Further Bank Of Japan Hikes Are Expected, But Not Imminent

The Bank of Japan opted for a widely-expected 25 bp hike and kept the door to future hikes open, though Governor Kazuo Ueda's comments were rather neutral on forward guidance. The November CPI matched market expectations, with persistent inflation pressures intact. We expect a further 25 bp hike by the BoJ, though only in 2026's second half.

Kazuo Ueda, Governor of the Bank of Japan

The Bank of Japan's Increased Confidence in Achieving its Inflation Target is Evident

The meeting statement shows growing confidence about sustainable inflation in several places, with comments like “firms will continue to raise wages steadily next year”, "the risk of firms’ active wage-setting behavior being interrupted is expected to be low", and "the mechanism by which both wages and prices rise moderately will be maintained."

At the same time, the BoJ emphasized that real interest rates are expected to remain “significantly” negative after the hike and accommodative financial conditions will continue to firmly support economic activity.

The statement itself clearly signals that more hikes will come as long as the BoJ's outlook continues to be realized, but the timing and magnitude of these hikes remain unclear. But we believe that the emphasis on real rates being significantly negative indicates that the BoJ now considers the lower range of the neutral rate to be above 1%.

However, it is important to note that the neutral rate is a conceptual range rather than a fixed point, and it should be used only as a reference. The BoJ would not attempt to specify it precisely, which was underscored by Governor Kazuo Ueda during the press conference.

Governor Ueda Took a Cautious Stance

The market had expected a hawkish hike from the BoJ, with the expectation of clarifying its stance on narrowing the neutral rate range and future rate hike path. However, both the BoJ and Ueda remained quite vague on this matter, which likely caused disappointment in the market. This could account for the market reaction – 10-year Japanese Government Bonds (JGB) exceeded 2.0%, and the USD/JPY currency pair climbed to the 156 level.

Ueda stayed away from providing any specific ranges of the neutral rate and emphasized that it is hard to see whether the range is actually narrowing. Instead of focusing on the neutral rate argument, he mentioned that the BoJ will closely evaluate the impact of higher interest rates on economic factors. We believe these should include corporate borrowing, bank lending, bankruptcies, private consumption, and capital expenditures.

BoJ Watch

We believe that inflation, spring wage negotiations, and the Japanese yen are the most closely watched indicators for the BoJ.

Thanks to government subsidies on energy and falling rice prices, headline inflation is likely to drop below 2% in the first half of 2026. However, core inflation, excluding fresh food and energy, is expected to decelerate only marginally, in turn remaining well above 2%. Solid wage growth and fiscal stimulus are likely to keep inflationary pressures in our view. Inflation is therefore likely to follow the BoJ’s projections.

On wage growth, several labor unions have set wage goals similar to last year’s above 5%, signaling that wage momentum should continue at a steady pace. We expect moderate yen appreciation largely because the US dollar should pull back next year. If the yen stays below 155 and heads toward 152, we don't believe the BoJ will rush into another rate hike. Currently, we expect the BoJ’s next rate hike to emerge in October 2026.

However, unlike our base case of moderate yen appreciation, if the yen weakens against the US dollar and continues to drive up import prices, the timeline could be moved forward to Q2 26. This time, the government did not openly oppose the BoJ’s decision to raise interest rates, since it also recognizes that increased import costs could hinder efforts to bring inflation down.

The soaring cost of living led to losses for previous Liberal Democratic Party (LDP) governments in recent major elections. As a result, the government will likely accept the BoJ's rate hike if inflation turns out to be stickier than expected. The Japanese yen will be key in timing the next rate hike.

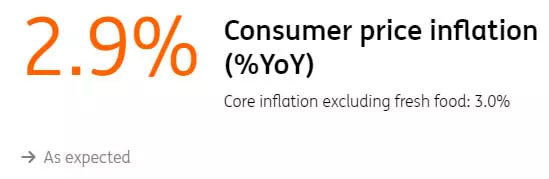

Inflation Remains Sticky

Headline inflation edged down to 2.9% year-on-year in November (versus 3.0% in October, and 2.9% market consensus) while core inflation, excluding fresh food, stayed at 3.0% for the third consecutive month.

On a monthly basis, inflation climbed a firm 0.4% month-on-month, seasonally adjusted, with goods and services prices both up by 0.7% and 0.2%, respectively. Utilities prices went up following the end of the energy subsidy program, while other prices gained due to wage growth and a weaker Japanese yen.

We believe inflation should be a main indicator to watch to gauge the BoJ's monetary policy changes in the coming months. Headline inflation is likely to drop below 2% in the first half of 2026 thanks to government energy subsidies, as well as further stabilization of rice prices, but core inflation will remain above 2% for a considerable time.

Meanwhile, the December Tokyo CPI inflation data will be released next Friday. We expect headline inflation to ease mostly due to the high base last year, yet core inflation, excluding fresh food and energy, is expected to remain at 2.8%.

Rice Prices Cooled Off Rapidly but Eating Out Prices Remained High

Source: CEIC

USD/JPY Goes Bid

Having ticked a little higher after the BoJ's initial press release, the USD/JPY currency pair has moved up with some momentum. If we had to pick out one comment that moved the pair, it might be the one in which Governor Ueda said that the BoJ would need to check the impact of the rate change each time before moving again. This year, it took the BoJ 11 months to monitor the impact of January's hike.

We are moving into a thinning year-end liquidity now, and trends tend to run. Above the 157.00 mark, the USD/JPY cross can push up to test the recent high at the 157.90 level. But in the 158/160 region, we are moving into intervention territory – levels where the BoJ sold around $100 billion in summer 2024.

We assume it will intervene again around those levels, although arguably it would prefer a backdrop of a soft dollar and a dovish Federal Reserve/imminent Fed easing to create a more supportive environment for FX intervention.

We do prefer the USD/JPY currency pair coming lower next year as FX hedging costs tumble for Japanese holders of US debt securities. Using the three-month forwards, FX hedging costs have now dropped to 3.22% per annum from 4.15% at the start of the year and from a peak of 6.00% in late 2023. The yen also remains the most undervalued G10 currency by far, and lower energy prices should also prove to be supportive of the yen.

Yet a strong interest in the carry trade into next year and strong direct investment trends are keeping the yen soft. And we certainly wouldn't rule out the USD/JPY pair pushing higher into year-end, prompting intervention and perhaps requiring an earlier BoJ hike after all.

More By This Author:

Italian Confidence Ticks Up, Led By An Olympics-Driven Tourism BoostAsia Week Ahead: Key Data From South Korea, Japan, And Taiwan

Italian Confidence Improves In December

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more