Futures Dip On Last Trading Day Of Blockbuster Year For Markets

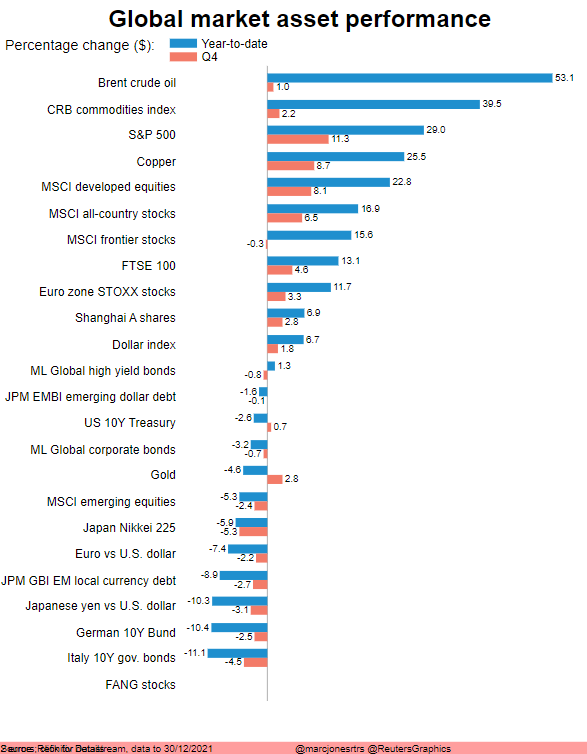

US stock futures edged lower and global markets - at least those that were open - dipped in thin trading on the final session of 2021 as concerns about the fast-spreading omicron variant let some air out of what has been a solid Santa rally to end a year of strong gains: after a 27% gain for the S&P 500 Index this year, fueled by a recovery from the coronavirus-induced slump, investors are assessing the impact of covid with new cases globally exceeding a record 2 million for the first time since the pandemic began. Also in focus is easing concern about a standoff between the U.S. and Russia after the latter expressed satisfaction with the outcome of a phone call between the countries’ presidents about Ukraine. Oil prices retreated from $80 a barrel following their biggest annual gain since 2009, the 10-year Treasury yield dropped to 1.5% and the dollar, which had its best year since 2015 with a 6.7% raise, was steady against most major currencies.

With several markets in Asia and Europe closed on Friday, trading volumes were thin and most markets directionless. At 730am, S&P e-mini futures were down 8 points or -0.17%, Nasdaq futures were down 40 points or 0.25% and Dow futures were also down 94 points, or 0.26%.

(Click on image to enlarge)

While activity was thin, there were some notable US pre-market movers today:

- Fathom Digital (FATH) soared 45% after bullish posts on Reddit about the maker of on-demand digital manufacturing platforms.

- Some cryptocurrency-exposed stocks rise in U.S. premarket trading on Friday as Bitcoin advances for a second day, paring its biggest monthly drop since May. Marathon Digital (MARA) +2.9%, Riot Blockchain (RIOT) +1.9%, Bit Digital (BTBT) +3.5%.

- Xeris Biopharma (XERS) shares gain 18% after the company said the U.S FDA approved Recorlev for treating endogenous hypercortisolemia in some patients. The risk-reward is attractive, according to Piper Sandler.

- Tesla (TSLA) dropped again in pre-market trading after a 475,000 vehicle recall.

In the latest Omicron news, a growing number of countries are reporting record daily cases of COVID-19 because of the Omicron variant, and New Year celebrations were being scaled back by uncertainty about the spread of the virus. But after initially tumbling in December, stocks have recovered over the holiday period as investors became reassured economies could handle the surge in Omicron cases, and are heading back towards record highs.

"As far as COVID is concerned, for now, market participants may stay willing to add to their risk exposures, and perhaps push equity indices to new highs, as several nations around the globe held off from imposing fresh lockdowns, despite record infections around the globe the last few days," said Charalambos Pissouros, head of research at Cyprus-based brokerage JFD Group.

Investors have held on to the resilience of the global recovery into 2022 and the prospect of further gains if money remains cheap and corporate profitability so high. This year's "everything rally" has seen a wall of cheap central bank cash, government stimulus and strong economic rebounds out of the pandemic make it hard not to profit from soaring asset prices.

