Forex And Cryptocurrency Forecast - April 17-21

EUR/USD: The Dollar Continues to Sink

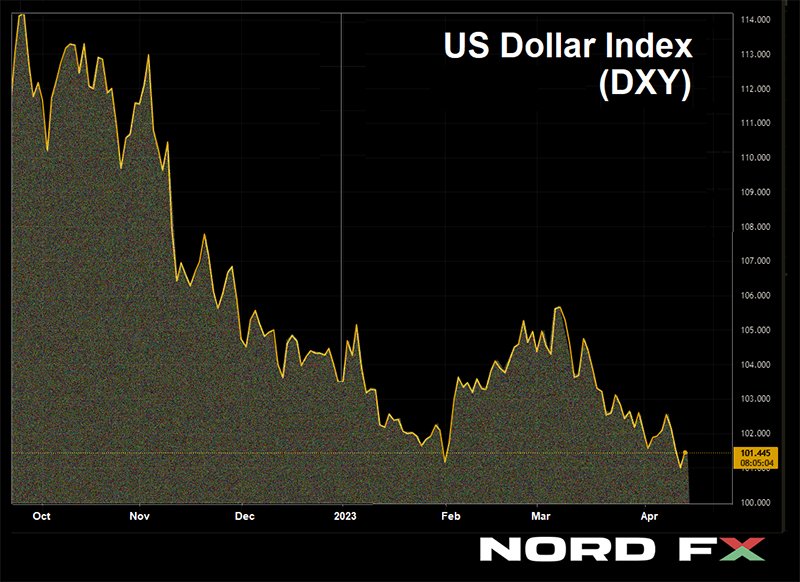

- The DXY dollar index updated a 12-month low last week, and EUR/USD, respectively, rose to a maximum (1.1075) since April 04, 2022. The US currency has been falling for the fifth week in a row: the longest series since summer 2020.

The dollar received a serious blow on Wednesday, April 12, when data on consumer inflation (CPI) and the minutes of the March US Federal Reserve FOMC (Federal Open Market Committee) meeting were published. Statistics showed that prices are under control and inflation in the US has been consistently slowing down for nine consecutive months, going from 9.1% y/y to the current 5.0% y/y. The US Producer Price Index (PPI), released a day later, also showed a decrease in inflation, although at the basic level, US price pressure still looks stable.

With regard to the Fed Protocol, at the meeting on March 22, FOMC members discussed the possibility of taking a pause in the rate hike cycle due to problems in the banking sector. Information about a possible mild recession in the US economy later this year was also discussed. However, the rate is likely to be raised again at the next meeting of the Committee on May 3. According to CME FedWatch forecasts, it is likely to grow by another 25 basis points (bp) to 5.25% per annum.

This increase has already been taken into account by the market in quotes and is unlikely to provide any support to the dollar. Moreover, 5.25% is likely to be the peak value of the rate, until the last months of the year, when it starts to decline. The futures market expects that federal funds spending will be 4.30-4.40% in December 2023, and they will fall even lower to 4.12-4.20% in January 2024.

Slower inflation and the end of the Fed's tight monetary policy cycle are putting pressure on the dollar, pushing the DXY down. At the same time, forecasts suggest that, unlike the Fed, the European Central Bank will continue its tightening cycle for now. This was confirmed by the Member of the Board of Governors of the ECB, President of the Bundesbank Joachim Nagel. He said on Thursday, April 13 that it is necessary to continue raising rates, as core inflation in the Eurozone is still very high.

Data on retail sales in the US released at the very end of the working week, on Friday, April 14 slightly supported the US currency. They showed that sales, although falling, were much slower than expected. With the forecast of -0.4% and the previous value of -0.2%, in reality, the decline was -0.1%. Market participants regarded such dynamics in favor of the dollar, and as a result, EUR/USD ended the last week at 1.0993. At the time of writing the review, on Friday evening, April 14, analysts' opinions are almost equally divided: 45% of them expect the dollar to further weaken, 45% expect it to strengthen, and the remaining 10% have taken a neutral position. As for technical analysis, all oscillators and trend indicators on D1 are 100% colored green. The nearest support for the pair is at 1.0975, then 1.0925, 1.0865-1.0885, 1.0740-1.0760, 1.0675-1.0710, 1.0620 and 1.0490-1.0530. Bulls will meet resistance at 1.1050-1.1070, then 1.1110, 1.1230, 1.1280 and 1.1355-1.1390.

