Forex And Cryptocurrencies Forecast - Jan. 30-Feb. 3

Image Source: Unsplash

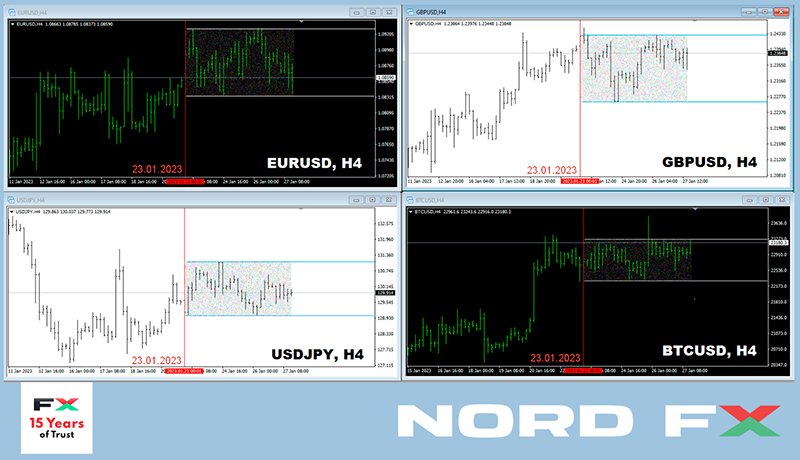

EUR/USD: Next Week - Five Days Of Storms and Tsunamis

It seems that the whole world celebrated the Chinese New Year last week. There was some volatility in all major currency pairs, of course, but we got an almost perfect sideways trend in the end. We will not deny the importance of the New Year holidays, but the reason for the lull is not in this, but in the key events that are coming next week.

On Feb. 1, when it will be late at night in Europe and dawn in Asia, the US Federal Reserve will announce its key interest rate decision, and the regulator's management will tell (or at least give a hint) about its future monetary policy. The European Central Bank will make its decision on the rate a few hours later, on Thursday, Feb. 2.

But, before giving forecasts, let's turn to the events of the past week. Data released on Thursday, Jan. 26 showed that the US economy is doing better than expected. The country's GDP, according to preliminary estimates, grew by 2.9% year-over-year in Q4 against the forecast of 2.6%.

At the same time, initial claims for unemployment benefits for the week to Jan. 21 fell to 186 thousand (forecast 205 thousand, the previous value of 192 thousand). This is the lowest weekly figure since April 2022. Underlying durable goods orders also beat estimates, dropping by -0.1% instead of the expected -0.2%. New home sales are also doing well, with sales up to 616 thousand in December from 602 thousand in November.

Looking at these figures, we can conclude that not everything is so bad, and there is no recession in the United States. And that the Fed's 2022 aggressive monetary policy (QT) has not had a suffocating effect on the economy. Therefore, it is possible to move on to its easing (QE).

However, some economists point out that consumer demand is losing its momentum (2.1% in Q4 against the forecast of 2.9% and 2.3% a quarter earlier). Based on this, they conclude that the chances of a mild recession remain.

For now, the market believes the Fed will raise rates by 25 basis points (bps) at its February meeting. It is currently 4.50%, and the market consensus indicates its peak value at the level of 4.90-5.00% in 2023. The probability that the rate will be raised by another 25 bp in March is estimated at 85%. Although some analysts believe that the peak value will stop at around 4.75%.

Moreover, the rate may even be lowered to 4.25-4.50% by the end of 2023. Such dynamics will obviously not benefit the dollar, but it will push up the competing currencies from the DXY basket and risky assets.

As for the common European currency, the market is sure that the ECB will raise the rate by 50 bp on Feb. 2. But, according to analysts, the difference in the rises in the US dollar and euro rates has already been taken into account by the market in the pair's quotes, which is why it keeps in the range of 1.0845-1.0925. And its foreseeable future will depend on the comments and signals that the leaders of the Fed and the ECB will give at the end of their meetings.

Starting at 1.0855 on Monday, Jan. 23, the EUR/USD pair ended last week at 1.0875. At the time of writing, the votes of supporters of bulls and bears are divided almost equally. 50% of analysts expect further strengthening of the euro and the growth of the pair. 45% expect that the US currency will be able to win back part of the losses. The remaining 5% of experts, in anticipation of the meetings of the Central Banks, prefer not to make forecasts at all.

Among the indicators on D1, the picture is different: 90% of the oscillators are colored green, 5% indicate that the pair is overbought, and 5% are colored a neutral gray. Among trend indicators, 80% recommend buying, and 20% recommend selling.

The nearest support for the pair is in the zone of 1.0835-1.0845, and then there are levels and zones of 1.0800, 1.0740-1.0775, 1.0700-1.0710, 1.0620-1.0680, 1.0560, and 1.0480-1.0500. The bulls will meet resistance at the levels of 1.0895-1.0935, 1.0985-1.1010, and 1.1130, after which they will try to gain a foothold in the 1.1260-1.1360 echelon.

