FOMC Preview: Fed Remains Inclined To Cut

While there is little prospect of an imminent policy change, the Federal Reserve thinks it will likely be appropriate to cut rates and move its stance towards a more neutral footing later this year, assuming the data cooperates. Monetary policy is in restrictive territory and we see scope for the Fed to cut rates by 125bp this year, starting in June.

Image source: Wikipedia

Rates held, but a bias to easing set to remain

US growth, jobs and inflation data remain too hot for the Federal Reserve to contemplate imminent interest rate cuts with some commentators still arguing the Fed has more work to do to control inflation. However, there is little prospect of action at next week’s meeting with Chair Jerome Powell stating that both he and his colleagues "believe that our policy rate is likely at its peak for this tightening cycle" when appearing before Congress on 6 March. Indeed, we (like the market) think the next move is a cut, most likely in June since Powell also suggested that officials are “not far” from having the confidence to “dial back” on the restrictiveness of monetary policy.

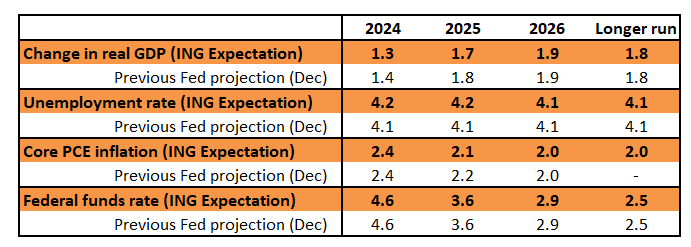

Given this situation, attention will focus on the projections of FOMC members. At the December forecast update, the Fed signalled they felt three 25bp rate cuts would be the most likely path forward for 2024 with a further 100bp of cuts pencilled in for 2025. We expect a similar set of projections at the 20 March FOMC meeting, with the messaging indicating that the Fed is inclined to cut rates later this year, but they need to see more evidence to justify that action. That said, given the dispersion of predictions by individual Fed members it would only take two of six FOMC members switching from a current 4.625% projection either higher or lower to move the median dot away from three rate cuts to signalling two or four rate cuts in 2024. We suspect a shift to two rate cuts from three is a higher risk than the Fed moving to signal four.

Wording similar what Powell used in Congress that "the risks to achieving our employment and inflation goals have been moving into better balance" is likely. In the subsequent press conference, we expect Chair Powell to repeat the sentence from the Congressional testimony that it will “likely be appropriate to begin dialling back policy restraint at some point this year. But the economic outlook is uncertain, and ongoing progress toward our 2% inflation objective is not assured."

ING’s expectations for what the Fed will forecast versus their December projections

Slower growth, jobs and inflation are on their way

We do expect to see weaker economic activity in the coming months. The consumer remains key with the combination of elevated borrowing costs and tight credit availability plus pandemic-era savings being exhausted and student loan repayments having restarted constraining consumer spending growth over coming quarters. Rising credit card and auto loan delinquencies already hint at intensifying stress and we fear that this will spread to an increasing number of households.

We are also seeing evidence that the jobs market is cooling even if it is yet to show up in payrolls numbers. The ISM employment components are in contraction territory, the National Federation of Independent Business suggests the weakest hiring by small businesses since May 2020 while the slowing quits rate – the proportion of workers quitting their job to move to a new employer each month – points to a less frenetic jobs market with diminishing wage pressures. Lay-off numbers from big employers are also on the rise and we expect to see payrolls growth slow meaningfully through the spring and summer.

While inflation, for now, remains well above the 2% target, corporate pricing power is easing with the recent Fed Beige Book noting that “businesses found it harder to pass through higher costs to their customers, who became increasingly sensitive to price changes.” With housing costs also set to dip further we look for inflation to return to 2% by year-end.

Fed to cut from June to avert recession

The Fed doesn’t want to cause a recession if it can avoid it and we believe they will be in a position to start moving monetary policy from a restrictive position to a more neutral stance before the summer. They are currently suggesting the neutral Fed funds rate is around 2.5% so there is room for up to 300bp of cuts just to move to “neutral”. We think they won’t want to go quite that far given the prospect of ongoing loose fiscal policy irrespective of who wins the November presidential election, but we expect 125bp of cuts this year, starting in June, with a further 100bp in 2025 as hopes rise for a soft landing for the economy.

No panic to slow QT is expected from the Fed. An intention to plan it is more probable

The Fed may or may not opine on the pace of balance sheet reduction. It’s been a topic of contemplation at the Fed this year, mostly as the Fed is conscious that the last time they engaged in quantitative tightening things began to seize up on repo markets, at a time when bank (excess) reserves had fallen to the US$1.5tn area.

Currently, bank reserves are up at US$3.6tn, and hence very comfortable, a legacy of pandemic-induced quantitative easing. There is also some US$400bn going back to the Fed on the reverse repo facility. That combo is the manifestation of excess reserves. The Fed’s quantitative tightening programme is projected to take some US$95bn per month from the Fed’s balance sheet as bonds maturing are not reinvested. In reality, this has been at a slower pace, closer to US$80bn and sometimes lower, as mortgage-backed pre-payments have slowed. That comes out at US$900 to 950bn per annum. On that pace, the reserve repo balance should hit zero by August.

After that, bank reserves will fall. To get bank reserves down to US$3tn, it could take an additional seven months. Essentially, this tells us that the Fed could and should be continuing with its quantitative tightening programme right through 2024, and comfortably into 2025. Yet, a lot of the talk out there has been along the lines of the Fed setting out a QT exit plan, or at the very least a slowdown plan. A slowdown plan is probable given what the Fed has been generically intimating. But we are doubtful that there needs to be any material worry on this front from a liquidity perspective any time soon, at least not during the calendar year 2024.

So no panic here, and the Fed can just as easily leave material QT slowdown planning on this to one of the subsequent meetings in May or June. Market rates will look at this, but it’s unlikely to be market-moving at this juncture. And indeed, this particular meeting is shaping up to be one that is not expected to be a significant driver for market rates, as the Fed will in the end point to the data that we will all see in subsequent months.

FX: Dollar's yield position is strong, even without a hawkish Fed

We recently stressed the upside risks for the dollar given its still strong underlying yield position, and we are finally observing some dollar buying across the board as we write. The coming days will tell us where the FX market is positioning itself in the hawkish-dovish surprise spectrum for the Fed meeting.

Remember that only a week ago, markets were wrong-footed by Powell’s congressional testimony, which failed to endorse hawkish expectations. That may discourage strong USD buying purely on the back of FOMC-related expectations in the next few days. We believe hawkish bets may be misplaced again this time as the Fed should reiterate a relatively optimistic narrative on disinflation and still hint at monetary easing ahead. The main upside risk for the dollar is a revision higher in the dot plots, but even then, we struggle to see this having a prolonged impact on FX if – as it appears likely – the Fed will continue to point to the crucial role of upcoming data releases, which are generally expected to start showing some signs of softening.

Still, we expect EUR/USD to enter FOMC week with softer momentum as it partly reconnects with its depressed short-term rate differential: in the two-year swap market, this has widened further in favour of the dollar lately (-135bp). Our medium-term view remains unchanged and bearish on the dollar as we see the Fed cutting big from June, but we could still see some dollar resilience in March now that the most crucial data for February has been published and came in on the positive side for the greenback.

More By This Author:

Asia Week Ahead: Will The Bank Of Japan Hike Rates

The Commodities Feed: Copper Surges To 11-Month High

FX Daily: Short-Dated Yields Point At A Higher Dollar

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more