Forex Today: A New Year Arrives, Focus Turns To US Labor Market Data

Image Source: Unsplash

An exciting beginning of the 2024 trading year lies ahead. Next week, economic reports include the US and Canada Job Reports, as well as inflation figures from the Eurozone. The FOMC will also release the minutes of its latest meeting. Here is what you need to know for next week.

The beginning of 2024 will bring key economic reports that will likely influence monetary policy expectations from the Federal Reserve and the European Central Bank. The action will commence on Tuesday as market functions will return to normal after the holidays.

The focus in regards to US data will be on the labor market, with the JOLTS Job Openings on Wednesday, followed by the ADP Employment Report and Jobless Claims on Thursday, as well as Nonfarm Payrolls on Friday.

Additionally, the ISM Manufacturing and ISM Services reports are scheduled for release on Wednesday and Friday, respectively. Market participants will also closely scrutinize the FOMC minutes of the December meeting, which will be released on Wednesday.

According to analysts at TD Securities:

"A rapidly improving inflation outlook and the specter of rising real rates have led the Fed to start considering the case for policy easing in 2024. Powell alluded to this possibility at the Dec FOMC, but Fed officials since then have pushed back on the idea of imminent easing. We expect the minutes to unveil that the FOMC is not entertaining the case for rate cuts just yet."

After Santa's rally, a new challenge has emerged on Wall Street. Stocks finished the year with solid gains, reaching record highs. The question now is whether this momentum can hold next week, or if it is time for a correction.

US Dollar Price This Week

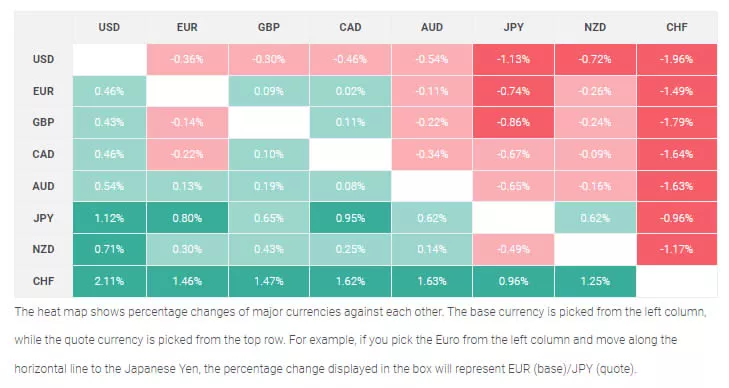

The table below shows the percentage change of the US dollar against major currencies this week. The US dollar was the weakest against the Swiss franc.

The US Dollar Index (DXY) posted its third consecutive weekly loss as market participants continued to anticipate Fed rate cuts in the coming year. It managed to end far from the bottom, at around 101.20, after a rebound on Thursday and Friday. The DXY maintained a bearish bias, and it may likely test the 100.00 level. However, positive US data could potentially trigger a sharp rebound.

The EUR/USD currency pair hit a fresh monthly high above 1.1100, but it then pulled back towards 1.1050. It posted its third consecutive week of gains, but the upward movement appeared to be losing momentum.

On Wednesday, the final Manufacturing PMI will be released, and on Thursday, the final Service PMI will be released as well. The crucial data for the week will be on Friday, with Eurostat releasing the Eurozone preliminary December Consumer Price Index (CPI).

The preliminary figures from Spain may be a good omen. Spain's Consumer Price Index slowed to 3.1% in December, which was below the market consensus of 3.4%. The core rate also eased to 3.8%, the lowest since March 2022.

The USD/JPY currency pair posted the lowest weekly close since July, and it suffered the biggest monthly loss in a year. The pair dropped towards the 140.00 level on expectations that the Fed will cut rates next year, while the Bank of Japan is expected to exit its negative interest rate policy.

The GBP/USD pair failed to hold above 1.2800 and retraced. Gains would likely be limited while trading below that level. The EUR/GBP duo briefly surpassed the 0.8700 mark before pulling back towards 0.8650.

The Chinese PMI data next week could be important for risk appetite and the Australian and New Zealand currencies. The AUD/USD pair recorded its sixth weekly gain out of the last seven weeks, and it was seen holding above the 100-week Simple Moving Average (SMA). The pair closed the week at around 0.6830.

The USD/CAD currency pair fell below the 100-week SMA, and it was seen testing support at around 1.3100. Canada will release the employment report on Friday.

The Mexican peso and the Colombian peso were the best performers in 2023. On the other hand, the Argentine peso, the Turkish lira, and the Russian ruble fared the worst.

Among G10 currencies, the Swiss franc performed the best. The USD/CHF duo had its worst year in a decade. Despite seeing a recovery during the fourth quarter, the Japanese yen suffered large losses. The USD/JPY currency pair rose for the third consecutive year, but it respected the 152.00 barrier. The overall outlook for the yen appears to have improved compared to 12 months ago.

More By This Author:

USD/JPY Pinned To The Low Side Near 141.00 As Markets Closed Out 2023At Year's End, No Quick Fix For Oil

USD/CAD Recovers Further To Near 1.3260 As U.S. Dollar Rebounds

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more