FOMC Hikes By 50bps, Hawkishly Signals Rates Will Go Higher-For-Longer

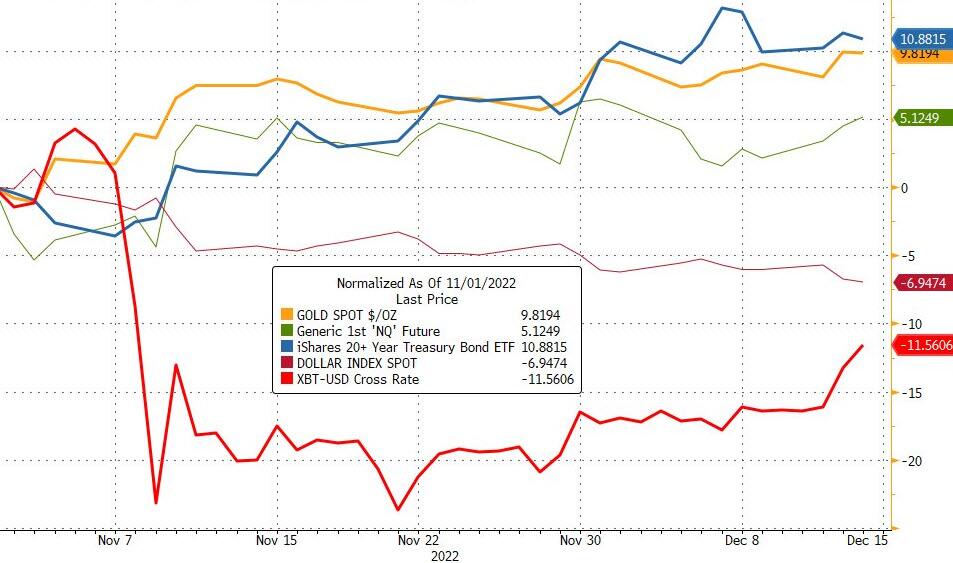

Since the November 2nd (dovish) FOMC statement and (hawkish) press conference chaos, gold and bonds have dramatically outperformed, stock have rallied as the dollar and crypto tumbled...

(Click on image to enlarge)

Source: Bloomberg

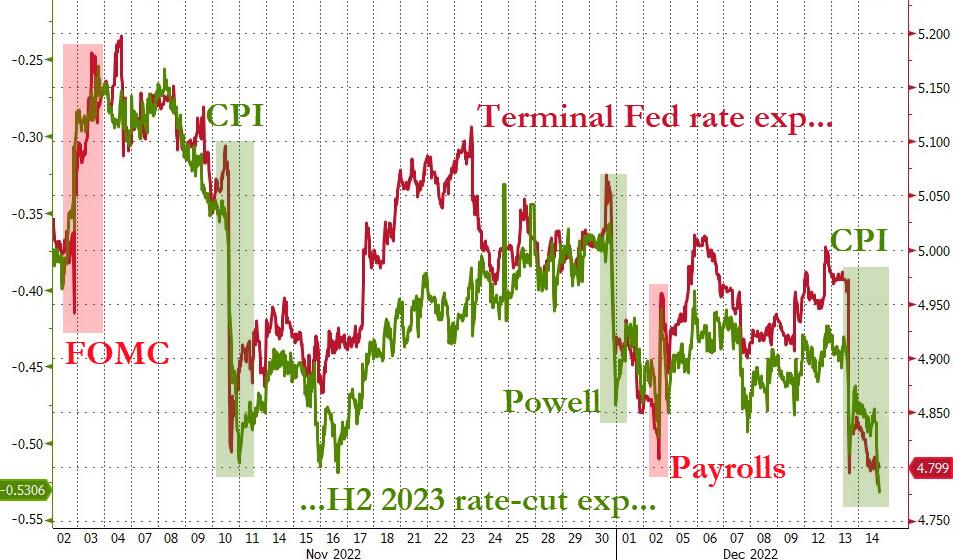

Most notably, despite Powell's extremely hawkish press conference (which sent rate-hike expectations higher), the overall expectations of the trajectory of the Fed rate has dived dovishly since the last FOMC. Note the terminal rate has dived from 5.20% to below 4.80%...

(Click on image to enlarge)

Source: Bloomberg

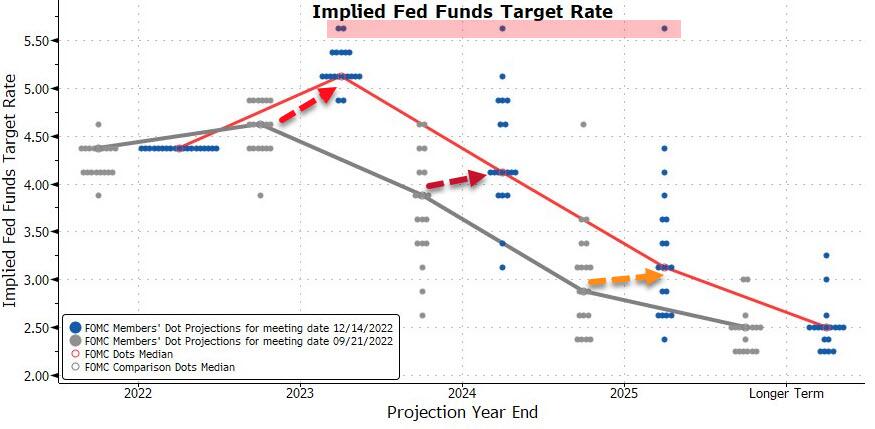

This has completely decoupled the market from The Fed's dot-plot expectations for the rate-trajectory from here (with the market considerably more dovish)...

