Forex And Cryptocurrency Forecast - April 24 - 28

EUR/USD: Rate Forecast: USD +0.25%, EUR +0.50%

- Due to the lack of significant economic news, the EUR/USD dynamics in recent days has been determined by statements by representatives of mega-regulators regarding interest rate hikes at the upcoming meetings of the US Federal Reserve on May 2/3 and the ECB on May 4.

The U.S. dollar index (DXY) rose following a statement from Federal Reserve representative Christopher Waller, who said that despite the most aggressive monetary policy tightening since the 1980s, the Fed has "not made substantial progress" in returning inflation to its target level of 2%, and that interest rates still need to be raised. As a result, DXY broke through the resistance of 102.00 on Monday, April 17 and reached the level of 102.22.

Raphael Bostic, President of the Federal Reserve Bank of Atlanta, seemed to support his colleague, but at the same time said that "another increase should be enough for us to step back and see how our policy affects the economy."

According to Philadelphia Fed President Patrick Harker, the US Central Bank may soon finish raising interest rates, after which there may be a pause of almost a year and a half. "Since the full impact of monetary policy measures on the economy can take up to 18 months, we will continue to carefully analyze available data to determine what additional actions we may need to take," said Harker, speaking as part of the Wharton Initiative on Financial Policy and Regulation.

Another member of the FOMC (Federal Open Market Committee), Cleveland Fed President Loretta Mester, agreed that the Fed is close to completing the rate hike cycle. However, since inflation in the U.S. remains too high, Mester believes that "the interest rate needs to be raised to a level above 5% and maintained there for some time." At the same time, Ms. Mester did not specify how much "above" 5% (as the current rate is already at 5.00%) and what duration constitutes "some time."

On Wednesday, April 19th, the Beige Book was published: an economic review by the Federal Reserve, which is based on the reporting documents of the 12 Federal Reserve Banks that make up its system. The analysis of the document's content can be summarized in the following points: 1) economic conditions have somewhat cooled in recent weeks, while inflation continues to remain relatively high; 2) wage growth has slightly slowed down but also remains high; 3) the overall price level moderately increased during the reporting period, although the pace of price growth appears to have slowed down.

Taking into account the content of the Beige Book and the statements of FOMC members, the market concluded that the regulator will raise the rate by another 25 bps (basis points) at its meeting on May 2/3, after which it will take a pause. According to the WIRP forecast, the probability of such a rate hike is now about 90%, compared to 80% at the beginning of last week and 50% at the beginning of April. And this is already included in the price. The quotes still take into account one possible rate cut at the end of the year (two cuts were previously predicted).

More clarity may appear in early summer. But two more employment reports, two CPI/PPI reports and one retail sales report will be released between the May 2/3 and June 13/14 meetings. It is clear that all these data can seriously affect the further policy of the Federal Reserve.

As for the situation on the other side of the Atlantic, the Consumer Price Index (CPI) published on Wednesday, April 19, showed that inflation in the Eurozone fell from 8.5% to 6.9% y/y. But since such a decline was fully consistent with the forecast, it did not have much impact on the pair's quotes.

The Minutes of the ECB's March monetary policy meeting were published the next day, on Thursday, May 20. According to this document, the overwhelming majority of the members of the Governing Board agreed with the proposal of Chief Economist Philip Lane to raise the key rate by 50 bps, after which it will reach 4.00%.

The situation described above led to the fact that the DXY Dollar Index consolidated in the area of 101.70-102.00, and EUR/USD stayed in the range of 1.0910-1.1000. S&P Global made a small contribution at the very end of the working week, it published preliminary data on the US Purchasing Managers' Index (PMI) for April. With a forecast of 52.8 and a previous value of 52.3, the Composite PMI came in at 53.7, which supported a certain degree of optimism regarding the state of the U.S. economy. But not for long. As a result, EUR/USD put the last chord almost at the upper limit of the weekly channel, at around 1.0988.

At the time of writing, on the evening of Friday, April 21, analysts' opinions are divided almost equally: 35% of them expect further weakening of the dollar, 35% - its strengthening, and the remaining 30% have taken a neutral position. As for technical analysis, all the trend indicators on D1 are colored green, as for the oscillators, these are 85%, 15% have changed color to red. The nearest support for the pair is located in the area of 1.0925-1.0955, then 1.0865-1.0885, 1.0740-1.0760, 1.0675-1.0710, 1.0620 and 1.0490-1.0530. The bulls will find resistance around 1.1000-1.1015, then 1.1050-1.1070, then 1.1110, 1.1230, 1.1280 and 1.1355-1.1390.

