Funny Facts Friday

The funny numbers came in a veritable torrent today. For instance, the so-called U-3 unemployment rate dropped to a 17-year low of 4.1% for October. Yet the same BLS household survey which posted the lowest unemployment rate since early 2000 showed that the number of employed Americans actually sank by 484,000 last month.

How's that?

Well, easy as pie according to the data mavens at the BLS. It seems that the number of persons not in the labor force soared by 969,000 in October. So, yes, with a smaller numerator and an even smaller denominator they came up with a better---nay, awesome----unemployment rate.

Then again, none of the talking heads on bubblevision even mentioned the staggering loss of 484,000 jobs during the month because they ignore the household survey's job count entirely in favor of the establishment survey number (up 261,000)----- even though the former drives the unemployment rate, which they crow about endlessly.

This cherry-picking of the data is quite understandable, however, when you consider what is really buried in the household survey and is completely ignored by the stock peddlers. To wit, not so awesome at all is the fact that during October there was an all-time record of 95.4 million persons not in the labor force and another 6.5 million that were jobless----meaning 102 Americans (16 and older) don't have jobs.

That compares to 42 million retired workers on social security. Consequently, there are 60 million adult Americans who are housewives, students, disabled, food stamp and welfare recipients, social security dependents, dwellers in mom's basement or denizens of the illegal drug, gambling or sex trades.

To be sure, we don't have any special opinion on the merits of these pursuits, but we do have a point of view on the societal and fiscal math. Namely, the diminishing relative ranks of workers and tax mules in American society are going to buckle under the weight of baby boom retirements and soaring welfare and public sector health care costs in the years just ahead.

In that context, one of the most striking numbers in today's report is that 53.0 million prime-age men 25 to 54 years old were employed in October 2017. As is evident in the chart below, that is down by 1.5 million jobholders since the pre-crisis peak in May 2007 and virtually identical to the number in January 2001.

Stated differently, there has been no gain in employed prime-age male workers during the entirety of this century!

At the same time, the number of social security recipients at the turn of the century was 45 million and is currently 61 million. But due to the inexorability of baby boom demographics and entitlement laws passed years and decades ago, that number will rise to 83 million by 2027.

We mention this dilemma of exploding entitlement recipients and stagnant numbers of workers and taxpayers because it's relevant to another set of funny numbers currently on the radar screen. We are referring to the GOP's budget resolution for FY 2018----which whiffs completely on the entitlement monster while promising big middle-class tax cuts.

As to the entitlements matter, the CBO baseline projects outlays of $24 trillion over the next decade for social security, Medicare and SSI (supplemental security income---mainly for the poor elderly). These expenditures are overwhelmingly driven by the baby boom retirement bow wave, and actually, constitute 50% of the $48 trillion baseline for total Federal spending (ex-interest) during the 10-year period.

Yet as we have previously explained, the House budget resolution does not include a mandatory reconciliation instruction to the standing committees to cut a single dime from these giant entitlements. So like some kind of budgetary doomsday machine, nothing will happen to change the law, and the demographically driven spending levels will rise automatically and indefinitely.

Worse still, if you add in veterans benefits and Medicaid----both of which are being driven rapidly higher by the aging-out of the eligible populations----the total cost is nearly $31 trillion over the coming decade or 65% of total Federal spending ex-interest.

So it might be wondered how the GOP can punt on these giant entitlements, slash business taxes and also deliver a "huuge" middle class tax cut----all without blowing sky high a fiscal equation that is already heading for $10.1 trillion of new deficits and outstanding public debt of $31 trillion by 2027.

Needless to say, they can't---nor can they remotely deliver upon the Donald's fatuous but endlessly repeated claim that this will be the biggest tax cut of all time. To the contrary, based on the funny facts below, we think the bill introduced yesterday is the biggest con job in years, and that the House GOP will struggle to avoid a complete implosion during the mark-up and floor consideration scheduled for the next three weeks.

In the first place, it does not cut anything that could remotely be called middle class taxes by a net dime over the next ten years; it actually increases them.

