Forex And Cryptocurrencies Forecast For May 15-19

Image Source: Unsplash

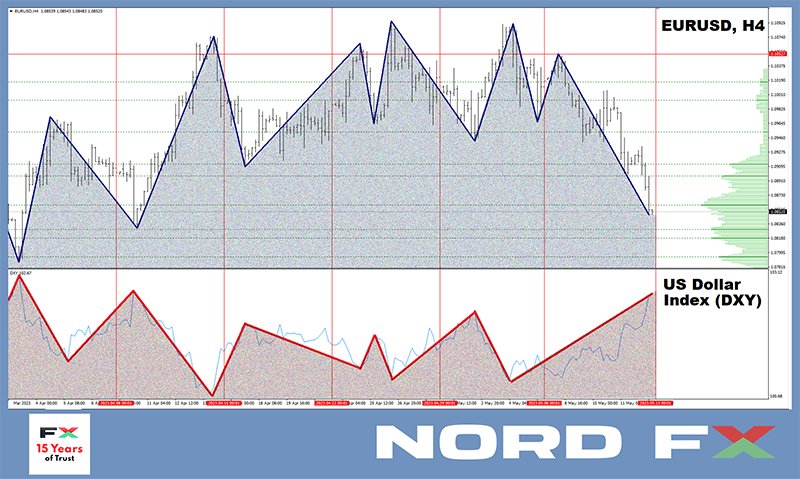

EUR/USD: Why The Dollar Rose

We named the previous review "Market at a Crossroads." We can now say that it finally made a decision and chose the dollar last week. Starting from 1.1018 on Monday, May 8, the EUR/USD pair reached a local low of 1.0848 on Friday, May 12.

Interestingly, this growth occurred despite the cooling of the U.S. economy. Not even the prospects of a U.S. debt default or the possibility of a reduction in federal fund rates could stop the strengthening of the dollar.

The slowdown in the American economy is further evidenced by a decline in producer prices (PPI) to the lowest level since January 2021, at 2.3%, and an increase in the number of unemployment benefit claims to the highest level since October 2021, reaching 264,000 (compared to a forecast of 245,000 and a previous value of 242,000).

Inflation in the United States, measured by the Consumer Price Index (CPI), decreased to 4.9% on an annual basis in April from 5.0% in March (forecasted at 5.0%), while the monthly core inflation remained unchanged at 0.4%.

It may have seemed that this situation would finally prompt the Federal Reserve to start easing its monetary policy. However, based on recent statements by officials, the regulator does not intend to do so.

For instance, Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, stated that although inflation has softened slightly, it still significantly exceeds the target level of 2.0%. Kashkari agreed that a banking crisis could be a source of economic slowdown. However, he believed that the labor market remains sufficiently strong.

Following the head of the Minneapolis Fed, Federal Reserve representative Michelle Bowman also confirmed the regulator's reluctance to change course towards a more dovish stance. According to Bowman, "inflation is still too high," and "the interest rate will need to remain sufficiently restrictive for some time."

Moreover, Bowman added that there is no certainty that the current policy is "sufficiently restrictive to bring down inflation," and if inflation remains high and the labor market remains tight, additional rate hikes are likely to be appropriate.

Similar conclusions have been reached by many analysts. For example, according to experts from Commerzbank, "given the slow decline in inflation, which remains well above the target level, the Fed is unlikely to consider the possibility of lowering the key rate this autumn."

The market reacted to the prospects of maintaining (and possibly further increasing) the interest rate with a rise in the dollar. The strengthening of the American currency could have been even more significant if not for the banking crisis and the issue of the U.S. debt ceiling.

A hawkish stance from the European Central Bank (ECB) could have aided the euro and reversed the EUR/USD pair to the upside. However, after the May meeting of the European regulator, it appears that the end of monetary restraint is near. It is quite possible that the rate hike in June will be the last. "At this point, the ECB can only surprise with a dovish tone. [...] Euro bulls should be prepared for this," warn economists from Commerzbank.

The final note of the past week for the EUR/USD pair was set at 1.0849. As for the near-term prospects, the majority of analysts (65%) believe that the dollar has become too overbought, and it's time for the pair to correct to the upside. Only 15% expect further strengthening of the dollar, while the remaining 20% hold a neutral position.