We expect a lot of economic statistics next week, especially from the United States. The US Consumer Confidence Index will be known on Tuesday, April 25. The next day, statistics on the volume of orders for capital goods and durable goods will be received from the United States. On Thursday, April 27, data on unemployment and GDP will be known, and on Friday - on personal consumption expenditures in the United States. At the very end of the working week, there will also be a lot of information about the state of the economy of Germany, the main locomotive of the EU. These are the country's GDP indicators, unemployment data, as well as such an important indicator of inflation as the Consumer Price Index (CPI). However, one thing not to expect in the upcoming week is speeches from Federal Reserve representatives, as a silence period began on April 21 and will last until the press conference by Fed Chairman Jerome Powell following the May meeting, with no other statements being made during this time.

GBP/USD: Things Are Not as Bad, But Not as Good Either

- The inflation data for March in the United Kingdom, published on Wednesday, May 19, turned out to be not very bad, but not quite good either: in March, the CPI dropped from 10.4% YoY to only 10.1%, while the market was expecting a decline to 9.8%. The fact that consumer prices remain high has given reason to expect that the Bank of England (BoE) will continue to raise interest rates. And this, in turn, supported the British currency a little.

The seasonally adjusted S&P Global/CIPS Purchasing Managers' Index (PMI) in the UK manufacturing sector, with a growth forecast of 48.5, has actually fallen from 47.9 to 46.6 over the month. On the other hand, the preliminary Index of business activity in the service sector presented a surprise: with the forecast and the March value of 52.9, it jumped to 54.9 in April. Thus, the composite PMI improved from 52.2 in March to 53.9 in April.

Commenting on this positive outcome, Dr John Glen, Chief Economist at the UK's Chartered Institute of Procurement and Supply (CIPS), said it was the fastest recovery for the year, which showed that "businesses are taking advantage of the pockets of recovery emerging in the UK economy, and activity levels have risen sharply thanks to new orders and improved supply chain performance."

The UK Office for National Statistics reported on Friday April 21 that retail sales fell 0.9% in March after a 1.1% increase in February. The data turned out to be weaker than the forecast, which suggested a decline of 0.5%, which put pressure on the pound.

GBP/USD started the past five days at 1.2414, and ended nearby at 1.2442, showing a sideways movement against the background of multidirectional statistics. At the moment, 45% of experts side with the pound and expect further growth of the pair, 35% side with the dollar and 20% vote for the continuation of the sideways trend. Among the oscillators on D1, the balance of power is as follows: 35% vote in favor of green, 25% have turned red and 40% prefer neutral gray. Trend indicators are 100% on the side of the greens. Support levels and zones for the pair are 1.2390-1.2400, 1.2330, 1.2275, 1.2200, 1.2145, 1.2075-1.2085, 1.2000-1.2025, 1.1960, 1.1900-1.1920, 1.1800-1.1840. When the pair moves north, it will face resistance at the levels of 1.2450-1.2480, 1.2510-1.2540, 1.2575-1.2610, 1.2700, 1.2820 and 1.2940.

No important statistics on the state of the UK economy are expected in the coming week.

USD/JPY: No BoJ Surprises Expected

- USD/JPY rose to its highest level in six weeks, reaching the height of 135.13 on April 19. The fall of the yen was exacerbated by the data of the Ministry of Finance on Japan's trade deficit for the 2022 fiscal year. The figure was $160 billion, setting an anti-record since 1979. At the same time, the mood is quite positive in the semi-annual report of the Bank of Japan, published on April 21, since "the Japanese financial system as a whole remains stable," and the expectation of inflation falling to the target 2% runs like a red thread through all statements.

The historic meeting of the Bank of Japan (BoJ) will take place next week, on Friday, April 28. Historic not because any revolutionary decisions may be made, but because it will be the first one chaired by the new Central Bank Governor Kazuo Ueda, following the departure of Haruhiko Kuroda. Citing a number of informed sources, Reuters reported that the regulator is likely to maintain an ultra-loose monetary policy at this meeting, without making any changes to the interest rate targets and the yield corridor. Recall that the rate is at a negative level of -0.1%, and the last time it changed was on January 29 of 2016, when it was lowered by 20 bps.

