FOMC Minutes Show 'Most Officials Fear Risk Of Cutting Too Quickly'

Image Source: Pexels

Tl;dr: The Fed is worried about cutting too soon more than waiting too long...

“Most participants noted the risks of moving too quickly to ease the stance of policy and emphasized the importance of carefully assessing incoming data in judging whether inflation is moving down sustainably to 2%.”

And the higher stocks go, and lower crediot spreads go, the less urgency the need for a rate-cut:

"Several participants mentioned the risk that financial conditions were or could become less restrictive than appropriate, which could add undue momentum to aggregate demand and cause progress on inflation to stall."

So, be careful what you wish for.

***

Since the last FOMC meeting, on January 31st, Bitcoin has been the outstanding performer. Bonds have traded lower in price since then while stocks have outperformed with the dollar and gold BOTH UP modestly.

Source: Bloomberg

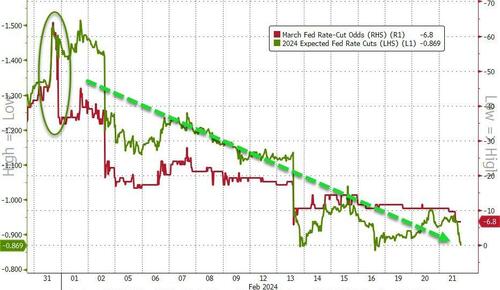

Rate-cut expectations have plummeted since the last FOMC meeting with March now off the table and 2024 total cuts down from 6 cuts to a 50-50 call between 3 and 4 cuts...

Source: Bloomberg

And as rate-cut expectations fell so Treasury yields rose notably with the short-end up over 30bps...

Source: Bloomberg

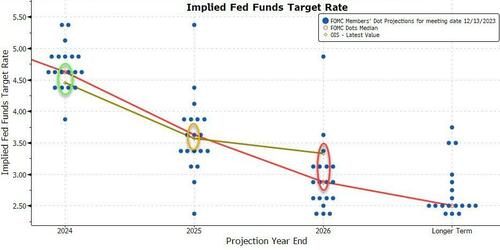

As The Fed has clearly won the jawboning battle to bring the market back to dot-plot reality...

Source: Bloomberg

All eyes will be on the Minutes for an explanation of why they pushed back against a March cut (but as a reminder, all the 'ugly' data - hot NFP, hot CPI, hot PPI - came after the Minutes).

So, what do they want us to know?

The headlines from the minutes are as follows:

On cutting rates (policymakers were more concerned about the risks of moving too soon to cut interest rates than waiting too long):

“Most participants noted the risks of moving too quickly to ease the stance of policy and emphasized the importance of carefully assessing incoming data in judging whether inflation is moving down sustainably to 2%.”

On tapering QT:

“Some participants remarked that, given the uncertainty surrounding estimates of the ample level of reserves, slowing the pace of runoff could help smooth the transition to that level of reserves or could allow the committee to continue balance sheet runoff for longer.”

On inflation fears:

"Upside risks included easier financial conditions and stronger growth. Others cited were “possible disruptions to supply chains from geopolitical developments, a potential rebound in core goods prices as the effects of supply-side improvements dissipate, or the possibility that wage growth remains elevated.”

"A few participants mentioned the possibility that economic activity could surprise to the upside and inflation to the downside because of more-favorable-than-expected supply-side developments."

On financial conditions:

"Several participants mentioned the risk that financial conditions were or could become less restrictive than appropriate, which could add undue momentum to aggregate demand and cause progress on inflation to stall."

On geopolitical risks:

“geopolitical risks that could result in a material pullback in demand” and also “possible negative spillovers from lower growth in some foreign economies.”

The staff outlook had some notable highlights:

-

Staff economic outlook was slightly stronger than December projection.

-

Staff placed some weight on chance that further progress on lowering inflation could take longer than expected

-

Staff characterized US financial system vulnerabilities as 'notable'

-

Staff forecast risks to economic forecast skewed to the downside.

And in the last few minutes, Fed Governor Michelle Bowman says that the current economic environment doesn’t warrant the central bank cutting interest rates.

“Certainly not now.”

Read the full FOMC Minutes below:

More By This Author:

Yields Surge After Terrible 20Y Auction With Biggest Tail On RecordDid The India Bubble Just Burst

Bonds, Bullion, & Big-Tech Fear Bid, Stocks Skid Ahead Of NVDA's Big Day

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more