Forex And Cryptocurrency Forecast For July 10-14

Image Source: Unsplash

EUR/USD: Much Depends on The CPI

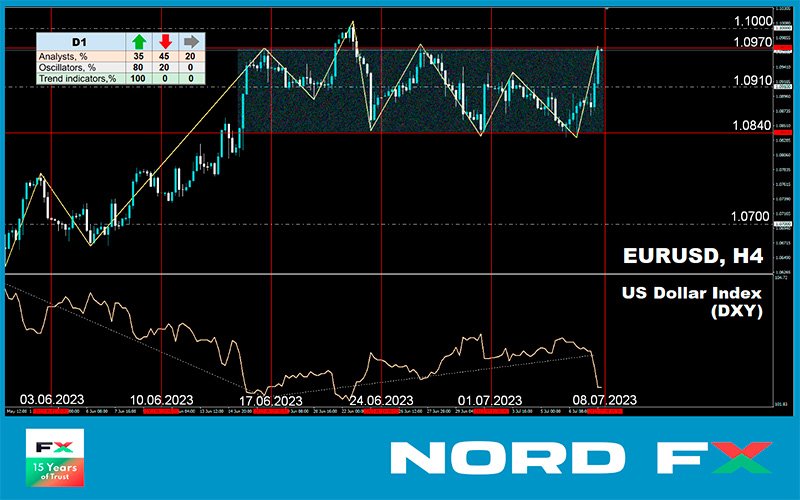

The Dollar Index (DXY) steadily increased during the past week, leading up to Thursday, July 6. As a result, the EUR/USD currency pair was more inclined towards the American currency, causing the pair to find a local bottom at the 1.0833 level.

The dollar's strength was driven by the publication of the minutes from the Federal Open Market Committee's (FOMC) last meeting on June 14. In it, the Committee members highlighted the risks of inflationary pressure and expressed a commitment to swiftly achieve their target inflation levels of 2.0%. They also noted the appropriateness of at least one more interest rate hike, in addition to the one in July, which boosted confidence for DXY bulls.

Recall that the head of the regulator, Jerome Powell, also stated at the end of June that the "vast majority of Federal Reserve leaders expect two or more rate hikes by the end of the year."

Everything seemed to be going well for the dollar. However, the statistics released throughout the week were quite mixed, stirring doubts regarding the unwavering hawkish policy of the regulator. On one hand, according to the ADP report, employment in the US private sector, with a forecast of 228,000, actually grew by 497,000 in June, significantly higher than the 267,000 in May.

On the other hand, the JOLTS job openings index stood at 9.82 million in May, down from 10.3 million the previous month and falling short of the expected 9.935 million. The US manufacturing PMI index, which has been falling for eight consecutive months, disappointed as well, reaching 46.0 in June – the lowest level since May 2020.

Commenting on these figures, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, stated that "the health of the US manufacturing sector deteriorated sharply in June, and this is fueling fears that the economy may slide into recession in the second half of the year."

These fears were further exacerbated by renewed trade tensions between the US and China. Against this backdrop, market participants are questioning whether the Fed will dare to make another interest rate hike after the July one? Note that the market has long taken into account the rate increase on July 27 from 5.25% to 5.50% in its quotations. Or will the regulator announce the end of the current monetary tightening cycle?

The latest batch of labor market data released on Friday, July 7, could help answer this question. The figures turned out to be disappointing for DXY bulls. Non-Farm Payrolls (NFP), a key barometer of potential economic cooling in the United States, showed that the number of new jobs created outside the agricultural sector decreased to 209,000 in June. This figure is lower than both the May value of 306,000 and the forecast of 225,000.

As for the growth of average hourly wages, according to the report from the US Bureau of Labor Statistics, this indicator remained at the previous level: 4.4% year-over-year and 0.4% month-over-month. The only market expectation that was met was the unemployment rate, which decreased from 3.7% to 3.6% over the month.

Following the release of such data, dollar sellers returned to the market, and the EUR/USD pair ended the work week at the 1.0968 level. As for the near-term prospects, 35% of analysts forecast further growth for the pair, 45% anticipate a decline, and the remaining 20% took a neutral stance. Among the oscillators on D1, 80% favor the bulls, 20% favor the bears, and all trend indicators are leaning towards bullish.

The nearest support for the pair is located around 1.0895-1.0925, followed by 1.0835-1.0865, 1.0790-1.0800, 1.0740, 1.0670, and finally, the May 31 low of 1.0635. The bulls will meet resistance in the 1.0975-1.0985 area, followed by 1.1010, 1.1045, and 1.1090-1.1110.

