Forex And Cryptocurrencies Forecast - Feb. 27-March 3

Image Source: Pexels

EUR/USD: FOMC Protocol Strengthens the Dollar

Macroeconomic statistics in both the US and the Eurozone look mixed. In both regions, inflation is slowing down (which is good), but GDP growth is also decreasing (which is bad for the economy). According to the US Department of Commerce, the pace of consumer spending growth in the country for Q4 was +1.4% after +2.3% in Q3 (forecasted at +2.1%).

The US GDP growth rate on an annual basis, according to preliminary estimates, will be lower than expected at +2.7% (previous value +2.9%). However, despite this, labor market statistics look positive enough. The number of initial claims for unemployment benefits, forecasted at 200,000, actually decreased from 195,000 to 192,000.

According to final data from Eurostat, inflation in the Eurozone slowed down to +8.6% year-over-year in January (+9.2% a month earlier). Things are becoming more difficult in Germany, the main locomotive of the European economy.

According to January data, the annual inflation rate was +9.2% compared to +9.6% in December, but at the same time, the country's GDP also went down, with a decline of -0.4% (forecast and previous value -0.2%). The very fresh February CPI data did not please either, showing an increase from +8.1% to +8.7%.

Against this backdrop, market sentiment remains in favor of the US dollar. This is primarily due to the Federal Open Market Committee's (FOMC) meeting minutes, which were published on Wednesday, Feb. 22 by the US Federal Reserve. The minutes did not bring any surprises. However, market participants saw once again that the regulator is not going to stop its fight against inflation.

United Overseas Bank (UOB) summarized the main conclusions from the minutes as the following:

- Despite progress in the fight against inflation, it remains significantly above the target level of 2%.

- All Committee members agreed that achieving inflation targets will require more interest rate hikes and keeping it at a high level until the Fed is confident that inflation is sustainably going down.

- Although the FOMC voted in February to raise the rate by 25 basis points (bps), several participants wanted it to be increased by 50 bps.

- The Fed is still more concerned about inflation than slowing economic growth.

US Treasury Secretary Janet Yellen confirmed these conclusions. She stated at the G20 finance ministers and central bank governors meeting on Friday, Feb. 24 that "inflation is coming down, measured on a 12-month basis, but core inflation is still above 2%." According to Janet Yellen, a "soft landing" for the economy without a recession is possible thanks to the strong labor market and strong US balances.

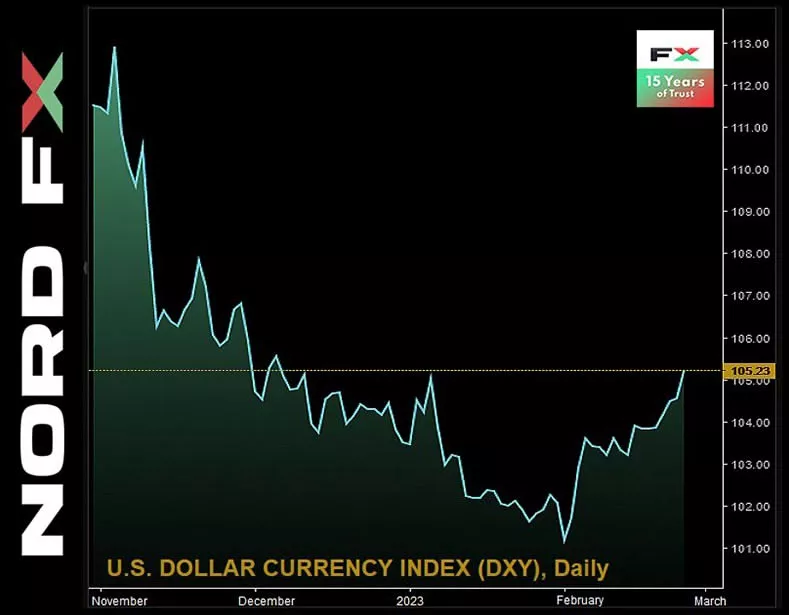

All of the above has led to the US dollar index, DXY, continuing its rise, reaching a local high of 105.26 points, while the EUR/USD currency pair ended the workweek at the level of 1.0546 (weekly low at 1.0535).

