For The First Time Since COVID Crash, Credit-Card Debt Shrinks For Second Month

Image Source: Unsplash

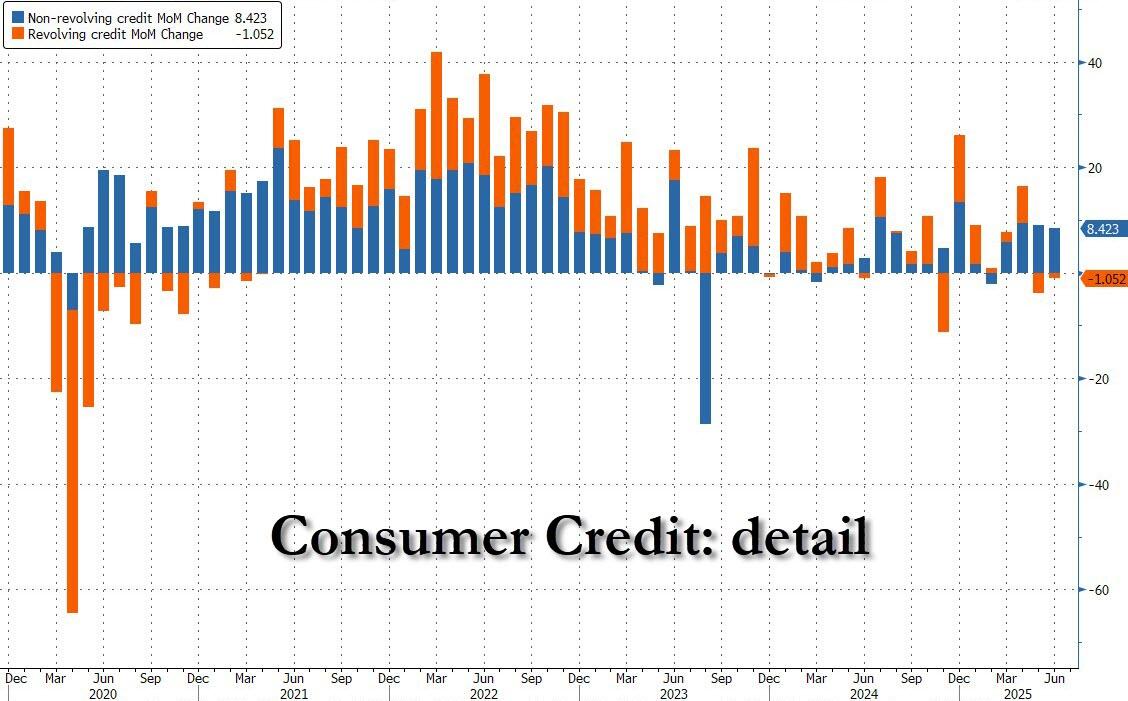

On the surface, there were no major surprises in today's consumer credit report: after last month's $5.1 billion increase, consensus expected a sequential increase of $7.5 billion and it got almost exactly that: an increase of $7.37 billion to $3.758 trillion, up from $3.749 trillion in May.

However, taking a closer look at the components reveals something troubling.