The upcoming week will bring a whole package of US consumer inflation data that could have the most significant impact on the Federal Reserve's future monetary policy. The Consumer Price Index (CPI) values, including the core, will be published on Wednesday, July 12. The next day, on Thursday, July 13, we'll get information on key indicators such as the number of initial jobless claims and the US Producer Price Index (PPI).

On Friday, as a 'cherry on top,' we'll be presented with the University of Michigan's Consumer Confidence Index. As for important European statistics, the German Consumer Price Index (CPI) will be published on Tuesday.

GBP/USD: Prospects for a Bullish Trend

In the past week, the pound clearly became the beneficiary in the GBP/USD currency pair. As of June 29, the British currency was trading at the 1.2600 level, and by July 7, it had already reached a high of 1.2848.

The pound was buoyed by weak manufacturing activity and labor market data in the US, as well as doubts about the continuation of the Fed's hawkish stance. It was also helped by the fact that the UK Manufacturing Purchasing Managers' Index (PMI) came in at 46.5 in June, which, although lower than the previous figure of 47.1, was above the market expectation of 46.2.

Against this backdrop, the likelihood of further active tightening of monetary policy by the Bank of England (BoE) is practically beyond doubt. Following its meetings in May and June, the BoE raised interest rates by 25 basis points and 50 basis points to 5.00%.

Many analysts believe that the regulator could push it up to 5.50% in the next two meetings, and then even up to 6.25%, despite the threat of an economic recession. In such a situation, the British currency has a significant advantage. For example, at Credit Suisse, they believe that the GBP/USD pair still has potential to grow to 1.3000.

The pair ended the past week at the 1.2838 level. "The trend momentum remains confidently bullish across short-term, medium-term, and long-term oscillators, suggesting that the push to 1.2850 (and beyond) is still in play," Scotiabank economists write.

In theory, with the current volatility, the GBP/USD currency pair could cover the remaining distance to 1.3000 in just a few weeks or even days. However, at this point, only 25% of experts support this scenario. The opposite position was taken by 45%, and neutrality was maintained by 30%.

As for technical analysis, 90% of the oscillators on D1 point to the north (a quarter are in the overbought zone), and 10% are looking to the east. 100% of the trend indicators recommend buying.

In case of the pair's movement to the south, it will find support levels and zones at 1.2755, 1.2680-1.2700, 1.2590-1.2625, 1.2480-1.2510, 1.2330-1.2350, 1.2275, and 1.2200-1.2210. In case of the pair's growth, it will meet resistance at the levels of 1.2850, 1.2940, 1.3000, 1.3050, and 1.3185-1.321.

Notable events for the upcoming week include a speech by Bank of England Governor Andrew Bailey on Monday, July 10, and the release of the UK's labor market data on Tuesday, July 11.

USD/JPY: The Pair's Interrupted Flight and Triumph of the Bears

What experts had long been waiting for has finally happened: the USD/JPY currency pair interrupted its "moon flight" and switched to an emergency decline. More precisely, it was not just a decline, but a real crash.

The reason for it, of course, was weak macroeconomic data from the U.S. since nothing has changed on the side of Japan. The policy of the Bank of Japan (BoJ) remains unchanged. The Deputy Governor of the Central Bank, Shinichi Uchida, has recently once again ruled out the possibility of an early end to ultra-soft monetary policy and exit from negative interest rates.

The monetary policy carried out by the Government and the Central Bank of Japan over the past few years clearly indicates that the yen rate, and even inflation, are not their top priority, even though the CPI has accelerated to 3.1% year-over-year.

The main thing is the economic indicators, and it seems that everything is fine here. The Tankan Index of Large Manufacturers published on Monday, July 3, showed an impressive increase from 1 to 5 (with a forecast of 3), indicating an improvement in the business climate in the country.

The USD/JPY pair traded at 145.06 on June 30, and the minimum on July 7 was recorded at 142.06. Thus, in just a week, the yen managed to win back a full 300 points from the dollar. The reason for such a triumph of the bears is the oversold Japanese currency. As strategists of the French financial conglomerate Societe Generale point out, the yen hasn't been this cheap since the 1970's.

"Large pricing errors can last longer than we are used to thinking," they write, "but this one is extraordinary, and as soon as rates start to convert again, the yen will undoubtedly start a rally."

Analysing the pair's prospects, Societe Generale expects that the yield on 5-year U.S. bonds will drop to 2.66% in a year, allowing the USD/JPY pair to break below 130. If the yield on Japanese government bonds (JGB) remains at the current level, the pair has a chance to even drop to 125.00.

We noted in the last review that Danske Bank economists predict a USD/JPY rate below 130.00 on the horizon of six to twelve months. Strategists at BNP Paribas make a similar forecast - they target the level of 130.00 by the end of this year and 123.00 by the end of 2024. The Wells Fargo prediction looks modest - its experts believe that by the end of 2024, the pair will only drop to 133.00.

