FOMC Minutes Confirm Fed Members Fear Trade Policy "Uncertainty", Support QT Taper

Image source: Wikipedia

A lot - and we mean a lot - has happened since the last FOMC meeting on March 19th. Bonds, stocks, and commodites have colppased; gold has made solid gains and the dollar is unchanged as Trump's 'Liberation Day' malarkey smashed the punchbowl...

Source: Bloomberg

Funding markets are starting to break...

Source: Bloomberg

Rate-cut expectations have surged from around 2 cuts to 4-5 cuts this year...

Source: Bloomberg

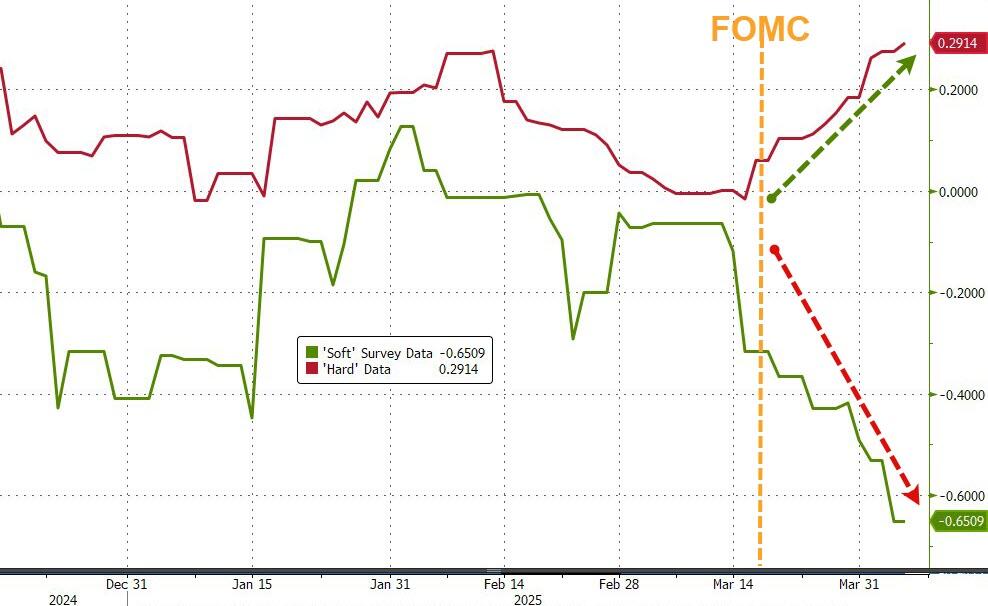

In the three weeks since the FOMC meeting, hard data has improved significantly while soft data has crashed...

Source: Bloomberg

So, with all that in mind, and having heard multiple Fed speakers since (including the Chair himself) all singing from the same hymn-sheet - 'lots of uncertainty'... 'we have time to pause' etc... we will see what exactly The Fed wanted us to take from the last meeting...

Key Headlines include (via Newssquawk):

RATES

- All participants viewed it appropriate to keep interest rates unchanged in light of elevated uncertainty around economic outlook

- Participants remarked uncertainty about net effect of government policies on the outlook was high, making it appropriate to take a cautious approach

STANCE

-

A majority of participants noted potential for inflationary effects from various factors to be more persistent than they projected

-

Participants assessed fomc was well positioned to wait for more clarity on the outlook

INFLATION

- Almost all participants viewed risk to inflation as tilted to the upside, risks to employment as tilted to the downside

- Some participants observed fomc may face difficult tradeoffs if inflation proved more persistent while the outlook for growth and employment weakened

- Several participants emphasized that elevated inflation could prove to be more persistent than expected

BALANCE SHEET

- Almost all participants supported slowing pace of balance sheet runoff; several did not see a compelling case for a slower runoff pace

- A few participants cautioned an abrupt repricing of risk in financial markets could exacerbate effects of any negative economic shocks

PROJECTIONS

-

Fed staff projection for real GDP growth was weaker than one prepared for January meeting

Read the full FOMC Minutes below:

More By This Author:

Stellar 10Y Auction Prices At 2nd Highest Stop Through On Record Despite Plunge In DirectsMicron Prepares To Slap Tariff-Related Charge On Customers

Why Doubts Over The Fed's Swap Lines Are Such A Big Deal

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more