In terms of technical analysis, among the oscillators on the daily chart (D1), 90% are colored red (although one-third of them are signalling the pair's oversold condition), with only 10% in green. Among the trend indicators, there are more green ones, 35%, while red ones account for 65%.

The nearest support for the pair is located around 1.0800-1.0835, followed by 1.0740-1.0760, 1.0675-1.0710, 1.0620, and 1.0490-1.0530. Bulls will encounter resistance around 1.0865, followed by 1.0895–1.0925, 1.0985, 1.1090-1.1110, 1.1230, 1.1280, and 1.1355-1.1390.

The upcoming week will be quite busy with important economic events. On Tuesday, May 16, we will see retail sales data from the United States and the ZEW Economic Sentiment indicator from Germany. Additionally, preliminary GDP data for the Eurozone for Q1 will be published on the same day.

On Wednesday, May 17, inflation data (CPI) for the Eurozone will be released. Thursday, May 18 will bring a series of U.S. statistics, including unemployment data, manufacturing activity, and the U.S. housing market. Furthermore, speeches by ECB President Christine Lagarde are expected on May 16 and May 19. The week will conclude with a speech by Federal Reserve Chair Jerome Powell on the last working day.

GBP/USD: BoE and GDP Upset Investors

The bulls managed to push GBP/USD higher until Thursday. Although the forecast suggested that the Bank of England (BoE) would raise the interest rate by 25 basis points at its meeting on May 11, investors were hopeful for a miracle: what if it's not 25, but 50? However, the miracle did not happen, and after reaching a high of 1.2679, the pair reversed and started to decline.

The decline continued the next day. The strengthening dollar played a role, and mixed preliminary GDP data for the UK added to the negative sentiment. The country's economy grew by 0.1% in Q1 2023, which fully matched the forecast and the growth in Q4 2022.

On an annual basis, GDP increased by 0.2%, which, although in line with the forecast, was significantly lower than the previous value of 0.6%. However, in monthly terms, the GDP showed an unexpected contraction of -0.3% in March, against expectations of 0.1% growth and a previous value of 0.0%.

Despite the optimistic statement by UK Chancellor of the Exchequer Jeremy Hunt that this was "good news" as the economy is growing, it did not help the pound. It was evident that the growth occurred only in January, stalled in February, and began to contract in March.

Economists at Commerzbank note that the indecisiveness of the Bank of England in combating inflation is a negative factor for the pound. "Future data will be crucial for the BoE's next rate decision," Commerzbank states. "If a swift decline in inflation becomes evident, as expected by the BoE, they are likely to refrain from further rate hikes, which will put pressure on the sterling."

Strategists at Internationale Nederlanden Groep (ING) also believe that the rate hike on May 11 may be the last. However, they add that "the Bank of England has maintained flexibility and left the door open for further rate hikes if inflation proves to be persistent."

The plunge on May 11 and 12 resulted in the GBP/USD pair failing to hold above the strong support level of 1.2500, and the week ended at 1.2447. However, according to 70% of experts, the bulls will still attempt to reclaim this support level. 15% believe that 1.2500 will now turn into resistance, pushing the pair further downward.

The remaining 15% preferred to refrain from making forecasts. Among the oscillators on the daily chart, 60% recommend selling (with 15% indicating oversold conditions), 20% are inclined towards buying, and 20% are neutral. Among the trend indicators, the balance between red and green is evenly split at 50%.

The support levels and zones for the pair are at 1.2390-1.2420, 1.2330, 1.2275, 1.2200, 1.2145, 1.2075-1.2085, 1.2000-1.2025, 1.1960, 1.1900-1.1920, and 1.1800-1.1840. In the event of an upward movement, the pair will encounter resistance at levels of 1.2500, 1.2540, 1.2570, 1.2610-1.2635, 1.2675-1.2700, 1.2820, and 1.2940.

There are several notable events on the calendar in the upcoming week. The Inflation Report hearing will take place on Monday, May 15. Data on the UK labor market will be released on Tuesday, May 16. And the Governor of the Bank of England, Andrew Bailey, is scheduled to speak on Wednesday, May 17.

USD/JPY: Yen as a Shelter from Financial Storms

The yen was the worst-performing currency in the DXY basket in April. The USD/JPY currency pair soared to a height of 137.77 on the ultra-dovish statements of the new Governor of the Bank of Japan (BoJ), Kadsuo Ueda. However, after that, the yen, acting as a safe haven, was aided by the banking crisis in the United States, causing the pair to reverse downwards.