Most likely, the main factor determining the dynamics of the dollar until the next FOMC meeting on March 21-22 will be speculations on how far the regulator is willing to go in its "crusade" against inflation. According to UOB's forecast, the rate may be raised by 25 bps in March and May, ultimately reaching 5.25%, and remain at this level until the end of the year. According to some other estimates, the peak federal funds rate by July could be 5.38%.

According to specialists at ING, the largest banking group in the Netherlands, February and March are seasonally strong months for the dollar, and the rate of 4.50% for overnight deposits may still slightly support the dollar. However, according to their colleagues at Commerzbank, it will become increasingly difficult for the US currency to strengthen against the euro.

Much has already been priced in, and there are no strong new drivers in sight. Especially since the ECB is not standing still in tightening its monetary policy. The final data on consumer prices in the Eurozone, which were revised upwards to 5.3% in the core index, published on Feb. 23, will be the next stimulus for such QT.

As of the time of writing, 40% of analysts expect further strengthening of the dollar (half as many as a week ago), 50% expect a correction of EUR/USD to the north, and the remaining 10% have taken a neutral position. All of D1 oscillators are painted red, although a quarter of them are signalling the pair is oversold. Among trend indicators, 75% recommend selling and 25% recommend buying.

The nearest support for the pair is located in the zone of 1.5000-1.0525, then come the levels and zones of 1.0440, 1.0370-1.0400, 1.0300, and 1.0220-1.0255. Bulls will encounter resistance in the regions and levels of of 1.0560-1.0575, 1.0600-1.0620, 1.0680-1.0710, 1.0745-1.0760, 1.0800, and 1.0865.

Events of the upcoming week include the publication of data on orders for capital goods and durable goods in the US on Monday, Feb. 27. Wednesday, the first day of March, will bring a large volume of macro statistics from Germany. This includes the Harmonized Consumer Prices Index (CPI), the Purchasing Managers' Index (PMI) in the manufacturing sector, as well as the change in the number of unemployed in the country.

In addition, the value of the PMI in the US manufacturing sector will be announced on this day. We are expecting the February CPI for the Eurozone, the ECB's statement on monetary policy, and data on unemployment in the US on Thursday, March 2. And there will be another portion of American statistics, including the Purchasing Managers' Index (PMI) in the service sector, at the very end of the workweek.

GBP/USD: Business Activity Grows, but the Pound Falls

The British pound is struggling to resist the advance of the dollar. Despite regular counterattacks, it is retreating step by step. Starting the week at 1.2040, the GBP/USD currency pair reached a local peak at 1.2147, but then went down and ended the five-day period at 1.1942.

It is worth noting that the UK economy managed to avoid a recession at the end of 2022, and the data on business activity in the United Kingdom, published on Tuesday, Feb. 21, is quite optimistic. The Composite PMI Index, with a forecast of 49.0, should grow from 48.5 to 53.0 points over the month.

However, these are only preliminary data, with the final ones becoming available on March 1 and 3. At the same time, the confidence of British consumers is lower than during the financial crisis, the COVID-19 pandemic, and the recessions of the 1980's and 1990's.

Although inflation in the country is decreasing, it remains in double digits and is five times higher than the Bank of England's target rate. (CPI fell to +10.1% in January, with a forecast of +10.3%, and +10.5% in December). Inflation is being kept high in part due to the labor market, and there is currently no reason to believe that wage growth in the UK is slowing down.

The market expects that the Bank of England, like the Federal Reserve, will raise the key interest rate twice by 25 basis points in March and April, bringing it to a peak of 4.5%. However, many in the BoE leadership are very concerned that a significant increase in rates could overly slow down the economy. Therefore, the regulator's monetary policy, which is already ambiguous, could be adjusted at any time.

As for the median forecast of experts, 45% of them vote for further weakening of the pound, 25% expect the GBP/USD pair to rise, and 30% prefer to refrain from making predictions. Among the trend indicators on D1, the balance of power is 85% to 15% in favor of the red. Among the oscillators, the red has a 100% advantage, 15% of which are in the oversold zone.