We expect quite a lot of economic statistics from the EU next week. Thus, the ZEW Economic Sentiment Index in Germany, the main locomotive of the European economy, will be published on Tuesday, April 18. On Wednesday, we will find out what is happening with inflation (CPI) in the Eurozone as a whole. On Thursday, the Minutes of the last meeting of the ECB on monetary policy will be published, and on Friday, April 21, business activity indicators (PMI) in the manufacturing sector of Germany and in the country as a whole will become known. No significant macro statistics are expected from the US next week.

GBP/USD: Things Are Much Better Than Expected

- Against the backdrop of the dollar weakening, GBP/USD still feels good, and it made another high in the first half of Friday, April 14, reaching the height of 1.2545. The pound has not traded this high since the beginning of June 2022. However, then, after the publication of data on retail sales in the US, the dollar improved its position, and the pair completed the five-day period at the level of 1.2414.

As for the UK economy itself, the GDP release on Thursday 13 April showed that the economy stagnated at 0.0% in February, compared with the forecast of 0.1% and the previous reading of 0.3%. The growth of production in the manufacturing industry in February was also 0.0% against the expected 0.2% and -0.1% in January, while the total industrial output is still in the negative zone -0.2% against the forecast of 0.2% and -0.5% a month earlier. On an annualized basis, manufacturing output came in at -2.4%, beating expectations of -4.7%. The total volume of industrial production decreased by -3.1% against the forecast -3.7% and the previous value -3.2%. Data on the trade balance of goods in the UK was also published last week, which in February amounted to £17.534 billion, which is more than the forecast of £17.000 billion and the previous value of £16.093 billion.

What do all these numbers say? Together with the data on business activity (PMI), which became known on April 03 and remained above 50 points, all these statistics give investors hope that the British economy is able to avoid a recession. Which, in turn, supports the position of the national currency. This was confirmed on April 13 by British Treasury Secretary Jeremy Hunt, who said that the economic outlook looks brighter than expected. “Thanks to the steps we have taken, we will avoid a recession,” he assured the audience.

The Bank of England (BoE) Chief Economist Hugh Pill's comments were quite optimistic as well. According to him, although "the exact path of inflation may be more uneven than we expect," the Central Bank still forecasts a decrease in CPI in Q2 of this year. "The latest figures are somewhat disappointing," said Hugh Pill, "but they are much better than the BoE's forecasts made at the end of last year." The economist also noted that the UK banking system remains very sound and resilient, and inflationary dynamics is a key factor determining the direction of BoE's monetary policy.

At the moment, 75% of experts side with the pound and expect further growth of the pair, the remaining 25% side with the dollar. Among the oscillators on D1, the balance of power is as follows: 65% vote in favor of green (10% give overbought signals), 10% have turned red and 25% prefer neutral gray. Among the trend indicators, the advantage is also on the side of the greens, they have 65%, the enemy has 35%. Support levels and zones for the pair are 1.2390-1.2400, 1.2330, 1.2275, 1.2200, 1.2145, 1.2075-1.2085, 1.2000-1.2025, 1.1960, 1.1900-1.1920, 1.1800-1.1840. When the pair moves north, it will face resistance at levels 1.2440-1.2455, 1.2480, 1.2510-1.2540, 1.2575-1.2610, 1.2700, 1.2820 and 1.2940.

Among the events of the coming week, the calendar can and should note the publication of the latest unemployment data in the United Kingdom on Tuesday, April 18. On Wednesday, the value of the Consumer Price Index (CPI) will become known, and on Friday the statistics on retail sales and business activity (PMI) in the UK will be published.

USD/JPY: Bank of Japan Is an Island of Stability

- Since last December, USD/JPY has been moving in a fairly wide sideways range of 129.00-138.00. (An exception is the brief strengthening of the yen to 127.15 in mid-January). The pair ended the last week almost in its very center, at the level of 133.75, which indicates the absence of significant drivers capable of giving the pair a powerful acceleration in one direction or another.