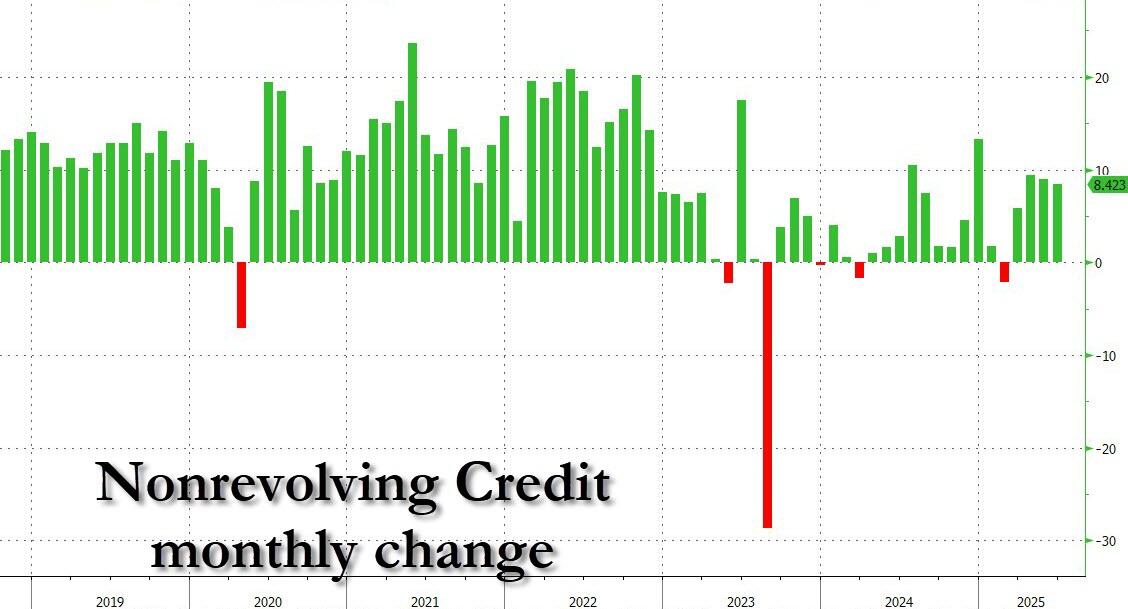

While boring non-revolving credit increased by $8.4 billion or more or less in line with what it has done in recent months...

