Futures Coiled Ahead Of Fed Decision, Biden-Putin Summit

US equity futures rebounded from a modest overnight drop in a rangebound session, coiled as investors turned cautious ahead of a policy decision from the Federal Reserve which some such as DB's Jim Reid have called the "most important for Powell's career". Oil extended a powerful rally and the dollar fell. Emini S&P futures were unchanged at 4,236.5 following Tuesday's modest drop which snapped a three-day winning streak amid weakness in technology and real estate; Nasdaq 100 futures rose 0.2%. The 10-year Treasury yield hovered around 1.5%. The dollar edged lower versus major peers, and bitcoin dropped back under $40,000.

“The FOMC meeting is unlikely to offer any surprises today as the Fed has painted itself into a corner,” Kaia Parv, head of investment research at FXPRIMUS, wrote in emailed comments. “The Fed is clearly hesitant to disturb the markets since an increasing portion of U.S. household wealth is tied to equity investments.” Here are some of the biggest U.S. movers today:

- Arrival (ARVL) jumps 11% in premarket trading, after climbing 6% on Tuesday, amid increasing references to the stock on Reddit. Other meme stocks are falling with GameStop (GME) down 1.1% and AMC Entertainment (AMC) slipping 1.6%.

- BioNTech ADRs (BNTX) fall 2.2% after Redburn cuts its rating to sell from neutral on an “excellent company” as it waits for a more attractive entry point following a strong rally in the shares.

- Blue Apron (APRN) tumbles 13% in premarket trading after the meal-kit company said it plans to sell shares.

- Electric-vehicle maker Greenland Technologies Holding (GTEC) surges 27% in premarket trading after saying customers can reserve its new GEL-1800 1.8 ton electric loader and GEX-8000 electric excavator online with a $250 refundable deposit.

- Oracle (ORCL) shares fall 4.7% with analysts saying the software group’s solid 4Q update is not good enough to extend the rally into the numbers.

- Roblox (RBLX) slumps 7.7% following postmarket losses, after the video-game company said May bookings declined from the previous month. Analysts think the decline was worse than expected.

Europe's Stoxx 600 extended gains to 0.3%, its ninth straight record ahead of the Fed with chemicals and utilities climbing the most among sectors. Here are some of the biggest European movers today:

- European renewable-energy stocks outperformed amid a series of positive broker notes and news in the sector, including an upgrade for Orsted and a takeover offer for Spanish solar company Solarpack.

- Swissquote Group shares gained as much as 17% to a record after the company said it expects to increase its full-year 2021 guidance significantly.

- Solarpack shares surged as much as 44% after Swedish investment firm EQT offered to buy the company for EU881.2m.

- Sareum Holdings Plc shares rose as much as 34% in London, having more than tripled so far this month, after the company announced on Tuesday it had raised GBP1.47m through a subscription for new shares.

- CD Projekt shares fell as much as 4.7%, reversing early gains that had followed Sony’s decision to reinstate Cyberpunk 2077 to the PlayStation store. Analysts see limited incremental uplift to sales from such a move after the troubled game’s launch.

Asian equities slid from a two-week high, led by a retreat in consumer discretionary and health-care shares, amid market wariness over the outcome of this week’s FOMC meeting. The MSCI Asia Pacific Index fell 0.3% after reversing an earlier gain of as much as 0.2%, dragged lower by a slump in Chinese stocks led by metals and commodity stocks following the latestcrackdown on high commodity prices by Beijing.

Meituan, Alibaba Group Holding and Sony Group drove a sub-gauge of consumer discretionary shares lower, while a measure of healthcare stocks is poised to halt the longest rally in more than a year. A measure of the region’s financial stocks climbed, set to snap a three-day losing streak and cushioning the market’s drop. “So long as there isn’t any drastic rise in U.S. yields, equities are likely to stay relatively stable,” said Hideyuki Suzuki, a general manager at SBI Securities. Still, “there’s a need to keep caution on what comes out of this event.” South Korea was among the day’s top performers while markets in China continued to underperform.

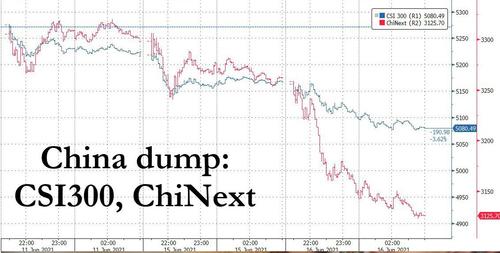

As noted earlier, Chinese stocks fell on Wednesday, as worries that the government plans to rein in commodity prices weighed on metals shares, while foreign investors continued to sell ahead of a policy decision from the U.S. Federal Reserve. The benchmark CSI 300 Index closed down 1.7% and the ChiNext tumbled 4.2% as declines in material and technology stocks offset a rally in financial and energy companies.