We have repeatedly written that even after Haruhiko Kuroda, Governor of the Bank of Japan (BoJ), leaves his post, the Central Bank “will continue to support his adequate and expedient policy.” This was once again confirmed by Kazuo Ueda, the new head of the regulator, who took office on April 9. He stated at the G20 meeting that he would support the current ultra-soft monetary policy. In addition, Ueda said that core consumer inflation in Japan, which is currently only about 3%, is likely to fall below 2% in the second half of this fiscal year. Market participants concluded from these words that there is no point in fighting it by raising rates for the Bank of Japan, and therefore it is not worth expecting a reversal of the BoJ rate in the foreseeable future. (Recall that economists at Societe Generale and ANZ Bank expected that this could still happen somewhere around June).

Regarding the immediate prospects for USD/JPY, analysts' opinions are distributed as follows. At the moment, 40% of experts vote for the further movement of the pair to the north, 50% point in the opposite direction and 10% prefer neutrality. Among oscillators, 75% point upwards at D1 (a third of them are in the overbought zone), 10% look in the opposite direction and 15% are neutral. For trend indicators, 85% point to the north, the remaining 15% point to the south. The nearest support level is located in the zone 132.80-133.00, then there are levels and zones 132.00-132.40, 131.25, 130.50-130.60, 129.65, 128.00-128.15 and 127.20. Levels and resistance zones are 134.00, 134.90-135.10, 135.90-136.00, 137.00, 137.50 and 137.90-138.00.

As for the release of any important statistics on the state of the Japanese economy, it is not expected this week.

CRYPTOCURRENCIES: Weak Dollar Is Strong Bitcoin

- Bitcoin rose above $30,000 on Tuesday, April 11, for the first time since June 2022. This happened due to instability in the banking sector and expectations that mega-regulators, primarily the Fed, will suspend raising interest rates. The MSCI World Index rose to its highest point since early February by Friday, April 14. This confirmed the fact that international investors are waiting for the American, and in the future, for other major Central Banks to curtail the policy of quantitative tightening (QT). Against this background, the main cryptocurrency continues to outperform other major asset classes, such as gold or oil. In addition, BTC has surpassed many top cryptocurrencies in terms of dynamics.

In the middle of the week, the bears had a chance to return BTC/USD to the support of $29,000. However, the FRS saved it from falling again: the published Minutes of the March FOMC meeting, coupled with macro statistics from the US, weakened the dollar, swinging the scales in favor of bitcoin.

The growth of BTC quotes pulls up the entire crypto market. The total market capitalization of cryptocurrencies has grown by more than 55% since the beginning of 2023, rising above $1.2 trillion. However, despite this, it still remains well below the all-time high of $2.9 trillion recorded in November 2021.

Several experts at once expressed their opinion on what happened on April 11. Michael Van De Poppe, a well-known strategist and founder of the investment company Eight, noted that bitcoin successfully passed the $28,600 test, which led to a breakthrough in resistance and reached $30,000. An analyst with the nickname PlanB tweeted that all the goals he set back in October 2022 have now been achieved. At that time, the expert predicted that BTC quotes would overcome $21,000, $24,000, and then $30,000. And another popular blogger and analyst, Lark Davis, stressed that the time will soon come when buying bitcoins for less than $30,000 will seem as fantastic as buying BTC at $3,000 now.

As of this writing, Friday evening April 14, BTC/USD is trading at $30,440. The total capitalization of the crypto market is $1.276 trillion ($1.177 trillion a week ago). The Crypto Fear & Greed Index rose from 64 to 68 in seven days and is still in the Greed zone. But what's next?

A well-known analyst under the nickname PlanB noted that bitcoin has left the deep bear zone and is at the very beginning of a new bull market. According to PlanB, the Stock to Flow (S2F) model he developed is still relevant. The expert claims that bitcoin fundamentals will eventually allow it to rise above the all-time high (ATH) of $69,000 set in November 2021. PlanB has previously predicted bitcoin will rise from $100,000 to $1 million after the 2024 halving. (Recall that the S2F (stock-to-flow ratio) model for predicting the BTC rate measures the relationship between the available supply of an asset and its production volume and has been repeatedly criticized by members of the crypto community).