The coming week will undoubtedly be stormy and filled with significant events. In addition to these Fed and ECB meetings, it should be noted that data on GDP are to be published on Jan. 30, on the unemployment rate and inflation rate (CPI) on Jan. 31, and on business activity (PMI) in the German manufacturing sector on Feb. 1.

We will find out what is the situation with consumer prices (CPI) in the Eurozone and what is happening with business activity (PMI) in the US also on Wednesday, Feb. 1. In addition, we are traditionally waiting for an impressive portion of statistics from the US labor market on Feb. 1, 2 and 3, including the unemployment rate and the number of new jobs created outside the agricultural sector (NFP).

GBP/USD: The Future of The Pound Is In a Thick Fog

The Bank of England (BoE) will also make its decision on the interest rate on Thursday, Feb. 2. And if the probability that the Fed and the ECB will raise their rates is close to 100%, everything is not going to be so simple with the pound. According to some analysts, the BoE may surprise the markets by pausing and slowing down the tightening of its monetary policy.

Although there may not be a pause, we will see a new round of QT instead of QE. British Chancellor of the Exchequer Jeremy Hunt said on Friday, Jan. 27 that “the weak recovery in the public sector after the pandemic reinforces the need for reforms,” and that “the best tax cut right now is lower inflation.” And the best (if not the only) cure for inflation, as the experience of overseas colleagues shows, is to raise interest rates.

Pound bulls hope that the Bank of England will raise the pound rate by 50 bp, and it will rise to at least 4.50% from the current 3.50% by the summer. As for the bears, they believe that the threat of an economic downturn and recession will prevent the Central Bank from raising it by more than 25 bps now, and it will do so for the last time, and then be forced to ease monetary policy despite high inflation.

In general, the future is shrouded in fog. But the fact that the country's economy has big problems is very clear. This is evidenced by the fall in the Composite Business Activity Index (PMI) from 49.0 to 47.8 points, instead of the expected increase to 49.3.

Bank of England Governor Andrew Bailey has recently said that the British economy after Brexit has faced a shortage of more than 300,000 workers due to the cessation of the free movement of labor from the EU. Such a deficit has become an obstacle to the fight against inflation, as it entails an increase in wages.

In addition, the country's economy continues to be pressured by high energy prices and supply disruptions, as well as other problems related to sanctions against Russia due to its invasion of Ukraine.

The quotes of GBP/USD have not changed much over the past week: starting from 1.2395, it set the final chord there. The median forecast for the near future also looks vague: 35% of experts believe that it is time for the pair to turn south, just as many point to the north, and the remaining 30% look east. Among the oscillators on D1, 85% are colored green, and 15% signal that the pair is overbought. Trend indicators are 100% on the green side.

Support levels and zones for the pair are 1.2360, 1.2300-1.2330, 1.2250-1.2270, 1.2200-1.2210, 1.2145, 1.2085-1.2115, 1.2025, 1.1960, 1.1900, and 1.1800-1.1840. When the pair moves north, it will face resistance at the levels of 1.2430-1.2450, 1.2510, 1.2575-1.2610, 1.2700, 1.2750, and 1.2940.

Among the events related to the economy of the United Kingdom in the coming week, apart from the meeting of the Bank of England, one can note down Feb. 1 and 3, when fresh January data on business activity (PMI) in the country will be published.

USD/JPY: The Future of The Pair Depends on The Fed

Unlike its counterparts, the Bank of Japan (BoJ) left its key rate unchanged at a negative level of -0.1% at its meeting on Jan. 18. The next meeting is not soon, on March 10. The current head of BoJ chapter Haruhiko Kuroda will preside over it for the last time. His powers will end on April 8, and the meeting of the BoJ on April 28 will be held by the new head of the Central Bank.

It is with this event that markets associate a possible change in monetary policy in the country. In the meantime, the views of market participants are focused on the US Federal Reserve.

As with the previous pairs, USD/JPY was not much active last week, starting at 129.57 and finishing at 129.85. Analysts' forecasts do not give any guidance until the next Fed meeting: 50% of them side with the bulls, 40% with the bears, and 10% have decided not to make predictions at all. Among the oscillators on D1, 10% point north, 35% look south, and 55% point east. For trend indicators, 15% look north, and 85% look in the opposite direction.

The nearest support level is located at 129.50 zone, followed by levels and zones of 128.90-129.00, 127.75-128.10, 127.00-127.25, 126.35-126.55, 125.00, and 121.65-121.85. Levels and resistance zones are 130.50, 131.25, 132.00, 132.80, 133.60, 134.40, and then 137.50.

No important events regarding the Japanese economy are expected this week.

