderate, and the BoC happened to revise their neutral rate 25bps higher to a range between 2% and 3%. They also revised higher their inflation and GDP forecasts for 2022, revising down their 2023 growth forecast to 3.2%, which is nevertheless still above trend growth.

US producer prices grew at a much faster rate than analysts were expecting, with final demand growing +11.2% year-on-year, versus expectations of +10.6%, while the core measure grew at +9.2%. Interesting enough, the elements of PPI that feed into core PCE were among those that printed to the soft side. Combined with the CPI data from the day before, our economists are expecting core PCE in March to grow at +0.25%

Asian equity markets are following US stocks higher this morning, with most indices in the green, augmented by China signalling a potential impending RRR cut. US equity futures are pointing to a steady start today, with contracts on the S&P 500 (+0.07%) and Nasdaq 100 (+0.16%) both a smidge higher. Brent crude futures are -0.61% down to $108.12/bbl. 10yr Treasury yields have declined -2.7bps to 2.67%, with the 2yr yields edging -2.9bps lower to 2.32%.

The Bank of Korea got in on the global tightening overnight, lifting its base rate by +25bps to 1.5%, its highest since August 2019 and making it the fourth rate increase since August 2021. The increase came even without the formal appointment of a new governor Rhee Chang-yong, who is expected to begin his four-year term from April 19.

With 10 days left until the French Presidential election, polls show a consistent lead for President Macron. His lead over Marine Le Pen expanded in 3 of the 4 polls released yesterday, yet still reflect a smaller expected margin of victory than his previous triumph. The spread of French 10yr yields over bunds narrowed to close beneath 50bps for the first time in over a week.

Aside from the US PPI data, the other main release yesterday were the UK inflation numbers, where the year-on-year measure for headline CPI rose to +7.0% (vs. +6.7% expected). That’s the 6th consecutive month that the reading has surpassed the consensus expectation, whilst core CPI also surprised to the upside at +5.7% (vs. +5.3% expected). In turn, investors moved to raise the probability of a 50bp hike in May from the Bank of England to 28%, the highest in a couple of weeks. Our UK economist also put out an update after the report (link here) move above 9% year-on-year in the April data next month.

To the day ahead now, the main highlight will be the ECB’s latest policy decision. We’ll also hear from the Fed’s Williams, Mester and Harker. Data releases include US retail sales for March, the weekly initial jobless claims, and the University of Michigan’s preliminary consumer sentiment index for April. Lastly, earnings releases are again financials heavy, with Wells Fargo, Citigroup, Morgan Stanley, Goldman Sachs and UnitedHealth Group showcasing.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more