(Click on image to enlarge)

Source: Bloomberg

Note we will get a new dotplot today.

The market is pricing in around 6 rate-cuts from mid-2023 to end-2024...

(Click on image to enlarge)

Source: Bloomberg

Finally, and perhaps most importantly for Powell, we note that financial conditions have eased dramatically since the last FOMC, now at their 'easiest' since June (225bps of rate-hikes ago!)...

(Click on image to enlarge)

Source: Bloomberg

The market has fully priced-in a 50bps hike today but since the CPI print, February and March expectations have dovishly dropped (27% odds of 50bps in Feb and 48% of 25bps hike in March)...

(Click on image to enlarge)

Source: Bloomberg

So, the primary points of uncertainty are:

(i) how high DOTS move, 25bps – 50bps. Bond markets are pricing a ~4.8% terminal rate effectively achieved at the March 2023 FOMC meeting

(ii) the degree of hawkishness of Powell’s press conference. Investors arewondering if Powell delivers Jackson Hole (SPX -3.4%) or more likeBrookings/Nov 30 (SPX +3.1%). It may be the case that Powell focuses onthe length of time Fed Funds will remain elevated rather than pace or level.

So what did the FOMC say?

The Fed hiked rates by 50bps as expected, adding that "ongoing" rate hikes are likely anticipated.

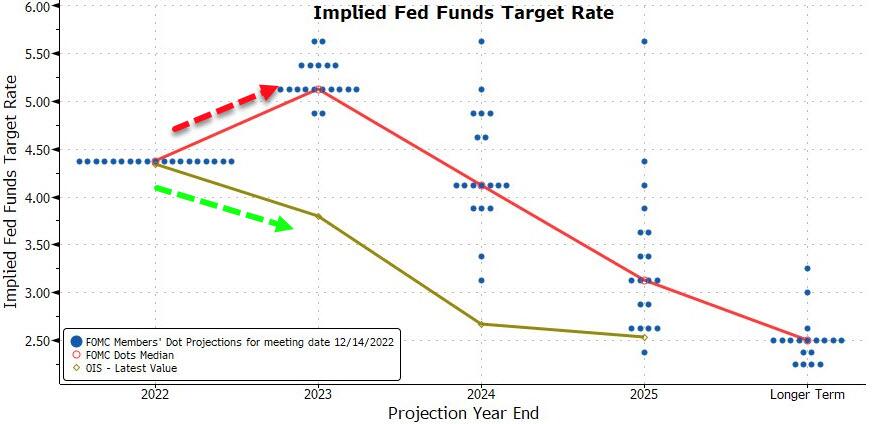

And even more hawkishly, The Fed's new dotplot signals a median forecast of 5.1% in 2023 (more hawkish than expected), dropping to 4.1% in 2024. Additionally, note that one Fed member expects 5.50-5.75% in 2025!

(Click on image to enlarge)

Which is even more hawkishly decoupled from the market's dovish expectations...

(Click on image to enlarge)

Now all eyes and ears are on Powell to see if he flips the script once again.

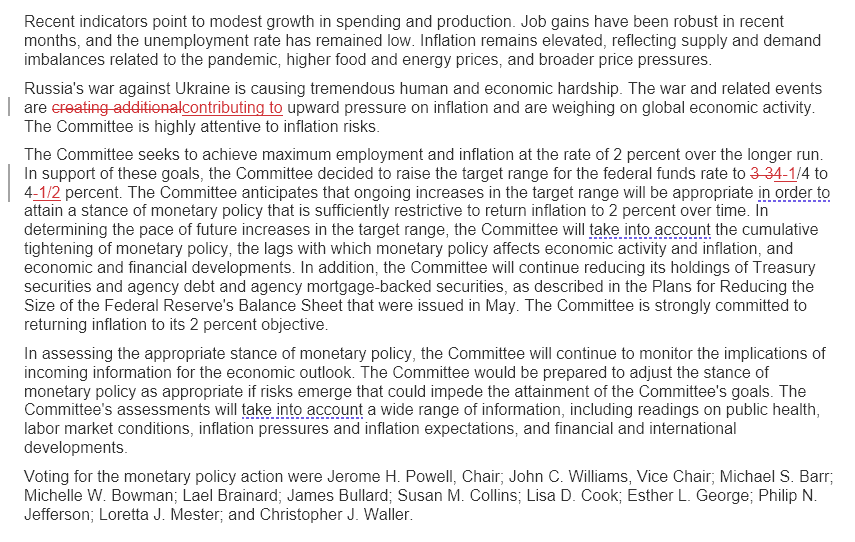

Read the full Redline of the statement below (virtually unchanged):

(Click on image to enlarge)

More By This Author:

Musk Relaunches Twitter Blue At $8 A Month - But $11 Via App StoreBond Investors Switch From Mutual Funds To ETFs At Record Clip

Store Credit Cards Hit 30% Interest Rates As Consumer Balances Rise

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more