That's right. The official cost-out provided last night by the Joint Committee on Taxation shows that the bill will reduce total individual taxes (excluding corporate) by $929 billion over the next decade, but that number sounds big only because we are in Federal budget land. In fact, the individual income tax baseline for this period is $22 trillion-----so the entire "cut" amounts to just 4.2% of the total.

But the real skunk in the woodpile is the fact that more than 100% of this cut in individual income taxes is accounted for by three items, which will accrue overwhelmingly to the very wealthy.

To wit, the bill repeals the alternative minimum tax at a cost of just under $700 billion over the decade, phases out the estate tax at a cost of $172 billion and provides for the so-called business pass-thru rate of 25% at a cost of nearly $450 billion.

Add these three items up and you see our point about funny numbers. The sum of $1.32 trillion for these three items is $386 billion larger than the entire individual tax cut contained in the bill!

Stated differently, set aside these three items and the baseline individual income tax revenue over the next decade would be $20.9 trillion----meaning that the GOP's ballyhooed tax bill will raise taxesby $386 billion or 2% on everyone else.

That is absolutely the math of the bill's contents, and it makes a mockery of Speaker Ryan's instance yesterday that the bill is a huge boon to the middle class. Nor should there by any doubt that the three big items mentioned above will not go to the middle class or even much of the upper middle class.

For instance, the alternative minimum tax is only paid by 3.9 million taxpayers out of the 150 million Federal income tax filers. While the Speaker claimed the GOP bill would save the $59,000 median income household $1,182 per year, he didn't mention that it would save $20,000 per minimum tax filer on average and millions per taxpayer for the very wealthy who account for most of the minimum tax payments.

Indeed, the Donald is going to be the poster boy for the AMT repeal That is, for the one year for which his Federal tax returns have been leaked, he paid $38 million to Uncle Sam----of which $31 million was accounted for by the AMT.

Likewise, 2.6 million American died in 2016, but only 5,200 estates owed death taxes due to the $5 million exemption each for husbands and wives. Accordingly, while the total collection was just $18.3 billion, it amounted to an average of $3.5 million per estate. The estate tax repeal, therefore, is not exactly a middle benefit.

And even though the GOP will talk about the entrepreneur who invented a particularly tasty brand of Christmas cookies in her home kitchen, and would now save $150,000 on her $1 million annual income owing to the 25% pass-thru tax (versus the fourth bracket regulator rate of 39.6%), there should be no illusions about who will get the big bucks.

The overwhelming bulk of the $448 billion "tax cut" for this nugget will go to the 400,000 filers (0.3% of filers) with AGIs over $1 million. These taxpayers have plenty of lawyers and accountants, and also plenty of incentive to arrange their affairs to qualify for the pass-thru rate at 14.6 points worth of lower taxes. And that's if and when endless rule-makings are accomplished and IRS opinions are rendered about exactly what kind of "productive assets" make a tax filer eligible for the 25% rate.

But as they say on late night TV, there's more. The reason that the middle-class tax cut is AWOL in the joint tax committee's official numbers is that there is a huge $3.1 trillion "payfor" coming out of their hides in the GOP plan. Namely, the repeal of most itemized deductions and similar breaks with 10--year savings of $1.50 trillion and the elimination of the $4,050 personal exemption, which saves $1.57 trillion over the period.

To be sure, the latter is offset by the doubling of the standard deduction to $24,000 per family and the increase in the child credit from $1,000 to $1,600---along with a new a $300 adult credit (through 2022 only). These two items happen to cost a nearly identical $1.55 trillion between them.

So after months of huffing and puffing, the House GOP came up with a giant reshuffle of the tax pie that will soon be producing its share of anomalies depending upon family size and other characteristics of any given tax filer.

To be sure, the collapse into just four rate brackets is estimated to save individual income taxpayers about $1 trillion, but that is substantially overshadowed by the $1.5 trillion of higher taxes that will be result from the elimination of itemized reductions and loopholes.

Needless to say, the Ways and Means Committee members are going to get manhandled good and hard as they move down Gucci Gulch each day on their way to the committee room mark-up session. Already, the real estate agents, homebuilders, charities lobby, small business and dozens of others are up in arms about the $1.5 trillion of deductions and loopholes that are on Chairman Brady's chopping block.