The past week saw the USD/JPY pair end at 142.10. At the time of writing, 60% of analysts believe that the southward movement is just a short-term correction, and that the pair will return to growth in the coming days. The remaining 40% voted for its further fall. The indications of indicators on D1 are quite diverse. Among oscillators, 25% are colored green, 15% are neutral grey, and 60% are red (with a quarter signaling the pair's oversold).

Among trend indicators, the balance of power between green and red is 50% to 50%. The nearest support level is in the zone of 1.4140-141.60, followed by 140.45-140.60, 1.3875-1.3905, 137.50, and 135.90-137.05. The nearest resistance is 145.00-145.30, then the bulls will need to overcome obstacles at the levels, 146.85-147.15, 148.85, and from there it is not far to the October 2022 peak of 151.95.

No significant economic information related to the Japanese economy is expected to be released in the upcoming week.

Cryptocurrencies: Three Growth Triggers - The Federal Reserve, Halving, and Women

The beginning of the summer turned out to be quite hot for the crypto industry. On the one hand, regulators continued to tighten their grip on the sector. On the other, we are witnessing a surge in institutional interest. First and foremost, it is applications for the launch of spot Bitcoin ETFs from such giants as BlackRock, Invesco, Fidelity, and others.

Regarding regulatory pressure, debates have been going on for over a year. Some warmly welcome this process, while others protest. The former argue that this will cleanse the industry of unscrupulous participants and attract billions, if not trillions, of institutional dollars to the crypto market.

The latter claim that the intervention of the same US Securities and Exchange Commission (SEC) completely breaks the main principle of cryptocurrencies - independence from states and governments. "Law enforcement regulation is killing our economy," wrote Tim Draper, co-founder of venture capital firm Draper Fisher Jurvetson, on June 20. "I think we have a real problem because the SEC is sowing fear... This compulsory regulation doesn't make sense."

Note that the SEC has previously rejected all applications to create spot ETFs on Bitcoin. This time around, the Commission stated that the fresh applications are not clear and comprehensive enough. However, companies are not retreating and have already submitted edited versions.

"Approval of applications for a spot ETF on Bitcoin will let investors know that the first cryptocurrency is a legitimate asset," explains MicroStrategy co-founder Michael Saylor. "If the SEC approves applications for this asset, a user can press a button and buy Bitcoin for $10 million in 30 seconds."

"This is an important milestone on the path to institutional acceptance. I think it's important, although I don't think Bitcoin will grow to $5 million overnight," the billionaire concluded. However, in the medium-term, according to Hugh Hendry, manager of hedge fund Eclectica Asset Management, Bitcoin could triple its capitalization.

By the way, the aforementioned Tim Draper previously predicted that the price of Bitcoin would reach $250,000 by the end of 2022. When his forecast did not come true, he extended the timing of its realization by another six months until mid-2023.

Now, Draper has adjusted his forecast again - according to him, the main cryptocurrency will reach the stated goal with a 100% probability by the end of June 2025. Moreover, one of the drivers of growth will be the acceptance of Bitcoin by women.

Housewives paying for purchases with Bitcoin can undoubtedly become a serious factor. However, more "conservative" analysts prefer to point to two others: the easing of the Federal Reserve's monetary policy and the upcoming Bitcoin halving in April 2024. In anticipation of these two events, crypto exchanges are noting a decrease in supply, and long-term holders have accumulated a record number of coins in their wallets: 13.4 million Bitcoins.

Regarding the first point, at its June meeting, the Federal Reserve decided to take a pause and left the key interest rate unchanged. However, the possibility of one or two more hikes of 25 bp each is not ruled out.

After this, the cycle of monetary tightening may be completed, and at the end of 2023 - the beginning of 2024 markets expect a reversal and the start of a decrease in the rate. This should positively affect investors' risk appetite and facilitate the inflow of capital, including into digital assets.

On to the second point. This event also usually has a positive effect on Bitcoin quotes. A correlation between the halvings that occur every four years and the dynamics of the coin's value has long been noted.

Analyst Root presented an interesting radial diagram on this topic. Making a circle in four years, the price forms the cycle's peaks and troughs in the same sectors. And, according to this diagram, after finding the bottom in 2023, Bitcoin should move towards a price of $1 million per coin, which it will reach in 2026.

As for the near future, CoinDesk researchers believe that market participants should now be doubly cautious when trading cryptocurrency. The fact is that since the IV quarter of 2022, fiat liquidity indicators worldwide are rapidly declining, and the growth of BTC quotes in such conditions is an anomaly. The BTC rate reached a local price bottom at the $15,500 mark last November and since then has doubled to $31,000. Moreover, since June 15 alone, the price has jumped by more than 20%.