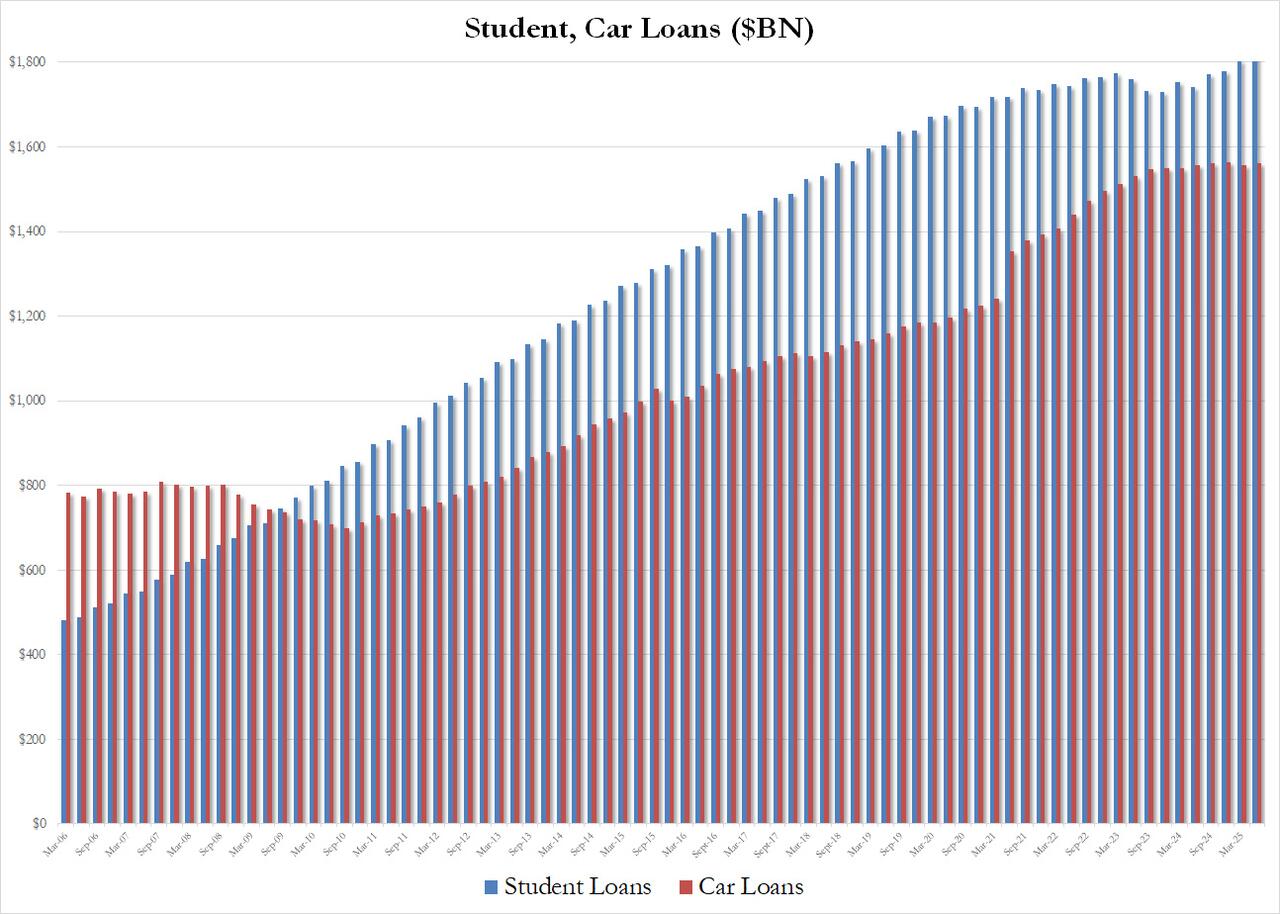

... an increase that in Q2 was driven in roughly equal part from contribution in student loans (+8.2BN) and auto loans (+$5.1)...

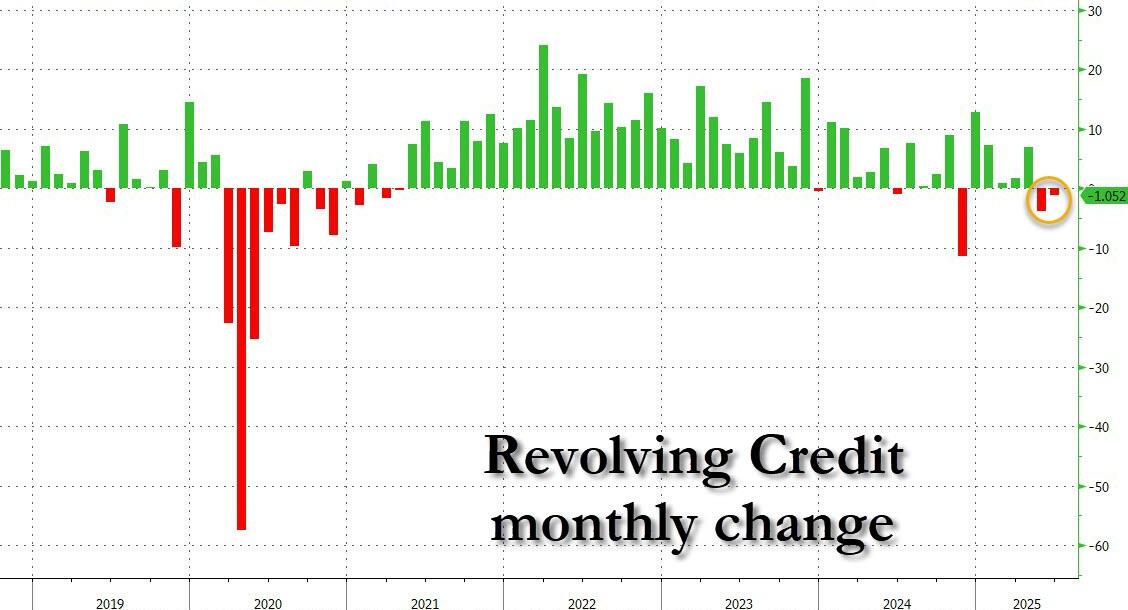

... the surprise was in the amount of revolving loans, i.e. credit card debt, which declined by just over $1 billion in June, which was the second consecutive monthly drop in the series...

... which is very notable because that would make it the first time since the economic collapse at the peak of the covid crash.

Which begs the question: is the a cause - i.e., will the economy now suffer a sharp slowdown with consumers clearly hunkering down and no longer charging it - or effect - has the economy already stalled and this is just the consequence. If indeed this is the latter, then expect a dramatic downward revision of all recent economic data, similar to what we saw last week with payrolls, as the US economy enters its new glideslope to a recession.

More By This Author:

Bank Of England Cuts Rates To 4% After Historic Re-VoteLilly Shares Tumble As Weak Weight-Loss Pill Data Overshadows Strong Earnings

Trump To Impose 100% Chip Tariffs, But Will Exempt US Investors Like Apple

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more