“As we look forward to 2022 the gains are probably going to be more modest than they’ve been in the past year or so” partly given where valuations are now, Jason Pride, chief investment officer for private wealth at Glenmede, said on Bloomberg Television. But there’s reason for optimism too since “we’re still in the recovery from the pandemic,” he said.

The spotlight was also on talks by telephone between U.S. President Joe Biden and Russian President Vladimir Putin. The Kremlin said Putin was satisfied with the outcome of the discussions. The U.S. and its allies have raised alarm over a potential Russian invasion of Ukraine.

The MSCI World Index was marginally higher and remains just 0.5% off record levels. The index has surged 17% in 2021, its third consecutive year of double-digit gains.

With most European markets closed or shutting down early on Friday, trading was thin as investors drew a line under a strong year for global equities as economies recovered from the pandemic. Emerging markets and Asian benchmarks lagged, partly due to China’s ongoing regulatory pressures and slowing economy. Bond investors are nursing losses as many central banks move toward tighter monetary settings to fight inflation. How the coronavirus and those policy shifts shape economic reopening are key for the outlook.

European equities fell in thin trading, with many major markets on the continent closed. The Stoxx Europe 600 Index dropped 0.2%, hovering close to a record close after advancing more than 22% this year, with trading volume about 86% lower than of the 30-day average as markets including Germany, Spain and Italy were closed. In the U.K., the FTSE Index fell 0.5%, while France’s CAC 40 Index also declined 0.5%.

The Stoxx 600 advanced more than 22% in 2021, on track for a seventh consecutive quarters of gains, the longest winning streak since 1998. European equities are hovering near a record, up about 75% from a pandemic low in March 2020, on the back of an unprecedented stimulus and a successful vaccination campaign against the coronavirus, which allowed economic activity to resume despite periodic flare ups in infections. Looking at the year ahead, Christophe Barraud, chief economist at Market Securities LLP in Paris, sees headwinds building up for European stocks, as the spread of omicron brings back restrictions, the economy slows and monetary policy support wanes.

“On the positive side, earnings could hit fresh record highs as nominal growth will remain strong, real rates are expected to remain low (TINA effect) and companies will still focus on buybacks and dividends,” he said.

Earlier in the session, Asian stocks gains as low liquidity and short-covering coupled up to boost Chinese technology shares that dragged the regional benchmark down this year. A rally in Hong Kong tech names followed a surge in U.S.-listed Chinese shares. The Hang Seng Tech Index rose 3.6%, while Chinese shares overall advanced. Those moves came in the wake of the Nasdaq Golden Dragon China Index’s biggest one-day jump Thursday since 2008, though it’s still down more than 40% for 2021.

The MSCI Asia Pacific Index advanced as much as 0.5% in 2021’s last trading session, with Alibaba and Tencent the biggest contributors to gains as investors snapped up China’s battered internet giants. The Hang Seng Tech Index rose 3.6%, while Hong Kong’s benchmark gauges led advances around the region in a shortened trading day.

“The fundamentals and regulatory environment haven’t changed,” said He Qi, a portfolio manager at Huatai Pinebridge Fund Management. “We need to monitor any news on the regulations and China-U.S. tensions in the new year” to decide whether China tech’s gains can continue, he added. MSCI’s Asian index is still set to clock an annual loss of more than 3%, underperforming the MSCI AC World Index by about 20 percentage points, the biggest gap since 1997. While measures in Vietnam and India surged the most this year, up about 36% and 24%, respectively, Chinese stocks dragged the regional gauge lower. The Philippine stock index was the biggest decliner in the region Friday, sliding nearly 3% as the Southeast Asian nation held back from further easing of mobility curbs amid rising Covid-19 cases. Japan, South Korea and Taiwan were among markets that were closed for year-end holidays.

The latest data showed China’s manufacturing sector continued to expand in December, providing some relief to Beijing as the world’s second-largest economy continues to struggle with a property market slump. Less positively, Hong Kong may be facing an omicron virus-strain cluster. The city’s stock market shut early and Japan is among those closed ahead of the New Year.

Traders are continuing to monitor China’s struggling property developers. A Chinese state-owned enterprise will take a 29% stake in China South City Holdings Ltd., in the latest sign of the authorities stepping up support for ailing real-estate firms.