Larry Lepard, managing partner at Boston-based equity firm Equity Management Associates, also looks extremely optimistic in the long-term outlook. According to him, the dollar will depreciate over the next 10 years, and citizens will begin to actively invest in cryptocurrencies, gold and real estate. The supply of bitcoins is limited, so the digital asset will become a highly sought-after investment vehicle and will benefit from the collapse of the fiat currency. “I believe that the price of bitcoin will go up a lot. I think it will first reach $100,000, then $1 million and eventually rise to $10 million per coin. I’m sure my grandchildren will be shocked at how rich people who own just one bitcoin become,” Lepard said in an interview.

In connection with this forecast, the businessman fears that the authorities will put spokes in the wheels of the crypto industry, trying to slow down the growth in the popularity of digital assets. For example, officials could raise taxes on profits from bitcoin trading and tighten regulation of coins to make it harder for startups to enter the market. However, Lepard is confident that bitcoin will be able to overcome these difficulties and succeed in the long run.

Many analysts agree that long-term macro conditions do point to a possible rise in BTC. But their estimates are much more restrained in relation to the current rally. This is due to the fact that bitcoin liquidity is now much lower than in the same period last year. This is manifested in a greater price dispersion among the leading exchanges. (In the previous review, we wrote that on the one hand, there is an increase in trading volumes, and on the other hand, a decrease in BTC liquidity to a 10-month low).

Although, of course, the prospects for this year will largely depend on the actions of the leading Central banks led by the Fed. Recall that the record capitalization of the crypto market in November 2021 was also the result of the actions of this regulator, which then flooded the economy with a huge amount of cheap money (the M2 monetary unit grew by 39%, which is an anomaly by historical standards). Moreover, interest rates were near zero levels at the time, which led to the emergence of a bubble in the market for risky assets, including stocks and digital currencies. The Fed then moved from quantitative easing (QE) to quantitative tightening (QT) through the fastest interest-rate hike cycle in 40 years, and... the bubble burst.

Speaking about the prospects of the flagship cryptocurrency, it is impossible not to mention those who still consider it a bubble and predict its final collapse. Dieter Wermuth, an economist and partner at Wermuth Asset Management, said last week that the economy would be better and simpler without bitcoin. In his opinion, these risky investments are associated with social costs, and the cryptocurrency itself does not contribute to global prosperity. If we consider bitcoin as a currency, then, given the high volatility and lack of real use, BTC is doomed to failure. In this vein, it makes sense to ditch bitcoin altogether: it could be good for shared prosperity, as investing in cryptocurrencies is wasteful and takes away funds from overall economic growth. In addition, bitcoin creates social inequality, allows for money laundering, tax evasion, and is very energy intensive due to mining. Dieter Wermuth even called bitcoin “the biggest climate killer.”

Cryptocurrency opponents received unexpected support from … artificial intelligence. ChatGPT Bot spoke about the formation of a recession-resistant investment portfolio. According to a document published by the Gold IRA Guide, it recommended allocating 20% for gold and other precious metals. The rest of its hypothetical portfolio consisted of bonds (40%), "defensive" stocks (30%) and cash (10%). The chatbot did not mention cryptocurrencies, much to the delight of well-known bitcoin critic and gold advocate Peter Schiff. “After all, artificial intelligence is pretty smart. It did not recommend any bitcoin deposit,” this investor wrote.

By the way, answering the question of which cryptocurrency is the most promising today, ChatGPT did not name bitcoin, but ethereum. Artificial intelligence, of course, did not know about the latest events, but it seems to have hit the mark. In the last review, we detailed the Shapella hard fork, which will allow validators to withdraw the frozen ETH coins they have invested and locked on the network over the past 3 years in exchange for interest. Investors and traders were worried that an unlock could lead to a massive selling wave and, as a result, a sharp drop in the price. However, we are still seeing the opposite process: on May 13, ETH/USD rose above $2,000, and on the evening of Friday, April 14, it is trading in the $2,100 zone.

More By This Author:

Forex And Cryptocurrencies Forecast - April 10-14Forex And Cryptocurrencies Forecast - April 3-7

Forex And Cryptocurrencies Forecast - March 20-24

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!