Three main factors can support the yen: investor risk flight, the weakening of the dollar due to the easing of the Fed's monetary policy and a decrease in Treasury yields. Recall that there is a direct correlation between ten-year US bonds and USD/JPY. If the yield on Treasury bills falls, the yen shows growth, and the pair forms a downtrend.

USD/JPY ended the last week at the level of 134.12. Regarding its immediate prospects, the opinions of analysts are distributed as follows. At the moment, 35% of experts vote for the growth of the pair, 65% point in the opposite direction, expecting the yen to strengthen. Among the oscillators, 90% point to D1 (10% of them are in the overbought zone), the remaining 10% adhere to neutrality. Trend indicators have 75% looking to the north, 25% pointing to the south. The nearest support level is located in the 134.00 zone, followed by the levels and zones 132.80-133.00, 132.00-132.40, 131.25, 130.50-130.60, 129.65, 128.00-128.15 and 127.20. The resistance levels and zones are 134.75-135.15, 135.90-136.00, 137.00, 137.50 and 137.90-138.00.

The meeting of the BoJ and the subsequent press conference of the leadership of this regulator was mentioned above. As for the release of any important statistics on the state of the Japanese economy, it is not expected in the coming week.

CRYPTOCURRENCIES: Bitcoin Falls, but Optimism Grows

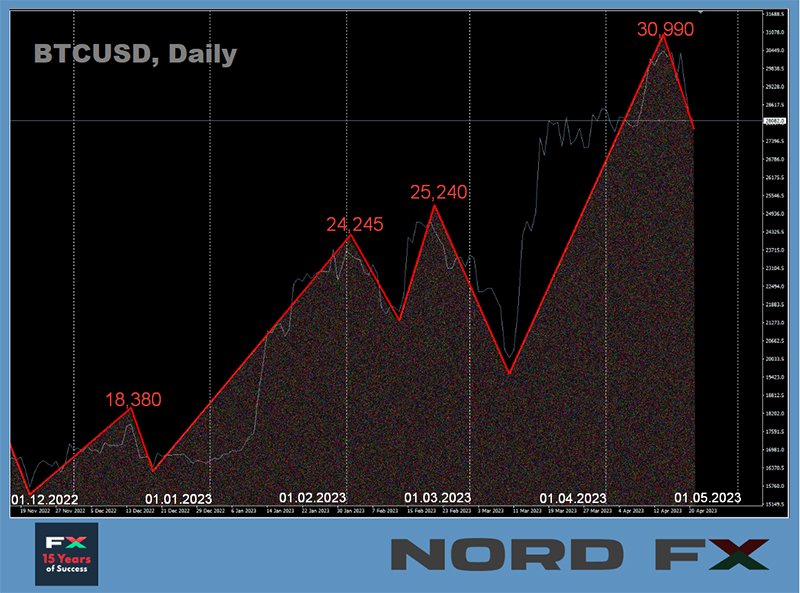

(Click on image to enlarge)

- The bulls have struggled to keep BTC/USD above the $29,000 support since April 10. However, it still fell on Thursday, April 20, pulling other cryptocurrencies with it and causing a wave of closing long positions. There was no obvious reason for this drawdown, beautifully named Coinglass. Some analysts believe that against the backdrop of a news vacuum, technical signals have come to the fore. And perhaps some growth in the DXY Dollar Index on April 14-17 played a role. But, despite this fall, according to many experts, the prospects for bitcoin look quite optimistic, which is confirmed by both network metrics and macroeconomic factors. Investors' appetites are fueled by a good start of the flagship cryptocurrency, which showed a yield of 70% in Q1. Thanks to this, Goldman Sachs experts called it the most effective financial asset in 2023.

According to analytics agency Glassnode, despite the collapse of FTX and tightening crypto regulation, the holdings of long-term holders (addresses with coins that have been idle for more than 155 days) rose to 14.2 million BTC. This is near the all-time high and suggests that coin owners are counting on their growth in the future.

At the moment, there is no clear understanding of the future monetary policy of the US Federal Reserve. But it is the behavior of the American mega-regulator that is decisive for the dollar exchange rate, and as a result, determines in which direction the BTC/USD scales will swing. Robert Kiyosaki, author of the popular book Rich Dad Poor Dad, spoke again this week about the inevitability of financial turmoil and called on investors to invest more in bitcoin, gold and silver. The businessman promised that he would increase reserves in digital currency in the near future, as he does not trust the US Federal Reserve and the economic policies of the Joe Biden administration. According to Kiyosaki's forecast, if big capital becomes more active in physical and digital gold, their price will rise to $5,000 and $500,000 by 2025, respectively.