For example, the deductibility of mortgage interest is sharply curtailed by lowering the eligibility cap to $500,000 from the current level of $1 million. But the sneaky part of it is that only purchase mortgages on new homes will qualify at all in the future.

The "refi" business is shut out entirely. And that means some serious body tackles are going to occur along Gucci Gulch because today's mortgage business is essentially a "rinse and repeat" household financial engineering game.

So here's the thing. Much of the benefit of the rate reductions built into the four new brackets will go to the very wealthy. That is, the 39.6% bracket starts at $471k under current law, but that would be raised to $1.0 million under the GOP plan. Accordingly, a $1 million per year taxpayer without a lot of deductions would get a $30,000 reduction under the new schedule, whereas a heavy used of SALT and other deductions would get nailed fairly hard.

At the end of the day, however, the whole contraption isn't going to fly. That because the total cost of the three big breaks for the wealthy mentioned above plus net corporate tax reductions for the 20% rate, 100% expensing of new equipment and other items will cost $2.2 trillion over the next decade, but the net cost of the GOP draft according to the joint tax committee is $1.49 trillion or the exact allowance in the FY 2018 budget resolution for a deficit-financed tax cut ($1.5 trillion).

And those are truly funny facts. The tax cut for the very wealthy and corporations in the GOP draft amounts to 147% of the net cut. Everybody else is getting a $700 billion increase!

We have been saying for a long time that the GOP is barking up the wrong tree. The individual income tax has become a rich man's levy with the top 4% of filers (6 million) paying 60% of the taxes, while the bottom 122 million pay just 13%.

Consequently, there is no way to square the circle---you can't have a middle-class tax cut when the middle class (households with incomes under say $125,000 pay less than 5% of their AGI in Federal income tax.

The proper tax to cut is the payroll tax. Speaker Ryan's median income family ($59,000) has $9,500 extracted to pay the employer and employee share---or 8X more than the $1, 182 he was talking about yesterday.

Needless to say, we don't think the corporate rate cut will generate much incremental domestic investment, jobs or wages because companies many go abroad for dramatically lower labor costs, supply chain logistics, and customer market propinquity.

So the overwhelming share of the $1.46 trillion savings owing to the 20% statutory rate will go into dividends and share buybacks-----which is to say the top 1% and 10% of households which own most of the financial assets.

So the net of it is future generations are being bushwhacked with $1.5 trillion of additional public debt in order to indulge a tiny fraction of taxpayers with several trillions of tax cuts and shareholder returns that the don't really need.

That is, not in an era of Bubble Finance and massive inflation of financial asset prices in which household net worth has risen from $56 trillion in March 2009 to $96 trillion at present---and most of that gain has gone to the top of the economic latter.

Those Friday Facts that are not really all that funny because they imply that the GOP is blowing big time its opportunity to reconnect with Flyover America, which will essentially be ignored by the GOP tax bill.

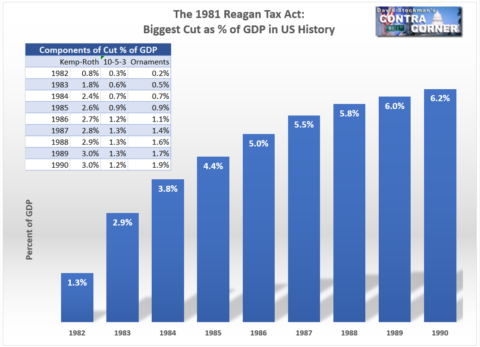

And a final less than funny fact about today's torrent of data will surely be called a "fake fact" by the Donald if he here's about it. According to the joint tax committees detailed calculations, the net tax cut in year 10 will amount to $167 billion or 0.6% of the $28 trillion of GDP forecast for 2027 by the CBO.

As it happened, by 1990 Ronald Reagan's original 1981 tax cut computed to 6.2% of GDP or ten times greater.

Of course, the Reagan tax cut was a fiscal disaster. So at least the GOP has scaled back on the size of its budgetary mayhem----the Donald's bombast notwithstanding.

Disclosure: None.