In rates, Treasuries are little changed on light volume, edging higher amid weakness in U.S. equity futures on year’s last day. Yields are lower by less than 1bp across the curve, with the 10-year little changed at ~1.50%, below the 50-DMA that was breached to the upside Wednesday for first time this month. Except in auction sectors (2-, 5- and 7-year) yields are little changed on the week, higher on the month in which Fed announced a faster pace of asset-purchase tapering beginning in January and revised dot- plot of forecasts for fed funds target pointing to three hikes in 2022 and 2023

Despite heading for first annual loss since 2013, U.S. government debt has benefited as a hedge for stocks at record highs. SIFMA recommends a 2pm ET close for fixed income markets, and month-end Treasury index rebalancing at 1pm is estimated to extend its duration by 0.07yr, which may support the market.

On the last day of the year, Brent crude futures dropped 0.8% to $78.87 a barrel and U.S. crude oil weakened 0.94% $76.27 a barrel. Despite this weakness, commodity prices have enjoyed a strong year, with supply often falling short of a jump in demand as economies reopened and both Brent and WTI are up more than 50% in 2021, their biggest gains since 2009, spurred by the global economic recovery and producer restraint

In FX, the Bloomberg Dollar Spot Index dropped 0.1%, trimming an almost 5% advance this year, the biggest since 2015; the Australian and New Zealand dollars outperformed peers as China PMI bolstered risk appetite, rising 0.2%. The euro, which has dropped 7.4% this year as investors bet the European Central Bank would be slower to end pandemic-era stimulus than rival central banks, rose 0.1% to hold above $1.13 . Japan's yen, which has lost more than 11% to the dollar in 2021, dipped slightly again to 115.1 yen per dollar - not far from four-year lows touched earlier this month. Sterling was little changed against the dollar and the euro .The pound remains down for the year against the dollar but looks set for its best year since 2014 versus the euro. On Friday it rose to as high as 83.69 pence, its strongest since February 2020.

Elsewhere in currency markets, Turkey's lira - by far the biggest currency loser in 2021 - fell for a fifth straight day. Turkey again tweaked the price-fixing method used to measure the returns of lira-protected deposits, less than two weeks after President Recep Tayyip Erdogan announced the new instrument as part of efforts to shore up the weakening currency. Under new guidelines issued by the central bank, the so-called conversion rate will be set using foreign-exchange buying rates announced six times a day instead of once a day. The rate is used to measure the lira’s level against major currencies at the opening date of new accounts. By all accounts, it appears that Turkey is making it up as it goes along, and after the initial monster squeeze in the lira, cracks are reappearing as shorts return to what has been the worst-performing currency of the year.

There is no economic data on today's calendar.

Market snapshot

- S&P 500 futures down 0.1% to 4,767.00

- STOXX Europe 600 down 0.1% to 488.19

- MXAP up 0.5% to 193.28

- MXAPJ up 0.7% to 630.38

- Nikkei down 0.4% to 28,791.71

- Topix down 0.3% to 1,992.33

- Hang Seng Index up 1.2% to 23,397.67

- Shanghai Composite up 0.6% to 3,639.78

- Sensex up 0.8% to 58,235.68

- Australia S&P/ASX 200 down 0.9% to 7,444.64

- Kospi down 0.5% to 2,977.65

- Brent futures down 0.2% to $79.14/bbl

- Gold spot up 0.2% to $1,819.08

- U.S. Dollar Index little changed at 95.92

- Euro little changed at $1.1332

Top Overnight News from Bloomberg

- China’s manufacturing sector continued to expand in December, providing some relief to Beijing as the world’s second-largest economy continues to struggle with the ongoing property market slump.

- Russian President Vladimir Putin is satisfied with the outcome of talks with U.S. President Joe Biden, which set the stage for three sets of negotiations on European security next month, the Kremlin said after a 50-minute call between the two leaders

- JPMorgan Chase & Co. is offering employees the option of working from home in the opening weeks of 2022, and Citigroup Inc. is encouraging staff to log on remotely

- South Korea’s inflation topped 3% for a third straight month in December, as still-high commodity prices, ongoing supply issues and resilient domestic demand all worked to lift consumer prices

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more