It should be noted here that, according to Glassnode, the correlation coefficient between XAU and BTC is growing and now exceeds 0.85. Such a connection of bitcoin with the classic safe-haven asset can provide it with serious support, since gold has already approached its all-time high and is preparing to update it.

Ark Invest looked even further into the future than Robert Kiyosaki and called the timing of bitcoin's reaching $1 million. “In the next decade, the value of bitcoin could reach $1 million as the digital economy grows,” said Yassine Elmandjra, an analyst at the company. He acknowledged that the 30x coin price growth forecast looks incredible, but it is “quite reasonable” if you look at the history of cryptocurrency development.

According to the Ark Invest analyst, statements that it is now too late to invest in BTC are wrong. The expert noted the impressive performance of bitcoin in recent times, which now makes digital gold an attractive component of investment portfolios. According to Elmandjra, a reasonable share of bitcoin in institutions should be between 2.5% and 6.5%, depending on the overall return of the portfolio and risk appetite.

Bobby Lee, the founder of the Ballet app and the former CEO of the BTCC China crypto exchange, have taken a similar position. In his opinion, against the backdrop of the banking crisis, digital currencies have demonstrated the qualities of safe-haven assets. “People have begun to realize that their money in the bank is not necessarily in place. Institutions lend these funds to other enterprises and firms. And cryptocurrencies like bitcoin provide self-storage and full control over resources". At the same time, Lee has noted signs of bitcoin's recovery after the crypto winter of 2022. “It has been like this for a long time. Cryptocurrency has four-year cycles [...] and now we have practically recovered. It looks inspiring,” said the industry veteran.

According to a report by Matrixport researchers, the price of bitcoin hit its predicted low in November 2022. The analysts explained that BTC historically bottomed out 515-458 days before the next halving. This event is scheduled for April 2024; hence the predicted low was between November 2022 and January 2023. And so it happened. This gives reason to expect that this model will continue to work further, and the value of the coin will rise to at least $63,160 by the spring of 2024.

As for the near-term prospects, the analytical agency K33 predicts the growth of BTC/USD by another 50% in the next 30 days. The analysis is based on the surprising similarity of the 2018 and 2022 cycles. So, in both cases, it took about 370 days to reach the bottom from the historical high, and recovery to 60% took another 140 days. Further extrapolation suggests that bitcoin will trade around $45,000 in the last decade of May.

The forecast of Galaxy Digital CEO Mike Novogratz looks more modest and stretched in time. In his opinion, the quotes of the first cryptocurrency will rise to $40,000 only when the US Federal Reserve begins to reduce the key rate. “The most profitable trades have been and will continue to be longs on gold, euro, bitcoin and Ethereum: these assets will do well when the Fed stops raising [the base rate] and starts lowering it,” Novogratz said. He also predicted a reduction in loans amid the collapse of US banks. In his opinion, this could lead to a credit crisis, and the Fed, against the background of a “slowdown in the economy”, will have to cut the rate more aggressively than expected.

And of course, against the background of dominant optimism, the forecast of analyst Nicholas Merten looks exactly the opposite. He announced in a new video on DataDash to his 511,000 subscribers that it's time to sell bitcoin, as the first cryptocurrency has grown by almost 100% since November 2022. Merten believes that the first cryptocurrency's latest breakthrough could be a trap, as crypto markets were overbought. The expert disagrees with those who believe that bitcoin will follow the 2019 scenario, when it rose by 300% in a few months. According to him, the scenario of June 2021 is likely to be repeated, when BTC reached its historical high and then collapsed.

At the time of writing, Friday evening, April 21, BTC/USD is trading at $27,305. The total capitalization of the crypto market is $1.153 trillion ($1.276 trillion a week ago). The Crypto Fear & Greed Index fell from 68 to 50 in seven days, and moved from the Greed zone to the very center of the Neutral zone.

More By This Author:

Forex and Cryptocurrency Forecast - April 17-21Forex And Cryptocurrencies Forecast - April 10-14

Forex And Cryptocurrencies Forecast - April 3-7

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!