The support levels and zones for the pair are seen at 1.1900-1.1915, 1.1840, 1.1800, 1.1720, and 1.1600. If the pair moves north, it will face resistance at the levels of 1.1960, 1.1990-1.2025, 1.2075-1.2085, 1.2145, 1.2185-1.2210, 1.2270, 1.2335, 1.2390-1.2400, 1.2430-1.2450, 1.2510, 1.2575-1.2610, 1.2700, 1.2750, and 1.2940.

As for the economy of the United Kingdom, in addition to the final data on business activity (PMI), which will be released on March 1 and 3, we can note the speech of the Governor of the Bank of England, Andrew Bailey, scheduled for Wednesday, March 1.

USD/JPY: Hopes for QT Are Weakening, but Still Remain

"It seems that the appointment of academic Kadsuo Wada as the new head of the Bank of Japan (BoJ) has not benefited the Japanese currency," we wrote in our previous review. And now, looking at the USD/JPY chart, we can only confirm this statement.

In addition to the strengthening dollar, another blow to the yen was dealt by Kadsuo Wada himself. His speech on Friday, Feb. 24 helped the pair to rise from the level of 134.04 to a height of 136.41.

The comments of the future head of the central bank, who spoke in the lower house of the Japanese Parliament, in general corresponded to the current BoJ policy, and only exacerbated the disappointment of those who hoped for significant changes in the regulator's monetary policy. Investors could not discern in these comments a clear "hawkish" signal that would boost the resumption of speculative demand for the yen, which was already weakening against the backdrop of the rise of the DXY and the increase in the yield of 10-year treasuries.

It should be reminded that there is a direct correlation between the USD/JPY currency pair and U.S. Treasury bills. If the yield of securities rises, then the dollar rises against the Japanese yen.

We already wrote that some experts expect a serious strengthening of the Japanese currency in the future. For example, economists at Danske Bank predict that the USD/JPY rate will fall and reach the level of 125.00 in three months. BNP Paribas Research strategists hold a similar position.

According to their forecasts, in the event of a tightening of monetary policy, positive yields in Japan may stimulate the repatriation of funds by local investors, resulting in USD/JPY falling to 121.00 by the end of 2023. But all of these are still quite shaky assumptions, although 75% of analysts share them.

As for the near-term prospects, only 35% of experts expect a southward movement of the pair, while an equal number look in the opposite direction, and the remaining 20% remain neutral. Among the oscillators on the D1 chart, 100% indicate a northward movement (15% of which are in the overbought zone). Among the trend indicators, 75% point to the north and 25% point to the south.

The nearest support level is located in the 135.90 zone, followed by levels and zones of 134.90-135.15, 134.40, 134.00, 133.60, 132.80-133.20, 131.85-132.00, 131.25, 130.50, and 129.70-130.00. Resistance levels and zones are at 136.70, 136.00, 137.50, 139.00-139.35, 140.60, and 143.75.

No important macroeconomic statistics regarding the state of the Japanese economy are expected next week. However, Kadsuo Wada will give another speech on Monday, Feb. 27, but it is unlikely to contain anything new and revolutionary.

Cryptocurrencies: Bitcoin is Under Pressure, but it Doesn't Give Up. Not Yet

Regarding the past week, we can say this: Bitcoin is under pressure, but it is holding up. Among the main pressure factors, we can name the financial report of the Coinbase exchange for Q4 2022 and the strengthening of the dollar. Coinbase's revenue plummeted by 75% in the last quarter of last year, which was unusually difficult for the cryptocurrency market.

The reason for such a collapse is clear: customer outflows due to a series of scandals and bankruptcies of major and not-so-major industry players. As a result, Coinbase's losses amounted to $2.46 per share. (For comparison, the profit per share of this crypto giant was $3.32 a year ago). It is unknown whether Coinbase will explode like FTX. But in any case, investors should not forget about the risks associated with this market.