China is expanding its oversight of commodities trading by state firms to overseas markets, and pledged to release the nation’s reserves of base metals. The metals subgauge slumped 3.1%, its biggest drop in about a month. Meanwhile, the government’s crackdown on drugmaker monopoly practices also hit health-care shares, leading to a 3% drop in that sub-index. Separately, today’s drop started before China released reports on retail-sales growth and property investment in May, which came below market consensus. Foreign investors sold a combined 405 million yuan ($63 million) worth of mainland shares on a net basis, the third consecutive day of selling A shares, Bloomberg-compiled data show

Japanese stocks were mixed as investors awaited statements from the Federal Reserve and Bank of Japan later this week. Machinery makers were the biggest boost to the Topix, which closed little changed after climbing Tuesday to the highest since April 5. Electronics makers fell, and Nintendo dragged game makers lower after its presentation at the key E3 conference failed to offer new catalysts. Fast Retailing was the biggest contributor to a loss in the Nikkei 225, which dropped 0.5%. “There’s likely to be profit-taking following yesterday’s rise,” said Mitsushige Akino, a senior executive officer at Ichiyoshi Asset Management. “Current monetary policies are likely to be kept in place during this month’s FOMC meeting, but there’s a need to monitor the press conference and commentary as there could be some wild swings triggered by some participants.” The value of Japan’s exports jumped 49.6% in May compared with a year earlier, below the forecast 50.8% gain. U.S. stocks dipped overnight as the market digested a drop in American retail sales and an uptick in producer prices.

For traders across the globe, discretion has been the better part of valor ahead of the conclusion of the Fed’s two-day meeting at 2pm ET as investors focus on possible hints about when the Federal Reserve will slow the pace of emergency asset purchases. Trading could be choppy around the event as forecasts from Fed members might read as hawkish, while the news conference from Fed Chair Jerome Powell has tended to sound dovish. The FOMC statement is set to include updated forecasts, and expectations are that officials would broadcast any taper plans well in advance.

"We think Chair Powell will indicate officials discussed talking about tapering, but tapering itself is still someway off given the Fed remains well short on making substantial progress on employment with payrolls still 7.3 million below pre-pandemic levels," said NAB economics director Tapas Strickland.

Key will be Fed members' projections, or dot plots, for interest rates and whether more now tip a hike in 2023. Previously only 7 out of 18 had seen such a move. The lack of a 2023 hike in the dots could be seen as dovish and lead to a further sharp drop in TSY yields sparked by massive short covering. There could also be some upward movement in inflation projections for this year and next, given the last two readings on consumer prices surprised to the high side. BofA's latest (laughable) survey of fund managers suggests most are sanguine on the outlook. Some 72% said inflation was transitory, while only 23% saw it as permanent.

In fx, the Bloomberg Dollar Spot Index inched lower and the greenback was mixed versus its Group-of-10 peers, though moves were overall small. The euro hovered above in a narrow 18 pips range and European government bond yields fell slightly. The pound rose to a session high versus the dollar after inflation unexpectedly surged past the BOE’s 2% target for the first time in almost two years, and ahead of a vote in parliament on plans to delay the final stage of pandemic reopening by a further four weeks. The Aussie dollar advanced, even after a China’s main economic data missed estimates in May and speech Thursday by RBA Governor Philip Lowe; New Zealand’s dollar rose versus all its Group- of-10 peers as it was bought against the Aussie. The yen was a tad higher while Japanese government bonds fell amid caution about how their U.S. peers may react in the wake of the upcoming Federal Reserve policy decision.

The onshore yuan rose for the first time in four days as the dollar weakened ahead of the Federal Reserve’s policy decision. Investors were also weighing activity data which showed a continued stabilization in China’s economic recovery. Retail spending lagged expectations in May due to a higher comparison a year ago according to China’s National Bureau of Statistics.

The yield on 10-year Treasuries was little changed at 1.484% richer by 0.8bp on the day vs 1.5bp decline for German 10-year, and erasing declines during European session, dragged higher by bunds after German 10-year auction. Price action was muted over Asia session, with low volumes. Yields, richer from belly to long-end, remain within a basis point of Tuesday’s close in limited price action ahead of FOMC decision at 2pm ET. For Fed decision, Bloomberg economist survey found low expectations for moves toward tapering; sell- side strategists, however, have flagged hawkish risk around the meeting following last week’s sharp bull-flattening rally.

“The outlook looks pretty positive but a lot of investors are asking for there to be better clarity on when we are going to have some start to the taper,” Julie Biel, portfolio manager and senior research analyst at Kayne Anderson Rudnick, said on Bloomberg Television. “There’s a lot of nerves that we are going to wait too long, the economy is going to overheat and then we’re going to have to taper all at once.”

In commodities, oil trimmed a powerful rally that saw Brent close in on $75 a barrel (BNO), after industry data pointed to a substantial draw in U.S. crude stockpiles; metals dropped as China stepped up its campaign to rein in commodity prices.

Bitcoin (BITCOMP) dropped below $40,000 after closing Tuesday at its highest level since May.

Looking at the day ahead now, the main highlight will be the aforementioned Federal Reserve decision and Chair Powell’s subsequent press conference. Other central bank speakers include the ECB’s Vice President de Guindos and the ECB’s Elderson, along with BoC Governor Macklem. Data releases include figures for May on US housing starts and building permits, along with the UK’s CPI. Finally, US President Biden will meet Russian President Putin in Geneva.

Market Snapshot

- S&P 500 futures little changed at 4,233.5

- STOXX Europe 600 little changed at 459.07

- MXAP down 0.3% to 209.66

- MXAPJ down 0.5% to 700.93

- Nikkei down 0.5% to 29,291.01

- Topix little changed at 1,975.86

- Hang Seng Index down 0.7% to 28,436.84

- Shanghai Composite down 1.1% to 3,518.33

- Sensex down 0.3% to 52,597.65

- Australia S&P/ASX 200 little changed at 7,386.17

- Kospi up 0.6% to 3,278.68

- Brent Futures up 0.14% to $74.09/bbl

- Gold spot little changed at $1,859.06

- U.S. Dollar Index little changed at 90.50

- German 10Y yield fell 0.5bps to -0.236%

- Euro little changed at $1.2124

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more