As for Japanese banks, Ueda stated on Tuesday, May 9 that "the impact of recent bankruptcies of American and European banks on Japan's financial system is likely to be limited," and that "financial institutions in Japan have sufficient capital reserves." Assurances of the stability of the country's financial system were also expressed by the Minister of Finance, Shunichi Suzuki.

Currency strategists at HSBC, the largest British bank, continue to believe that the Japanese yen will strengthen further, aided by its status as a "safe haven" amidst the banking crisis and US debt issues. According to their analysis, the yen may also strengthen because the current review by the Bank of Japan does not exclude changes in its yield curve control (YCC) policy, even if it happens slightly later than previously expected.

The shift in the BoJ's course could be influenced by the fact that core inflation in Japan remained stable in March, and excluding energy prices, it accelerated to a 41-year high of 3.8%. However, when comparing this level with similar indicators in the U.S., EU, or the UK, it is difficult to consider it a significant problem.

Meanwhile, analysts at Societe Generale, a French bank, believe that considering yield dynamics, geopolitical uncertainty, and economic trends, the USD/JPY pair may "get stuck in narrow ranges for some time."

However, they also mention that the sense that the dollar is overvalued, and the anticipation of the Bank of Japan's actions will not be easy to dismiss. The perception that the yen's recovery is only a matter of waiting for actions by the Bank of Japan lingers.

The next meeting of the Bank of Japan is scheduled for June 16. Only then will it become clear whether or not there will be any changes in the monetary policy of the Japanese central bank. Until that day, the USD/JPY exchange rate will likely depend largely on events in the United States.

The pair concluded the past week at 130.72. Regarding its immediate prospects, analysts' opinions are divided as follows. At present, 75% of analysts have voted for the strengthening of the Japanese currency. 15% of experts expect an upward movement, while the same percentage remains neutral.

Among the oscillators on the daily chart, the balance leans toward the dollar, with 65% indicating an upward trend, 20% remaining neutral, and the remaining 15% showing a downward direction. Among the trend indicators, the balance of power is 90% in favor of the green zone.

The nearest support level is located in the range of 134.85-135.15, followed by the levels and zones at 134.40, 133.60, 132.80-133.00, 132.00, 131.25, 130.50-130.60, 129.65, 128.00-128.15, and 127.20. The resistance levels and zones are at 135.95-136.25, 137.50-137.75, 139.05, and 140.60.

As for economic data releases, the preliminary GDP data for Japan's Q1 2023 will be announced on Wednesday, May 17. However, there are no other significant economic information expected to be released concerning the Japanese economy in the upcoming week.

Cryptocurrencies: Bitcoin Hopes for a Banking Crisis

Bitcoin has been under selling pressure for the eighth consecutive week, but it continues to attempt to hold within the strong support/resistance zone of around $26,500. The past week once again did not bring joy to investors. As noted by WhaleWire, transaction fees within the Bitcoin ecosystem reached global highs for the third time in history (similar to what was observed in 2017 and 2021).

The average network speed does not exceed 7 transactions per second. As a result, those wishing to make transfers increase the amount of the transaction fee to expedite its execution. This caused the average fee on May 8 to soar to $31 per transaction. This was very frustrating for users but welcomed by miners, as for the first time since 2017, fees surpassed block rewards.

Some operators, including Binance, were unprepared for this and did not adjust the fees in time for users. Hundreds of thousands of transactions got stuck in the mempool. In order to speed up their "clearing," the largest cryptocurrency exchange suspended withdrawals twice and increased the transfer fee.

The situation was exacerbated by an investigation launched by US authorities against Binance. According to Bloomberg reports, the exchange is suspected of violating sanctions related to Russia due to its invasion of Ukraine.

Panic sentiment was further heightened by the news that the cryptocurrency exchange Bittrex filed for bankruptcy on the same day, May 8 (although this procedure is expected to only affect its U.S. subsidiary).

The problems faced by Binance and Bittrex reminded investors of the FTX crash. All of this has instilled fear, uncertainty, and doubt among participants in the crypto market, leading to a decrease in the number of active addresses to yearly lows. Bitcoin experienced a sharp decline against this backdrop.