As for the second pressure factor, it's all about the Federal Reserve System (FRS) of the United States, as always. Increased market expectations regarding the interest rate have strengthened the quoted currency in BTC/USD and, accordingly, weakened its base part. And it should be noted that Bitcoin has shown itself to be a stronger asset in this situation than stock indices, with which it usually correlates.

Thus, the S&P 500 returned to mid-January values, and the Dow Jones even fell to December values, while the flagship cryptocurrency has grown by 40% since Jan. 1, 2023.

Debate over the future of digital assets continues. Vice Chairman of legendary holding company Berkshire Hathaway and Warren Buffet's right-hand man, Charlie Munger, still calls on US authorities to completely ban cryptocurrencies.

The 99-year-old billionaire called those who disagrees with him "idiots" and added, "I'm not proud of my country for allowing this filth. It's just ridiculous that anyone buys this [digital assets]. It's no good. It's crazy. It only does harm."

Kevin O’Leary, investor, journalist, and host of the popular show Shark Tank recalled this as well. He said that "American financial regulators are tired" of watching waves of bankruptcies in the cryptocurrency industry. "These guys in Washington are very angry. The FTX collapse woke up the bear. It woke up in a rage. Senators are really tired of having to gather every six months when another major cryptocurrency firm collapses. They're tired of the industry being unregulated and anyone being able to issue their absolutely useless tokens," said the Canadian entrepreneur.

His conclusion was much softer than Charles Munger's choking calls. O'Leary called on all industry participants to cooperate with the SEC and other government agencies and said that regulated companies would attract significantly more investment than their unregulated competitors.

Bitcoin quotes are mainly supported by small and medium investors at the moment. According to the analytics company Glassnode, the number of wallets with a volume of at least 1 BTC is constantly reaching new highs. Their number has increased by 20% over the past year, approaching 982,000. As for addresses with a balance of 1000 BTC or more, it has fallen from its peak in February 2021 (about 2,500) to levels in August 2019.

As of Feb. 20, 2023, there are only 2,024 such whales. However, the number of addresses with a balance of 10,000 BTC or more (worth approximately $240 million at recent prices) has consistently remained near peak levels, corresponding to November 2022 and October 2018 values. Currently, there are 115 such "mega-whale" wallets.

According to co-founder of the Gemini crypto exchange Cameron Winklevoss, Asian investors may push Bitcoin prices up. Winklevoss believes that the next phase of price growth will occur in the East, and the US will have to adapt to the new conditions. According to Chainalysis, the Asia-Pacific region already ranks third in the world in terms of cryptocurrency investment volume.

Several experts believe that it is crucial for the market for Bitcoin to maintain levels above the intermediate resistance at $24,500. This will allow the coin to rise to $25,000 first and then to the $29,000-30,000 range. According to analysts at Matrix, the rise to $29,000 is possible by the summer, and BTC could reach $45,000 by the end of this year.

However, they note that this will happen only if the pace of consumer inflation in the US continues to slow. Matrix analysts also point out that the cryptocurrency's price has already risen above $25,000 several times in recent days, despite negative news about tightening cryptocurrency regulations in the US and Europe, which they see as a positive sign.

Speaking of their forecast, Matrix also refers to the "January effect": price success in the first month often determines the movement of the main cryptocurrency price for the entire year. In addition, experts note that historically, 12-15 months before the next halving, Bitcoin's price tests its minimums. This time, such a period fell on December 2022 - March 2023.

Well-known analyst Plan B also suggests a possible rally, estimating that Bitcoin may test the $42,000 level in March. As of the time of writing, BTC/USD has recently been seen trading at around $23,100. The total market capitalization of the crypto market is approximately $1.059 trillion ($1.106 trillion a week ago). The Crypto Fear & Greed Index fell from 61 to 53 points over the week and returned from the Greed zone to the Neutral zone.

More By This Author:

Forex And Cryptocurrencies Forecast - Feb. 20-24

Forex And Cryptocurrencies Forecast - Feb. 13-17

Forex And Cryptocurrencies Forecast - Feb. 6-10

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is ...

more