FOMC Minutes Signal Dovish Policy Tilt, But 'Majority' Fear Inflation Upside Risks

Image Source: Pexels

Since the last FOMC meeting (when The fed cut rates by 25bps with one dissent for 50bps on Sept 17th), gold has gone to the moon, stocks are higher (as is the dollar) while bonds are down modestly...

Source: Bloomberg

As a reminder, at his post-meeting press conference, Chair Powell characterized the rate cut as a risk management decision, responding to meaningful downside risks to the labor market, but stressed that he does not feel the need to move quickly on rates.

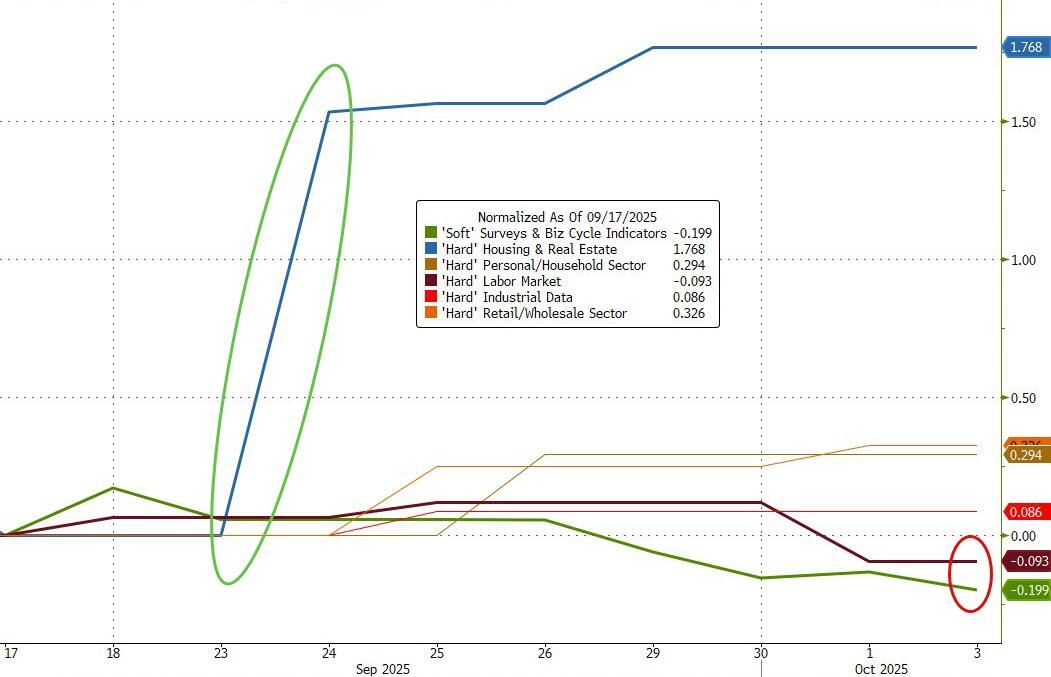

Despite the lack of data (due to the government shutdown), the labor market is cooling, and now policymakers are turning their attention to that side of the mandate (though we note that housing data saw a huge upside surprise while soft survey data since the FOMC meeting has weakened)...

Powell said that moving rates down slightly supports a more neutral policy stance and balances risks to employment and inflation.

The government shutdown is seen as complicating the Fed's data-dependent policy approach, with key employment and inflation releases (including weekly jobless claims, September payrolls, and CPI reports) delayed; analysts say this could cloud judgment for the October FOMC meeting, increasing uncertainty over further rate cuts amid the Committee's divided views on inflation, GDP growth, and labor market resilience.

Interestingly, the odds of a 25bps cut in Oct (29th) has risen from 75% to 95% since the last FOMC meeting while the odds of an additional cut in December has slipped to just above 80%...

Source: Bloomberg

The Fed Chair emphasized a meeting-by-meeting approach, guided by incoming data, and noted that markets are pricing in a path of cuts, but the Fed is focused on the data rather than market expectations. Current market expectations are for 44bps of cuts in 2025 (unchanged since the meeting) and 63bps of cuts in 2026 (hawkishly lower than the 73bps at the meeting).

Powell has spoken again after the FOMC meeting and said the Committee will continue balancing high inflation risks against a slowing job market in upcoming rate decisions, maintaining flexibility rather than a preset path.

So, what does The Fed want us to know it was thinking during the meeting?

Almost all participants supported 25bps cut to Fed funds rate at the September meeting.

“Most judged that it likely would be appropriate to ease policy further over the remainder of this year,” according to minutes of the Federal Open Market Committee’s Sept. 16-17 meeting.

One participant preferred a 50bps rate cut at last month’s meeting.

Some noted financial conditions suggested policy may not be particularly restrictive, those participants judged a cautious approach to future policy was warranted.

“A few participants stated there was merit in keeping the federal funds rate unchanged at this meeting or that they could have supported such a decision,” the minutes said.

"Around half" of Fed officials saw another two interest rate cuts by the end of 2025 (which we already knew from the Dot Plot).

Most participants judged the downside risks to employment had increased, upside risks to inflation had either diminished or not increased.

The record of the meeting also showed “a majority of participants emphasized upside risks to their outlooks for inflation.”

A few participants noted the standing Repo facility would help keep the Fed funds rate in the target range and ensure money market pressures would not disrupt ongoing quantitative tightening.

Fed staff revised up the GDP growth projection for 2025 through 2028.

Equity prices continued to rise over the intermeeting period and stood very close to record highs despite the recent weaker-than-expected employment reports.

A few participants commented that the agricultural sector continued to face headwinds because of low crop prices and high input costs.

Read the full minutes below:

More By This Author:

Gold Tops $4,000 For The First Time, And How Goldman Is Trading The Meltup From Here

Tesla Unveils Cheaper Model Y Starting At $37,990 After Tax Credit Loss

Ford Shares Hammered On Report Aluminum Plant Fire May Disrupt Ford F-150 Production

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more