BTC is forming a "head-and-shoulders" pattern on the daily chart. A trader and analyst known as Altcoin Sherpa suggested that the price of the leading cryptocurrency may soon drop to $25,000. According to his analysis, this price level coincides with the 200-day EMA, the 0.382 Fibonacci level, and has previously been tested as support/resistance.

The possibility of a deeper correction, down to the $24,000 level, cannot be ruled out. However, experts at CoinGape point out that the supply of Bitcoins on centralized platforms is at its lowest level since 2017. They believe this indicates that the upcoming correction may have a local character.

The strengthening of the U.S. dollar last week also played against Bitcoin. However, hopes that the banking crisis in the U.S. will continue to support the digital market are still in the air. For many cryptocurrency enthusiasts, Bitcoin is considered a safe haven and a store of value similar to physical gold, protecting against loss of funds.

The tightening of monetary policy by the Federal Reserve has reduced the value of certain assets on banks' balance sheets and decreased demand for banking services. Therefore, the likelihood of new disruptions in the traditional financial sector remains quite high.

Four U.S. banks (First Republic Bank, Silicon Valley Bank, Signature Bank, and Silvergate Bank) have filed for bankruptcy, and a dozen more are facing difficulties. According to surveys by the Gallup polling agency, half of U.S. citizens are concerned about the safety of their funds in bank accounts.

Robert Kiyosaki, the author of the bestseller Rich Dad Poor Dad, often emphasizes that challenging times lie ahead for the U.S. and global economy. This time, he addressed his 2.4 million Twitter followers, stating that the sharp increase in the yield of one-month U.S. Treasury bills indicates that a recession may be approaching.

He questioned whether this implies that the global banking system is collapsing and advised people to focus on gold, silver, and Bitcoin. It is worth noting that Kiyosaki has previously predicted that the price of Bitcoin will soon rise to $100,000.

Michael Van de Poppe, an analyst, trader, and founder of the consulting platform EightGlobal, conducted a detailed analysis of the relationship between the banking sector and the crypto market. The stocks of American banks reacted with a decline to an attempt by Jerome Powell, the head of the U.S. Federal Reserve, to calm the financial markets.

Within a few hours after the official's speech on May 3, shares of PacWest Bancorp fell by almost 58%, and Western Alliance by more than 28%. Other credit institutions such as Comerica (-10.06%), Zion Bancorp (-9.71%), and KeyCorp (-6.93%) experienced a decline as well.

Using a 30-minute chart, Van de Poppe demonstrated that while banks were falling in price, Bitcoin and gold were rising. According to the founder of EightGlobal, there is growing uncertainty and distrust among bankers towards the statements made by government officials. Such sentiments may lead to further problems in traditional markets and contribute to the continued growth of digital and physical gold.

Warren Buffett, the billionaire investor, remains steadfastly skeptical of the flagship cryptocurrency, Bitcoin. At the annual Berkshire Hathaway shareholders' meeting, Buffett stated that while people may lose faith in the dollar, it does not mean that Bitcoin can become the world's reserve currency.

In response to this, James Ryan, the founder of Six Sigma Black Belt, pointed out that Buffett does not believe in gold either, as he believes the precious metal does not produce anything and does not generate cash flow.

By the way, Warren Buffett may be right about gold. According to research by DocumentingBTC, an investor who invested exactly $100 in physical gold ten years ago would now have only $134 in their account. But if they had invested in digital gold, they would have $25,600. That's why Bitcoin is considered the best investment of the decade.

Second are NVIDIA stocks, which would have grown to $8,599. The honorable third spot goes to Tesla with an investment growth from $100 to $4,475. Apple investors could have gained $1,208, Microsoft - $1,111, Netflix - $1,040, Amazon - $830, Facebook - $818, and investing in Google stocks would have yielded $504 in the present.

To further justify the hopes of Bitcoin enthusiasts, technically Bitcoin needs to rise above $28,900, test $30,400, and firmly fix above the $31,000 level. However, at the time of writing, BTC/USD has been seen trading at around $26,415.

The total market capitalization of the crypto market stands at $1.108 trillion ($1.219 trillion a week ago). The Crypto Fear & Greed Index has decreased from 61 to 49 points over the past seven days, moving from the Greed zone to the Neutral zone.

More By This Author:

Forex And Cryptocurrencies Forecast For May 8 - 12, 2023Forex And Cryptocurrencies Forecast - May 1-5

Forex And Cryptocurrency Forecast - April 24 - 28

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is ...

more