Cryptocurrencies: New Trading Strategy - Chinese New Year

Bitcoin has been behaving even more calmly than the S&P 500, Dow Jones, and Nasdaq stock indices on the eve of the Fed meeting on Feb. 1. Of course, a certain correlation between them remains, but the volatility of the main cryptocurrency has become noticeably less. Although, it is quite possible that this is just the calm before the storm. Which, as usual, will be arranged by the American regulator with its monetary policy and the key rate for the US dollar.

According to Ark Invest CEO Cathie Wood, the cryptocurrency market will enter a new phase in 2023. The rise in Bitcoin and other virtual currencies will be the result of the Fed's monetary easing in the second half of this year. It is this move that will become a trigger for investors testing stock markets and digital currencies. Bloomberg strategist Mike McGlone expressed a similar point of view earlier, pointing out the possibility of BTC rising to $30,000.

Adam Farthing, Chief Risk Officer at crypto company B2C2, noted that the first cryptocurrency needs to overcome the key level at around $25,000 in order to continue the rally. “It will be a tough nut to crack,” the expert shared his opinion. According to him, after passing the designated milestone, interest will resume from outsiders who want to return to the market.

However, analysts at the brokerage company Bernstein are convinced that such a rally is unlikely to continue at the moment, as there are no signs of “any new injections” into the industry.

However, in their opinion, institutional capital will still begin to show more interest in cryptocurrency this year, as it becomes an increasingly regulated asset class. (We have also repeatedly raised the topic of regulation and its conflict with the main idea of cryptocurrencies in our reviews).

And DataDash analyst and channel creator Nicholas Merten also believes that while cryptocurrencies have a bright future, many underestimate the current global environment. In his opinion, the damage caused by FTX, Celsius, Three Arrows Capital, and Terraform Labs has left an indelible mark on the industry.

In addition, it is necessary to take into account the macroeconomic component, since many countries are struggling with rapid inflation, and supply chains have not fully recovered after the coronavirus pandemic.

According to the expert, investors need to understand that the long-term bullish trend is over. Unfortunately, the digital asset industry needs to prepare for new challenges, and the current bullish trend in the market is only a local correction within the overall bearish trend.

Jim Cramer of CNBC agrees with Nicholas Merten. The “Mad Money” TV presenter has also focused on the risks in light of the FTX crash. He noted that a similar situation could happen at any time with any other large crypto company. In his opinion, no one knows what the big players in the industry are really hiding. And there are no guarantees that they are actually honest with their customers.

Any new scandal, according to him, will cause a sharp drop in Bitcoin quotes, which means that investors' assets are at risk. Citing Carley Garner, senior commodity strategist & broker at DeCarley Trading, he recommended staying away from virtual currencies and opting for physical gold instead as a hedge against rising inflation and economic chaos.

Such an authority as Jamie Dimon, the head of the American banking giant JPMorgan, has also gone with a heavy roller on digital gold. He doubted on the air of CNBC that the supply of Bitcoin is really limited to 21 million coins. "How do you know? Maybe it will go up to 21 million, and Satoshi's photo will pop up and laugh at all of you,” he suggested.

This top manager already publicly expressed skepticism in October 2022 regarding the code embedded in the algorithm of the first cryptocurrency. “Have you all read the algorithms? Guys, do you believe in all this?" Dimon grinned at the time.

For your information. Given the programmed halvings, the bar of 21 million should be reached by 2141. At the same time, experts say that the limit on Bitcoin emissions is provided by only five lines of the code. It is open for study, and anyone can verify this.

And here the question arises: what if Jamie Dimon's raids on Bitcoin are connected with the desire to eliminate this successful competitor? After all, thanks to the recent bullish rally, the capitalization of the flagship cryptocurrency has exceeded $443 billion, and has surpassed all key traditional financial institutions, including global world banks, in this indicator.

For example, the capitalization of the American banking giant JPMorgan Chase is $406.42 billion, while Bank of America has a capitalization of $277.56 billion. In addition, BTC is ahead of companies such as Alibaba ($317.01 billion), Samsung ($335.37 billion), Mastercard ($365.09 billion) and Walmart ($385.15 billion). However, it has slightly lost to Tesla ($454.72 billion).

According to CompaniesMarketCap, Bitcoin is the 16th most valuable asset in the world. The leaders of the rating are gold ($12.77 trillion), Apple ($2.25 trillion) and Saudi Aramco ($1.94 trillion).

At the time of writing, BTC/USD has recently been seen trading around the $23,070 zone. The total capitalization of the crypto market is approximately $1.060 trillion ($1.038 trillion a week ago). The Crypto Fear & Greed Index has grown from 51 to 55 points over the week and has moved from the Neutral zone to the Greed zone, where, according to the creators of the index, it is already dangerous to open short positions.

More By This Author:

Forex and Cryptocurrencies Forecast - Jan. 23-27Forex And Cryptocurrencies Forecast - Jan. 16-20

USDJPY And GBPUSD: What Happened In 2022, What Will Happen In 2023

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is ...

more