According to Decentral Park Capital's portfolio manager Lewis Harland, the situation remains complicated. He confirmed that recently tracked fiat indicators, such as the net liquidity of the Fed and the global level of net liquidity, have fallen sharply.

"This is the main reason why we are cautious about BTC, despite the optimistic market consensus. We think investors are overlooking this," added Harland. (The global net liquidity indicator, which accounts for fiat supply in several major countries, has dropped to $26.5 trillion - the lowest level since November 2022. These data were provided by TradingView and Decentral Park Capital).

Anomalous, in the opinion of several specialists, is also the drop in correlation between physical and digital gold. While the price of Bitcoin shows explosive growth, the value of gold is gradually decreasing. Fred Thiel, CEO of Marathon Digital, a mining company, suggested that this not only indicates a change in priorities in favor of digital assets, but also demonstrates that Bitcoin is becoming more accessible to a wider range of investors.

Euro Pacific Capital President Peter Schiff disagrees with these theses. According to this ardent gold supporter, most investors don't actually believe in Bitcoin, but are only hoping that someone will buy it from them at a higher price.

"The rapid fall in the price of the first cryptocurrency is just a matter of time. The peak we saw in 2021, around $70,000, is it. And ultimately Bitcoin will explode," said Schiff, adding that stories about people losing money on cryptocurrency will eclipse stories about people getting rich on it.

According to renowned analyst Benjamin Cowen, the decline in fiat liquidity will primarily negatively impact not Bitcoin, but altcoins. "Liquidity is drying up, so people see relative safety in Bitcoin compared to the altcoin market," the specialist believes. "But that doesn't mean Bitcoin can't fall; it just means it's a little safer."

According to Cowen's forecast, Bitcoin could rise about 14% compared to current levels and reach a maximum of $35,000 in 2023. "In the short-term, it's really hard to say if Bitcoin can rise a little again. For myself, I set a target of $35,000," the analyst said.

The crypto trader known as Altcoin Sherpa is confident that the main cryptocurrency can first rise to $32,000 and then to a new 2023 high of $40,000. However, he's not so sure about the $40,000 mark. After that, there should be a significant correction downwards.

According to technical analysis, the BTC/USD cryptocurrency pair may be forming a new "bullish flag" pattern on the chart. This opinion was expressed by experts from Fairlead Strategies. They stated, "Bitcoin is digesting its gains during the consolidation phase. A potential new bullish flag is forming, which would occur with a breakthrough above the weekly Ichimoku cloud around $31,900."

The experts explained that this pattern consists of a pole and a flag. The pole represents the initial price rally, while the flag represents subsequent consolidation caused by "temporary exhaustion of bullish sentiment" and a lack of strong selling pressure. According to the theory of technical analysis, once the asset breaks above the flag's boundary price, it tends to rise by a distance approximately equal to the length of the pole.

In the case of Bitcoin, the upward movement from the low on June 15, 2023, at $24,790 to the high on June 23 at $31,388 represents the pole, and the subsequent consolidation formed the flag. According to analysts, a potential breakthrough for BTC would allow the cryptocurrency's price to reach the next key resistance level at $35,900.

According to crypto strategist and trader Bluntz, who accurately identified the bottom of the bear market for Bitcoin in 2018, he has now provided a forecast regarding Ethereum. He believes that the leading altcoin is showing all the signs of a powerful rally that could take place in the coming months. According to the crypto strategist, the remaining part of 2023 could set Ethereum up for parabolic growth, surpassing Bitcoin significantly.

Bluntz is considered an experienced practitioner of technical analysis, particularly Elliott Wave Theory, which allows for price behaviour forecasting based on crowd psychology, often manifesting in waves.

According to this theory, a bullish asset exhibits a five-wave rally, with the third wave signalling the steepest ascent. Bluntz suggests that Ethereum is already in the early stages of the third wave surge, which could lead to ETH approaching $4,000 before the end of 2023.

In contrast, Altcoin Sherpa made an opposing forecast. Looking at ETH/BTC, he noted that Ethereum is likely to decline in relation to the flagship cryptocurrency and aim for the lower end of the range around 0.053 BTC, or $1,614.

As of the time of writing, BTC/USD has recently been seen trading at around $30,200, and ETH/USD has been seen in the range of $1,860. The overall cryptocurrency market capitalization has decreased and stands at approximately $1.176 trillion ($1.191 trillion a week ago). The Crypto Fear & Greed Index remains on the border between the Greed and Neutral zones, currently at 55 points (56 points a week ago).

More By This Author:

Forex And Cryptocurrency Forecast For July 3-6Forex And Cryptocurrency Forecast For June 19-23

XAU/USD: Historical Overview and Forecast Until 2027

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is ...

more